Discover It Card Credit Score Needed

For consumers seeking to build or rebuild their credit, the Discover it card family often presents an accessible entry point. Understanding the credit score requirements for these cards is crucial for applicants hoping to get approved and start their credit-building journey.

This article examines the credit scores typically needed for various Discover it cards, exploring the approval likelihood for different credit profiles and highlighting alternative options for those who may not initially qualify.

Understanding the Discover it Card Landscape

Discover offers a range of credit cards designed to cater to different needs and credit profiles. These include student cards, secured cards, and traditional unsecured cards with rewards programs.

The Discover it Secured Credit Card, designed for those with limited or damaged credit, generally requires a lower credit score compared to other Discover it options. According to Experian, secured cards are often accessible even with scores below 600.

Credit Score Ranges and Approval Chances

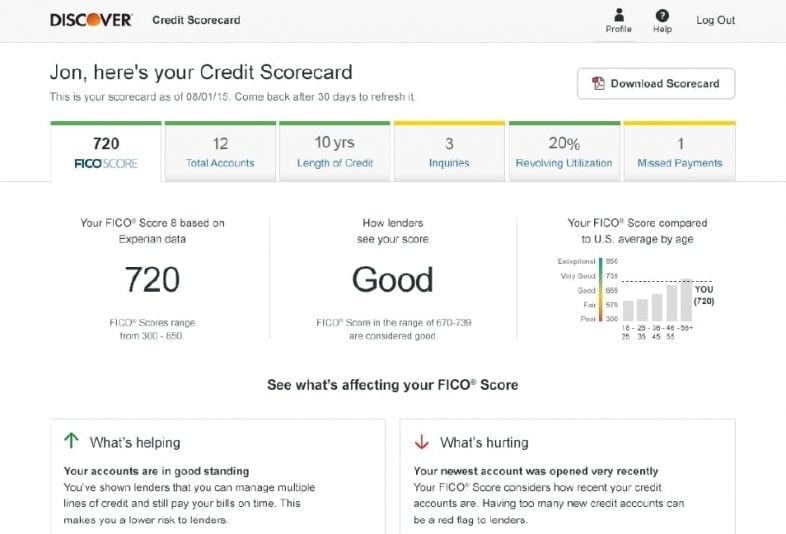

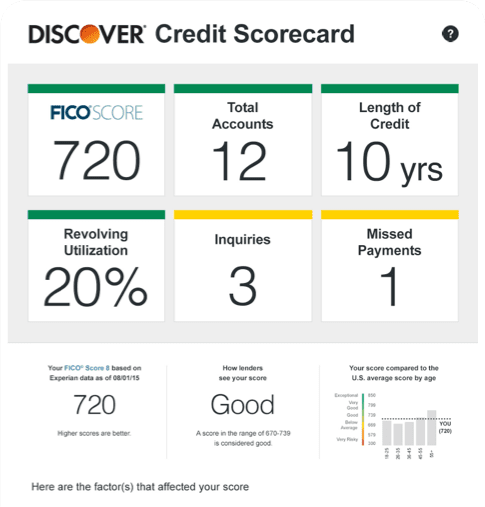

While Discover doesn't explicitly publish minimum credit score requirements, data points suggest general guidelines. Credit Karma notes that the Discover it Student Cash Back card typically requires a "fair" credit score, usually ranging from 630 to 689.

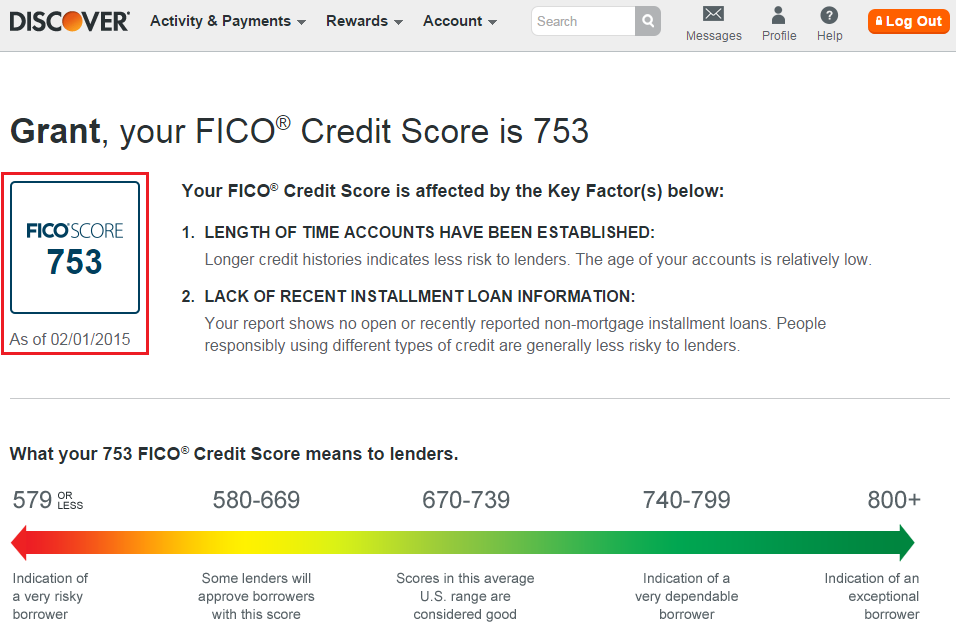

The unsecured Discover it Cash Back and Discover it Chrome cards typically target applicants with "good" to "excellent" credit. This generally translates to a FICO score of 670 or higher, but ideally closer to 700 or above for better approval odds and potentially more favorable terms, as noted by WalletHub.

Applicants with scores in the "fair" range (630-689) may still be approved for certain Discover it cards, but the Discover it Secured Credit Card offers a higher chance of approval.

Factors Beyond Credit Score

It's essential to note that credit score is not the sole determinant of approval. Discover also considers factors such as income, employment history, and overall creditworthiness.

A strong payment history and low credit utilization can significantly improve your chances. Even with a borderline credit score, demonstrating responsible credit behavior can increase your odds of approval.

Discover also evaluates your debt-to-income ratio. A lower ratio indicates a greater ability to manage debt, making you a more attractive candidate.

Alternatives for Building Credit

If your credit score falls below the typical range for Discover it cards, several alternatives exist. A secured credit card from another issuer is a solid option, requiring a cash deposit that serves as your credit limit.

Becoming an authorized user on a responsible cardholder's account can also help you build credit. Reporting rental payments to credit bureaus is another strategy to establish a positive credit history.

Consider a credit-builder loan from a local credit union. These loans are designed to help individuals with limited or no credit establish a positive payment history.

The Significance of Choosing the Right Card

Choosing the right credit card for your credit profile is important. Applying for cards with stricter requirements may result in rejection and a temporary dip in your credit score.

Starting with a secured card or a card designed for building credit can improve your approval odds. Consistently using the card responsibly and making on-time payments is a key step to building a strong credit history.

Regularly monitoring your credit score through free services like Credit Karma or AnnualCreditReport.com allows you to track your progress and make informed decisions about future credit applications.

Ultimately, understanding the Discover it card credit score requirements, along with exploring alternative credit-building options, empowers consumers to take control of their financial future and achieve their credit goals.

:max_bytes(150000):strip_icc()/discover-business-card_FINAL-62720016f74d497d90e0dc0896ca0be4.png)