Cash Flow Statement For New Business

Cash flow is the lifeblood of any new business, and understanding its intricacies is paramount to survival. Mismanagement can quickly lead to insolvency, making a cash flow statement an indispensable tool.

This article provides a concise overview of how to create and utilize a cash flow statement, crucial for navigating the financial challenges of a startup.

Understanding the Basics

A cash flow statement tracks the movement of cash both into and out of a business over a specific period. It differs from a profit and loss statement, which measures profitability, because it accounts for the actual cash changing hands.

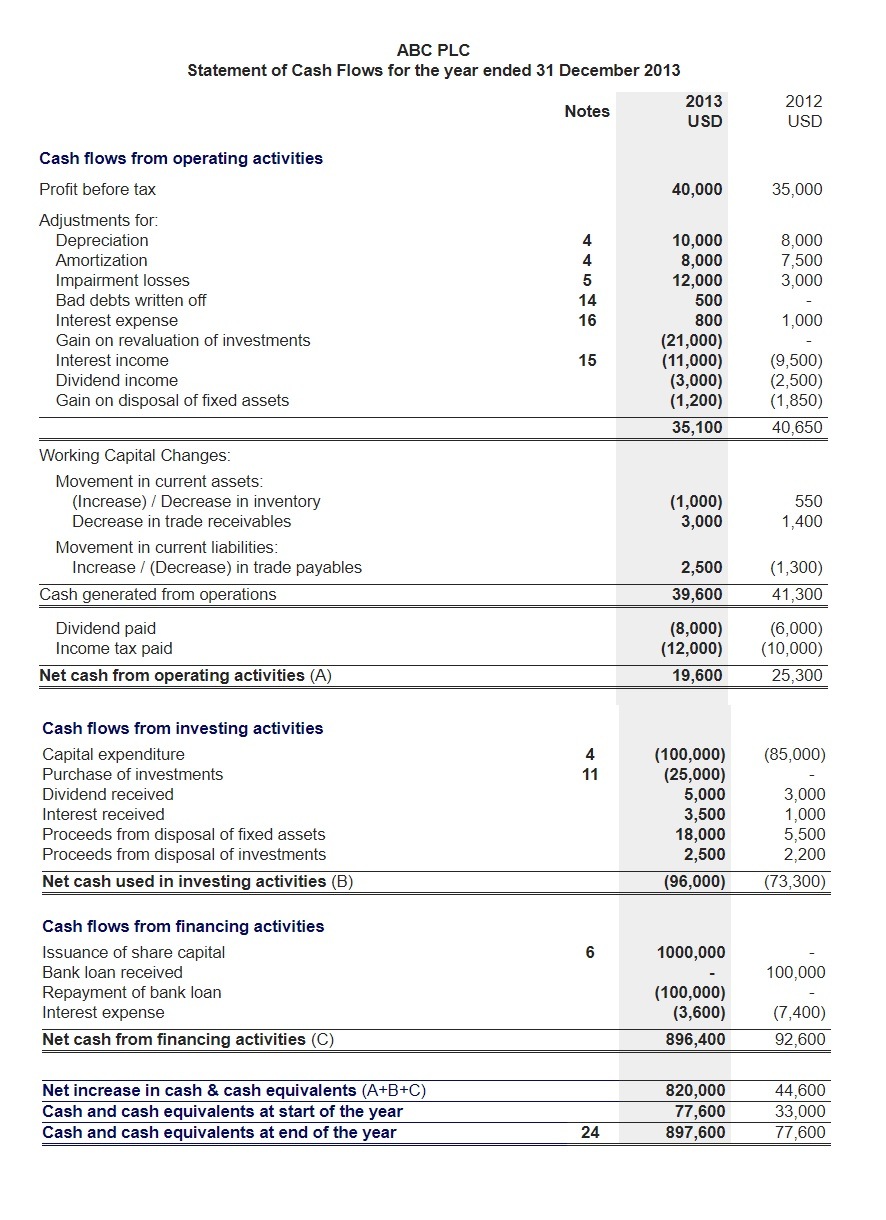

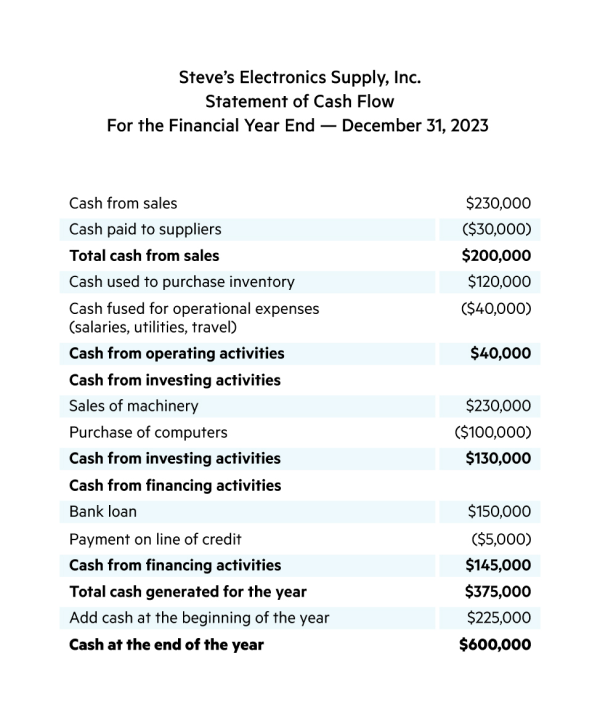

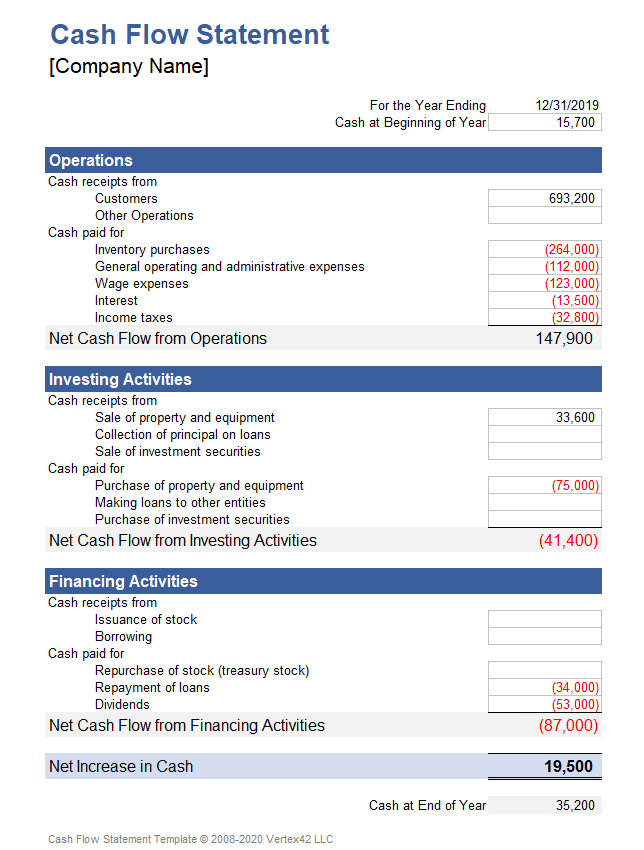

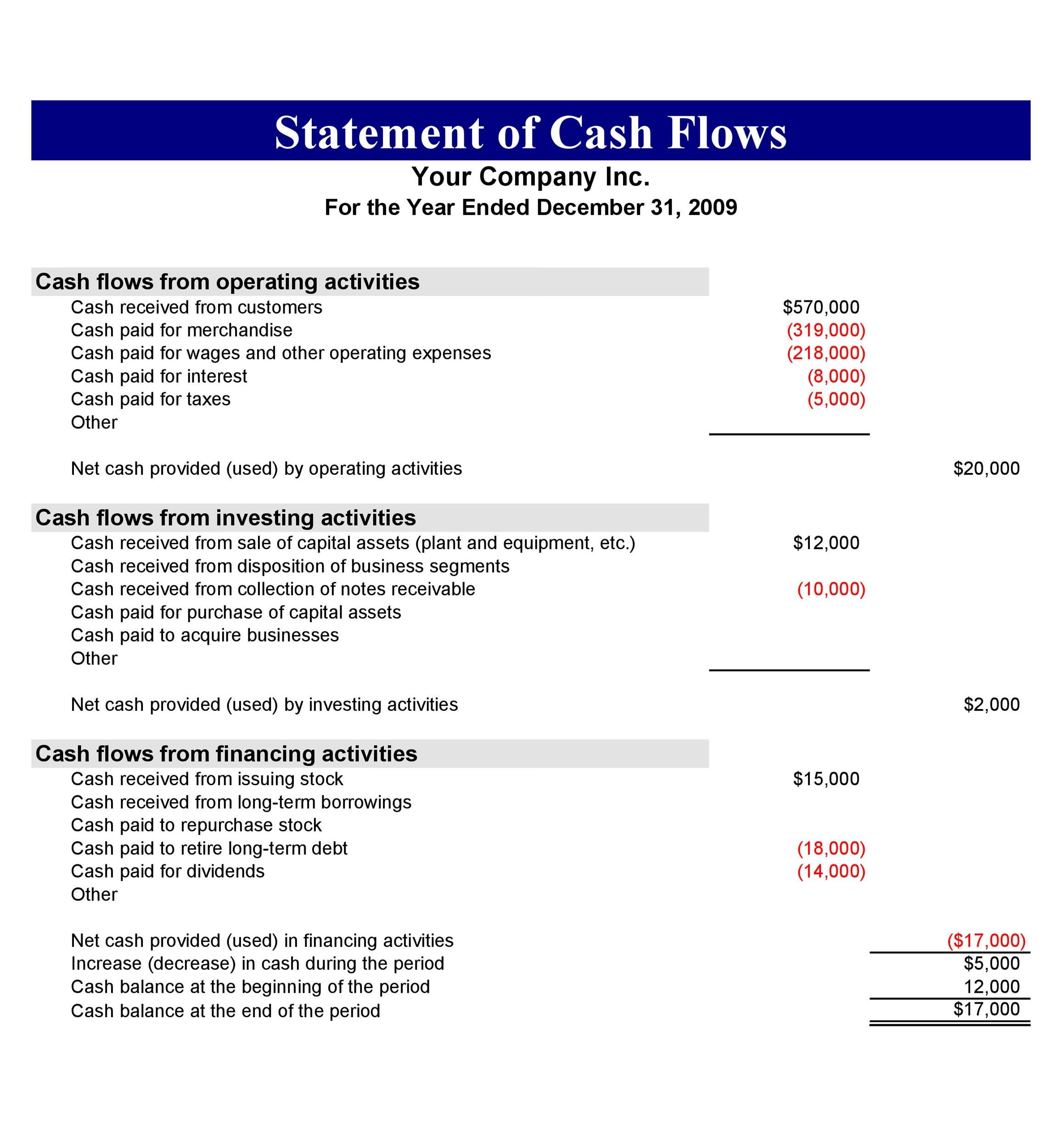

It is divided into three main sections: operating activities, investing activities, and financing activities.

Operating Activities

This section reflects the cash generated from the core business operations. It encompasses cash inflows from sales and services, and cash outflows for expenses like salaries, rent, and inventory.

According to Small Business Administration (SBA), a healthy operating cash flow indicates a business's ability to generate enough cash to maintain and grow its operations.

Investing Activities

