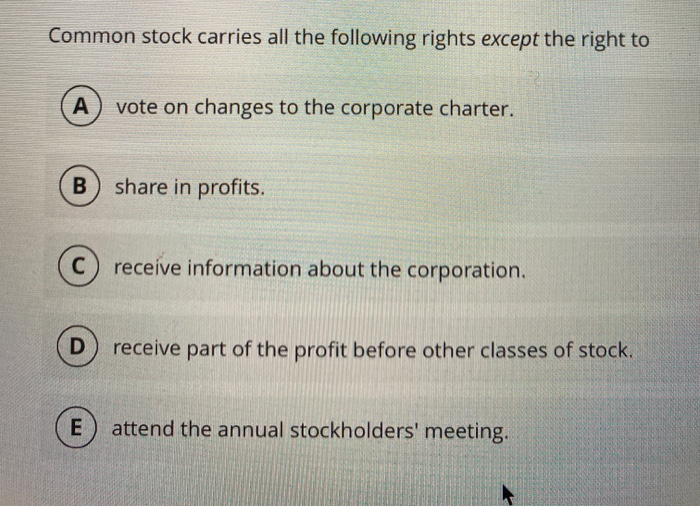

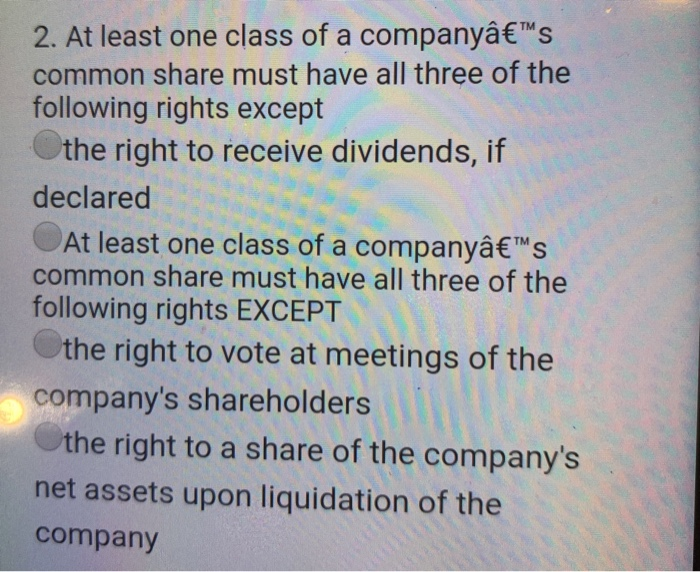

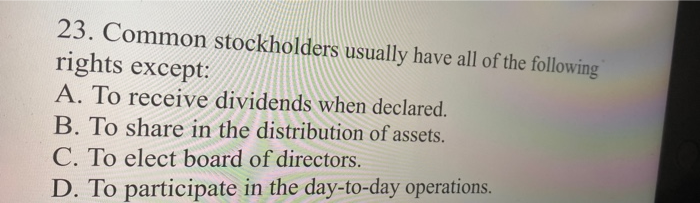

Common Stockholders Usually Have All Of The Following Rights Except:

Urgent investor alert: A critical misunderstanding regarding common stockholder rights is spreading, potentially leading to misinformed investment decisions. Many believe common stockholders possess a right they actually do not, impacting their investment strategies and risk assessment.

The core issue: While common stockholders enjoy significant privileges like voting rights, dividend participation (when declared), and the right to inspect company books, they do not have the right to receive dividends. This misconception could severely skew investment expectations and financial planning.

