Decrease Assets Increase Liabilities And Stockholders' Equity

A notable shift in the financial landscape has been observed across several publicly traded companies, characterized by a decrease in assets accompanied by an increase in both liabilities and stockholders' equity. This complex interplay of financial elements signals potential strategic realignments and warrants careful examination of its implications.

This financial trend, while not universally applicable, represents a significant deviation from typical corporate growth models. Understanding the driving forces behind this phenomenon is crucial for investors, analysts, and the public alike. The effects could ripple through the markets, influencing investment decisions and potentially impacting economic stability.

Understanding the Financial Shift

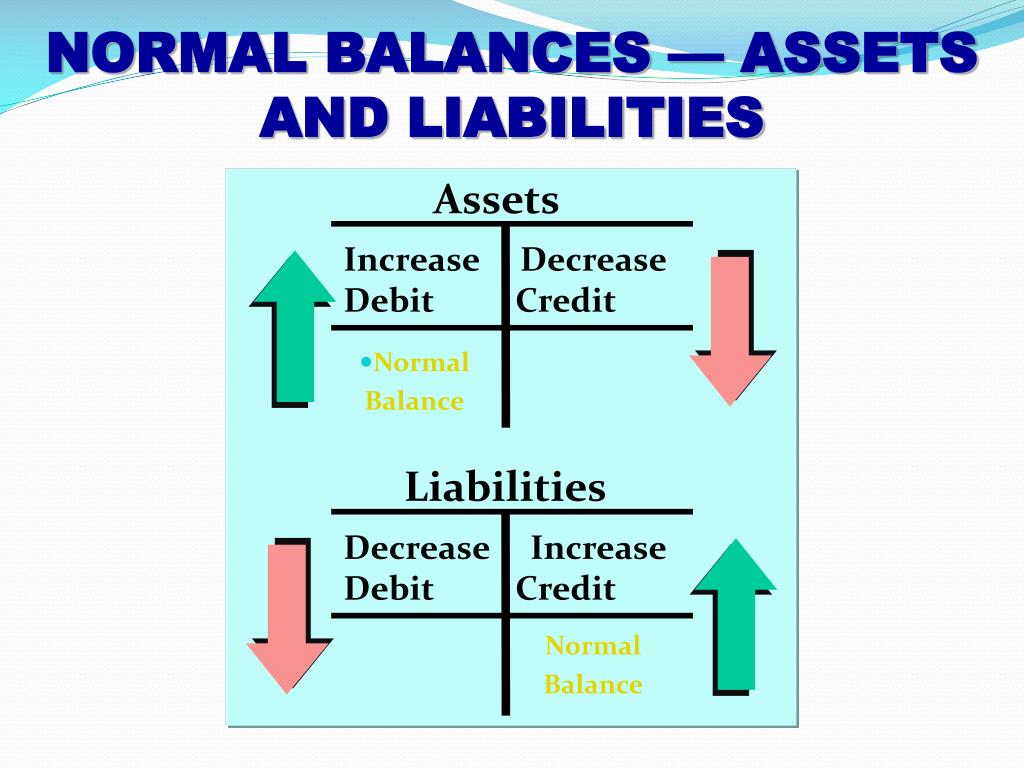

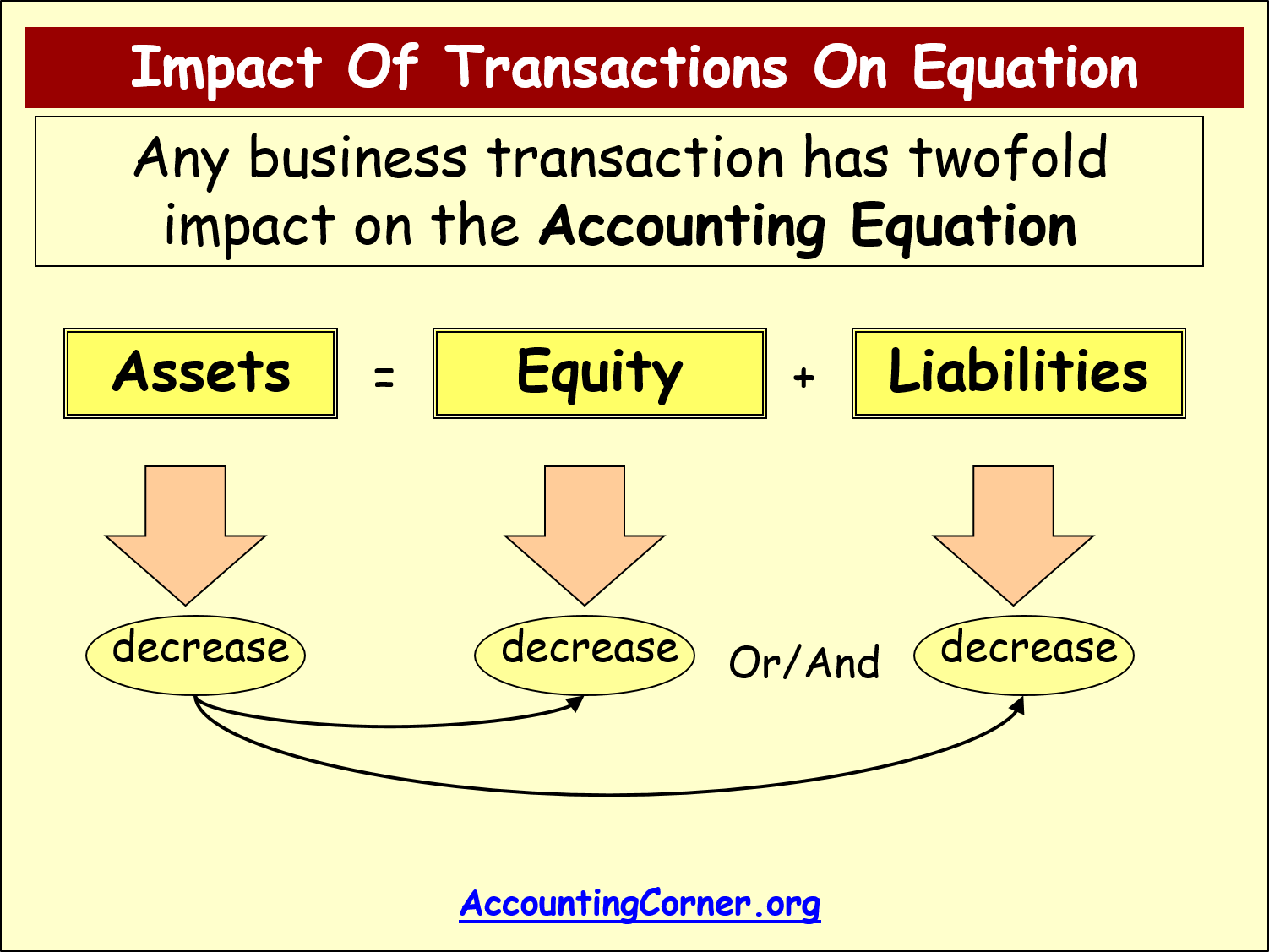

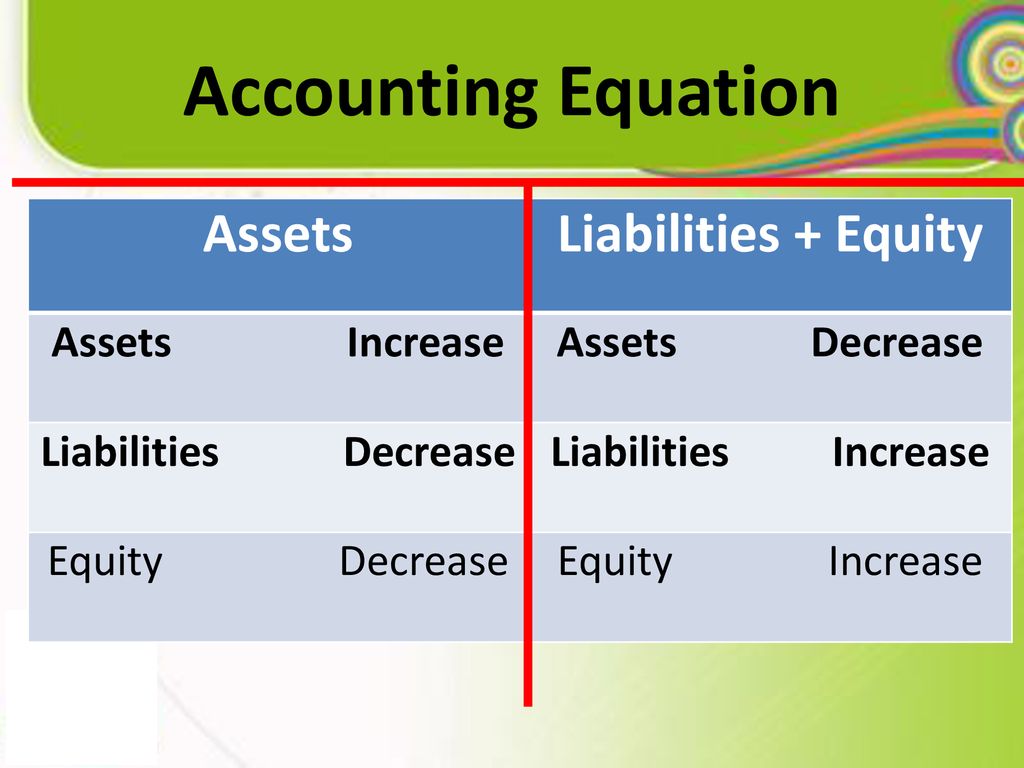

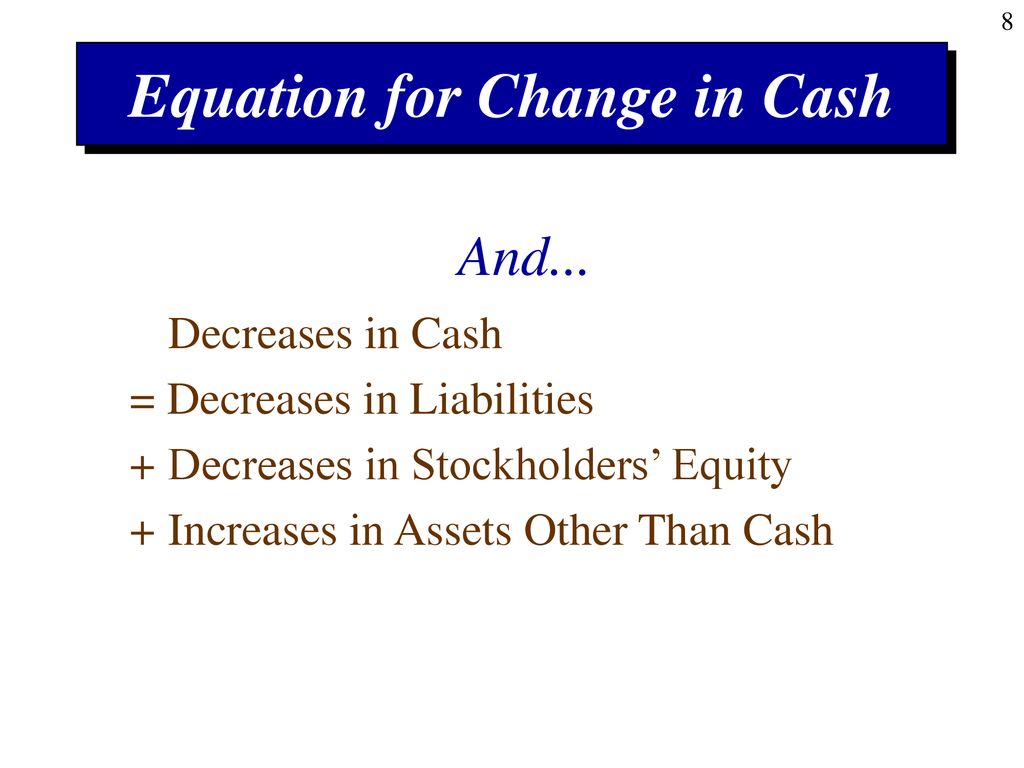

