Chase Pre Qualifying Mortgage Application

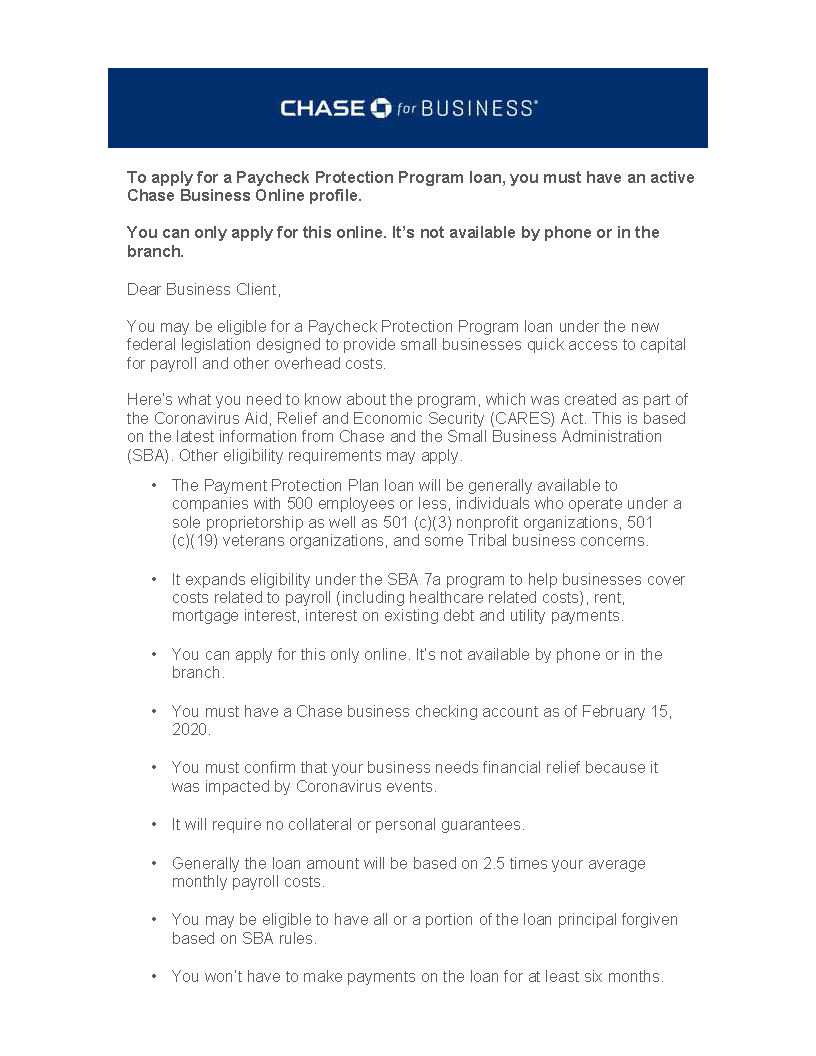

Homebuyers, act fast: Chase is urging potential mortgage applicants to utilize their pre-qualification tool now amidst fluctuating interest rates. This move aims to give individuals a clearer understanding of their borrowing power in a volatile market.

This article details the urgency surrounding Chase's pre-qualification push, explaining the process and its potential benefits for prospective homeowners navigating the current real estate landscape.

