Credit Score To Qualify For American Express

Imagine the sleek, iconic American Express card in your hand, a symbol of financial freedom and access to exclusive rewards. But what stands between you and that coveted piece of plastic? For many, the answer boils down to one crucial factor: your credit score. The journey to qualifying for an American Express card can feel like navigating a complex maze, but understanding the credit score landscape is the first and most important step.

This article delves into the credit score requirements for securing an American Express card, offering insights into what constitutes a "good" score, how American Express evaluates applications, and practical steps you can take to improve your chances of approval. Whether you're just starting to build credit or looking to upgrade your rewards program, understanding these criteria is essential.

The Credit Score Spectrum: What American Express Looks For

Generally, a "good" to "excellent" credit score is needed to qualify for most American Express cards. This typically means a FICO score of 670 or higher, although some premium cards may require a score in the 700s or even 800s. Different cards cater to different credit profiles, but aiming for the higher end of the spectrum is always a good strategy.

According to Experian, one of the major credit bureaus, a score between 670 and 739 is considered "good," while 740 to 799 is "very good," and 800 or above is "exceptional." American Express considers several factors beyond just the raw number.

Beyond the Numbers: A Holistic View

American Express doesn't solely rely on your credit score. They also assess your credit history, income, and payment behavior. A long and positive credit history demonstrates responsible credit management, which significantly increases your approval odds.

Consistent on-time payments are crucial. Late payments, even if infrequent, can negatively impact your chances. Your income also plays a role, as American Express needs to ensure you can comfortably manage your credit limit.

Card-Specific Requirements

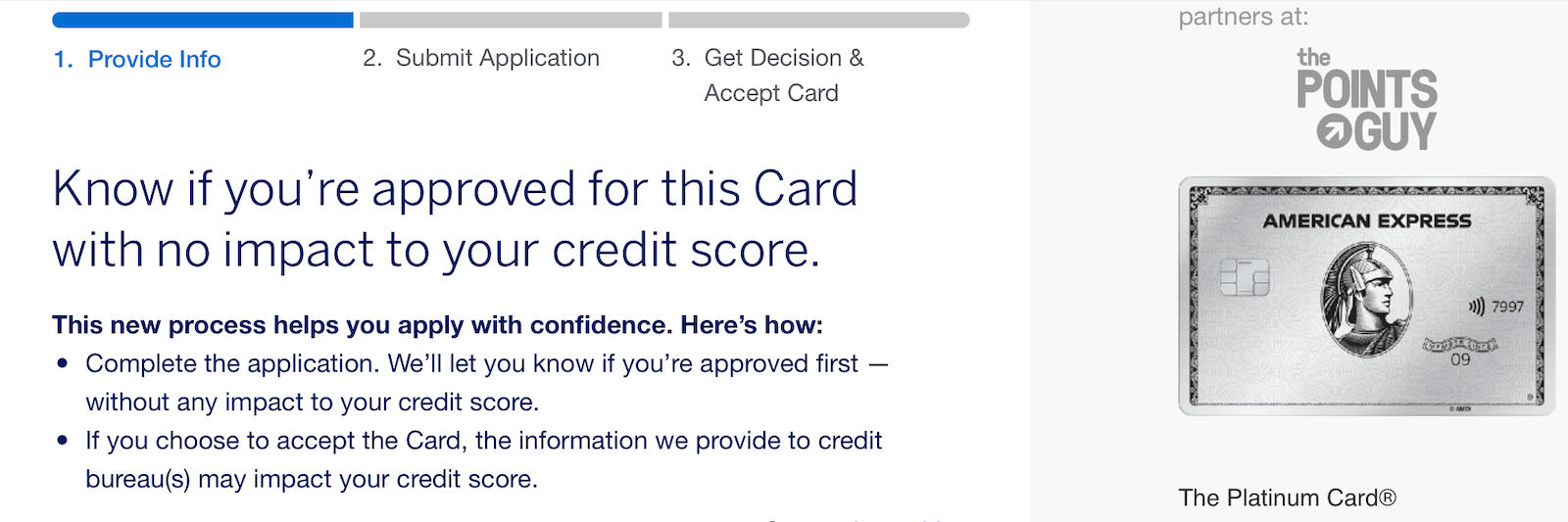

It's important to note that different American Express cards have varying credit score requirements. Entry-level cards might be more accessible to those with a "good" credit score, while premium cards like the Platinum Card or Centurion Card often demand "excellent" credit.

