Desired Option Trading Level Webull

The trading platform Webull is facing increasing scrutiny and user frustration over access to specific options trading levels. Many users are expressing concerns about the criteria and transparency surrounding approvals for higher-risk options strategies. This issue has sparked a heated debate within the retail investing community.

The core of the problem lies in Webull's tiered system for options trading authorization. Access to higher levels is essential for executing more complex strategies, which some investors view as crucial for maximizing potential returns and managing risk effectively. Users report inconsistencies and lack of clarity in the approval process.

Webull's Options Trading Levels: A Closer Look

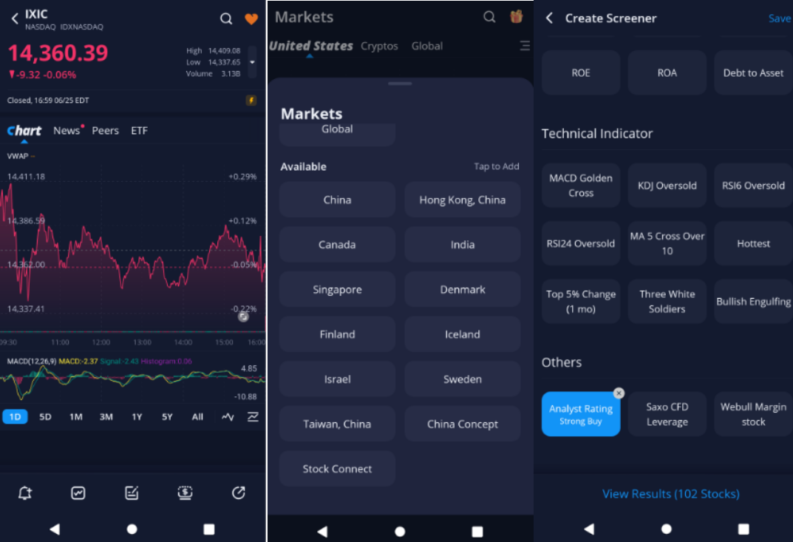

Webull, like many brokerage firms, offers tiered access to options trading. The levels typically range from Level 1, allowing basic covered calls and protective puts, to higher levels that permit more sophisticated strategies like spreads and strangles. The platform claims these levels are designed to protect inexperienced investors from taking on excessive risk.

Obtaining access to higher levels usually requires meeting certain criteria. These can include demonstrating trading experience, a certain level of financial knowledge, and maintaining a specific account balance. The exact metrics used by Webull remain somewhat opaque.

"We strive to provide a secure and informed trading environment for all our users. Our options approval process is designed to ensure that investors understand the risks involved," stated a Webull spokesperson in response to inquiries.

User Frustration and Allegations of Inconsistency

Numerous users have taken to online forums and social media to voice their dissatisfaction. Many allege that they meet the stated criteria but are still denied access to higher option trading levels. Some users have reported being approved initially, only to have their access revoked later without clear explanation.

These reports of inconsistencies have led to accusations of unfair practices. Some investors suspect that Webull is selectively restricting access to certain strategies. This is potentially limiting their trading opportunities based on undisclosed factors.

Examining the Data

Quantifying the exact number of users affected by this issue is challenging. Webull does not publicly release data on options approval rates. Independent researchers have attempted to gauge user sentiment through surveys and data scraping of online forums.

One such study, conducted by the Retail Investors Association, found that a significant percentage of Webull users surveyed expressed dissatisfaction with the options approval process. They cited lack of transparency and inconsistent decisions as primary concerns.

Regulatory Scrutiny and Industry Standards

The issue of options trading access is not unique to Webull. It is a concern that regulators like the Securities and Exchange Commission (SEC) monitor closely. The SEC mandates that brokerage firms implement adequate risk management procedures when granting access to complex financial instruments.

Industry standards generally emphasize transparency and fairness in options approval processes. Brokerage firms are expected to clearly communicate their criteria and provide adequate explanations for decisions.

However, the application of these standards can vary, leading to inconsistencies across different platforms. This highlights the need for greater standardization and regulatory oversight in this area.

Looking Ahead: Potential Changes and Solutions

Webull faces growing pressure to address user concerns and improve the transparency of its options approval process. Potential solutions include providing more detailed explanations for approval decisions. They also may consider implementing a more standardized and consistent application of its criteria.

The company could also benefit from increased communication with its user base, actively soliciting feedback and addressing concerns in a timely manner. Ultimately, restoring user trust will be crucial for Webull's long-term success.

The future of options trading access on Webull will likely depend on the platform's willingness to adapt to user demands and regulatory expectations. The industry as a whole may also see greater scrutiny and standardization in the coming years. It is a shift to ensure fair and responsible access to complex investment strategies for all retail investors.

![Desired Option Trading Level Webull Webull Paper Trading Options [Complete Guide!] - Trade with market Moves](https://images.surferseo.art/a3f4e9cf-0154-45db-bdca-7df75058a6a8.jpeg)

![Desired Option Trading Level Webull Webull Paper Trading Options [Complete Guide!] - Trade with market Moves](https://images.surferseo.art/8153bcc0-71cd-4685-884d-3d5a9a0aef78.jpeg)