Credit Builder Loan That Gives You Money Upfront

For millions struggling to establish or rebuild credit, the path to financial stability often feels like an uphill battle. Traditional credit-building tools, while helpful, can be slow and require consistent discipline. However, a new type of loan is emerging that promises to offer a faster, more accessible route to improved credit scores: the credit builder loan that gives you money upfront.

This innovative approach flips the conventional credit builder loan model on its head. Instead of locking away the loan proceeds until repayment, borrowers receive a portion of the funds immediately, providing immediate financial relief while still helping them build a positive credit history. This article delves into the mechanics of these loans, their potential benefits and drawbacks, and expert opinions on their effectiveness as a credit-building tool.

How Credit Builder Loans with Upfront Money Work

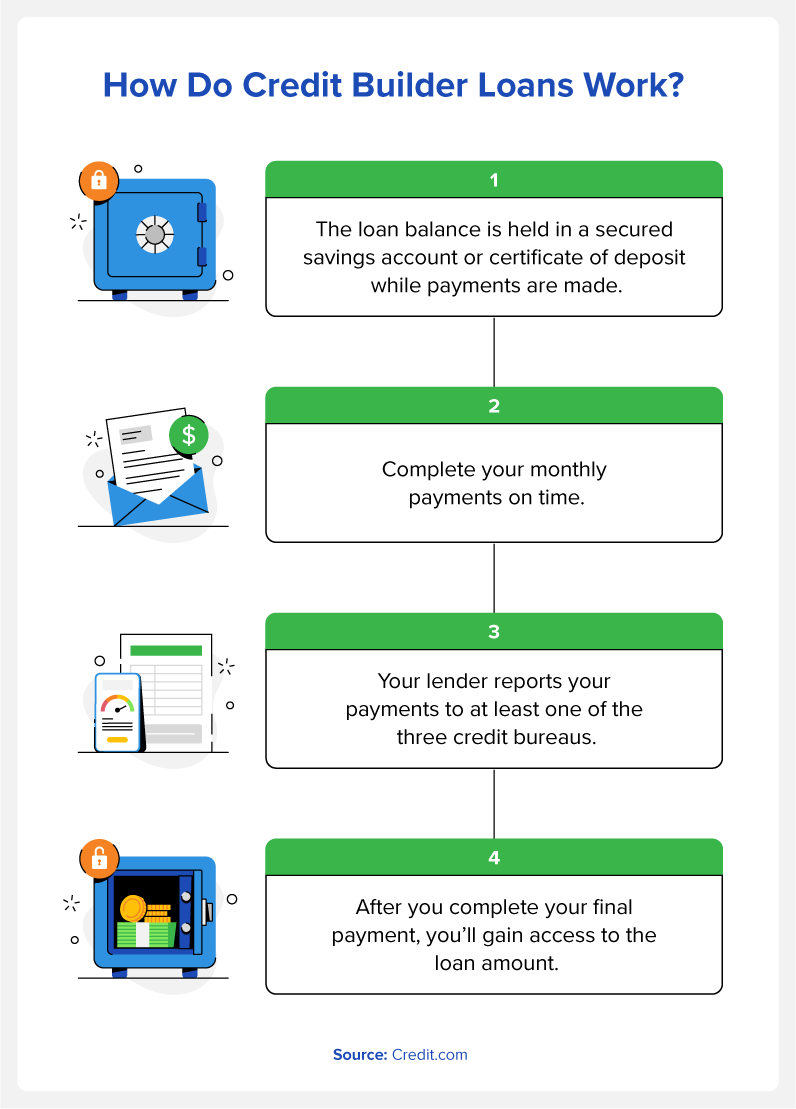

Traditional credit builder loans function by depositing the loan amount into a secured account. The borrower then makes regular payments, and upon completion, receives the principal amount back, all while building credit. Credit builder loans that give you money upfront deviate from this model.

