Difference Between Net Income And Retained Earnings

Understanding the financial health of a company can seem daunting, especially when navigating the jargon. Two key terms that often cause confusion are net income and retained earnings. While both are crucial indicators of a company's financial performance, they represent different aspects and are used for distinct purposes.

This article will clarify the difference between net income and retained earnings, explaining their individual significance and how they interact within a company's financial statements. Understanding these concepts is essential for investors, business owners, and anyone seeking to analyze a company's financial performance.

Net Income: The Profit Picture

Net income, often referred to as the "bottom line," represents a company's profit after all expenses, including the cost of goods sold, operating expenses, interest, and taxes, have been deducted from its total revenue. It is a fundamental measure of profitability over a specific period, such as a quarter or a year.

The formula for calculating net income is straightforward: Total Revenue - Total Expenses = Net Income. A positive net income indicates a profit, while a negative net income indicates a loss.

Net income is a critical metric for investors because it reflects the company's ability to generate profits from its operations. It's a key input in calculating important financial ratios like earnings per share (EPS) and price-to-earnings (P/E) ratio, which are used to assess a company's value and investment potential.

Retained Earnings: Accumulating Profits

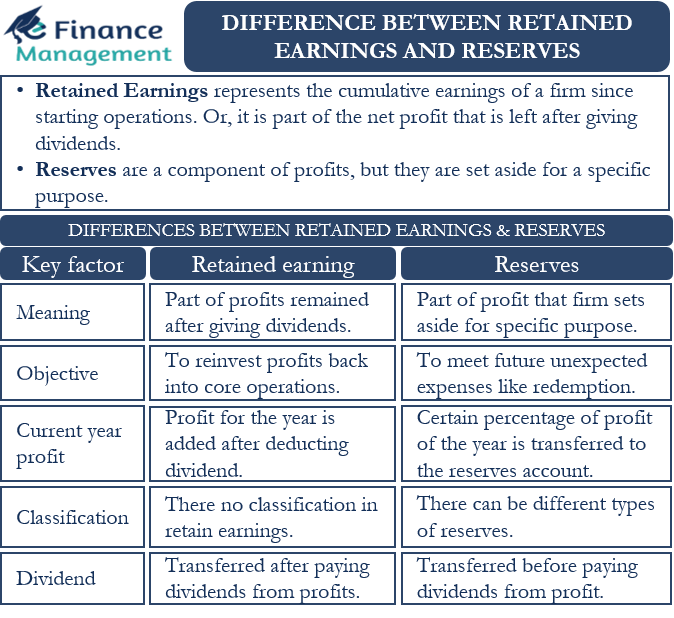

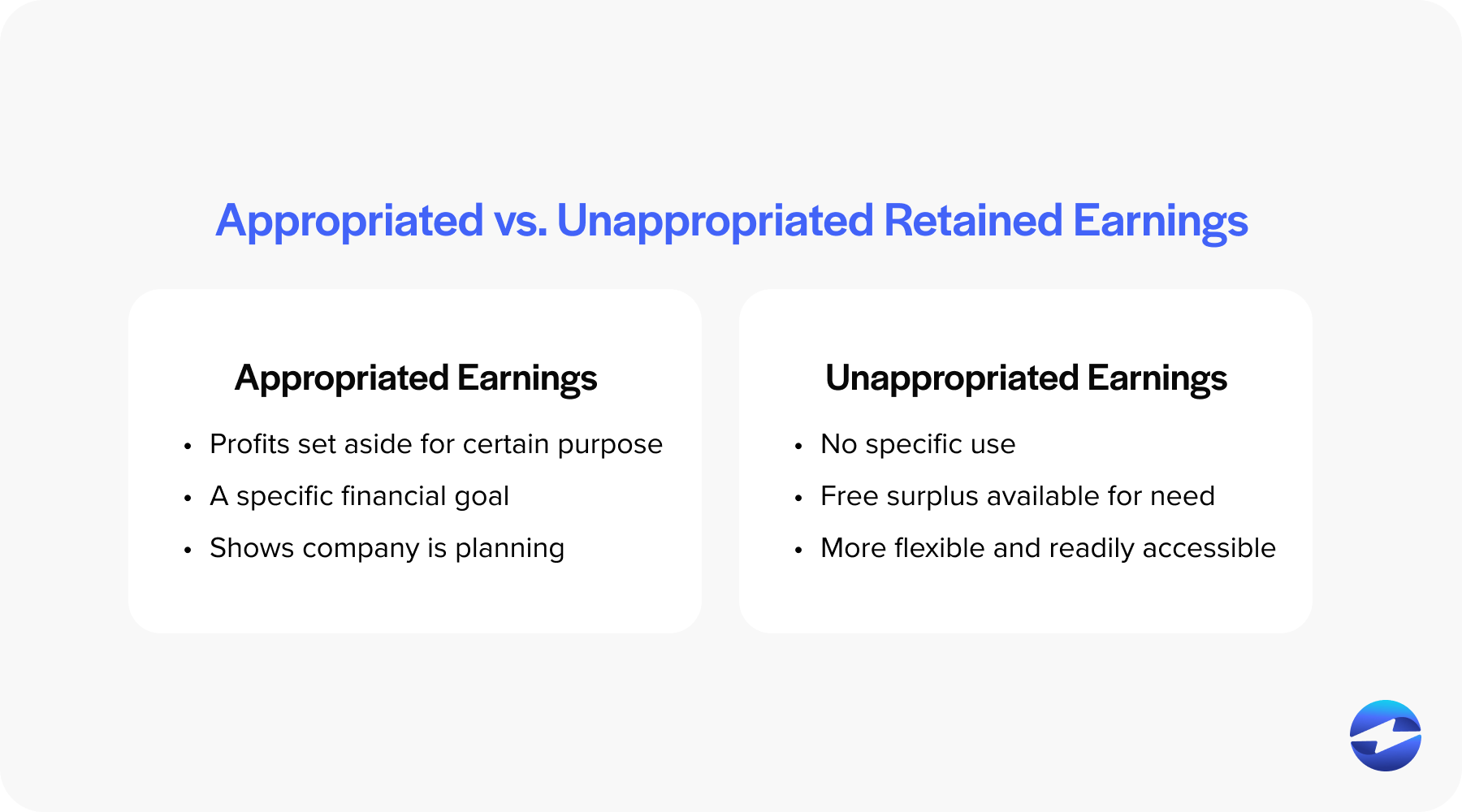

Retained earnings, on the other hand, represent the accumulated profits a company has earned over its lifetime, less any dividends paid out to shareholders. Think of it as the portion of net income that a company chooses to reinvest back into the business rather than distribute to its owners.

