Credit Score To Get A Citi Credit Card

URGENT: Citi has updated its credit score requirements for several of its most popular credit cards. Applicants now need to be even more vigilant about their credit health to qualify.

This shift in eligibility criteria impacts a wide range of Citi cards, potentially affecting approval rates and access to valuable rewards and benefits. Understanding these changes is crucial for anyone planning to apply for a Citi credit card.

Credit Score Thresholds Increased

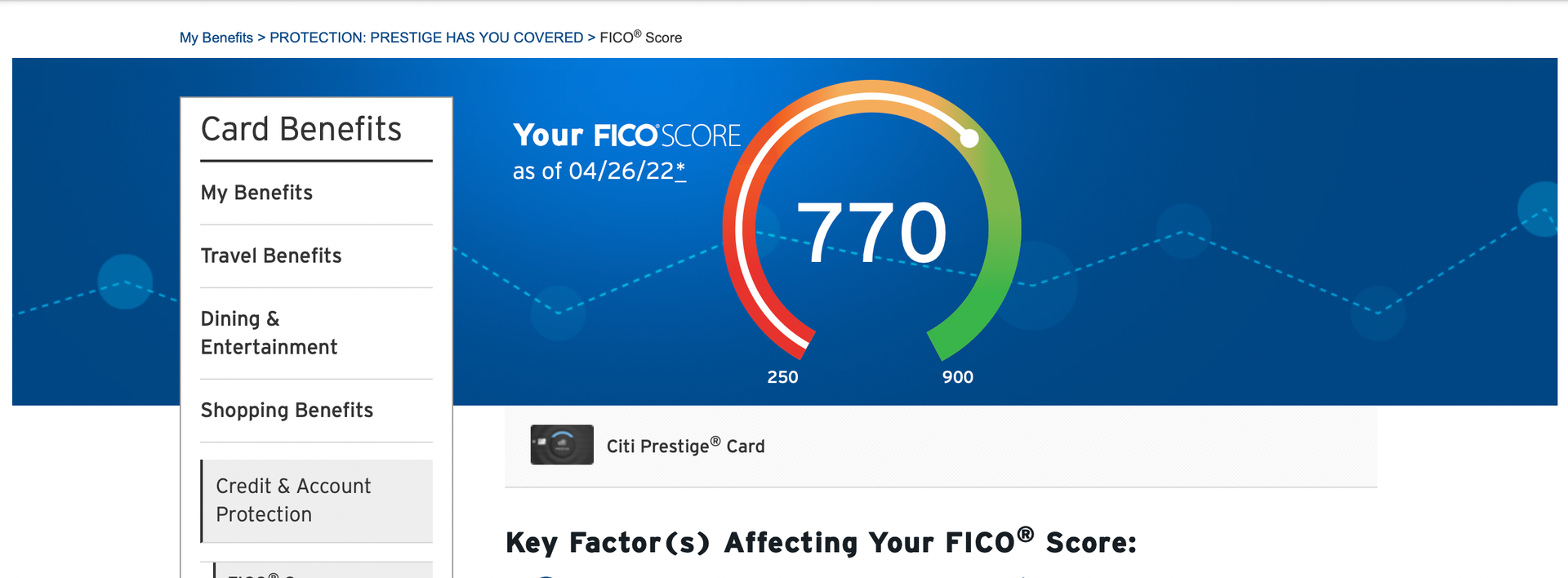

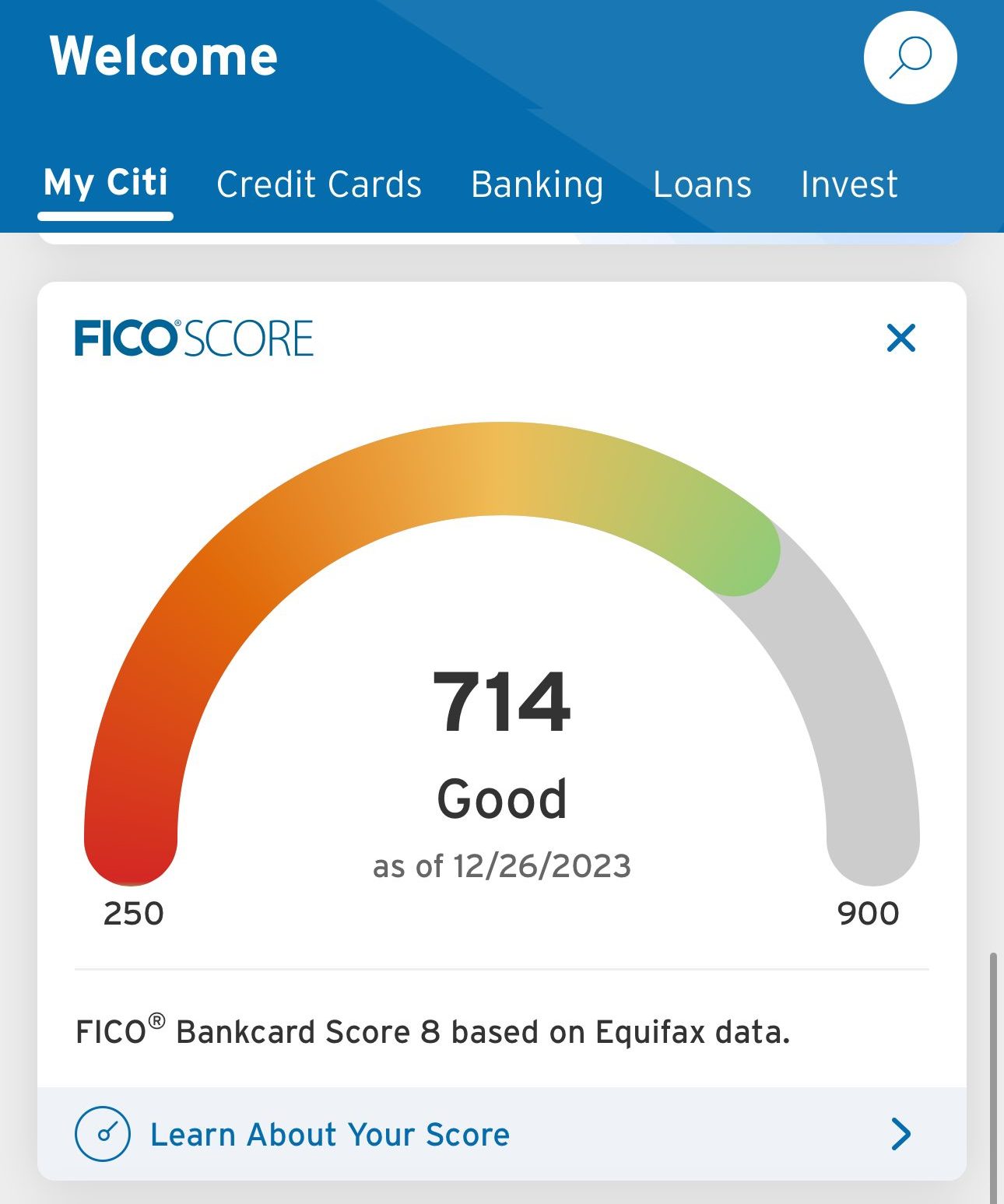

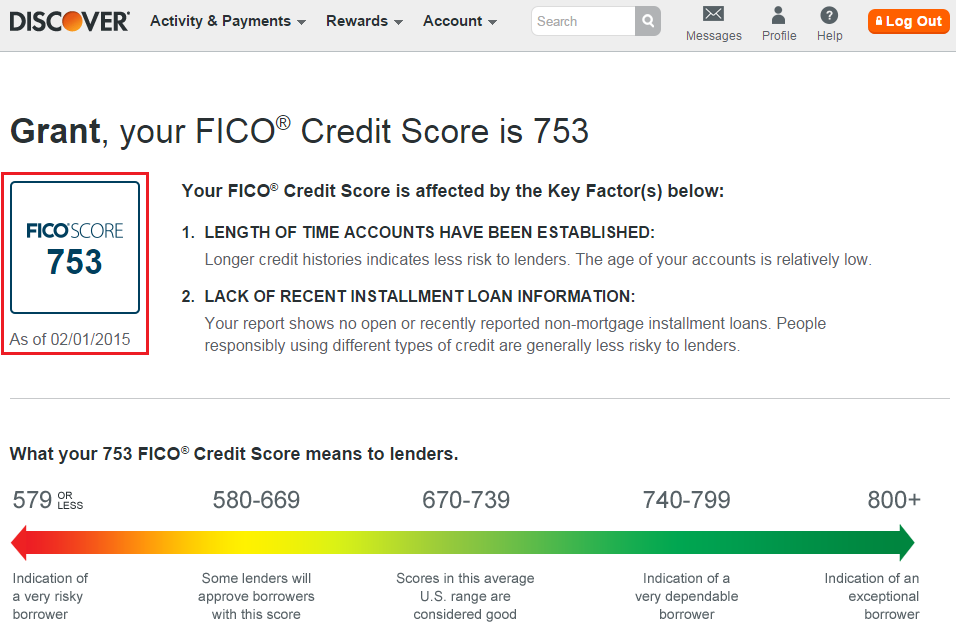

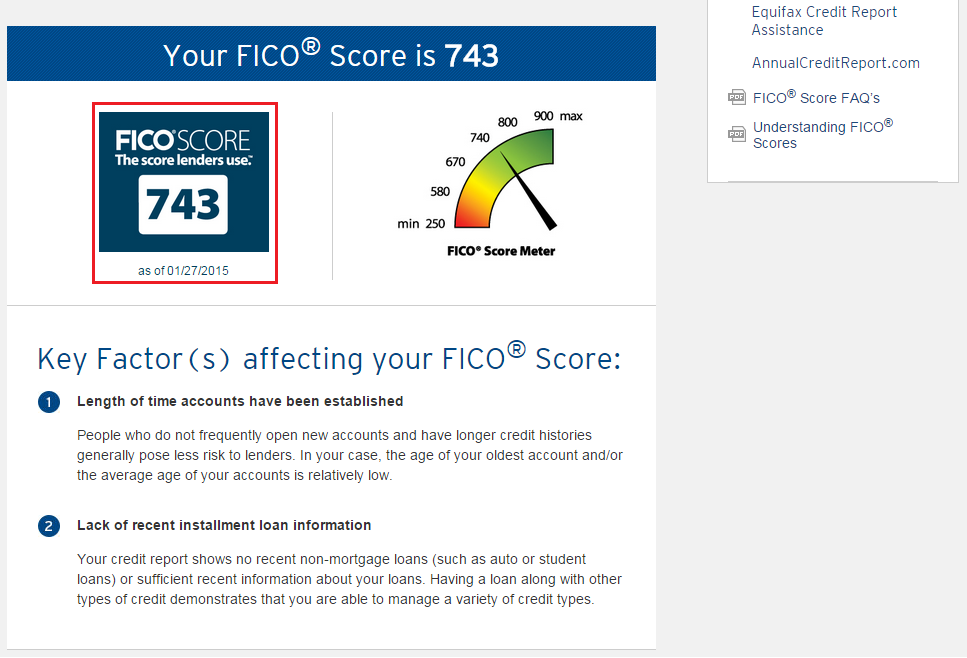

Citi has reportedly raised the minimum credit score required for approval on a range of its cards. Previously, a "good" credit score (typically 670-739) might have been sufficient for some cards. Now, sources indicate that a "very good" to "excellent" score (740+) is almost universally necessary.