Understanding Chase's Pre-Qualification Process

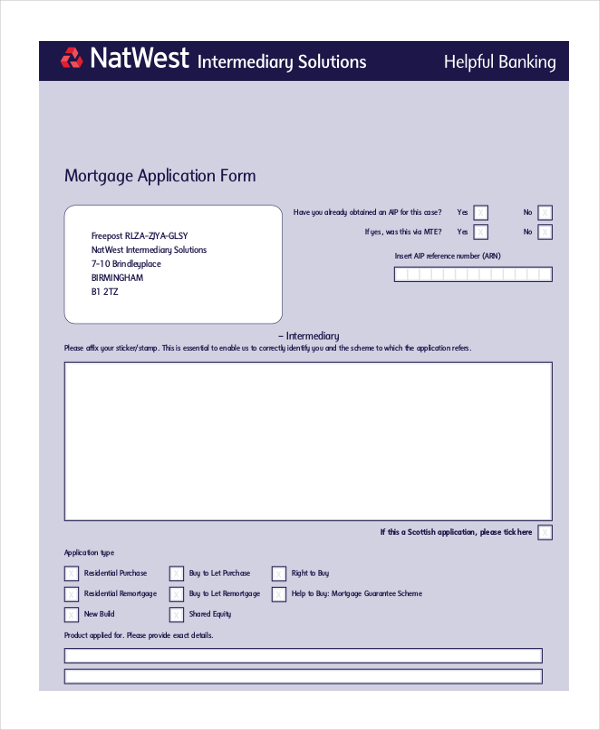

The Chase mortgage pre-qualification tool is an online process designed to estimate how much you might be able to borrow. It provides a preliminary assessment based on information you supply about your income, assets, and credit profile. This initial evaluation does not require a hard credit check.

You can find the tool on the Chase website, under the mortgage section. The process typically takes only a few minutes to complete.

