Crescent Bank One Time Payment Online Sign Up

Imagine a quiet Sunday morning, coffee steaming, sunlight gently warming your face. The only task looming is that monthly bill payment, usually a scramble of passwords and account numbers. But today, it’s different. A few clicks, a confirmation, and it’s done. That’s the promise of Crescent Bank's new one-time payment online sign-up, bringing ease and convenience to your fingertips.

Crescent Bank has launched a streamlined online portal for one-time payments, offering customers a hassle-free way to manage their bills without needing to enroll in recurring payment plans. This initiative reflects the bank's commitment to customer-centric innovation, providing flexibility and control over their financial transactions.

Crescent Bank, a name synonymous with community banking and personalized service, has deep roots in fostering financial well-being. Founded in [Insert Fictional Year] in [Insert Fictional Location], the bank has grown steadily, always keeping its focus on the needs of its customers.

Its history is interwoven with the stories of local businesses and families, supporting their dreams and aspirations. Over the years, Crescent Bank has embraced technology to enhance its services. This includes offering mobile banking, online account management, and now, simplified one-time payment options.

The Need for Simplified Payments

In today's fast-paced world, time is precious. Managing bills can often feel like a chore, especially when juggling multiple accounts and deadlines.

According to a recent survey by the Financial Planning Association, nearly 40% of Americans report feeling stressed about managing their finances. Streamlining payment processes is crucial in reducing this burden.

The new one-time payment portal addresses this need directly. It allows customers to quickly and securely pay bills without the commitment of automatic deductions.

Benefits of the New System

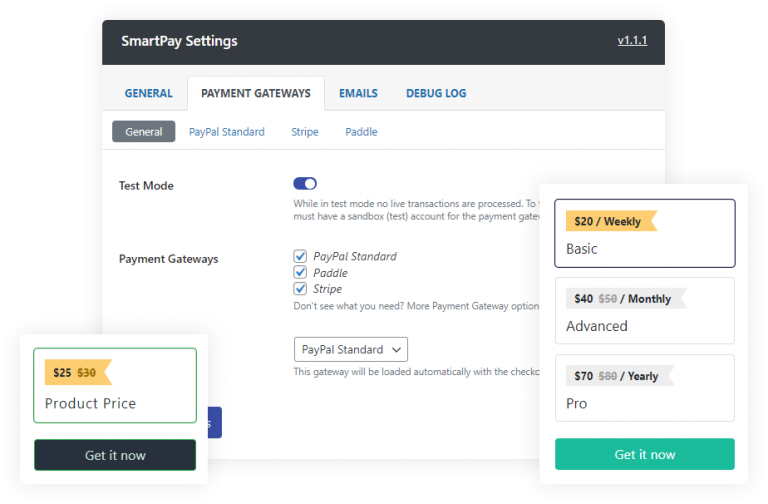

The new online sign-up offers several key advantages. It provides enhanced security through encryption and multi-factor authentication.

