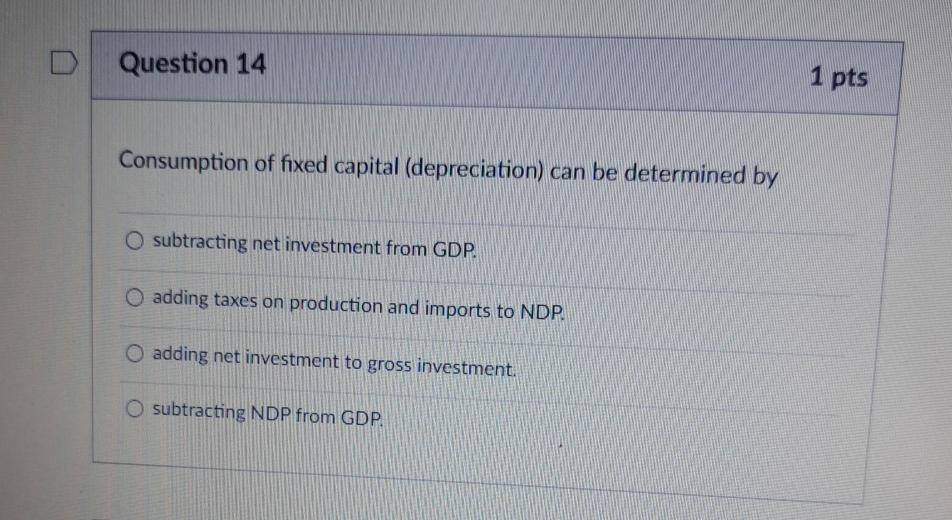

Consumption Of Fixed Capital Depreciation Can Be Determined By

Urgent economic indicators shift: A new methodology for determining Consumption of Fixed Capital (CFC), or depreciation, could drastically alter reported economic growth and investment figures.

The revised approach, focusing on asset-specific lifespan and replacement costs, challenges traditional linear depreciation models and promises a more accurate reflection of real economic activity but raises concerns about comparability across time periods and international datasets.

The Core of the Change

The previous method for calculating CFC often relied on broad industry averages and simplified assumptions about asset lifespans.

This new methodology moves to a granular, asset-by-asset assessment, incorporating factors like technological obsolescence and actual usage patterns.

Who is impacted? Businesses, government agencies, and economists who depend on accurate economic data for forecasting and policy making.

Key Elements of the New Methodology

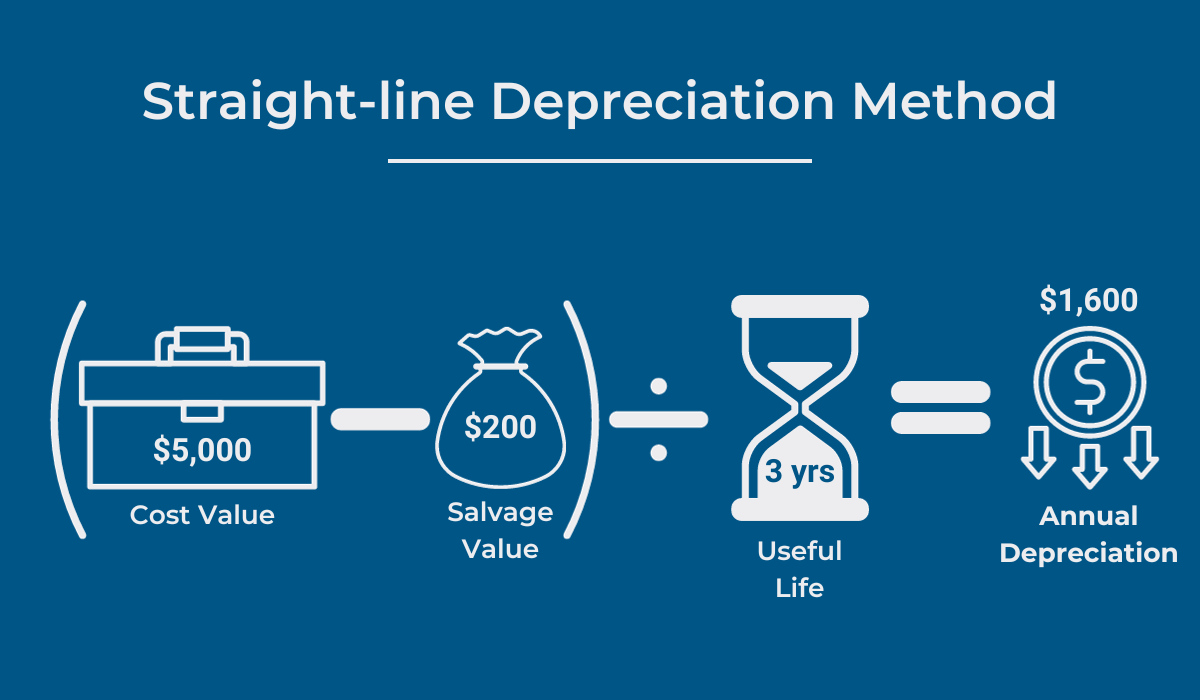

At the heart of the revised system lies a more precise estimation of asset lifespan. The *Bureau of Economic Analysis (BEA)* states that it is based on observed retirement patterns and engineering studies.

It also includes a shift from historical cost to current replacement cost accounting.

This means depreciation is calculated based on how much it would cost to replace the asset today, not what it originally cost.

What This Means for Economic Reporting

What is the change? A more realistic depiction of capital consumption, leading to potentially lower reported profits but also a more accurate picture of true investment needs.

The shift could reveal sectors where capital investment is being understated, highlighting areas needing further stimulus.

Conversely, it might expose industries with inflated asset valuations, prompting a re-evaluation of investment strategies.

Where and When

Where is this being implemented? Initially within the United States, but the potential for international adoption is significant.

When did this begin? The BEA has already started incorporating these changes in select industry reports with full integration projected within the next two years.

This phased rollout aims to allow stakeholders time to adapt and understand the implications.

How the Calculation Works

How is this implemented? Through updated statistical models, incorporating asset-specific data collected from industry surveys and government records.

Specifically, the new approach considers the *geometric depreciation* model, reflecting the reality that assets depreciate more rapidly in their early years.

Data sources include detailed asset registers and retirement surveys, providing a richer dataset than previous models.

Potential Consequences and Concerns

One immediate challenge is the comparability of economic data across different time periods. Switching methodologies creates a break in the data series.

The BEA is working on historical revisions to mitigate this issue but complete alignment may prove impossible.

Another concern is the increased complexity and cost of data collection.

Expert Opinions

"This shift could fundamentally alter our understanding of capital formation and productivity growth," says Dr. Anya Sharma, a leading economist at the *Brookings Institution*.

She adds that while more accurate, it requires significant investment in data infrastructure and statistical expertise.

Business leaders express cautious optimism but highlight the need for clear communication and transparency from government agencies.

The Path Forward

The BEA is holding a series of public forums to explain the new methodology and gather feedback from stakeholders.

Ongoing research is focused on refining the models and exploring the implications for other economic indicators.

The success of this change hinges on effective communication and a willingness from all parties to adapt to this new economic reality. The agency is also collaborating with international organizations like the *International Monetary Fund (IMF)* to promote global standardization in depreciation accounting.

+Termed+as+Depreciation.jpg)

.jpg)