Commonwealth Annuity And Life Insurance Company

Commonwealth Annuity and Life Insurance Company, now known as Global Atlantic Financial Life Insurance, has a long and complex history marked by periods of significant growth, acquisitions, and ultimately, a rebranding that reflected its evolving strategic direction.

A History of Growth and Change

Founded in 1983 as a subsidiary of Reliance Group Holdings, Commonwealth Annuity quickly established itself in the fixed annuity market. Over the next two decades, the company expanded its product offerings and distribution channels, becoming a major player in the retirement savings industry.

This growth wasn't without its challenges. Reliance Group Holdings faced financial difficulties in the early 2000s, leading to a period of uncertainty for Commonwealth Annuity.

In 2005, the company was acquired by a group of investors led by Goldman Sachs. This marked a turning point, providing Commonwealth Annuity with the capital and resources needed to pursue further growth opportunities.

Strategic Acquisitions and Expansion

Under its new ownership, Commonwealth Annuity embarked on a series of strategic acquisitions designed to broaden its reach and diversify its product portfolio. These acquisitions included companies specializing in life insurance, reinsurance, and asset management.

One notable acquisition was Allmerica Financial Life Insurance and Annuity Company in 2007. This significantly expanded Commonwealth Annuity's footprint in the individual annuity market.

The company also focused on developing innovative new products to meet the changing needs of retirees and pre-retirees. These included indexed annuities and other types of retirement income solutions.

The Rebranding to Global Atlantic

In 2013, Commonwealth Annuity underwent a significant rebranding, changing its name to Global Atlantic Financial Life Insurance. This rebranding reflected the company's increasingly global focus and its ambition to become a leading provider of financial solutions worldwide.

The decision to rebrand was also driven by a desire to create a stronger, more unified brand identity across its various business lines. The name "Global Atlantic" was chosen to evoke a sense of stability, strength, and international reach.

According to official statements released at the time, the rebranding was not simply a cosmetic change but rather a reflection of a deeper strategic shift within the organization.

Impact on Policyholders and the Industry

The transition from Commonwealth Annuity to Global Atlantic had a limited direct impact on existing policyholders. Existing policies remained in force under the same terms and conditions.

However, the rebranding and subsequent growth of Global Atlantic has had a broader impact on the insurance industry. The company's innovative product development and aggressive acquisition strategy have helped to shape the competitive landscape.

Furthermore, Global Atlantic's focus on financial strength and risk management has contributed to the overall stability of the annuity market.

Recent Developments and Future Outlook

In recent years, Global Atlantic has continued to grow and evolve, expanding its presence in both the U.S. and international markets. The company has also invested heavily in technology and analytics to improve its customer service and operational efficiency.

In February 2021, KKR, a leading global investment firm, completed its acquisition of Global Atlantic. This acquisition further strengthened Global Atlantic's financial position and provided it with access to KKR's extensive investment expertise.

Looking ahead, Global Atlantic is well-positioned to continue its growth trajectory. The company's strong financial foundation, innovative product offerings, and experienced management team give it a competitive advantage in the increasingly complex and challenging retirement savings market.

Key Takeaways:

What: The evolution of Commonwealth Annuity and Life Insurance Company into Global Atlantic Financial Life Insurance Company.

Why: Strategic acquisitions, rebranding, and a focus on global expansion.

Impact: Limited direct impact on existing policyholders, but a significant impact on the insurance industry landscape.

The rebranding to Global Atlantic marked a new chapter in the company's history, reflecting its ambition to become a leading global provider of financial solutions.

:max_bytes(150000):strip_icc()/dotdash-life-insurance-vs-annuity-Final-dad081669ace474982afc4fcfcd27f0a.jpg)

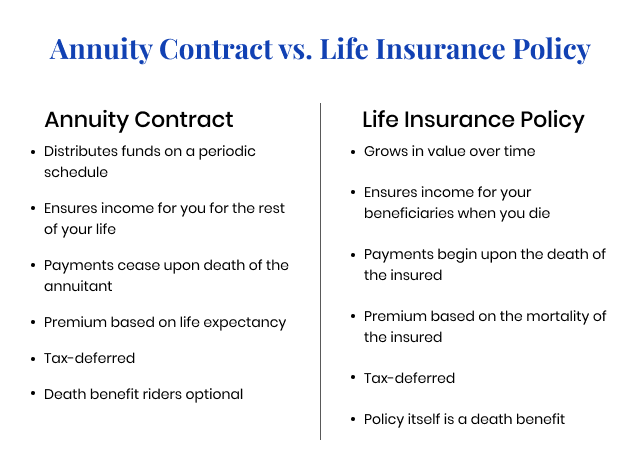

![Commonwealth Annuity And Life Insurance Company Life Insurance Vs Annuities [Similarities and Differences] – I&E](https://www.insuranceandestates.com/wp-content/uploads/life-insurance-annuity-e1573490799831.jpg)