Credit Score Needed For Divvy Homes

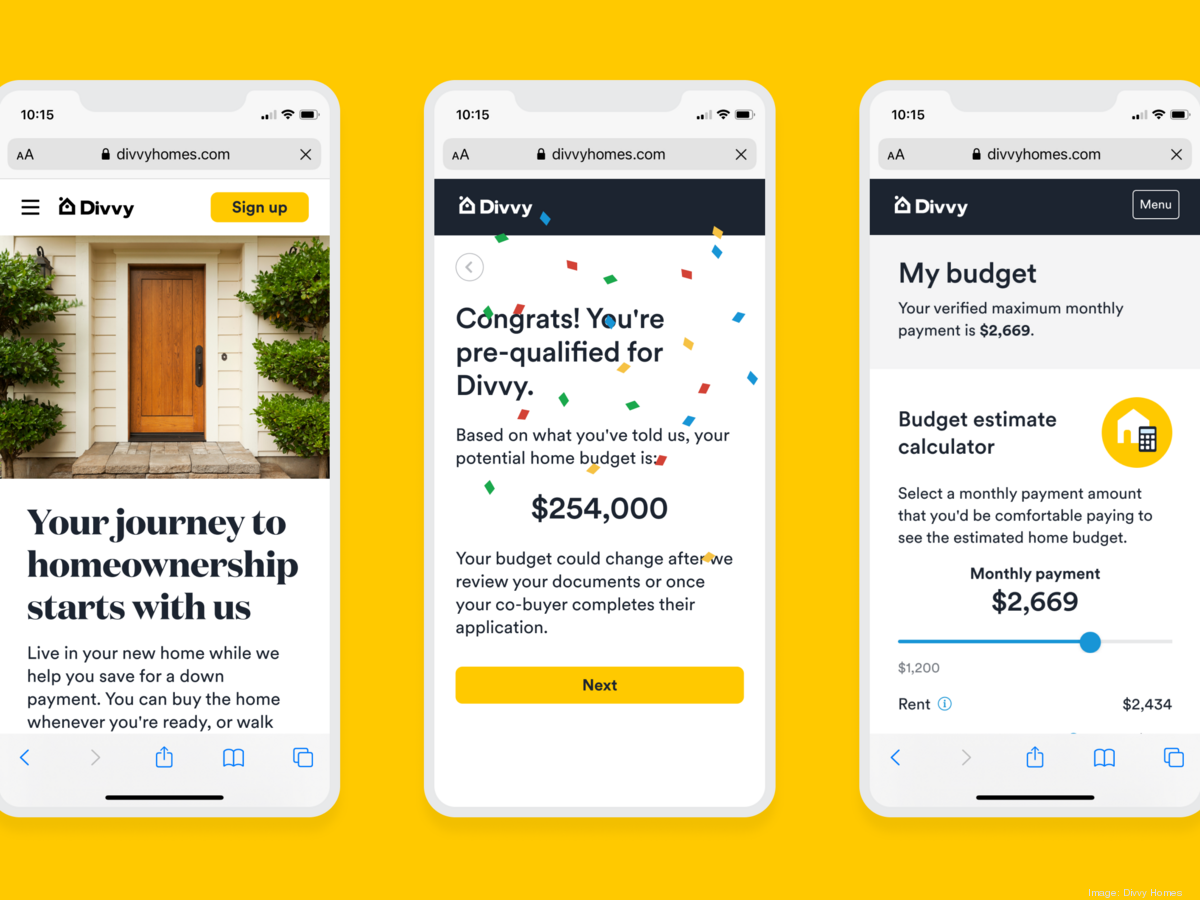

Divvy Homes, a rent-to-own company aiming to make homeownership more accessible, considers various factors when evaluating potential applicants. One frequently asked question revolves around the minimum credit score required to qualify for their program. Here's a breakdown of what prospective Divvy Homes customers need to know.