Investing activities involve the purchase and sale of long-term assets, such as property, plant, and equipment (PP&E). Cash outflows in this section usually represent investments in the company's future.

Conversely, cash inflows arise from selling assets, indicating a reduction in the company's holdings. Negative cash flow here isn't necessarily bad, especially if it means the business is investing in expansion.

Financing Activities

This section covers activities related to debt, equity, and dividends. It includes borrowing money from banks, issuing stock, repaying loans, and paying dividends to shareholders.

A positive cash flow in this section could mean the company is raising capital, while a negative cash flow could signal debt repayment or dividend payouts.

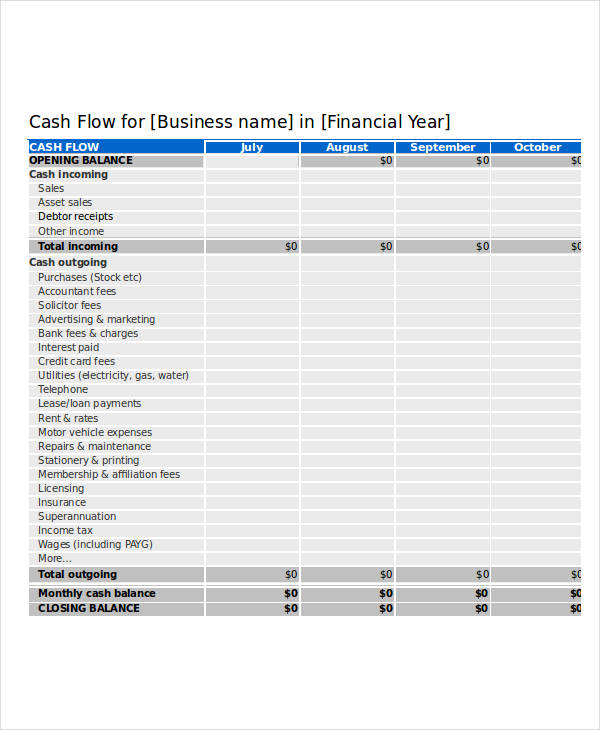

Creating a Cash Flow Statement

There are two primary methods for preparing a cash flow statement: the direct method and the indirect method. The direct method calculates cash flow from operations by directly tracking cash inflows and outflows.

While more accurate, it's also more complex and requires detailed records. The indirect method starts with net income and adjusts it for non-cash items, like depreciation and changes in working capital.

This method is more commonly used because it relies on readily available information from the income statement and balance sheet. According to the Financial Accounting Standards Board (FASB), both methods are acceptable under GAAP.

Utilizing the Statement for Decision-Making

A well-constructed cash flow statement provides valuable insights into a company's financial health. It can help identify potential cash shortages, assess the company's ability to meet its obligations, and inform investment decisions.

For example, a consistently negative operating cash flow coupled with high debt levels should raise red flags. Business owners can use this information to make proactive adjustments, such as cutting costs or seeking additional funding.

Moreover, investors use the cash flow statement to assess a company's ability to generate cash and sustain future growth.

Essential Steps for New Businesses

New businesses should prioritize creating a cash flow forecast, a projection of future cash inflows and outflows. Regularly compare actual cash flow to the forecast to identify variances and adjust strategies accordingly.

Consider using accounting software like QuickBooks or Xero to automate the process and ensure accuracy. Seek advice from a qualified accountant to ensure the cash flow statement is prepared correctly and interpreted effectively.

Ignoring cash flow can be a fatal mistake for any new business.

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)