Citibank Mortgage Relationship Discount

The dream of homeownership, already a challenging pursuit for many, just became slightly more attainable for some Citibank customers. The banking giant has quietly refined its mortgage relationship discount, a program that could significantly lower interest rates for those with existing accounts. But the specifics of the program, and who exactly benefits, remain a subject of scrutiny.

At its core, the Citibank mortgage relationship discount aims to incentivize customer loyalty by offering reduced mortgage rates to those who maintain substantial balances or investments with the bank. While the concept is not entirely novel, the depth of the potential savings and the opacity surrounding eligibility criteria have sparked both interest and questions within the real estate and financial communities.

Decoding the Discount: How it Works

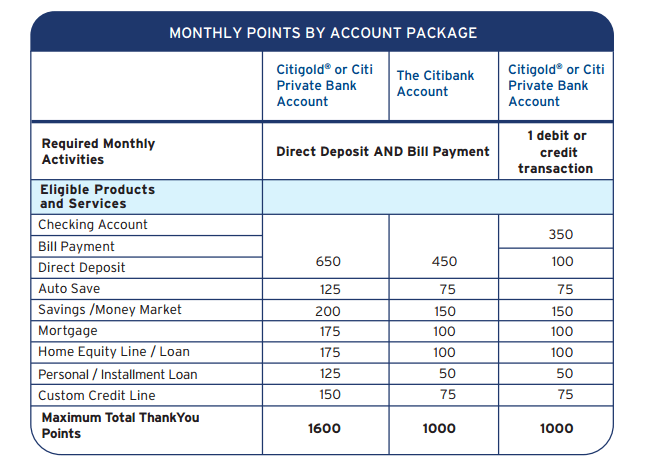

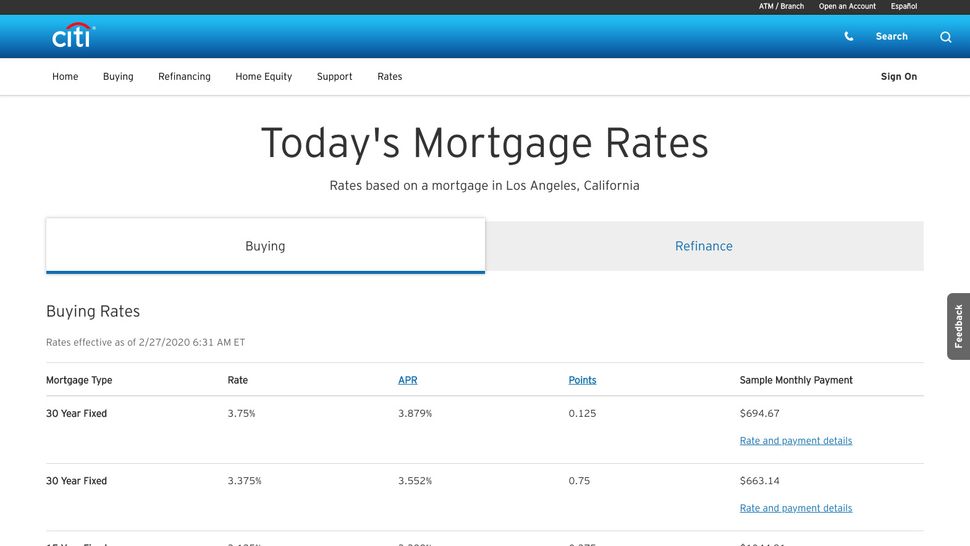

The mortgage relationship discount operates on a tiered system. The discount amount depends on the total combined balances held in eligible Citibank accounts.

These accounts typically include checking, savings, money market accounts, and investment holdings like stocks and bonds managed through Citibank. Higher balances translate to steeper discounts on the mortgage interest rate.

Eligibility and Requirements

Specific eligibility requirements are not publicly advertised in detail. However, industry experts suggest that maintaining a minimum combined balance of at least $50,000 is often a prerequisite.

The specific amount required and the corresponding rate reduction are determined on a case-by-case basis. This is based on the customer's financial profile and current market conditions.

Applicants need to demonstrate a stable financial history and meet standard creditworthiness criteria to qualify for a mortgage, regardless of their relationship with Citibank.

The Impact on Homebuyers

For eligible borrowers, the potential savings can be considerable. A reduced interest rate, even by a fraction of a percentage point, can translate to thousands of dollars saved over the life of a 30-year mortgage.

This can make homeownership more affordable. It can also allow buyers to potentially purchase a more expensive property than they could otherwise afford.

However, prospective homebuyers should carefully weigh the benefits of the discount against the potential costs of maintaining large balances at Citibank.

A Competitive Edge for Citibank?

In a competitive mortgage market, the mortgage relationship discount could give Citibank an edge in attracting and retaining customers. By incentivizing customers to consolidate their finances within the bank, Citibank aims to increase its assets under management and generate additional revenue.

This strategy aligns with a broader trend in the financial industry. It’s about leveraging customer relationships to cross-sell products and services.

Other major banks also offer similar relationship-based discounts, but the terms and conditions vary significantly.

Concerns and Criticisms

Some critics argue that the mortgage relationship discount favors wealthier clients. They may have the financial means to maintain the required balances and investments.

This raises concerns about equitable access to affordable housing. It raises questions about potentially widening the wealth gap.

The lack of transparency surrounding the specific eligibility criteria and discount amounts also draws criticism. This makes it difficult for consumers to compare offers and make informed decisions.

Looking Ahead

The long-term impact of Citibank's mortgage relationship discount remains to be seen. Its success will depend on its ability to attract and retain high-value customers. It will also depend on the evolving landscape of the mortgage market.

Other financial institutions are likely to closely monitor the program's performance. They could adjust their own offerings accordingly.

As interest rates fluctuate and the housing market evolves, the value proposition of relationship-based discounts will continue to be a key factor for homebuyers to consider.

:fill(white):max_bytes(150000):strip_icc()/Citi.svg-a74dcd38c0cc4c6c9892106d6f6a891b.png)