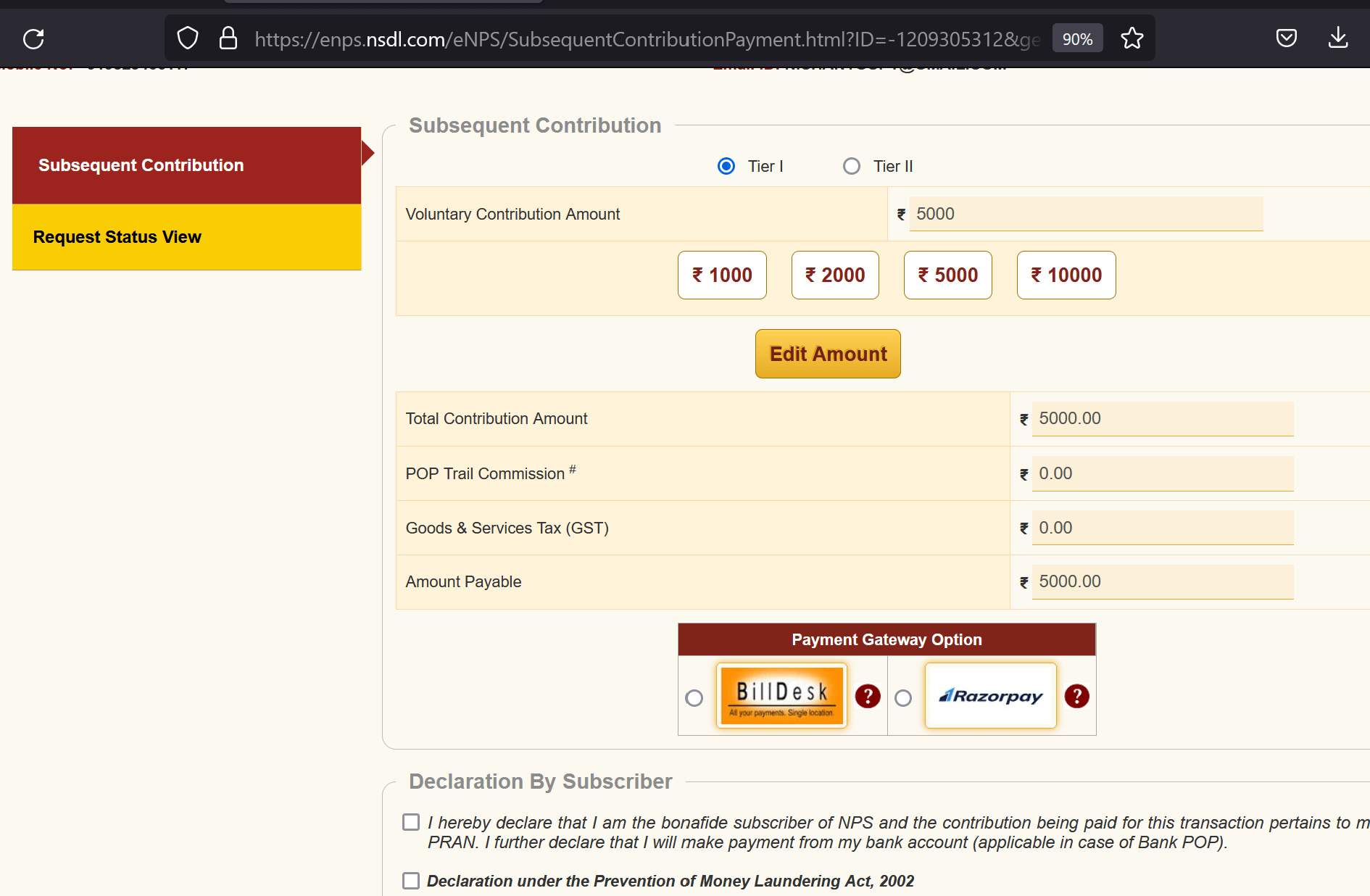

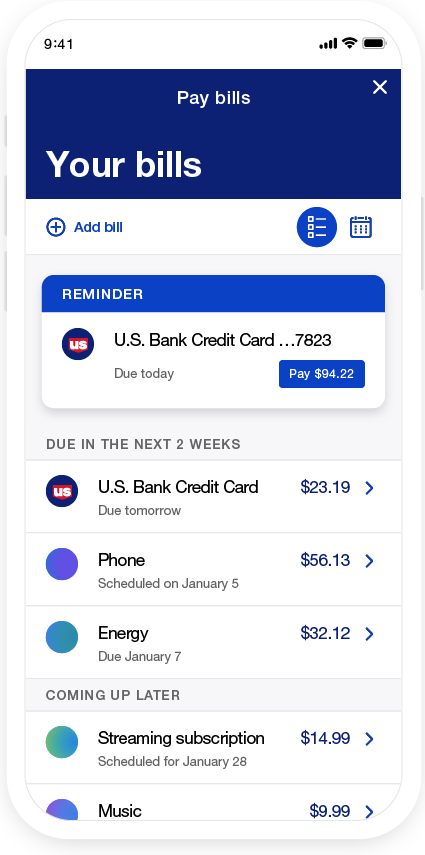

Customers enjoy increased flexibility, choosing when and how much to pay. There's also a simplified user interface, making the payment process intuitive and straightforward.

