Como Borrar Hard Inquiries De Mi Credito

In today's credit-driven world, maintaining a healthy credit score is paramount for accessing loans, mortgages, and even securing employment. Many consumers find themselves grappling with the impact of hard inquiries on their credit reports, often unaware of how these inquiries affect their creditworthiness and how to potentially remove them.

Understanding how to address and potentially remove these inquiries is crucial for taking control of one's financial health. This article delves into the intricacies of hard inquiries, exploring what they are, how they impact credit scores, and legitimate strategies for their removal.

Understanding Hard Inquiries and Their Impact

A hard inquiry occurs when a lender or company checks your credit report to make a lending decision. This usually happens when you apply for a credit card, loan, or mortgage. These inquiries can slightly lower your credit score, especially if you have several in a short period.

According to Experian, the effect of a hard inquiry is usually minimal, typically knocking off just a few points. However, multiple hard inquiries within a short timeframe can raise red flags for lenders, suggesting you might be desperately seeking credit.

Unlike soft inquiries, which don't affect your credit score and occur when you check your own credit report or when companies pre-approve you for offers, hard inquiries are visible to other lenders and remain on your credit report for two years. Understanding the difference is key to managing your credit health.

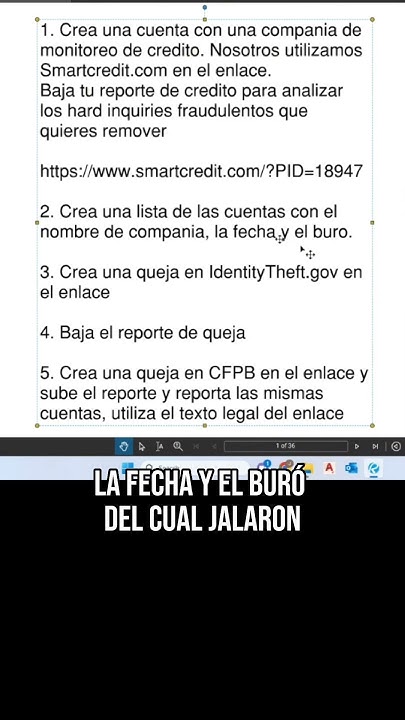

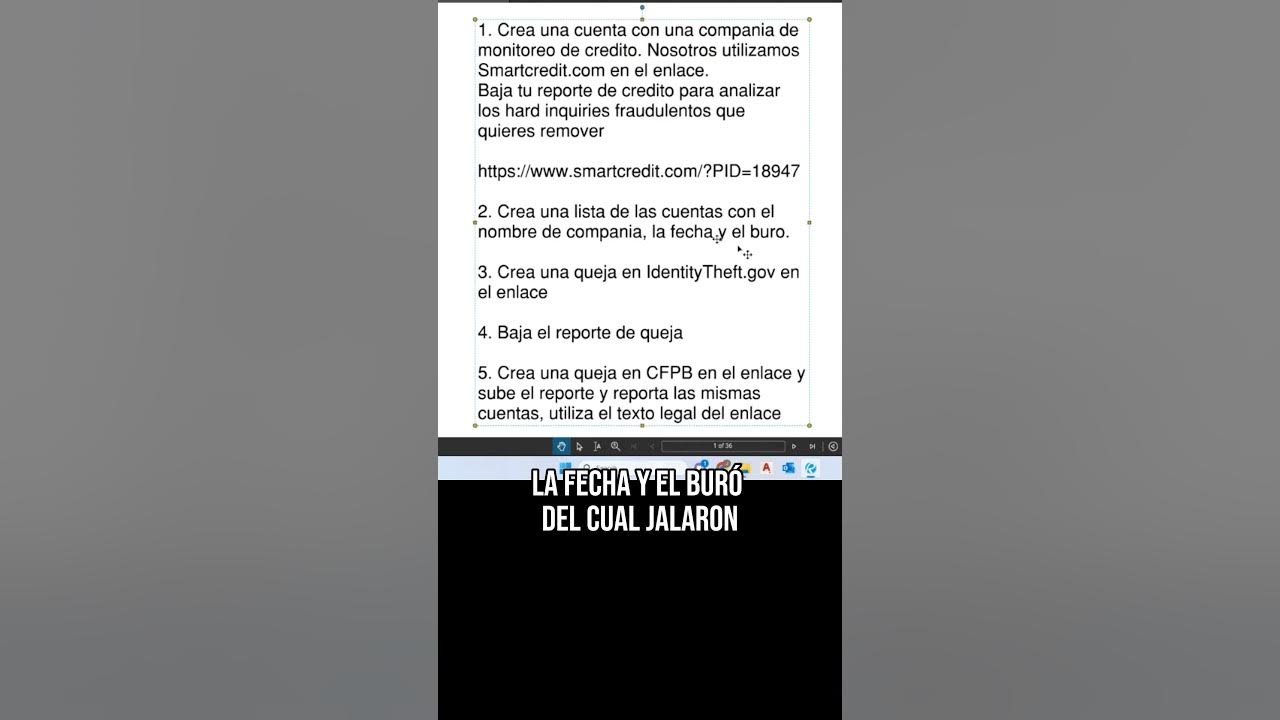

Legitimate Strategies for Removal

While hard inquiries generally fade from your credit report after two years, there are legitimate methods for potentially accelerating their removal, especially if they are inaccurate or unauthorized.

Disputing Inaccurate or Unauthorized Inquiries

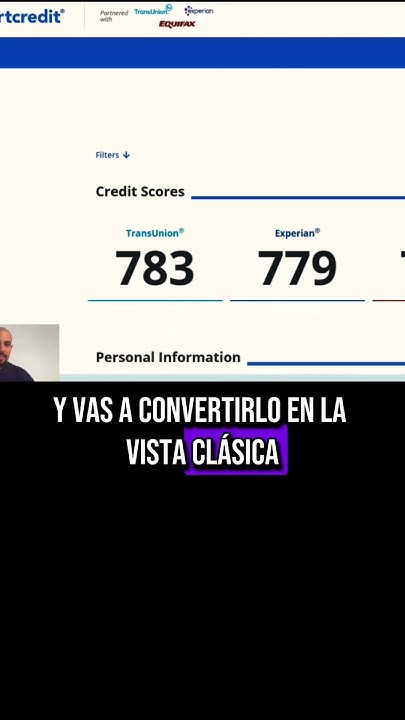

The most common and effective method is disputing inaccuracies with the credit bureaus (Equifax, Experian, and TransUnion). If you find a hard inquiry you don't recognize, it's crucial to file a dispute. The credit bureau is then legally obligated to investigate and verify the inquiry with the lender.

