Do Payday Lenders Report To Credit Bureaus

Imagine this: You're facing an unexpected car repair, a medical bill throws your budget off-kilter, or you simply need a little extra cash to bridge the gap until your next paycheck. The bright lights of a payday lender beckon, promising a quick and easy solution. But as you sign on the dotted line, a question lingers in the back of your mind: What impact will this have on my credit score?

The answer, unfortunately, isn't always straightforward. The crucial point to understand is that while some payday lenders *do* report to credit bureaus, many do not. This distinction has significant implications for your credit health, depending on how you manage the loan.

The Murky World of Payday Lending and Credit Reporting

Payday loans, characterized by their short repayment terms and high interest rates, often target individuals with limited access to traditional credit options. These loans, typically for small amounts, are designed to be repaid on the borrower's next payday.

The question of whether these lenders report to credit bureaus is a complex one. It hinges on the lender's policies and the credit bureaus they choose to work with.

Credit Bureaus: The Gatekeepers of Your Financial Reputation

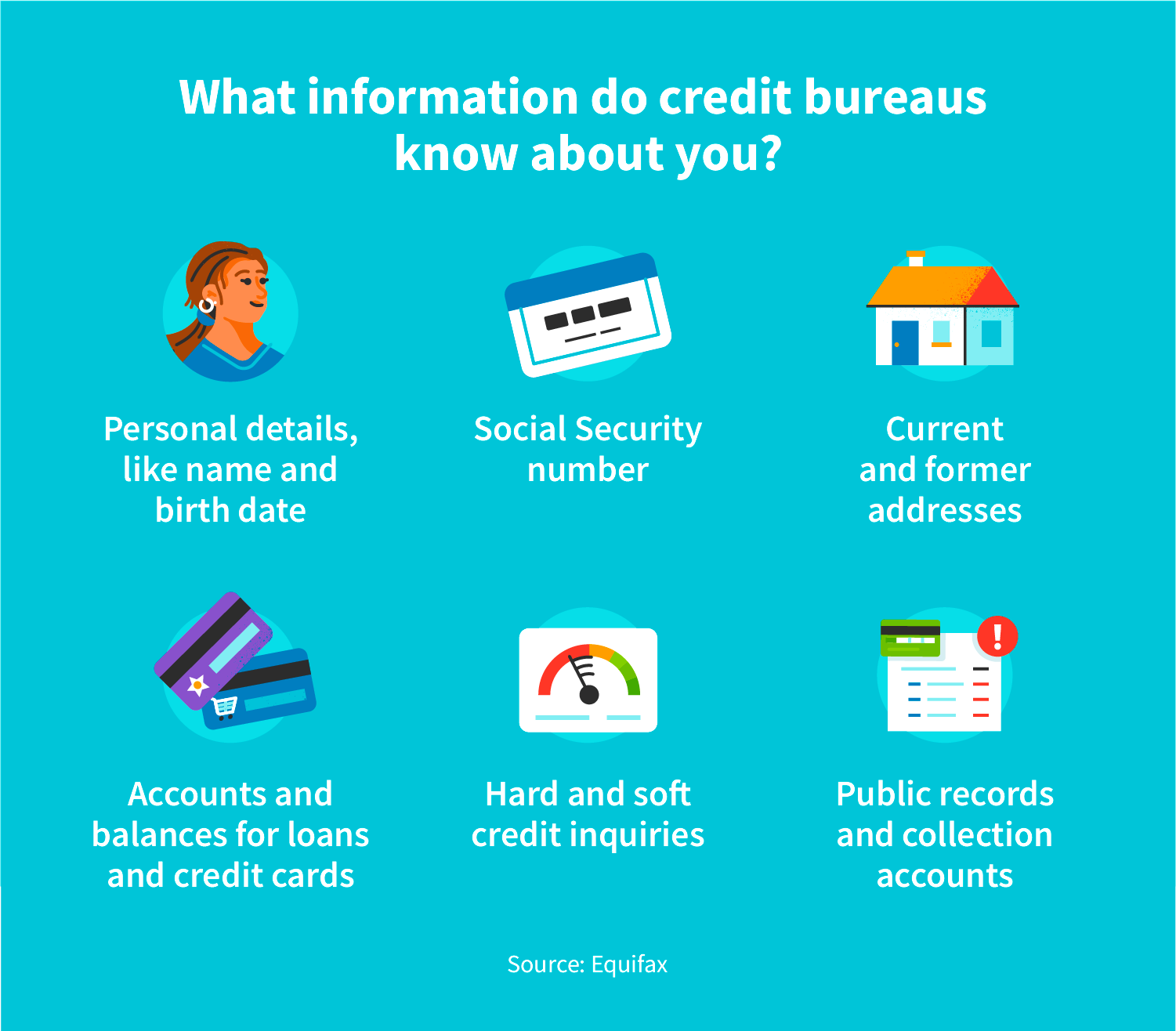

Before diving deeper, let's clarify the role of credit bureaus. These agencies, like Equifax, Experian, and TransUnion, collect information about your credit history and compile it into a credit report.

This report forms the basis of your credit score, a three-digit number that reflects your creditworthiness. Lenders use this score to assess the risk of lending you money.

Do All Payday Lenders Report? Absolutely Not.

Here's the core issue: not all payday lenders subscribe to the services of major credit bureaus. Many operate outside the mainstream credit reporting system.

This means that unless a payday lender *does* report, taking out a loan and repaying it responsibly may not improve your credit score. It simply won't be reflected on your credit report.

The Downside: When Payday Loans Hurt Your Credit

The real danger arises when you fail to repay a payday loan. If a payday lender *does* report to credit bureaus, a missed payment can severely damage your credit score.

Delinquent accounts can stay on your credit report for up to seven years, making it difficult to obtain loans, rent an apartment, or even secure certain jobs.

Moreover, even if a payday lender doesn't initially report, they may sell your debt to a collection agency. Collection agencies almost always report to credit bureaus, adding another negative mark to your credit history.

Even if the payday lender doesn't report directly, they might use a *Consumer Reporting Agency (CRA)* to screen applicants. While not the same as the big three credit bureaus, these CRAs still collect and share information that can affect your eligibility for other financial products.

Protecting Your Credit: Questions to Ask Before Borrowing

Before taking out a payday loan, it's crucial to ask the lender whether they report to credit bureaus. This simple question can save you a lot of trouble down the line.