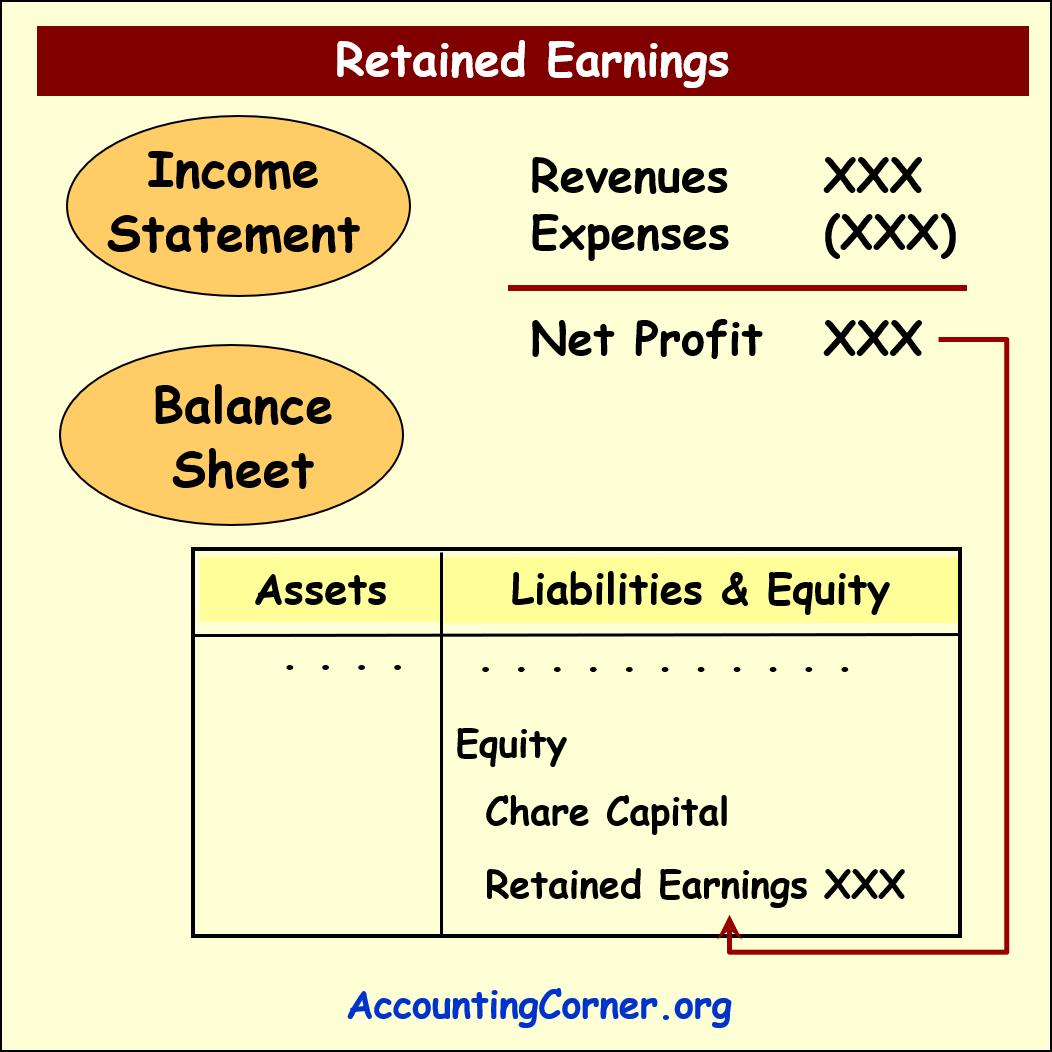

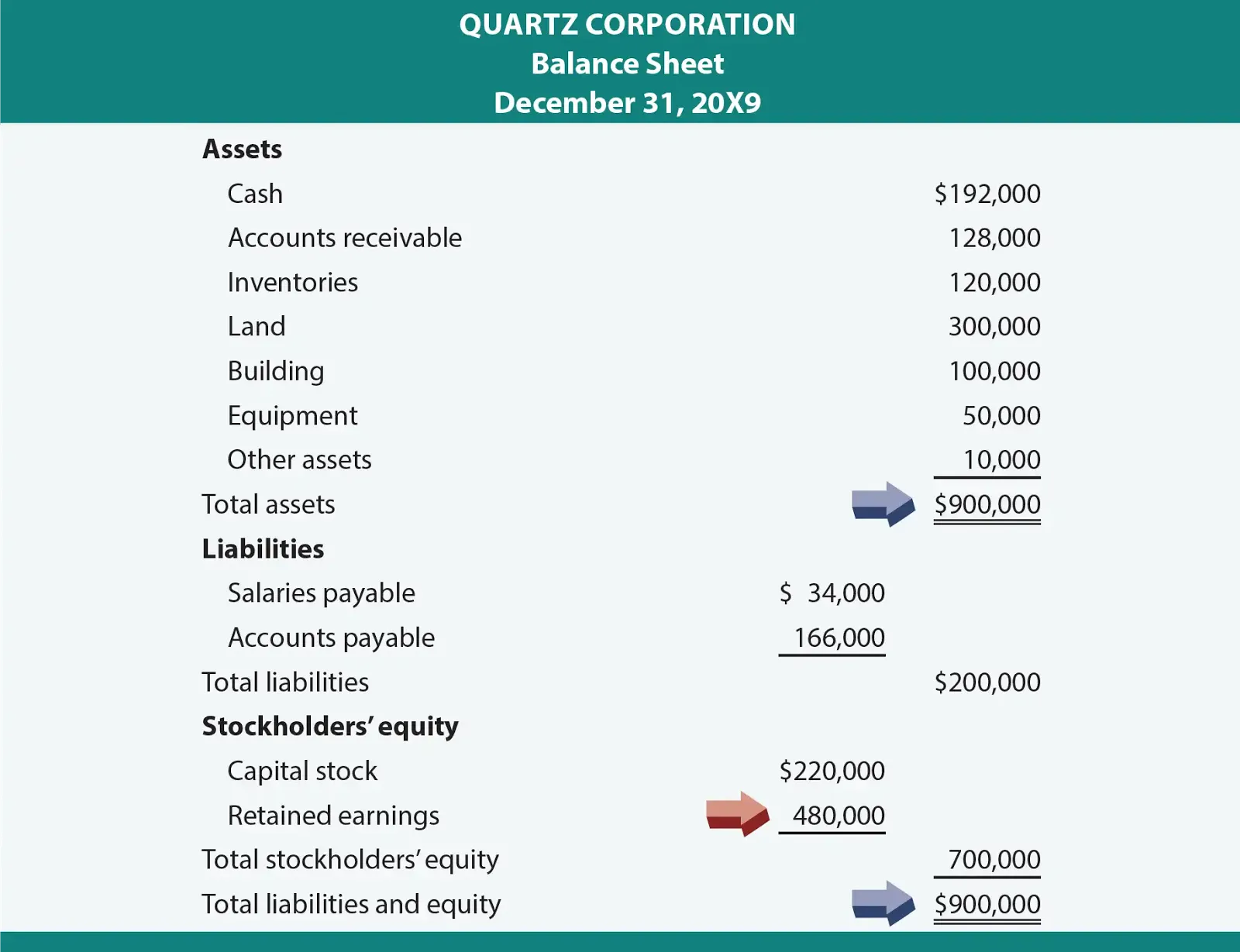

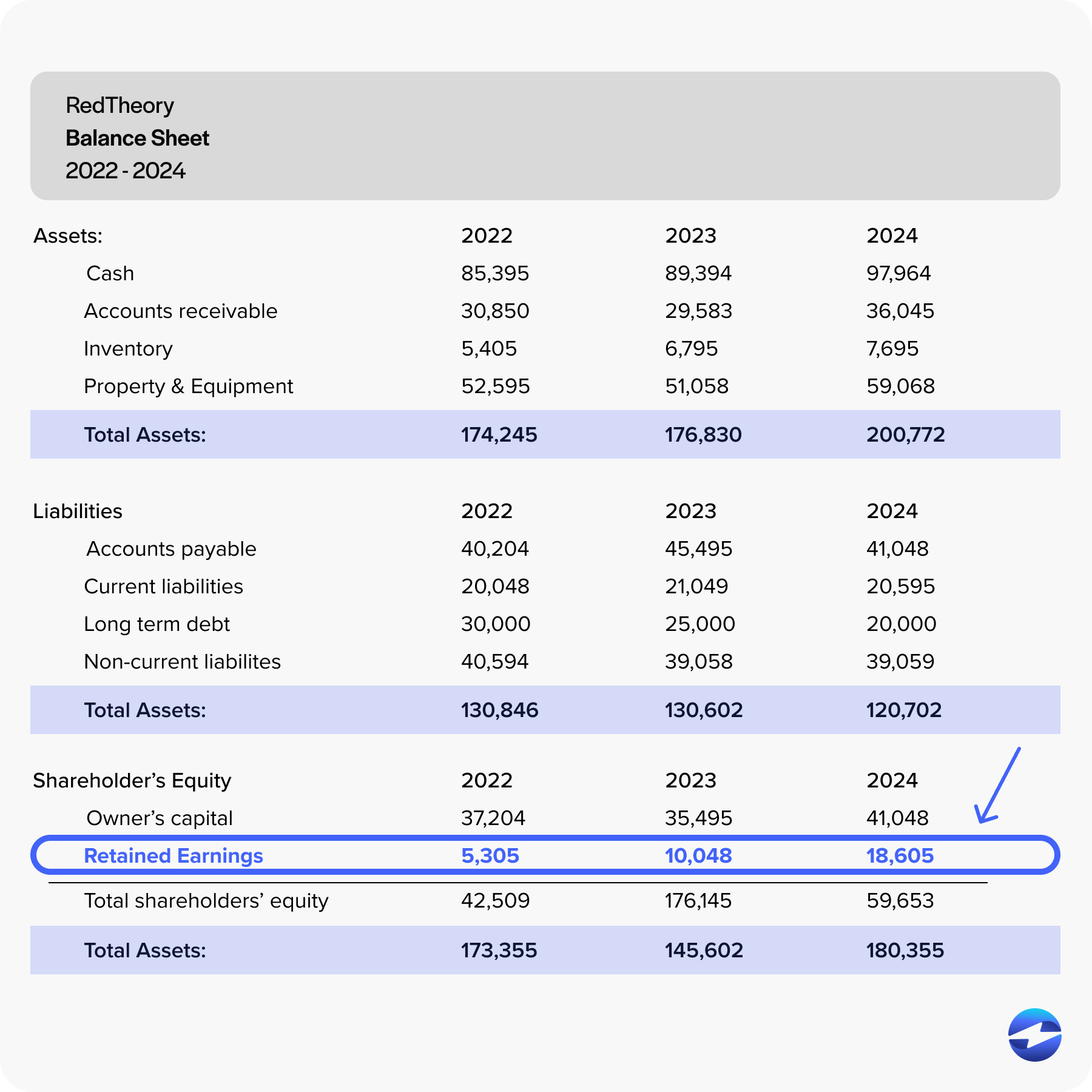

The retained earnings balance is found on the balance sheet under the equity section. It's a cumulative figure that grows each year with net income and decreases with dividend payments or losses.

Retained earnings are used to fund various business activities, such as expanding