Competitor Analysis In Usa Trucking Industry Segment Wise Report

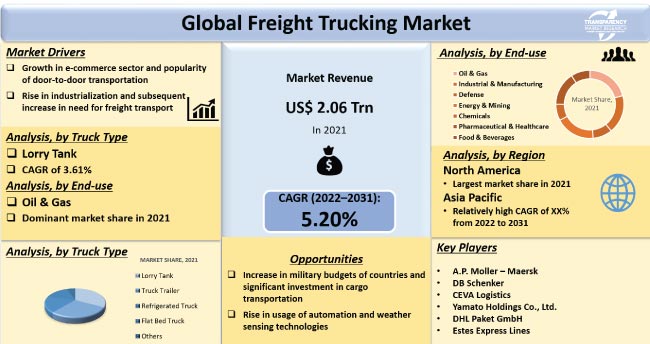

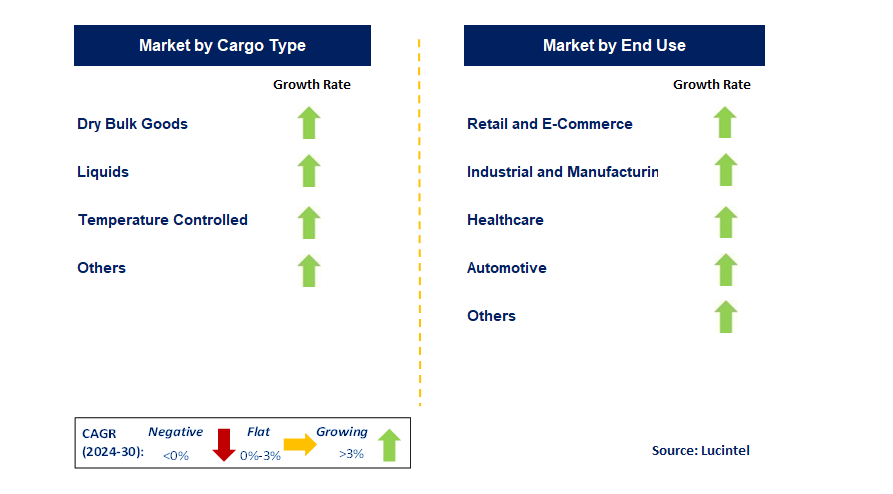

The competitive landscape of the U.S. trucking industry is undergoing a significant transformation, marked by increasing fragmentation, evolving customer demands, and the persistent pressure to adopt new technologies. A recent report dissecting the industry segment by segment reveals a complex and dynamic playing field where understanding competitor strategies is paramount for survival and growth.

The comprehensive analysis provides a granular view of the competitive forces shaping various segments, offering insights into market share, pricing strategies, technological adoption, and the overall operational efficiency of key players.

Understanding the Segmented Landscape

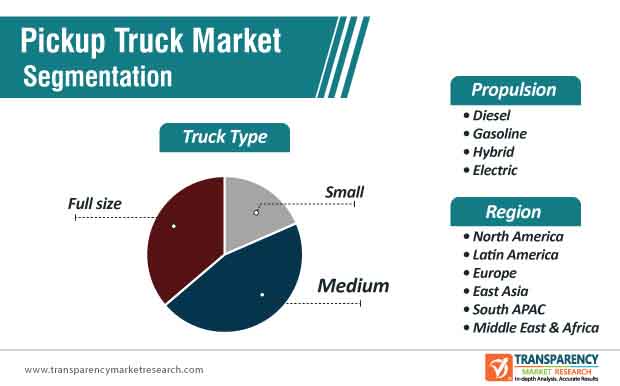

The report divides the U.S. trucking industry into distinct segments, including Less-Than-Truckload (LTL), Truckload (TL), and specialized sectors like refrigerated transport, hazardous materials, and flatbed services.

Each segment faces unique competitive pressures and boasts its own set of leading players.

Truckload (TL) Segment

The TL segment, characterized by hauling full trailer loads directly from origin to destination, remains highly fragmented.

The report highlights key players such as Schneider National, J.B. Hunt Transport Services, and Knight-Swift Transportation, analyzing their strategies for maintaining market share amidst intense competition from smaller carriers and owner-operators.

Pricing pressures, driven by fluctuating fuel costs and freight demand, are a significant concern for TL carriers.

Less-Than-Truckload (LTL) Segment

The LTL segment, involving the consolidation and distribution of smaller shipments, exhibits a higher degree of concentration.

Leading LTL carriers like FedEx Freight, XPO Logistics, and Old Dominion Freight Line dominate this space, leveraging extensive networks and sophisticated logistics technologies to optimize efficiency and service levels.

The report emphasizes the importance of technology adoption, particularly in areas like route optimization and real-time tracking, for LTL carriers to maintain a competitive edge.

Specialized Segments

Specialized segments, such as refrigerated transport and hazardous materials hauling, present unique challenges and opportunities.

Stringent regulations, specialized equipment requirements, and the need for highly trained personnel create barriers to entry, leading to a more concentrated competitive landscape within these sectors.

The report identifies key players in each specialized segment and analyzes their strategies for complying with regulations while maintaining profitability.

Key Competitive Strategies

The analysis reveals several key competitive strategies employed by trucking companies across different segments.