You should also inquire about their policies regarding late payments and debt collection. Understanding these policies will help you make an informed decision about whether the loan is worth the risk.

Alternative Options: Exploring Safer Financial Solutions

Payday loans are often seen as a last resort, but there are often alternatives. Consider exploring options like personal loans from credit unions or banks, credit card cash advances (though be mindful of interest rates), or borrowing from friends and family.

You might also explore options such as negotiating with creditors to establish a payment plan, seeking assistance from local charities or non-profit organizations, or exploring options like paycheck advance apps that offer smaller amounts with no interest.

It's worth speaking with a financial advisor or credit counselor who can help you develop a budget and explore strategies for managing debt. Many non-profit organizations offer free or low-cost credit counseling services.

The Importance of Financial Literacy

Ultimately, the best way to protect your credit is to develop strong financial habits. This includes creating a budget, tracking your spending, and saving for emergencies.

Understanding how credit works and how it impacts your financial well-being is essential. There are many resources available online and in your community to help you improve your financial literacy.

The Future of Payday Lending and Credit Reporting

The landscape of payday lending is constantly evolving, with increased regulatory scrutiny and growing awareness of the risks associated with these loans. It's possible that in the future, more payday lenders will be required to report to credit bureaus, providing greater transparency and accountability.

For instance, the Consumer Financial Protection Bureau (CFPB) has been actively involved in regulating the payday lending industry, aiming to protect consumers from predatory lending practices.

However, until that happens, it's up to consumers to educate themselves and make informed decisions about borrowing money. Knowing your rights and understanding the potential impact on your credit score is crucial for navigating the complex world of payday lending.

A Final Thought: Credit as a Tool, Not a Trap

Your credit score is a powerful tool that can help you achieve your financial goals. But it's also something that needs to be protected and nurtured.

Avoid the allure of quick cash and prioritize building a solid credit history through responsible borrowing and repayment habits. A little planning and awareness can go a long way in securing your financial future.

Ultimately, the relationship between payday lenders and credit bureaus highlights the importance of understanding the fine print and making informed decisions when it comes to borrowing money. Armed with knowledge and a proactive approach, you can protect your credit and achieve your financial aspirations.

:max_bytes(150000):strip_icc()/GettyImages-846159228-5ad668671d64040039b3c200.jpg)