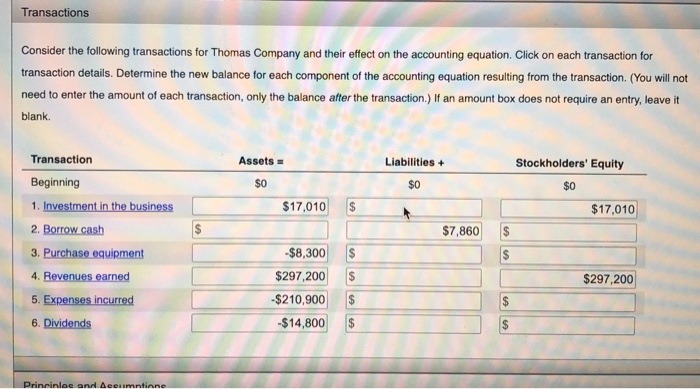

Consider The Following Transactions For Thomas Company

The financial integrity of Thomas Company is under scrutiny following a series of transactions that have raised concerns among investors and industry analysts. Allegations of improper accounting practices and potential conflicts of interest have triggered internal and external investigations, casting a shadow over the company's future prospects.

At the heart of the controversy lies a complex web of financial dealings, including related-party transactions, asset valuations, and revenue recognition practices. These actions have prompted intense debate about whether Thomas Company adhered to Generally Accepted Accounting Principles (GAAP) and whether its disclosures provided a true and fair view of its financial position. The outcome of these investigations could have significant ramifications, ranging from financial restatements and regulatory penalties to civil lawsuits and even criminal charges.

Related-Party Transactions Under the Microscope

One area of particular concern involves a series of transactions between Thomas Company and entities controlled by family members of its top executives. These transactions, which include the sale of assets and the provision of services, have raised red flags due to the potential for conflicts of interest and the possibility that they were not conducted at arm's length.

According to sources familiar with the matter, the transactions involved properties that may have been overvalued, resulting in a financial gain for the related parties at the expense of Thomas Company. Experts emphasize the importance of scrutinizing these transactions to determine whether they were in the best interests of the company and its shareholders. These arrangements are allowed, but must be fully disclosed.

Expert Opinions Divided

Experts offer differing perspectives on the appropriateness of Thomas Company's related-party transactions. Some argue that these transactions were legitimate business dealings that provided benefits to the company. Others claim that the transactions were designed to enrich insiders and that they may have violated securities laws.

“Related-party transactions can be legitimate and even beneficial if they are properly disclosed and approved by an independent committee,” says Sarah Chen, a forensic accountant at Chen & Associates. However, others are more cautious. “The burden of proof is on Thomas Company to demonstrate that these transactions were fair and reasonable,” adds David Miller, a securities lawyer at Miller & Zois.

Asset Valuation Concerns Mount

Concerns have also been raised about the valuation of certain assets on Thomas Company's balance sheet. Specifically, questions have been asked about the company's accounting treatment of intangible assets, such as goodwill and intellectual property.

Critics argue that Thomas Company may have overstated the value of these assets, potentially inflating its net worth and misleading investors. The company defends its valuation methods, claiming they are in line with industry standards and based on reasonable assumptions. The SEC will likely delve deeply into this issue.

The Role of Independent Auditors

The role of Thomas Company's independent auditors is also under scrutiny. The auditors, Anderson & Stein LLP, are responsible for ensuring that the company's financial statements are presented fairly in accordance with GAAP. Questions have been raised about whether Anderson & Stein adequately scrutinized the related-party transactions and asset valuations at issue.

In a statement, Anderson & Stein said that they conducted their audit in accordance with professional standards and that they stand behind their opinion. However, the Public Company Accounting Oversight Board (PCAOB) is reportedly investigating Anderson & Stein's audit of Thomas Company.

Revenue Recognition Practices Questioned

Another area of contention surrounds Thomas Company's revenue recognition practices. Critics allege that the company may have prematurely recognized revenue on certain transactions, boosting its reported sales and profits. The premature recognition of revenue is a serious matter.

This, they assert, potentially distorted the company's financial performance and misled investors. A source familiar with the matter indicates that the issue centers on long-term contracts where the company recognized revenue before the actual completion and delivery of services.

Impact on Investors

The uncertainty surrounding Thomas Company's financial reporting has taken a toll on its stock price. Shares of the company have plummeted in recent weeks as investors have grown increasingly concerned about the potential for restatements and regulatory action.

Several class-action lawsuits have been filed against Thomas Company, alleging that the company misled investors about its financial condition. The outcome of these lawsuits could have a significant impact on the company's financial health.

Looking Ahead: A Period of Uncertainty

The investigations into Thomas Company's financial dealings are ongoing, and it remains unclear what the ultimate outcome will be. Regardless of the findings, this situation serves as a reminder of the importance of transparency and accountability in financial reporting.

The coming months will be critical for Thomas Company as it seeks to restore investor confidence and resolve the outstanding issues. The SEC will likely play a major role. The company will need to fully cooperate with investigators and take corrective action to address any deficiencies in its internal controls.

The future of Thomas Company hinges on its ability to navigate this crisis and demonstrate its commitment to ethical and transparent financial practices. Ultimately, its survival depends on regaining the trust of its investors and the broader financial community.