These include investments in technology, focus on driver recruitment and retention, expansion of service offerings, and strategic acquisitions.

Technology adoption is a critical factor, with companies increasingly investing in telematics, electronic logging devices (ELDs), and advanced analytics to improve operational efficiency and reduce costs.

The ongoing driver shortage is a significant challenge for the industry, making driver recruitment and retention a top priority for many companies.

Strategies to attract and retain drivers include offering competitive pay and benefits packages, improving work-life balance, and investing in driver training and development programs.

Expanding service offerings, such as providing value-added services like warehousing and distribution, is another common strategy for differentiating from competitors and capturing a larger share of the market.

Strategic acquisitions are also playing a significant role, with larger companies acquiring smaller players to expand their geographic reach, service offerings, and customer base.

Impact and Future Outlook

The competitive dynamics within the U.S. trucking industry are expected to continue evolving rapidly in the coming years.

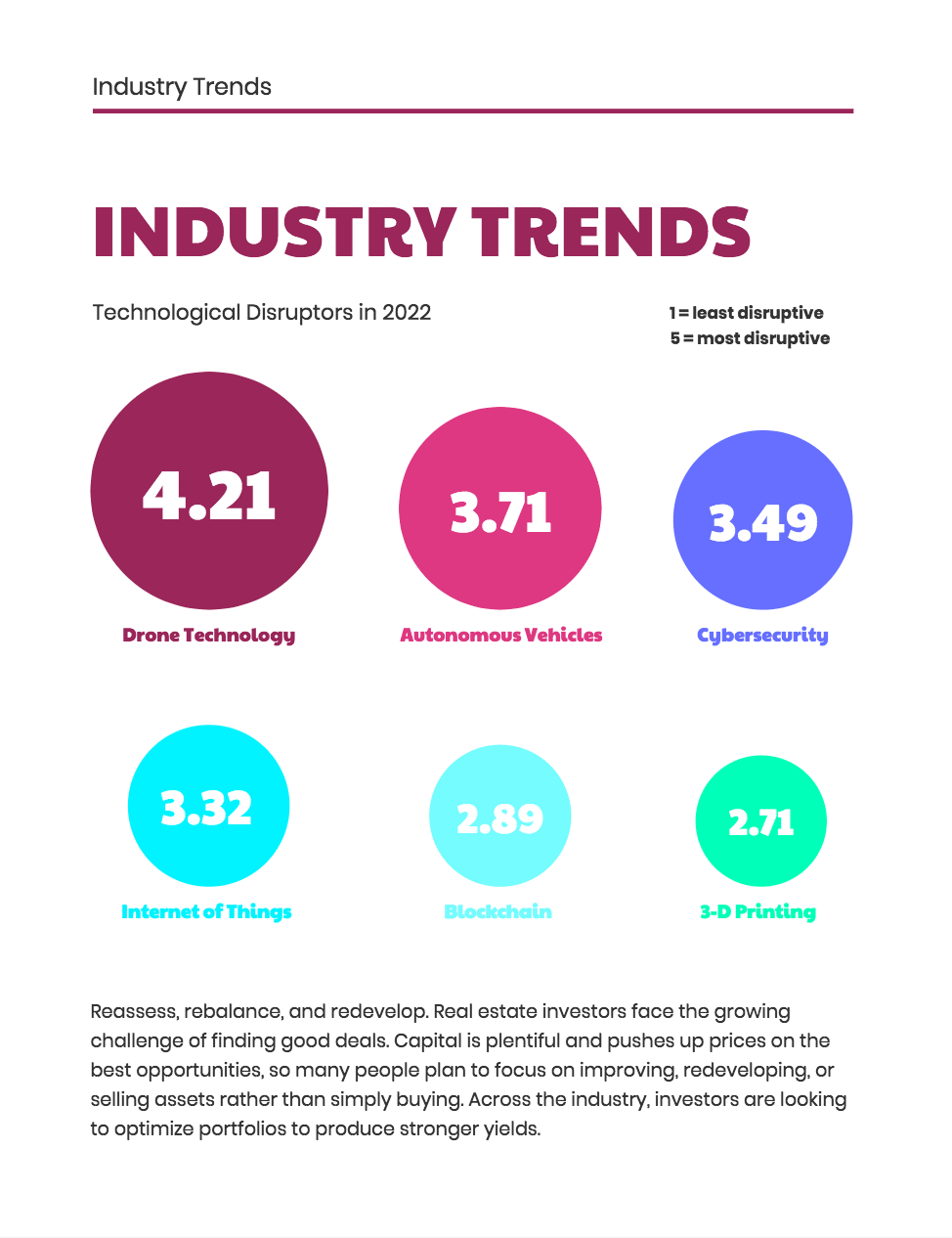

Factors such as the growth of e-commerce, increasing regulatory scrutiny, and the development of autonomous trucking technologies will shape the future of the industry.

The report suggests that companies that embrace technology, prioritize driver satisfaction, and adapt to changing customer demands will be best positioned for success.

Understanding the competitive landscape segment by segment is crucial for making informed business decisions and navigating the challenges and opportunities that lie ahead.

For stakeholders across the industry, including carriers, shippers, investors, and policymakers, this detailed analysis provides valuable insights into the forces shaping the future of trucking in the United States.