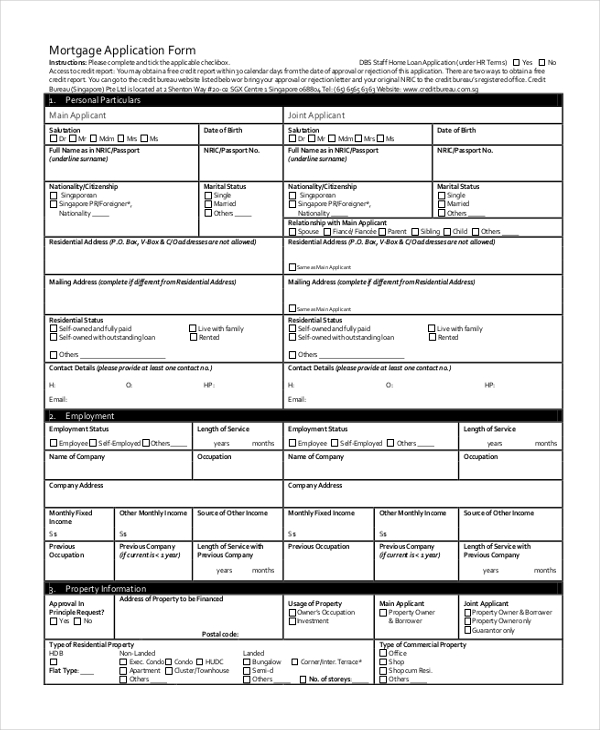

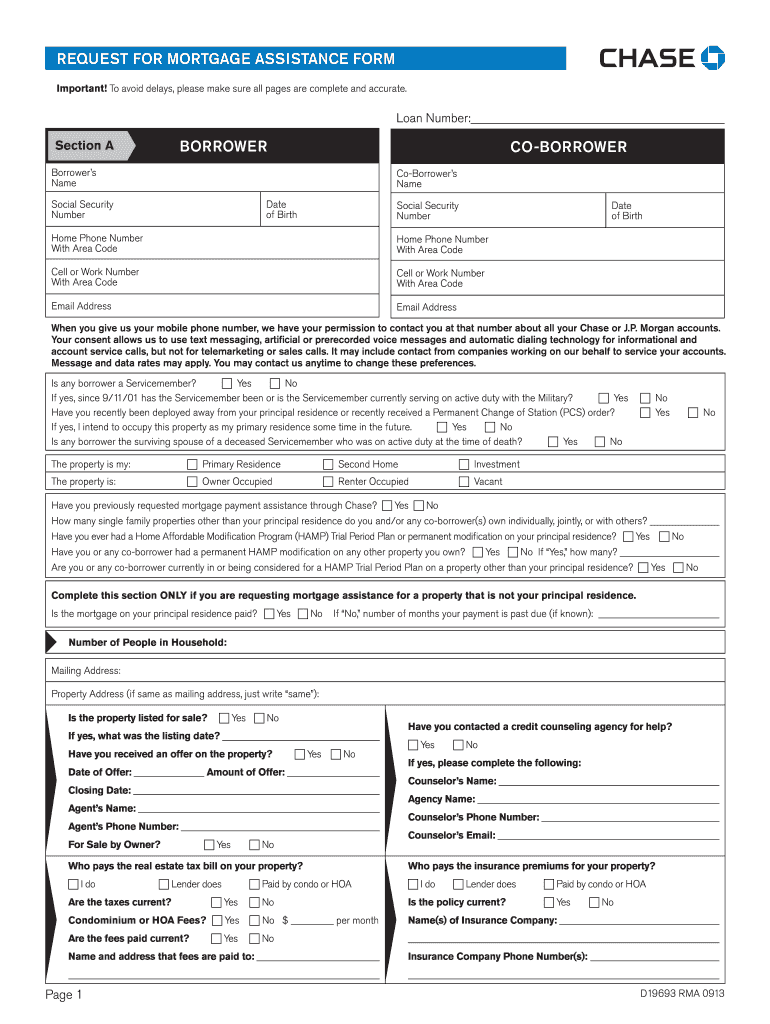

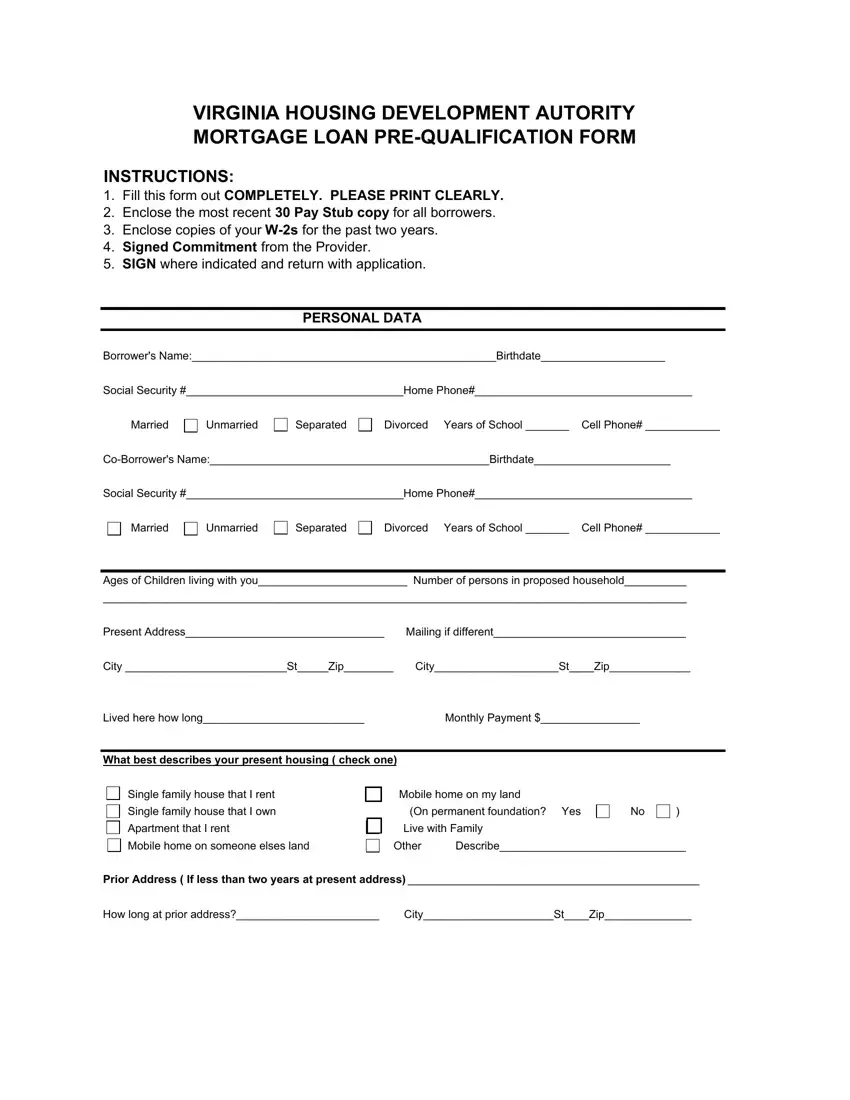

What Information is Needed?

During pre-qualification, you'll generally need to provide information such as your gross monthly income, estimated credit score range, and desired loan amount. Be prepared to share details about your assets and any existing debts.

It's crucial to provide accurate information. Inaccurate details can lead to a misleading pre-qualification result.

Benefits of Pre-Qualification

Pre-qualification offers several advantages. It allows you to understand your potential borrowing power before seriously searching for a home.

It also helps you gauge what price range is within your reach, saving you time and effort by focusing your search on appropriate properties. This knowledge can make you a more competitive buyer in a hot market.