Understanding Common Stockholder Rights

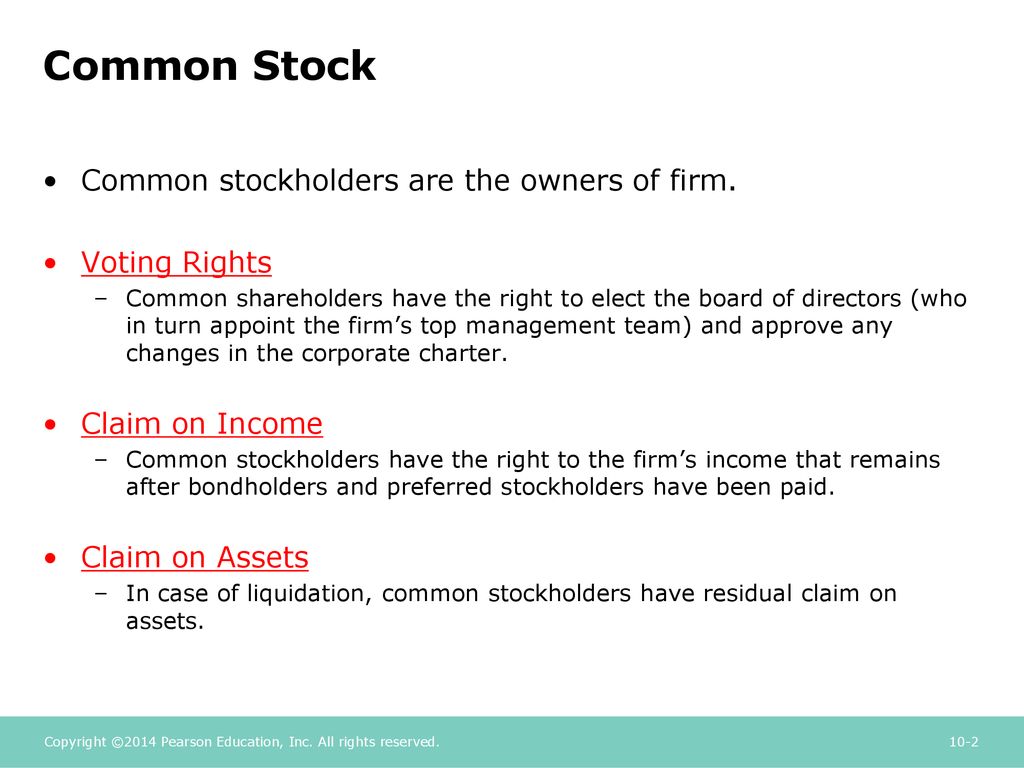

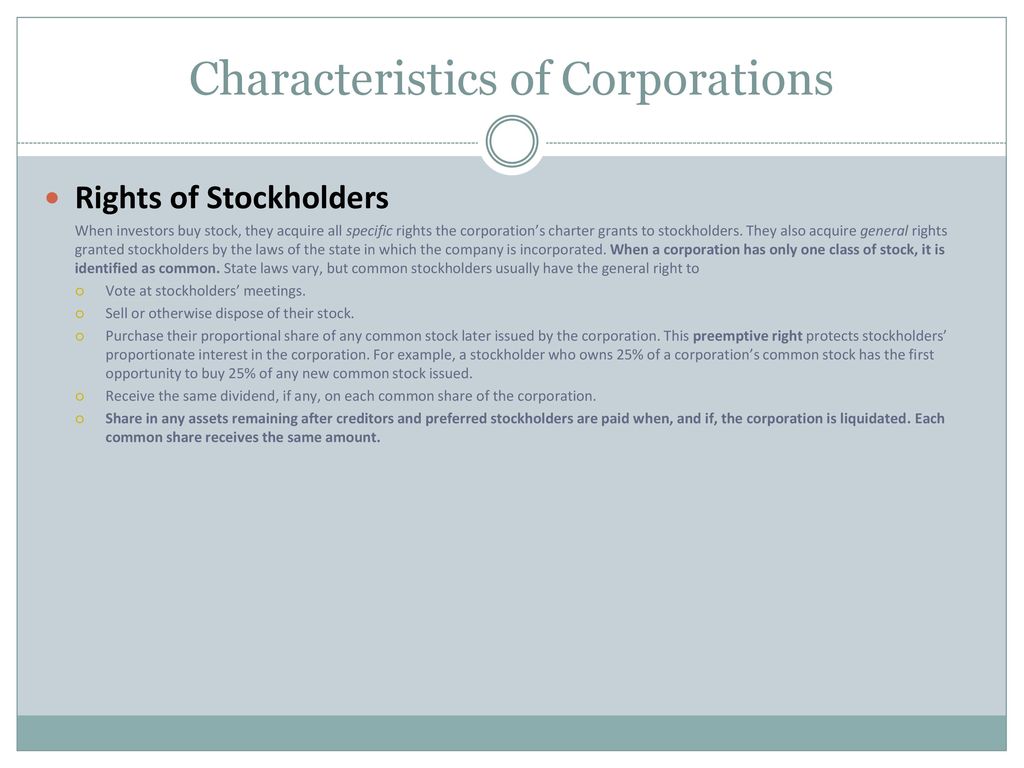

Common stockholders are the backbone of many publicly traded companies. Their investment fuels growth, and in return, they are granted specific rights designed to protect their interests and provide opportunities for financial gain.

