Chase Freedom Unlimited Pre Qualify

In today's competitive credit card landscape, consumers are constantly searching for ways to maximize rewards and minimize risk. The Chase Freedom Unlimited card, known for its cashback rewards and flexibility, has become a popular choice. A key feature that many prospective cardholders explore is the ability to pre-qualify, offering a glimpse into their approval odds before a formal application.

Pre-qualification for the Chase Freedom Unlimited, and other credit cards, allows consumers to check their likelihood of approval without impacting their credit score. This article delves into the pre-qualification process for the Chase Freedom Unlimited, examining its benefits, limitations, and what consumers should consider before applying.

Understanding Pre-Qualification

Pre-qualification is essentially a preliminary assessment based on limited information. Credit card issuers, like Chase, use this process to identify potential customers who meet their basic criteria. It's important to remember that pre-qualification is not a guarantee of approval.

The process typically involves providing some personal information, such as name, address, income, and social security number (for identity verification, but not a full credit check). Based on this data, Chase performs a "soft pull" on your credit report, which doesn't affect your credit score.

Benefits of Checking for Pre-Qualification

The primary benefit of pre-qualification is that it allows consumers to gauge their approval odds. This can save time and prevent unnecessary hard inquiries on their credit report. Hard inquiries, which occur when you formally apply for credit, can slightly lower your credit score, especially if you accumulate several in a short period.

Pre-qualification can also provide insights into the potential credit limits and interest rates offered. While these are not guaranteed, they give consumers a general idea of what to expect if approved. It also allows consumers to compare offers between different credit cards.

Limitations and Cautions

While pre-qualification is a helpful tool, it's crucial to understand its limitations. As mentioned earlier, pre-qualification is not a guarantee of approval. The final decision is based on a more comprehensive review of your credit history and financial situation.

Even if pre-qualified, you may still be denied due to factors such as a recent bankruptcy, high debt-to-income ratio, or discrepancies between the information provided during pre-qualification and the formal application. Furthermore, the terms offered during pre-qualification, such as the APR or credit limit, are subject to change based on the full application review.

How to Check for Chase Freedom Unlimited Pre-Qualification

Chase offers a pre-qualification tool on their website. Consumers can typically find a link to this tool on the Chase Freedom Unlimited product page or through a general search on the Chase website. Be wary of third-party websites claiming to offer pre-qualification checks, as they may not be legitimate or secure.

The process involves entering the requested information and submitting it to Chase. The results are usually displayed within seconds, indicating whether you are pre-qualified and, if so, the potential terms of the card.

Beyond Pre-Qualification: Factors to Consider

Even if you pre-qualify for the Chase Freedom Unlimited, it's important to evaluate whether the card aligns with your spending habits and financial goals. Consider the card's rewards structure, interest rates, fees, and other benefits.