operations, developing new products, paying off debt, or acquiring other companies. It demonstrates a company's ability to self-finance its growth without relying solely on external funding sources.

The Key Difference: A Matter of Perspective

The primary difference lies in their scope and timing. Net income is a period-specific measure of profitability, reflecting performance over a defined timeframe. Retained earnings, however, is a cumulative measure that reflects the total undistributed profits accumulated since the company's inception.

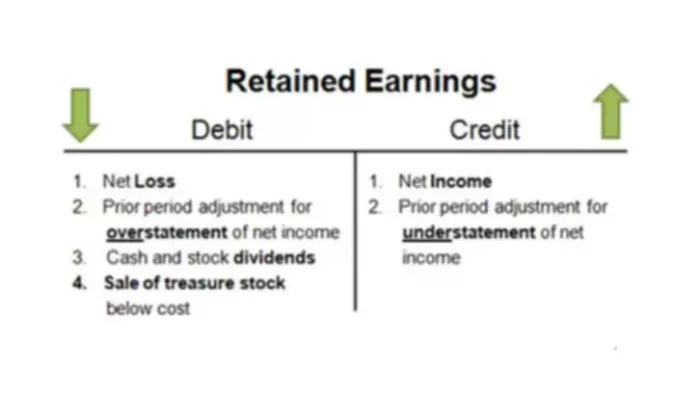

Net income is a component of retained earnings. It flows into the retained earnings account at the end of each accounting period, increasing the balance. Dividends paid out to shareholders decrease the retained earnings balance.