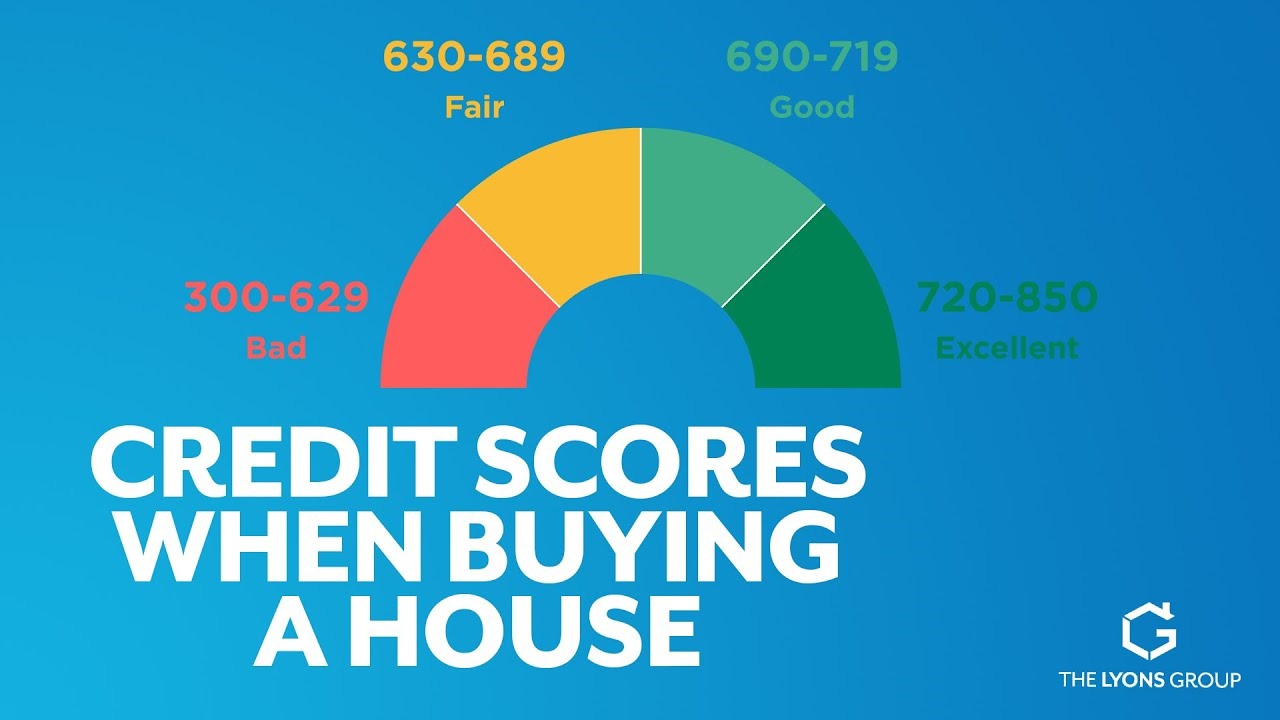

The credit score required for Divvy Homes is just one piece of the puzzle, but it’s an important one. While Divvy Homes doesn't explicitly advertise a hard minimum credit score, they do state that a "fair to good" credit history is generally needed, according to their website and customer service representatives. This typically translates to a FICO score of around 620 or higher.

Understanding Divvy Homes' Qualification Process

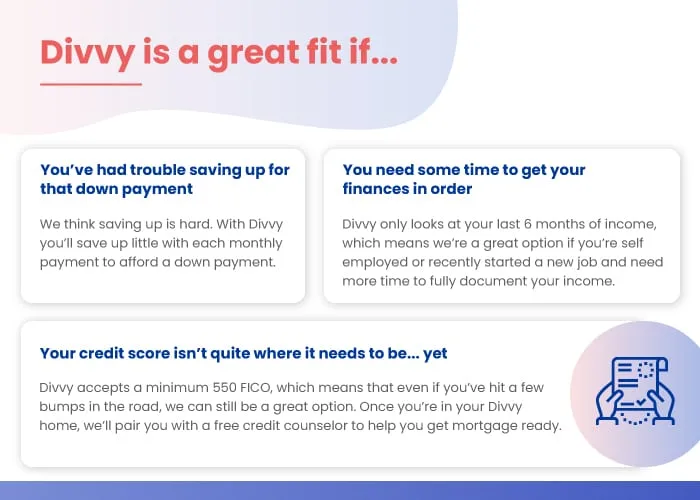

Divvy Homes takes a holistic approach when assessing applicants, looking beyond just the credit score. Their underwriting process evaluates factors such as income, employment history, and debt-to-income ratio (DTI).

A stable employment history demonstrates an applicant's ability to consistently earn income. Furthermore, a manageable DTI, which compares monthly debt payments to gross monthly income, indicates financial responsibility.

The company looks for a debt-to-income ratio that demonstrates the applicant's ability to manage current debt obligations while taking on the added responsibility of home payments. This ratio is weighed alongside the applicant's credit score to get a comprehensive understanding of their financial standing.

Key Factors Beyond Credit Score

Besides credit score, income is a critical factor. Divvy Homes typically requires applicants to have a minimum income that can adequately cover the monthly rent and savings contribution required by the program.

Another factor involves a down payment. Divvy Homes typically requires a down payment, usually around 1% to 2% of the home's value.

Divvy Homes emphasizes the importance of savings. Demonstrating a history of responsible saving behavior can strengthen an application.

The Significance of Credit Improvement

For individuals with credit scores below 620, improving their creditworthiness can significantly increase their chances of approval. There are several steps individuals can take to improve their credit profile.

These steps include paying bills on time, reducing credit card debt, and avoiding opening too many new credit accounts at once. Monitoring credit reports regularly for errors and disputing any inaccuracies can also boost one’s credit score.

"We encourage applicants to work on improving their credit health if they are initially denied,"a Divvy Homes representative stated. The representative further advised seeking guidance from financial advisors or credit counseling agencies.

Potential Impact and Accessibility

Divvy Homes aims to provide a pathway to homeownership for individuals who may not qualify for a traditional mortgage. This approach can be particularly beneficial for those with limited credit history or those who are self-employed.

However, it's essential to carefully evaluate the terms and conditions of Divvy Homes' program before committing. Potential applicants should weigh the costs and benefits against traditional homebuying options.

Ultimately, understanding the credit score requirements and other qualification factors can help potential Divvy Homes customers prepare effectively for the application process and increase their chances of achieving their homeownership goals.