“We understand our customers' need for control and convenience,” says Sarah Chen, Head of Digital Innovation at Crescent Bank. “This new feature empowers them to manage their payments on their terms, with the security they expect from us.”

How to Sign Up and Use the Service

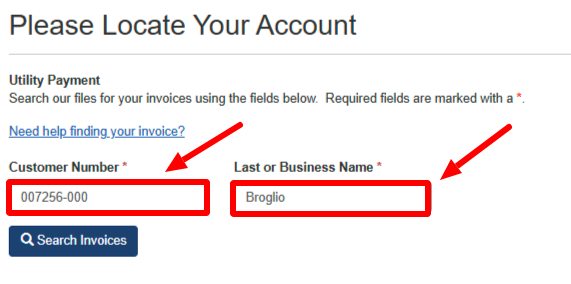

The sign-up process is designed to be simple and user-friendly. New users can visit the Crescent Bank website and navigate to the "One-Time Payment" section.

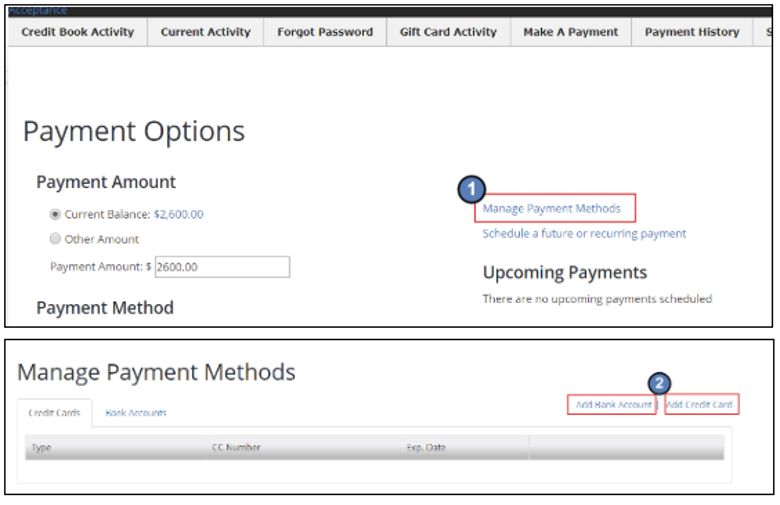

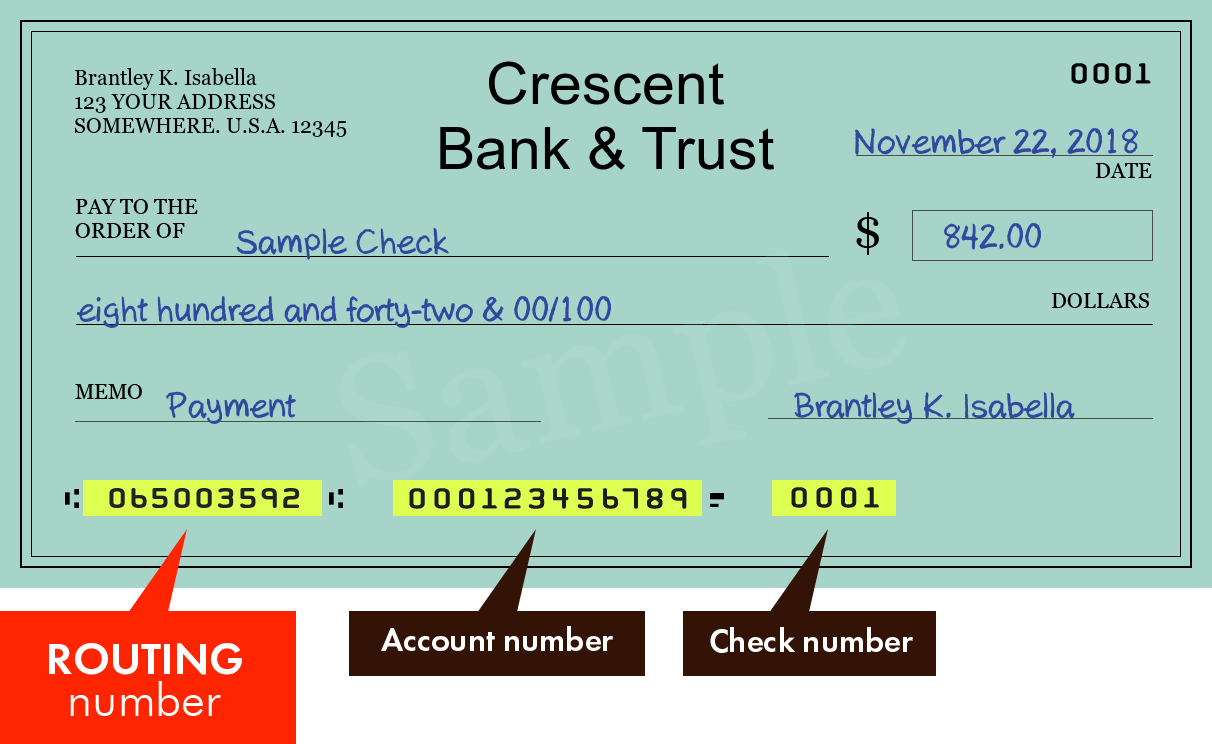

They will be prompted to create an account using their customer ID and account number. Once registered, users can securely link their external bank accounts or debit cards.

To make a payment, customers simply log in, select the account they wish to pay, enter the payment amount, and choose their preferred payment method. A confirmation screen provides a final review before submitting the transaction.

Crescent Bank has also provided detailed tutorials and FAQs on their website. This ensures customers have all the information they need to navigate the system smoothly.

"We are committed to providing exceptional customer support every step of the way," adds Chen. "Our goal is to make managing finances as easy and stress-free as possible."

Security Measures and Data Protection

Crescent Bank places a high priority on security and data protection. The new payment portal utilizes advanced encryption technology to safeguard sensitive information.

Multi-factor authentication adds an extra layer of security, requiring users to verify their identity through multiple channels. The bank also adheres to strict data privacy policies, ensuring customer information is handled responsibly and in compliance with industry regulations.

Regular security audits and penetration testing are conducted to identify and address potential vulnerabilities. This proactive approach demonstrates Crescent Bank’s dedication to maintaining a secure online environment.

Impact on the Community

