Citibank Junior Account Minimum Balance

Imagine a young girl, Lily, carefully counting her allowance money, her eyes sparkling with determination. She dreams of opening her very own bank account, a tangible symbol of her growing independence and financial responsibility. For many families, this milestone is a significant step in teaching children about saving, budgeting, and the power of financial planning.

The landscape of junior bank accounts can be tricky to navigate, particularly when minimum balance requirements come into play. This article explores Citibank's approach to junior accounts and minimum balance requirements, examining its potential impact on families and their financial goals.

Junior accounts serve as vital tools for instilling financial literacy in young individuals. They provide a safe and structured environment for children to learn about managing money, differentiating between needs and wants, and understanding the concept of interest.

Understanding Junior Accounts

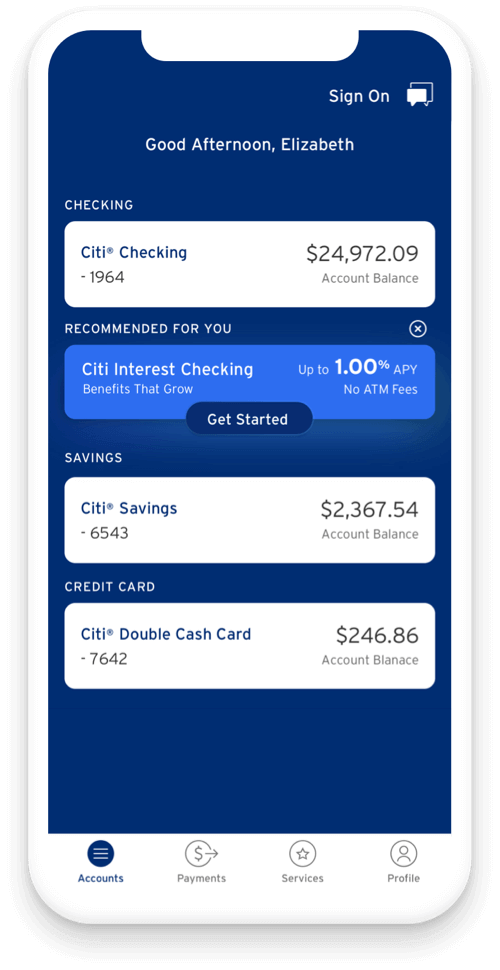

A junior account is essentially a bank account designed specifically for minors, often with parental or guardian oversight. These accounts typically offer features tailored to young users, such as educational resources, simplified online banking interfaces, and limited transaction capabilities.

Opening a junior account can foster a sense of ownership and responsibility in children, encouraging them to participate actively in financial decisions. It's a hands-on learning experience that can set the foundation for sound financial habits later in life.

Citibank's Junior Account Offerings

While Citibank might not explicitly advertise a specific "junior account," they offer various options that can be suitable for young individuals. These accounts may include savings accounts, checking accounts, or custodial accounts, each with varying features and requirements.

It's important to review Citibank's current offerings and consult with a bank representative to determine the best fit for a child's individual needs and circumstances. Understanding the fine print, especially regarding minimum balance requirements, is crucial.

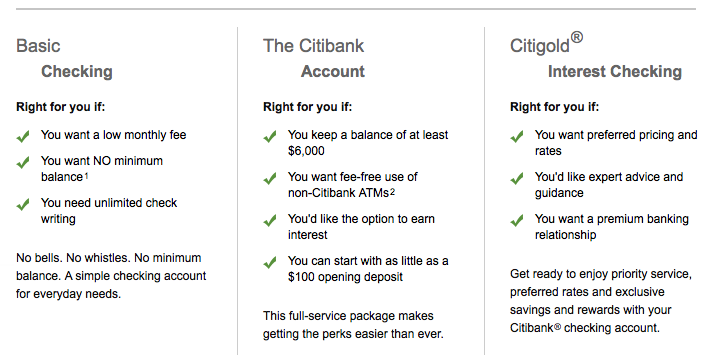

Minimum Balance Requirements: The Key Considerations

Minimum balance requirements are the stipulations set by a bank regarding the lowest amount of money that must be maintained in an account to avoid fees or other penalties. These requirements can vary significantly between banks and account types.

For families, these requirements can pose a challenge, particularly if they are starting small or have limited financial resources. Understanding the potential fees associated with falling below the minimum balance is essential for avoiding unexpected charges.

Often, banks will waive minimum balance requirements for junior accounts or offer alternative options with lower thresholds to encourage youth savings. Parents should inquire about these possibilities when opening an account.

"Financial literacy is a critical life skill, and starting early can significantly impact a child's future financial well-being." - National Financial Educators Council

Impact on Families

Minimum balance requirements can disproportionately affect low-income families, potentially creating a barrier to accessing banking services for their children. If a family struggles to maintain the minimum balance, they may face recurring fees, which can quickly erode any savings they have accumulated.

However, when managed effectively, minimum balance requirements can also serve as an incentive to save diligently. Parents can use this as an opportunity to teach children about setting financial goals and the importance of consistent saving habits.

By strategically planning deposits and withdrawals, families can avoid falling below the minimum balance threshold and reaping the full benefits of the junior account.

Ultimately, the decision to open a junior account with Citibank or any other financial institution depends on a family's individual circumstances, financial goals, and risk tolerance. Thorough research and careful consideration of the terms and conditions are essential.

As Lily continues to save her allowance, dreaming of a future filled with financial security and independence, the importance of accessible and supportive banking options becomes clear. By understanding the nuances of junior accounts and minimum balance requirements, families can empower their children to embark on a lifelong journey of financial literacy and success. Start early, save wisely.