Data points from recent applicant experiences suggest this change took effect in late October 2024. Several users have reported denials despite having credit scores previously considered adequate for Citi cards.

Impacted Credit Cards

Several Citi credit cards are believed to be affected by this change. These include popular options like the Citi Premier® Card and the Citi® Double Cash Card.

The Citi Custom Cash® Card, known for its flexible rewards structure, is also reportedly subject to the stricter requirements. Even co-branded cards like the Citi Rewards+® Card appear to demand higher creditworthiness.

What You Need to Know

Before applying for a Citi credit card, check your credit score. Several free services, like Credit Karma and Experian, provide access to your credit report and score.

Ensure there are no errors or inaccuracies on your credit report. Disputing and correcting any mistakes can significantly improve your score. Pay down existing debt to lower your credit utilization ratio, a key factor in credit score calculations.

How to Improve Your Chances

If your credit score falls below 740, focus on improving it before applying. Consistently paying bills on time is crucial. Avoid opening too many new credit accounts in a short period.

Consider becoming an authorized user on a responsible cardholder's account. This can help build your credit history. Monitor your credit score regularly to track your progress.

Next Steps and Ongoing Developments

Citi has yet to officially announce this change in credit score requirements. However, the consistency of anecdotal evidence and reported denials suggests a policy shift is in effect.

We are continuing to investigate and will provide updates as more information becomes available. Check back for further details on how these changes might affect your credit card application strategy. Always review the specific terms and conditions on the Citi website before applying for any credit card.