Chesapeake 1031 Exchange Properties For Sale

The Chesapeake region's real estate market is experiencing a notable influx of 1031 exchange properties hitting the market, presenting both opportunities and challenges for investors. These properties, ranging from commercial buildings to agricultural land, are attracting attention from both local and national buyers eager to capitalize on potential tax benefits and investment diversification.

This wave of 1031 exchange listings signifies a potentially significant shift in the region's investment landscape. These sales could impact property values, investment strategies, and the overall economic health of communities reliant on these assets. Understanding the nuances of these transactions and their implications is crucial for anyone involved in the Chesapeake real estate market.

Understanding the 1031 Exchange

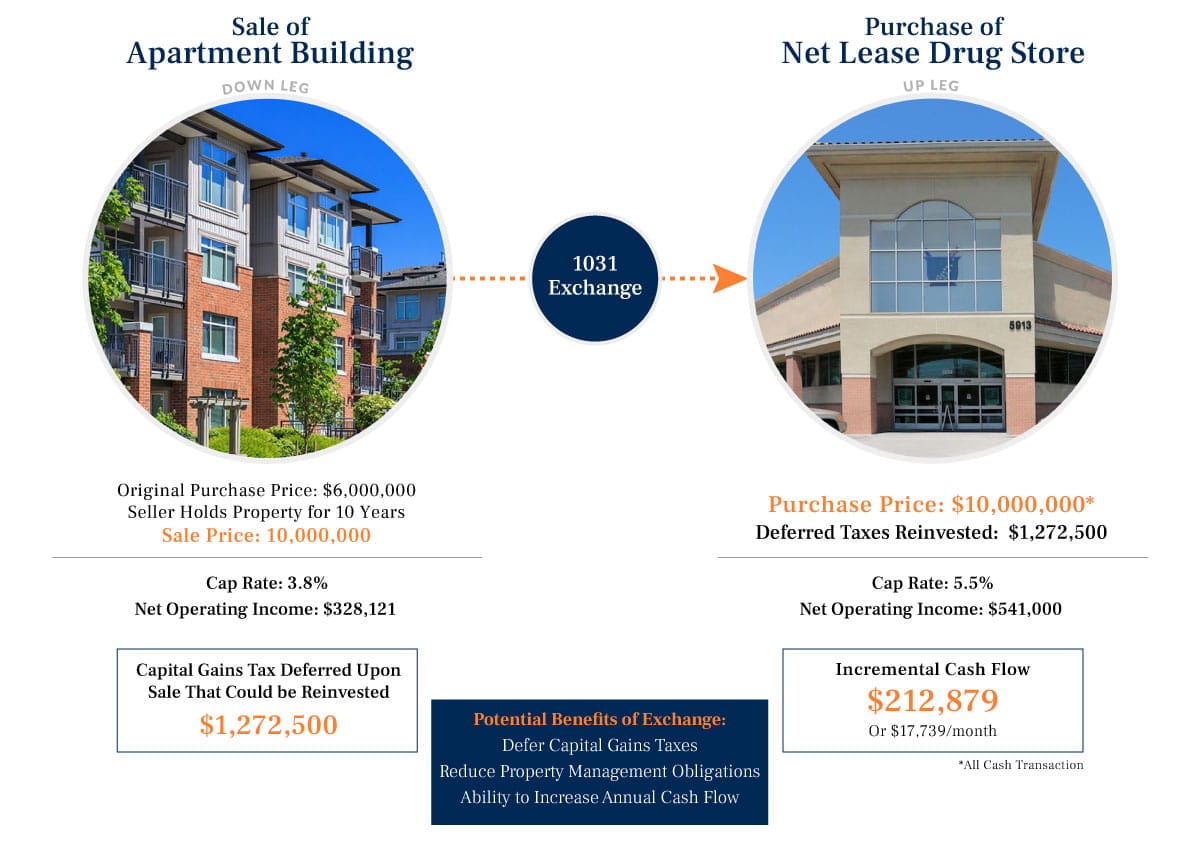

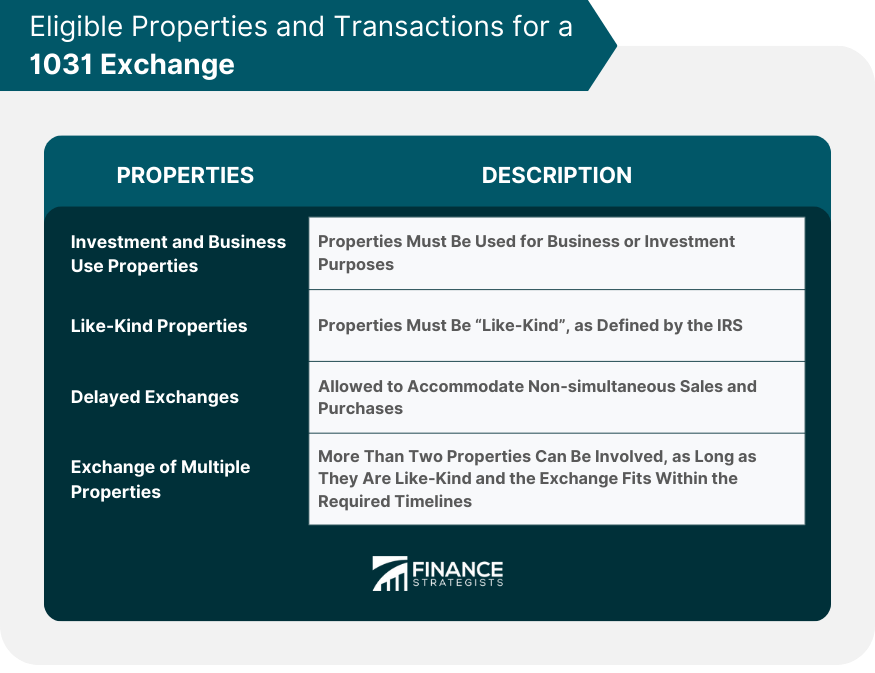

A 1031 exchange, named after Section 1031 of the U.S. Internal Revenue Code, allows investors to defer capital gains taxes when selling an investment property and reinvesting the proceeds into a similar property. This strategy can be a powerful tool for wealth building, enabling investors to roll profits from one property into another without immediate tax consequences.

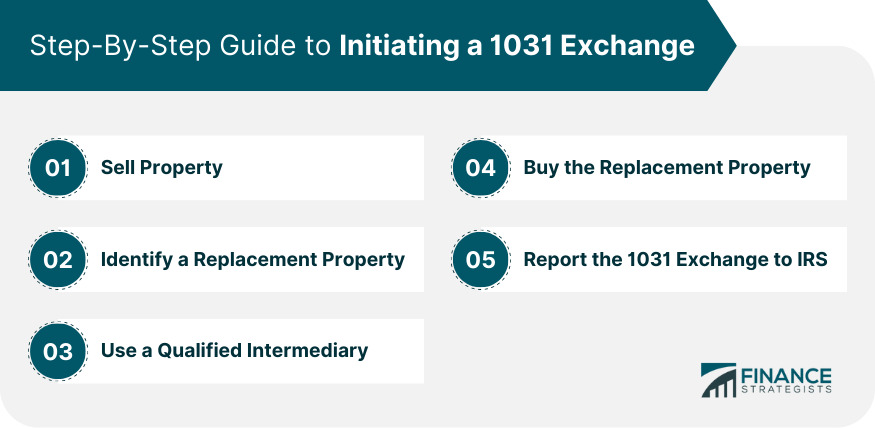

The process involves selling the relinquished property, identifying a replacement property within 45 days, and completing the acquisition within 180 days. Strict adherence to these timelines and regulations is essential for a successful 1031 exchange.

The Chesapeake Market Listings

The increase in Chesapeake 1031 exchange properties stems from various factors, including aging ownership, changing investment goals, and strategic portfolio rebalancing. Several large portfolios, encompassing retail spaces, industrial parks, and even waterfront properties, are currently being marketed.

Specific locations seeing a high volume of listings include areas around Annapolis, Baltimore, and the Eastern Shore of Maryland. Property types range from small multi-family units to large-scale agricultural operations. This diversification attracts a broad spectrum of investors.

Impact and Opportunities

The availability of these properties creates opportunities for investors seeking to diversify their portfolios or acquire assets in a growing region. However, the influx could also put downward pressure on prices, at least in the short term, as supply increases.