To dispute an inquiry, you'll need to contact the credit bureau in writing or online, providing details of the inaccurate inquiry and any supporting documentation, such as proof that you didn't apply for the credit in question. The credit bureau typically has 30 to 45 days to investigate.

If the lender cannot verify the inquiry's legitimacy, the credit bureau is required to remove it from your credit report. This can lead to a swift improvement in your credit score, particularly if the disputed inquiry was contributing significantly to a negative credit profile.

Negotiating with the Lender (Less Common)

While less common, another approach is to contact the lender directly and request that they remove the inquiry. This might be successful if you were pre-approved for a credit card or loan but ultimately didn't proceed with the application.

It's important to present a polite and reasonable explanation, emphasizing your commitment to responsible credit management. While lenders aren't obligated to remove inquiries, some may be willing to do so as a courtesy, especially if you are a long-standing customer.

"It is important to remember that disputing legitimate inquiries, simply because you regret applying for credit, is unethical and unlikely to be successful," warns TransUnion's website.

What Not to Do: Avoiding Scams

Numerous companies falsely promise immediate hard inquiry removal for a fee. Be very cautious of these services. Most of these services offer nothing that you can't do yourself for free.

According to the Federal Trade Commission (FTC), consumers should be wary of any company that demands upfront payment before providing credit repair services or guarantees specific results. Remember, you have the right to dispute inaccuracies on your credit report for free.

Focus on building positive credit habits by paying bills on time, keeping credit card balances low, and avoiding unnecessary credit applications. These actions have a far greater impact on your long-term credit health than any quick-fix solution.

Conclusion: Taking Control of Your Credit

Understanding hard inquiries and their impact is crucial for maintaining a healthy credit score. By knowing your rights, monitoring your credit report regularly, and disputing inaccuracies, you can effectively manage and potentially remove unwanted hard inquiries.

Remember, building a strong credit profile is a marathon, not a sprint. Patience, responsible credit management, and awareness of your rights are the keys to achieving your financial goals.