A portion of the loan – often a smaller percentage, such as 20% or 30% – is disbursed to the borrower immediately. The remaining funds are held in a secured account, similar to a traditional credit builder loan. The borrower then makes monthly payments on the full loan amount, which are reported to the major credit bureaus.

Upon successful completion of the loan term, the borrower receives the balance of the secured funds, minus any fees or interest. This hybrid approach aims to address immediate financial needs while simultaneously fostering responsible financial habits and creditworthiness.

Benefits of Upfront Credit Builder Loans

The most significant advantage of these loans is the immediate access to funds. This can be particularly helpful for individuals facing unexpected expenses or those who need a small financial boost to cover essential needs. It can provide a lifeline in situations where traditional loans or credit cards are unavailable due to poor credit.

Beyond immediate financial relief, these loans offer the same credit-building benefits as traditional credit builder loans. Consistent, on-time payments are reported to credit bureaus, leading to improved credit scores over time. This can open doors to better interest rates on future loans, mortgages, and even rental applications.

These loans often come with educational resources and financial coaching. Lenders may provide budgeting tools, credit monitoring services, and personalized advice to help borrowers manage their finances more effectively and avoid future credit problems. This educational component can empower borrowers to make informed financial decisions and build long-term financial stability.

Potential Drawbacks and Risks

Despite their appeal, credit builder loans with upfront money are not without potential drawbacks. The interest rates on these loans can be relatively high compared to traditional loans, reflecting the higher risk associated with lending to individuals with limited or damaged credit. This can increase the overall cost of the loan.

Another concern is the potential for overspending or mismanaging the upfront funds. If borrowers are not disciplined in managing their finances, they may be tempted to spend the money on non-essential items, making it more difficult to repay the loan and ultimately hurting their credit score. Defaulting on the loan will significantly damage credit.

It's crucial to carefully review the loan terms and fees before committing to a credit builder loan. Some lenders may charge origination fees, late payment fees, or other hidden charges that can significantly increase the overall cost of the loan. Thoroughly understanding the terms and conditions is essential to avoid any surprises.

Expert Opinions and Industry Perspectives

Financial experts offer mixed opinions on credit builder loans with upfront money. Some believe they can be a valuable tool for individuals who need immediate financial assistance and are committed to improving their credit. Others caution against their use, citing the high interest rates and potential for misuse of funds.

"Credit builder loans can be a great way to start or rebuild your credit," says Sarah Choi, a certified credit counselor at the National Foundation for Credit Counseling. "But it's essential to understand the terms and fees and to make sure you can afford the monthly payments." Choi emphasizes the importance of responsible borrowing and budgeting.

Mark Williams, a financial analyst at Credit Karma, suggests exploring alternative options before resorting to credit builder loans. "Consider secured credit cards or becoming an authorized user on someone else's credit card as potentially lower-cost alternatives," Williams advises. "It's important to compare all available options and choose the one that best fits your individual financial situation."

Several fintech companies are offering these innovative credit builder loans. These companies often utilize technology to streamline the application process and provide personalized financial guidance. The loans are designed to be accessible and user-friendly, appealing to a younger, tech-savvy demographic.

The Future of Credit Building

Credit builder loans, including those offering upfront money, represent a shift in the approach to credit building. They are designed to be more accessible and responsive to the immediate financial needs of individuals with limited or damaged credit. This trend is likely to continue as fintech companies develop new and innovative ways to help people improve their credit scores.

As the market evolves, it is crucial for consumers to educate themselves about the various credit-building options available. They should carefully consider the potential benefits and risks, compare interest rates and fees, and seek advice from financial experts before making a decision. Responsible borrowing and financial literacy are essential for building a solid credit foundation.

The key to success with any credit-building tool, including credit builder loans with upfront money, lies in responsible financial management. By making consistent, on-time payments and avoiding overspending, individuals can build a positive credit history and achieve their financial goals. The Consumer Financial Protection Bureau (CFPB) offers many free resources to help consumers understand credit and manage their finances responsibly.