Current Interest Rate On Home Loan In Pnb

Imagine stepping into a sunlit home, the scent of fresh paint lingering in the air. It's a space where memories will be made, laughter will echo, and dreams will take flight. For many, the journey to homeownership begins with a crucial question: What are the current interest rates on home loans?

Punjab National Bank (PNB), a trusted name in Indian banking, offers various home loan options. Understanding their current interest rates is paramount for prospective homeowners. This article delves into PNB's prevailing home loan interest rates, providing a comprehensive overview to help you make an informed decision.

Understanding PNB's Home Loan Landscape

PNB, a legacy institution, has long been a pillar of financial support for countless families. They understand the importance of owning a home, and they offer a range of home loan products tailored to diverse needs and financial profiles. Their commitment to transparency and customer-centricity makes them a popular choice for aspiring homeowners.

Current Interest Rate Scenario

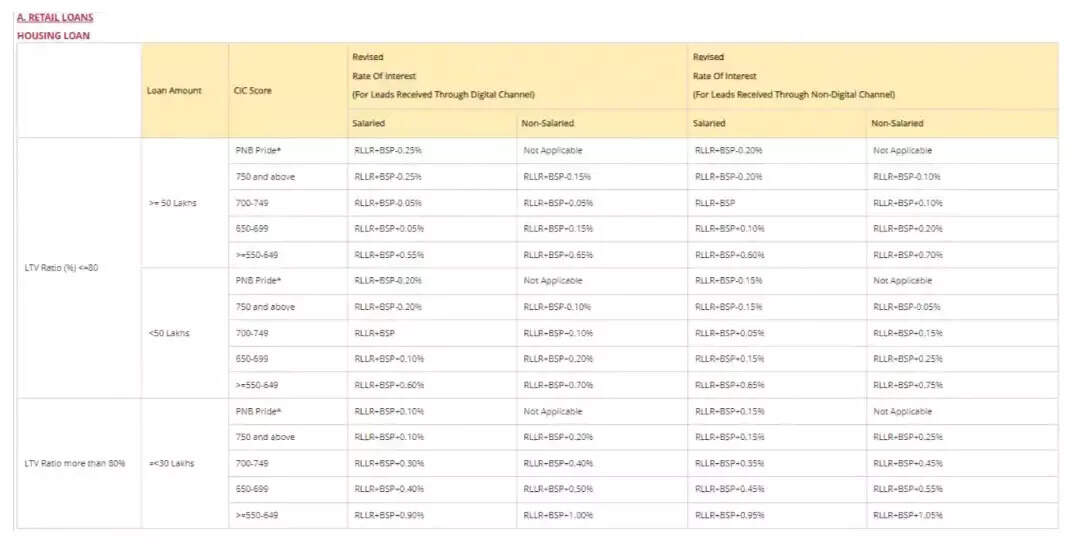

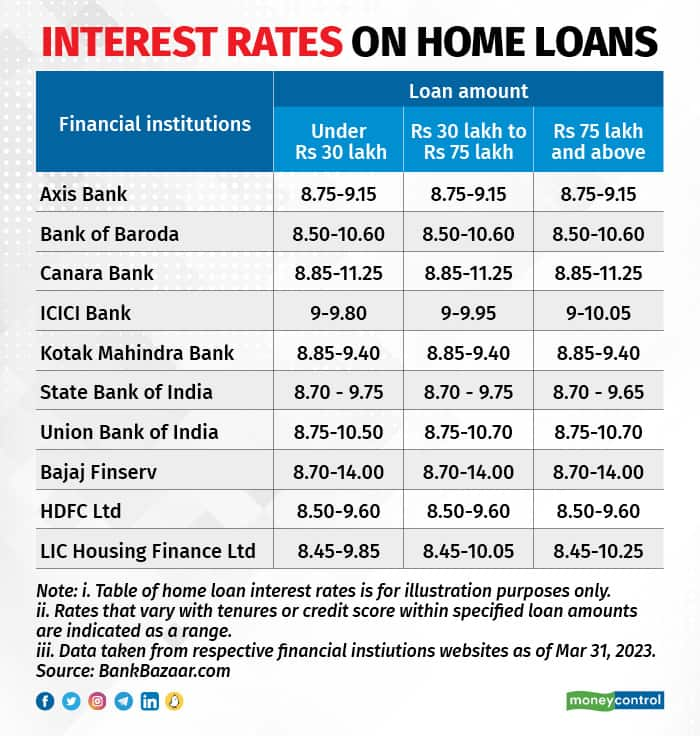

As of late 2024, PNB's home loan interest rates are influenced by various market factors, including the Reserve Bank of India's (RBI) benchmark lending rates. Generally, PNB offers competitive rates that align with the industry standards.

While specific interest rates can vary based on the loan amount, tenure, and the borrower's credit score, it’s essential to visit the official PNB website or consult with a PNB representative for the most up-to-date information. Interest rates are subject to change, making real-time data crucial.

Factors Influencing Interest Rates

Several factors play a pivotal role in determining the interest rate offered on a home loan. A borrower's credit score is arguably the most significant. A high credit score indicates a lower risk to the lender and typically results in a more favorable interest rate.

The loan-to-value (LTV) ratio, which represents the loan amount as a percentage of the property's value, also influences the rate. A lower LTV ratio (meaning a larger down payment) often translates to a lower interest rate. Other influential factors include the loan tenure and whether the loan is offered at a fixed or floating interest rate.

Fixed vs. Floating Interest Rates

PNB, like many lenders, offers both fixed and floating interest rate options. Fixed interest rates remain constant throughout the loan tenure. This provides stability and predictability in monthly installments, shielding borrowers from market fluctuations.

Floating interest rates, on the other hand, fluctuate in accordance with the market. While they may initially be lower than fixed rates, they carry the risk of increasing over time. The choice between fixed and floating rates depends on individual risk tolerance and expectations regarding future interest rate trends.

Tips for Securing the Best Home Loan Rate from PNB

Securing the most favorable home loan interest rate requires careful planning and preparation. First, maintain a healthy credit score by paying bills on time and managing debt responsibly.

Compare different loan options and lenders, including PNB, to understand the prevailing market rates. Consider making a larger down payment to reduce the LTV ratio.

Negotiate with the lender and inquire about any available discounts or special offers. Often, banks provide preferential rates to existing customers or those with strong financial profiles.

The Dream of Homeownership

Owning a home is more than just acquiring property; it's about building a foundation for the future. It's about creating a sanctuary where families can thrive and individuals can find solace. Understanding home loan options and securing the best possible interest rate are crucial steps in realizing this dream.

PNB, with its rich history and commitment to customer service, can be a valuable partner in your journey to homeownership. By carefully evaluating your options and staying informed about the current interest rate landscape, you can make a confident and informed decision that sets you on the path to a brighter future.

Remember, the journey to finding the perfect home loan requires research, patience, and a clear understanding of your financial situation. With the right preparation and guidance, you can unlock the door to your dream home and create a space where memories will flourish for years to come.