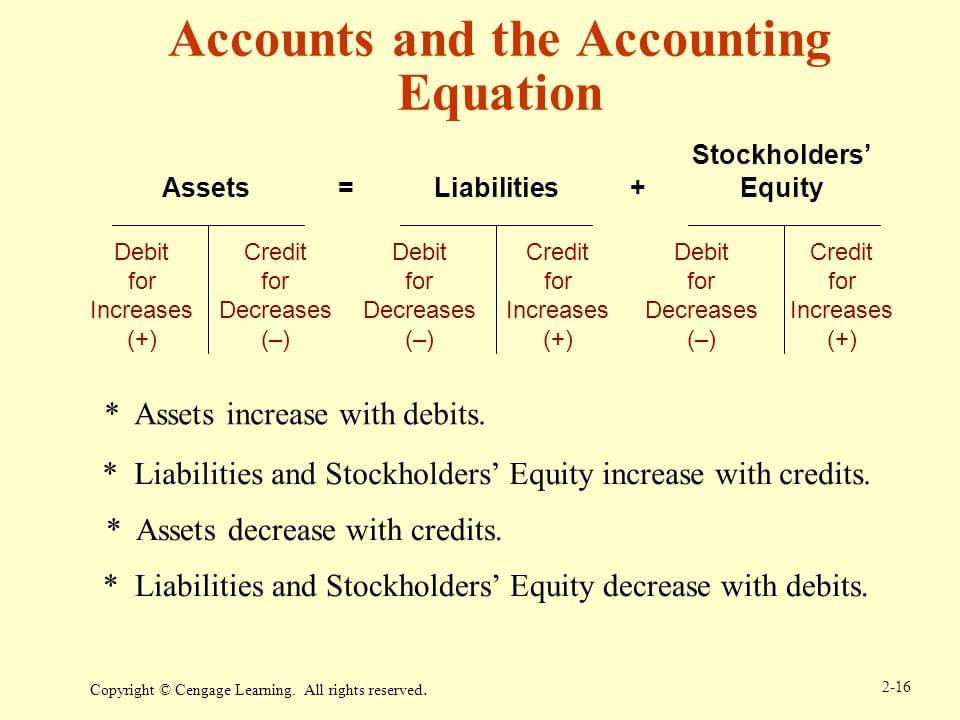

The core of this financial event lies in the alteration of the fundamental accounting equation: Assets = Liabilities + Stockholders' Equity. When assets decrease while liabilities and stockholders' equity increase, it suggests specific types of financial transactions or operational changes are underway.