Important Considerations

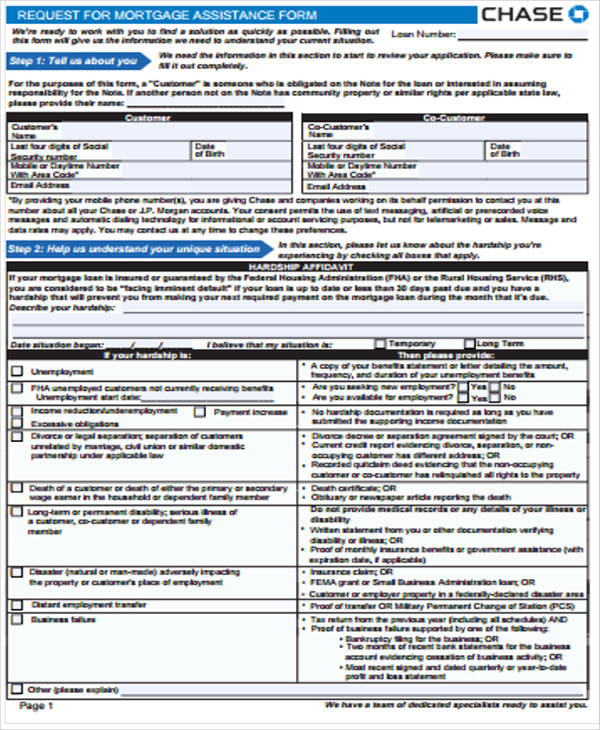

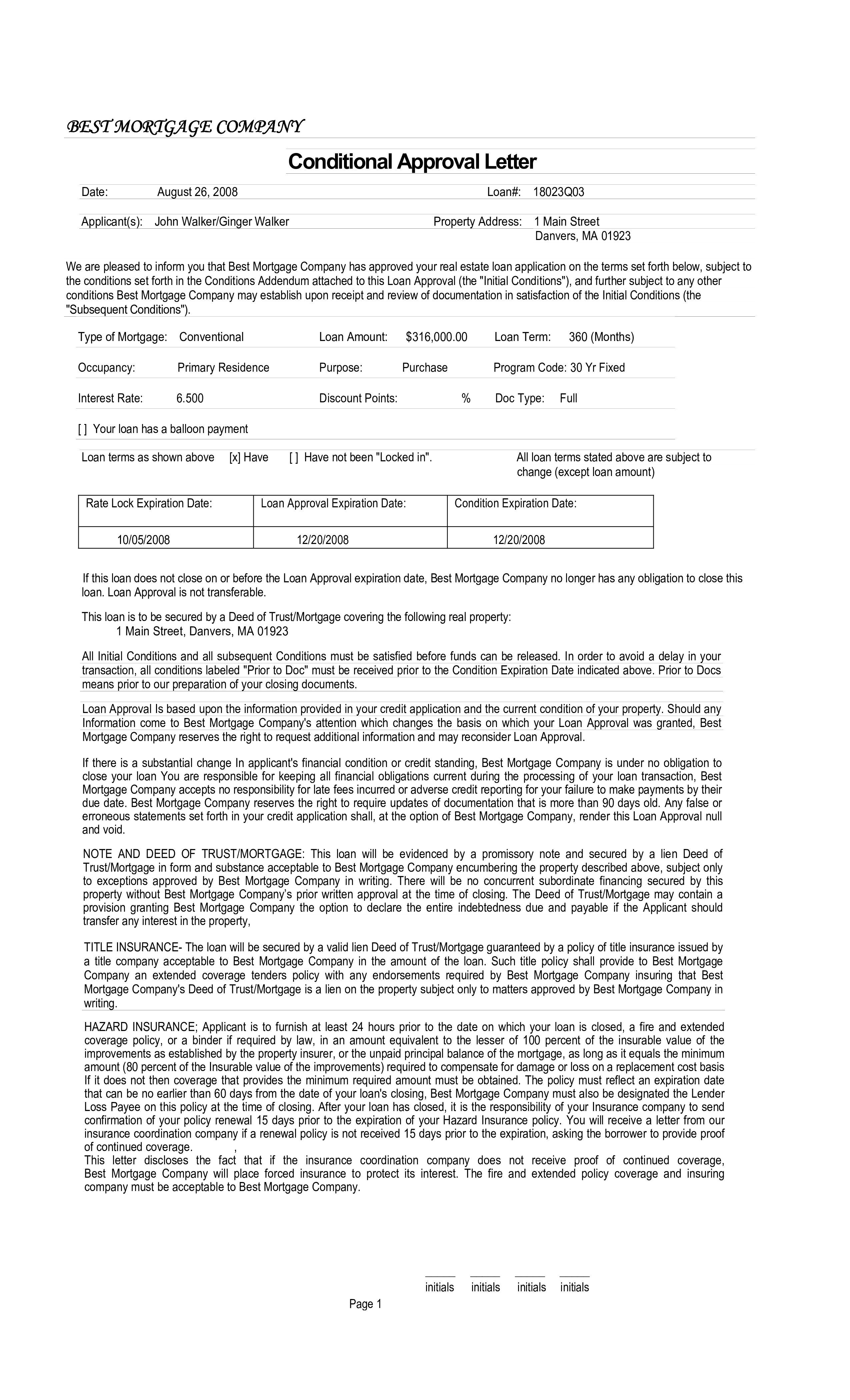

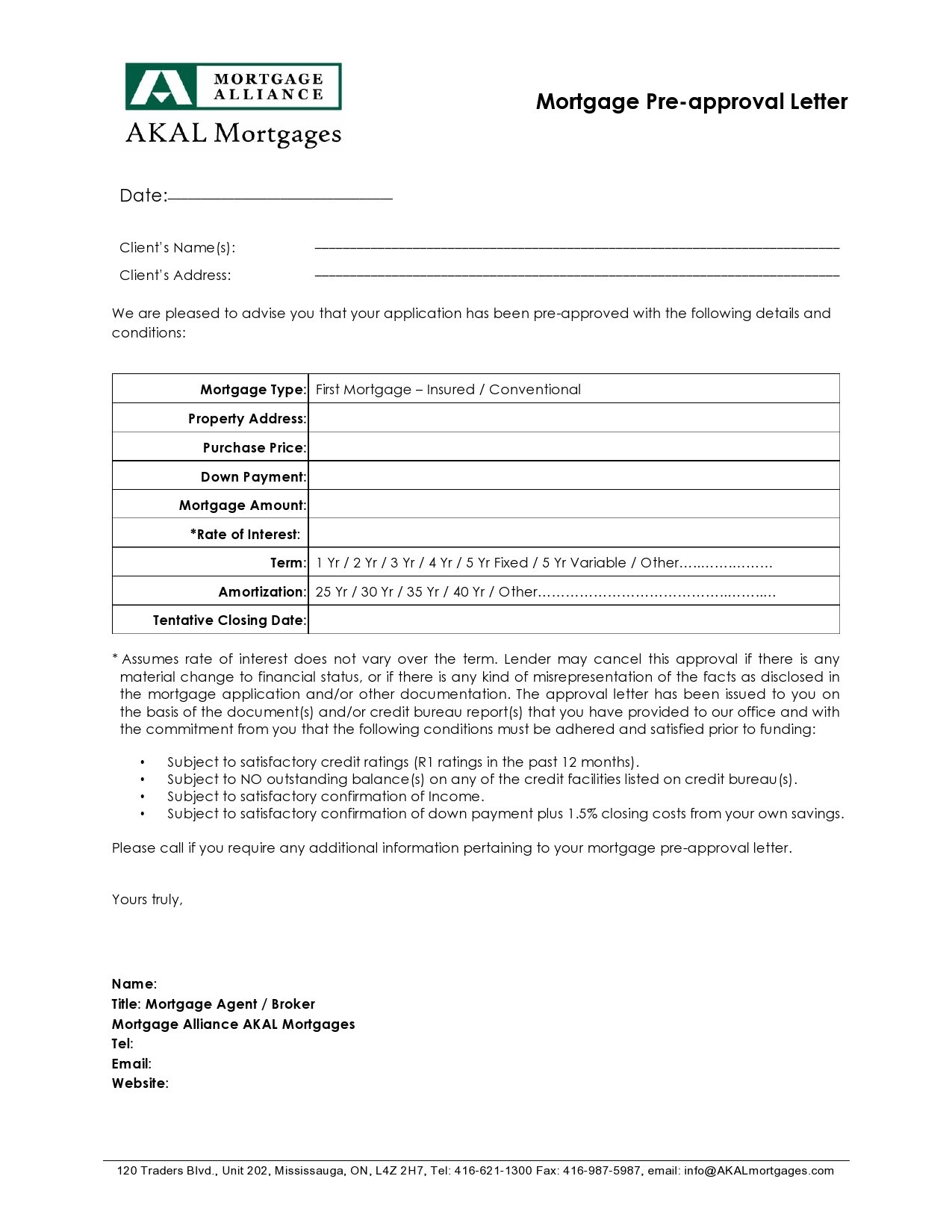

Pre-qualification is *not* a mortgage approval. It's simply an initial assessment of your financial situation. A full mortgage application and approval require further verification and a thorough underwriting process.

A hard credit check is required for mortgage approval. Pre-qualification uses a soft credit check which does not affect your credit score.

Interest rates are constantly changing. Your pre-qualification doesn't guarantee a specific interest rate.

Expert Insight on the Timing

Industry experts suggest that utilizing pre-qualification tools during periods of rate volatility is particularly smart. This gives potential buyers the ability to quickly assess their changing affordability.

"Understanding your purchasing power is crucial in today's market," says Sarah Miller, a financial advisor. "Pre-qualification can be a valuable first step."

What's Next?

If you are considering buying a home soon, visit the Chase website to explore the pre-qualification option. After pre-qualification, consider speaking with a Chase mortgage specialist to discuss your options in more detail.

Keep monitoring interest rate trends. Stay informed about market changes impacting your home-buying goals.

![Chase Pre Qualifying Mortgage Application Free Printable Pre-Approval Letter Templates [PDF] & Mortgage & Loan](https://www.typecalendar.com/wp-content/uploads/2023/05/pre-approved-letter.jpg?gid=302)

![Chase Pre Qualifying Mortgage Application Free Printable Pre-Approval Letter Templates [PDF] & Mortgage & Loan](https://www.typecalendar.com/wp-content/uploads/2023/05/fake-mortgage-pre-approval-letter.jpg)