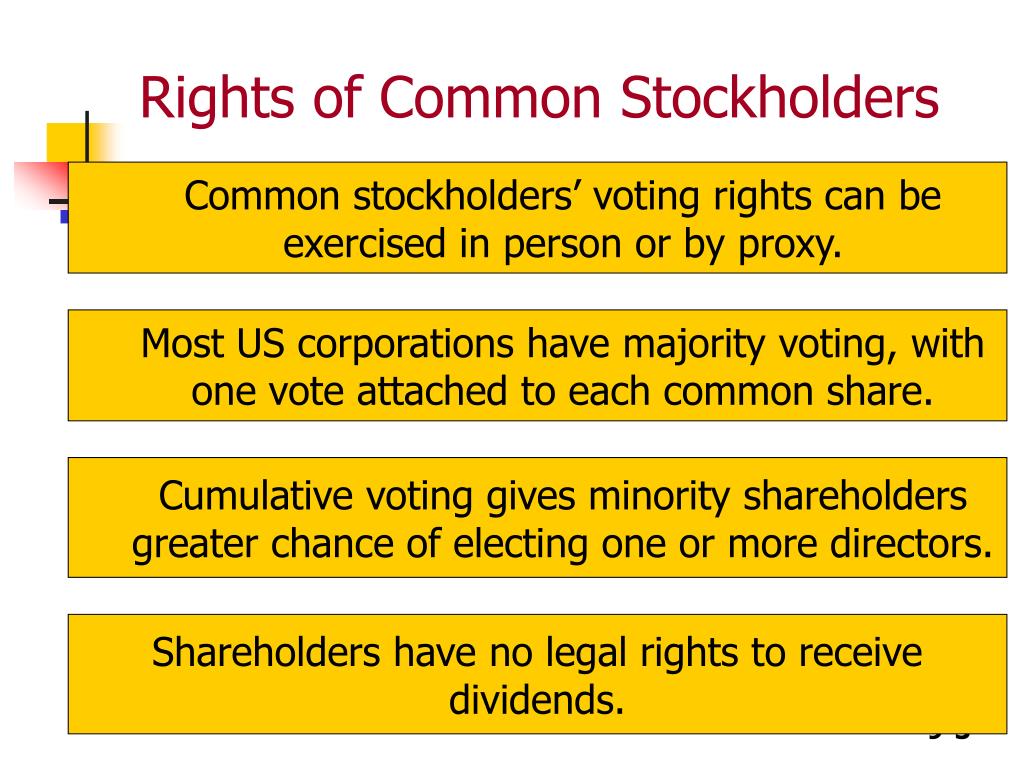

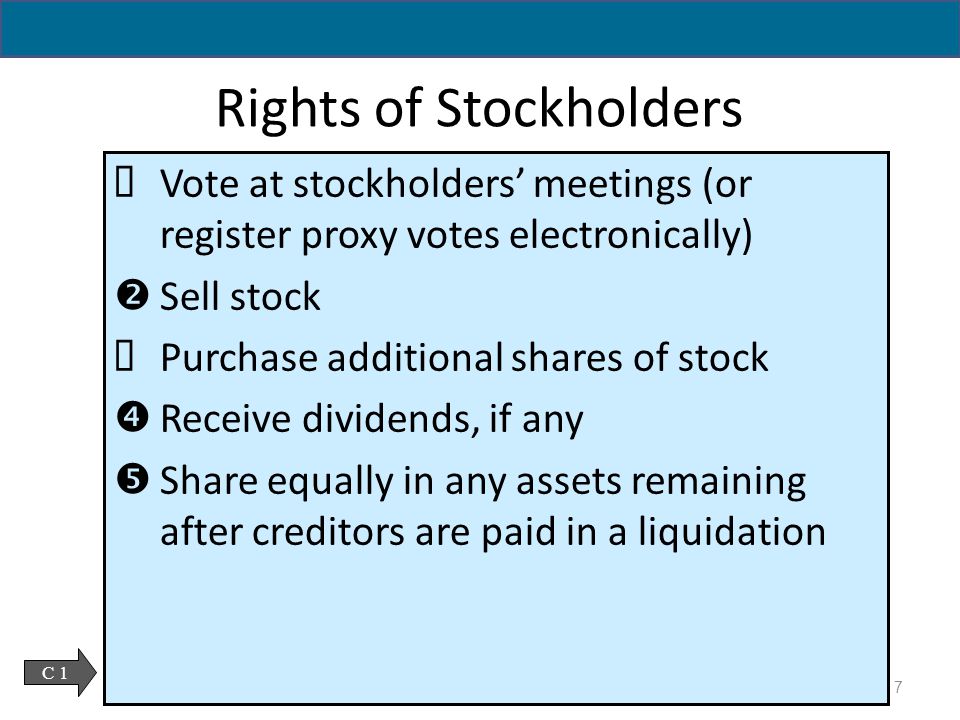

These rights typically include the power to vote on key corporate matters, such as electing board members and approving major transactions. Stockholders also have the right to receive their pro-rata share of any dividends declared by the company.

Furthermore, they are entitled to inspect the company's books and records, ensuring transparency and accountability from management. This oversight allows investors to monitor the financial health and operational efficiency of the business.