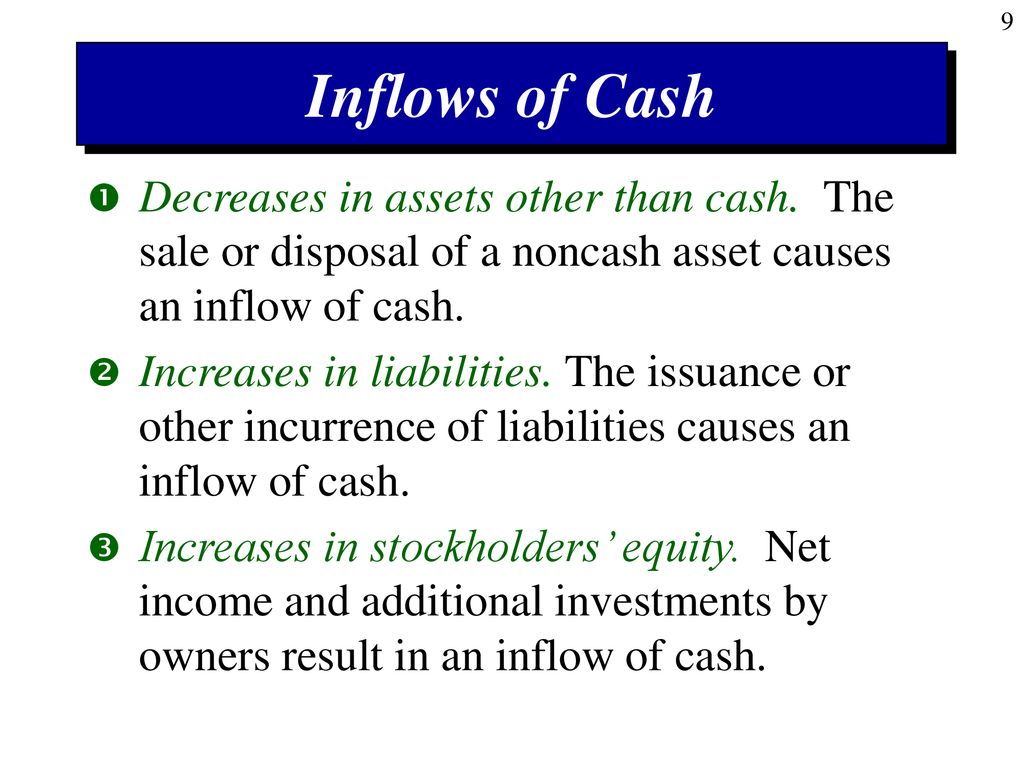

Specifically, the decrease in assets can occur for several reasons. These include, but are not limited to, the sale of significant portions of company assets, substantial depreciation, or write-offs due to impairment.

Liabilities, representing the company's debts and obligations, can increase due to various factors. Borrowing money through loans or issuing bonds is a common driver, as is an increase in accounts payable and accrued expenses. Increased deferred revenue liabilities can also play a role.

Stockholders' equity, the owners' stake in the company, can expand even as assets shrink. This can happen through equity offerings (issuing new shares of stock), revaluation of assets or through the company's retained earnings—profits kept in the company rather than paid out as dividends.

Who is Affected?

The observed financial shift impacts a broad range of stakeholders. Investors are particularly vulnerable, needing to assess whether the changes are strategic adjustments or signs of deeper financial trouble.

Employees could face uncertainty if asset sales lead to restructuring or layoffs. Management bears the responsibility of communicating transparently about the reasons for these financial changes and their implications.

Regulators and the broader financial community need to monitor these trends. They are responsible for ensuring accurate financial reporting and safeguarding market stability. A wave of similar financial changes could signal systemic issues.

Potential Causes and Explanations

Several factors could explain a decrease in assets alongside increasing liabilities and stockholders' equity. One common reason is a strategic restructuring. This could involve selling off underperforming assets to raise capital, then reinvesting that capital while also taking on debt.

Companies might also issue new stock to raise funds. This dilutes existing shares, but also provides cash for investment or to cover existing liabilities. These actions can improve long-term financial health even with a short-term shift.

Another cause could be accounting adjustments. For example, a change in accounting standards might require a company to recognize certain liabilities differently. This in turn can require the devaluation of assets, even if underlying operational performance has not changed drastically.

A Human Perspective

The story of a small manufacturing company illustrates the real-world impact of these financial shifts. Acme Manufacturing, a family-owned business for three generations, recently sold its oldest factory to modernize operations.

The sale resulted in a significant reduction in assets but generated funds to invest in new, more efficient equipment. To finance the upgrade, Acme also took out a sizable loan, increasing liabilities. They also decided to offer more stock as incentives to their employees.

According to CEO Jane Doe, "The decision was difficult, but essential for our survival. We aim to modernize our business to keep up with our competitor". This action illustrates the human dimension behind balance sheet changes.

Impact and Considerations

The short-term impact of this financial shift can be mixed. The stock price might initially decline as investors digest the asset sale and increased debt, or new stock issuance.

However, if the strategy proves successful, the long-term effect can be positive. This results in improved profitability, increased shareholder value, and greater stability. Investors must thoroughly research the motivations and potential outcomes to make informed decisions.

Ultimately, this financial shift presents a complex scenario requiring careful analysis and transparent communication. A proactive approach benefits all parties involved in safeguarding the market.

..jpg)