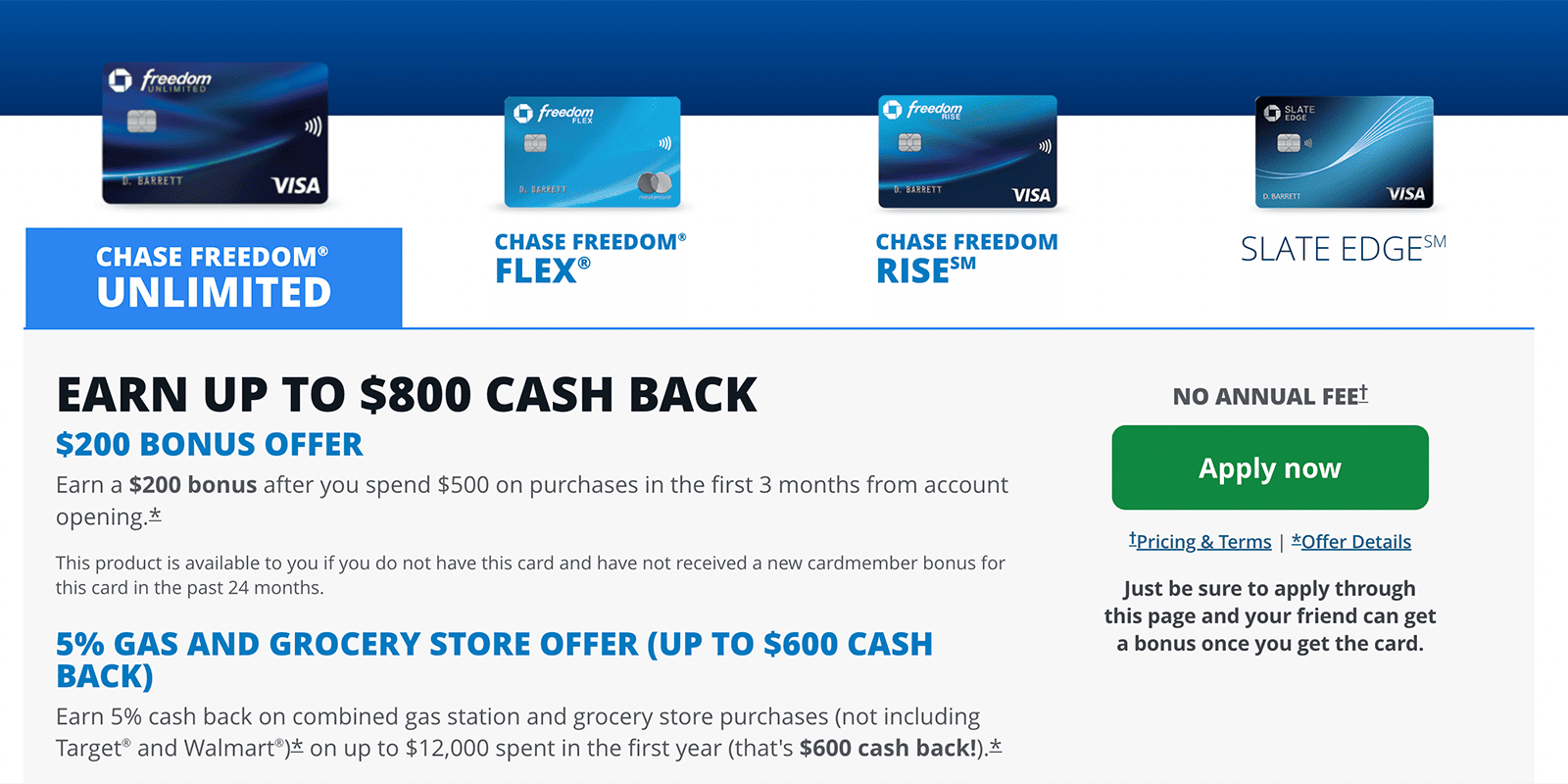

The Chase Freedom Unlimited offers 1.5% cashback on all purchases, and potentially higher rates on travel purchased through Chase Ultimate Rewards, dining, and drugstore purchases. Determine if these categories align with your typical spending patterns. Also, understand the fees, such as potential annual fees (though the Freedom Unlimited has none) and late payment fees.

Your credit score is a critical factor regardless of pre-qualification. A good to excellent credit score (typically 670 or higher) significantly increases your chances of approval and securing favorable terms. Monitor your credit report regularly for any errors or inconsistencies that could negatively impact your application.

The Future of Pre-Qualification

Pre-qualification tools are becoming increasingly sophisticated, with issuers leveraging more data points to provide more accurate assessments. As technology evolves, we can expect these tools to become even more refined, offering consumers greater transparency and control over their credit card applications.

Ultimately, pre-qualification remains a valuable tool for consumers navigating the credit card market. By understanding its benefits and limitations, and by conducting thorough research, individuals can make informed decisions and maximize their chances of approval for the Chase Freedom Unlimited, or any other card that fits their needs.

:max_bytes(150000):strip_icc()/chase-freedom-unlimited_blue-90aa9a715e0641a692dc08bb21d71f8b.jpg)