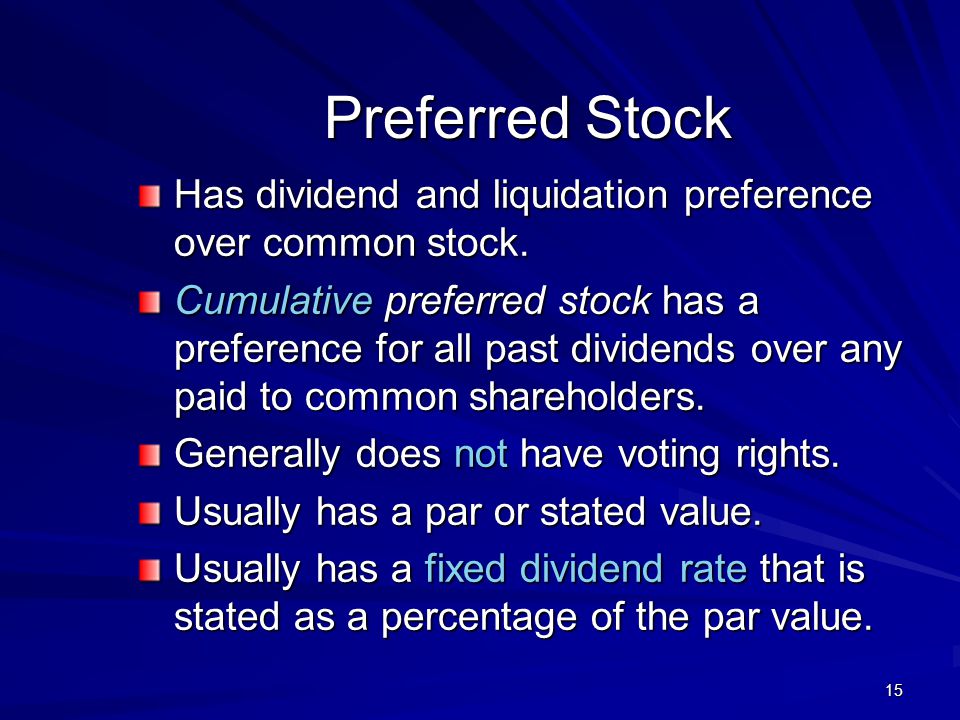

The Critical Distinction: Dividend Entitlement

The common misconception lies in assuming that common stockholders are guaranteed dividends. While they have the *right* to receive dividends if declared, the decision to declare dividends rests solely with the company's board of directors.

This decision is influenced by a multitude of factors, including profitability, reinvestment needs, and overall financial strategy. A company facing financial challenges or prioritizing growth may choose to reinvest profits rather than distribute them as dividends.

Therefore, the absence of a dividend payment does not necessarily indicate poor performance or mismanagement. It simply reflects the board's strategic decision regarding the allocation of company resources.

Consequences of Misunderstanding

Investors who mistakenly believe they are entitled to dividends could face significant disappointment and financial strain. This misunderstanding can lead to poor investment choices and unrealistic expectations about returns.

For example, retirees relying on dividend income might be caught off guard if a company suspends or reduces its dividend payments. This situation could disrupt their financial planning and create unforeseen hardship.

Moreover, the misconception can distort investment valuations. Investors might overvalue stocks based on the expectation of future dividends, leading to inflated prices and potential market corrections.

Real-World Examples

Numerous companies, even established ones, have suspended or reduced dividend payments during periods of economic uncertainty or financial restructuring. General Electric (GE), a former dividend stalwart, drastically cut its dividend in 2017 and 2018, impacting countless shareholders who relied on that income.

Similarly, during the COVID-19 pandemic, many companies across various sectors, including airlines and hospitality, suspended dividends to conserve cash and navigate the crisis. Data from S&P Dow Jones Indices showed a significant decrease in dividend payouts during 2020, affecting investors globally.

These examples underscore the crucial distinction between having the right to receive dividends *if declared* and being *entitled* to them regardless of the company's financial circumstances.

Protecting Your Investments: Due Diligence is Key

Investors must conduct thorough research and due diligence before investing in any stock. This includes carefully reviewing the company's financial statements, dividend history, and overall business strategy.

Focusing solely on dividend yield can be misleading. A high dividend yield might signal underlying financial problems or unsustainable payout ratios. Analyze the company's cash flow, debt levels, and profitability to assess the long-term viability of its dividend policy.

Seek professional financial advice if you are unsure about any aspect of your investment strategy. A qualified advisor can provide personalized guidance and help you make informed decisions aligned with your financial goals.

Ongoing Developments and Next Steps

Regulatory bodies like the SEC are increasingly focused on investor education, aiming to clarify common misconceptions about stock ownership and financial instruments. New initiatives and educational resources are being developed to empower investors with accurate information.

Investors should stay informed about changes in corporate dividend policies and monitor the financial health of their investments regularly. Utilize resources such as company filings, analyst reports, and financial news outlets to stay abreast of the latest developments.

This is a developing situation; continued awareness and education are crucial to protecting investors from potential financial pitfalls. Further updates will be provided as more information becomes available.