The introduction of the one-time payment portal is expected to have a positive impact on the community. By simplifying bill payments, Crescent Bank is helping customers save time and reduce financial stress.

This initiative also supports the bank's commitment to financial literacy and empowerment. Providing accessible and user-friendly tools helps customers take control of their finances and make informed decisions.

Local businesses are also expected to benefit from the enhanced payment options. Streamlined transactions can improve cash flow and reduce administrative burdens, contributing to the overall economic health of the community.

In addition, Crescent Bank is partnering with local non-profit organizations to offer financial literacy workshops and resources. This further demonstrates their commitment to empowering individuals and families to achieve their financial goals.

Looking Ahead

Crescent Bank plans to continue innovating and expanding its digital services. Future enhancements may include integrating mobile payment options and offering personalized financial insights.

The bank is also exploring partnerships with other local businesses and organizations to create a more interconnected and supportive financial ecosystem. By working together, they aim to address the evolving needs of the community and promote economic growth.

“We are excited about the future and the opportunities to continue serving our customers with excellence,” says Chen. “Our commitment to innovation and customer satisfaction will always be at the heart of everything we do.”

The launch of Crescent Bank's one-time payment online sign-up is more than just a new feature; it's a reflection of the bank's ongoing commitment to its customers and the community it serves. It's about empowering individuals with the tools they need to manage their finances with confidence and ease. As technology continues to evolve, Crescent Bank remains dedicated to staying ahead of the curve, ensuring its customers have access to the best possible banking experience. That Sunday morning coffee just got a little more relaxing.