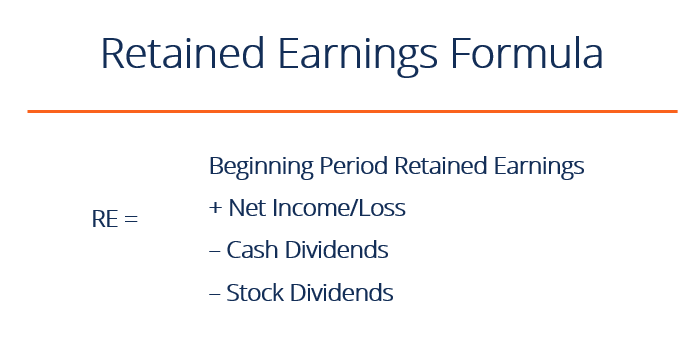

Here’s the formula for calculating retained earnings: Beginning Retained Earnings + Net Income - Dividends = Ending Retained Earnings.

How They Work Together

Net income and retained earnings are inextricably linked. A company must generate net income to increase its retained earnings. The decision of how much of the net income to distribute as dividends versus retain for future investments significantly impacts the company's growth trajectory and shareholder value.

A company with consistently high net income and a prudent retained earnings policy is generally viewed favorably by investors. This indicates financial stability, growth potential, and a commitment to long-term value creation.

Conversely, a company with low or negative net income may struggle to retain earnings, potentially hindering its ability to fund future growth and remain competitive.

Real-World Implications

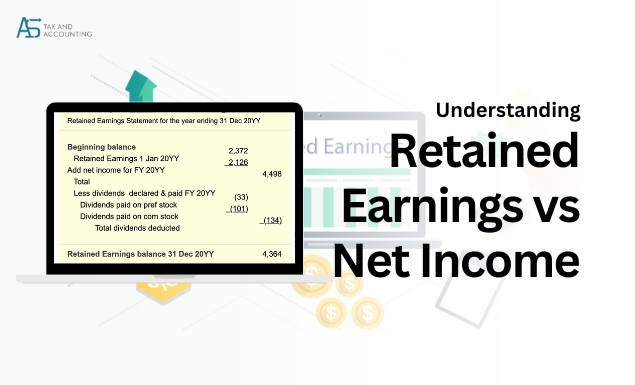

Consider a hypothetical example: TechForward Inc. reports a net income of $1 million for the year 2023. The company's board of directors decides to pay out $200,000 in dividends to shareholders. The remaining $800,000 is added to the company's retained earnings.

If TechForward Inc. started the year with $5 million in retained earnings, the ending retained earnings balance for 2023 would be $5.8 million ($5 million + $1 million - $200,000 = $5.8 million). This increased retained earnings balance can then be used to fund research and development, expand into new markets, or acquire a competitor.

Understanding the relationship between net income and retained earnings helps investors make informed decisions about whether to invest in a company. A healthy retained earnings balance often signifies a strong and sustainable business model.

Beyond the Numbers

While net income and retained earnings are quantitative measures, they also reflect a company's strategic decisions and management philosophy. A company's dividend policy, for example, reveals its approach to balancing shareholder returns with reinvestment opportunities.

A high dividend payout ratio might appeal to income-seeking investors, but it could also signal a lack of internal investment opportunities. Conversely, a low dividend payout ratio suggests that the company believes it can generate higher returns by reinvesting profits back into the business.

Analyzing these metrics in conjunction with other financial data, such as cash flow statements and balance sheets, provides a more complete picture of a company's financial health and future prospects.

Conclusion

Net income and retained earnings are distinct but interconnected concepts that provide valuable insights into a company's financial performance. By understanding the difference between these two metrics and how they interact, investors and business professionals can gain a deeper understanding of a company's profitability, financial stability, and growth potential.

Ultimately, a comprehensive analysis of both net income and retained earnings, along with other relevant financial information, is essential for making informed decisions and assessing a company's long-term value.