American Express also offers secured cards, like the American Express Secured Credit Card, which are designed for individuals with limited or no credit history. These cards require a security deposit, which typically becomes your credit limit.

Improving Your Credit Score: A Practical Guide

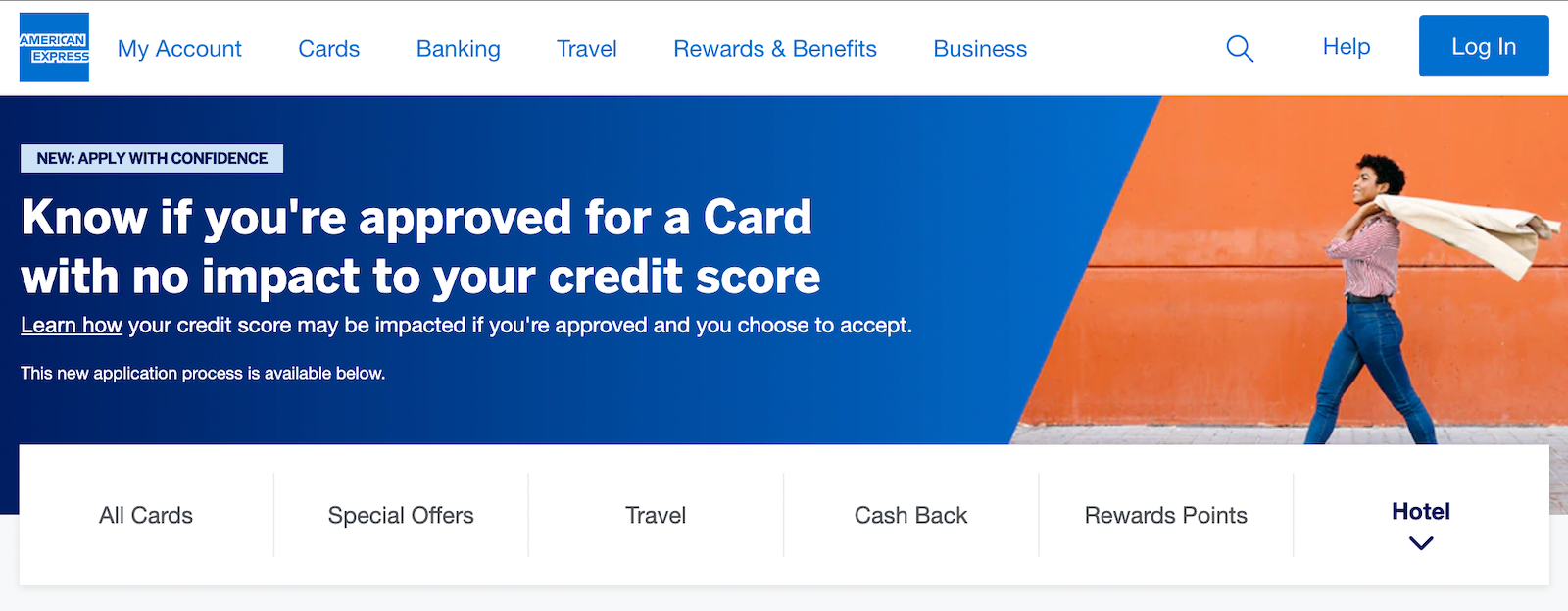

If your credit score isn't quite where it needs to be, don't despair. There are several actionable steps you can take to improve it. Start by checking your credit report for any errors and dispute them immediately.

Make all your payments on time, every time. Consider setting up automatic payments to avoid missing deadlines. Reducing your credit utilization ratio, which is the amount of credit you're using compared to your total available credit, can also boost your score.

Finally, avoid opening too many new credit accounts at once, as this can lower your average account age and potentially hurt your score. Be patient and consistent with your efforts, and you'll likely see positive results over time.

The American Express Appeal

The allure of American Express extends beyond just a piece of plastic. It represents a lifestyle, access to exclusive benefits, and a certain level of financial achievement. From travel rewards and purchase protection to premium customer service, the benefits can be substantial.

However, it's crucial to remember that credit cards are a financial tool, and responsible usage is paramount. Avoid carrying a balance and pay your bills in full each month to maximize the benefits and avoid high interest charges.

Securing an American Express card is achievable with careful planning and diligent credit management. By understanding the credit score requirements, focusing on improving your financial habits, and choosing the right card for your profile, you can unlock the rewards and experiences that American Express has to offer. The journey may require effort, but the destination is well worth it.