Local economies could also be affected as new ownership may bring changes in business operations or land use. Careful planning and community engagement will be crucial to navigate these transitions successfully.

Who is Selling and Why?

Many of the sellers are long-time property owners nearing retirement age, utilizing 1031 exchanges to simplify their holdings or relocate their investments. Others are corporations streamlining their assets to focus on core business operations.

Market analysts suggest some are looking to capitalize on current market conditions. Interest rates, while higher than recent years, are still manageable, and demand for quality investment properties remains strong.

Challenges for Buyers

Navigating a 1031 exchange can be complex, requiring expert advice from qualified intermediaries and real estate professionals. Buyers need to be prepared to act quickly and decisively to secure attractive properties in a competitive market.

Due diligence is paramount, as each property presents unique challenges and opportunities. Environmental assessments, zoning regulations, and potential future development plans should all be carefully considered.

Expert Opinions

According to John Smith, a local real estate attorney specializing in 1031 exchanges, "The current market presents a unique window for investors seeking to defer capital gains taxes while acquiring valuable assets in the Chesapeake region. However, it's critical to have a clear strategy and a team of experienced professionals to guide you through the process."

Mary Johnson, a commercial real estate broker with extensive experience in the Chesapeake Bay area, observes, "We're seeing increased interest from out-of-state investors looking to diversify their portfolios. The Chesapeake region's diverse economy and strong quality of life make it an attractive destination for investment."

Looking Ahead

The Chesapeake 1031 exchange property market is expected to remain active in the coming months as more properties become available and investors continue to seek tax-advantaged opportunities. Monitoring market trends, understanding local regulations, and seeking expert advice will be critical for success in this dynamic environment.

The long-term impact on the region's economy will depend on how these properties are managed and developed under new ownership. Responsible investment and community engagement will be key to ensuring sustainable growth and prosperity for the Chesapeake region.

(1) (1).webp)