Do Secured Credit Card Limit Increase

For many seeking to rebuild or establish credit, secured credit cards offer a vital lifeline. But a crucial question lingers: can the credit limit on these cards actually increase over time, offering a path toward unsecured credit and greater financial flexibility? The answer is nuanced, varying significantly across issuers and dependent on individual cardholder behavior.

Understanding the mechanics of secured credit card limit increases is crucial for consumers navigating the credit-building process. While not guaranteed, an increased credit limit on a secured card can signal improved creditworthiness and potentially unlock access to better financial products. This article delves into the possibility of secured credit card limit increases, exploring the factors influencing these decisions and offering insights for cardholders aiming to expand their credit access.

The Landscape of Secured Credit Cards

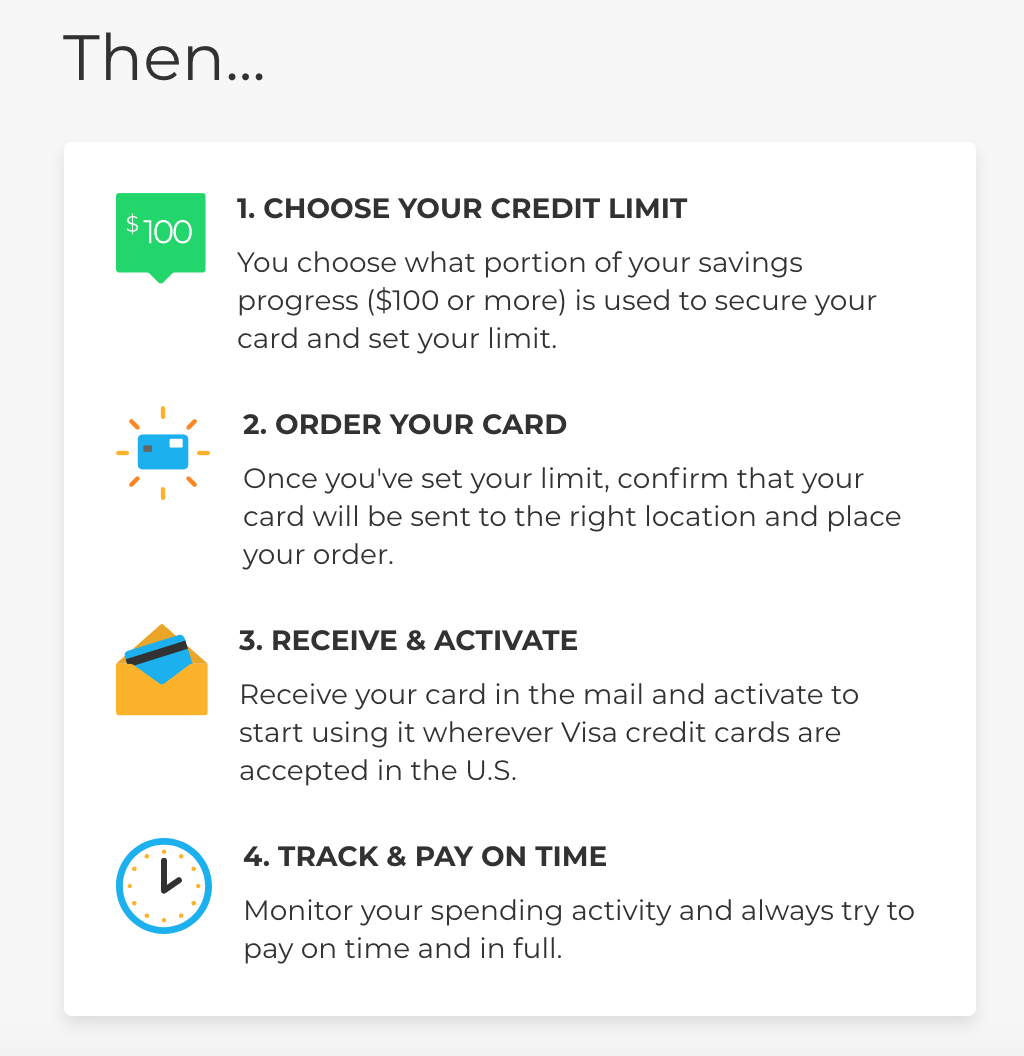

Secured credit cards require an upfront cash deposit, which typically serves as the credit limit. This deposit acts as collateral, mitigating the risk for the issuer and allowing individuals with limited or damaged credit to gain access to credit.

Unlike unsecured cards, where the credit limit is based primarily on credit history, secured cards offer a more accessible entry point. However, the question remains: can that initial limit grow without adding further deposit?

Can Your Limit Actually Increase?

The possibility of a credit limit increase on a secured card is not universally offered, but it certainly exists with some issuers. Discover, for example, is known for offering opportunities for secured cardholders to graduate to an unsecured card and often increases the credit limit during this transition.

Other issuers, like Capital One, may also consider credit limit increases on secured cards, although less frequently. The key is proactive management and demonstrating responsible credit behavior.

Factors Influencing Limit Increases

Several factors play a crucial role in determining whether an issuer will grant a credit limit increase. These include responsible payment history, credit score improvement, and overall credit utilization.

Payment History: Consistently paying your secured credit card bill on time and in full is paramount. This demonstrates financial responsibility and builds trust with the issuer.

Credit Score Improvement: As you use your secured card responsibly, your credit score should gradually improve. A higher credit score signals reduced risk and increases the likelihood of a credit limit increase.

Credit Utilization: Keeping your credit utilization low is crucial. Aim to use only a small percentage of your available credit limit each month, ideally below 30%. High utilization can negatively impact your credit score and decrease your chances of an increase.

Beyond the Basics: Other Considerations

In addition to the core factors, other elements can influence the decision-making process. These may include income, employment stability, and the issuer's specific policies.

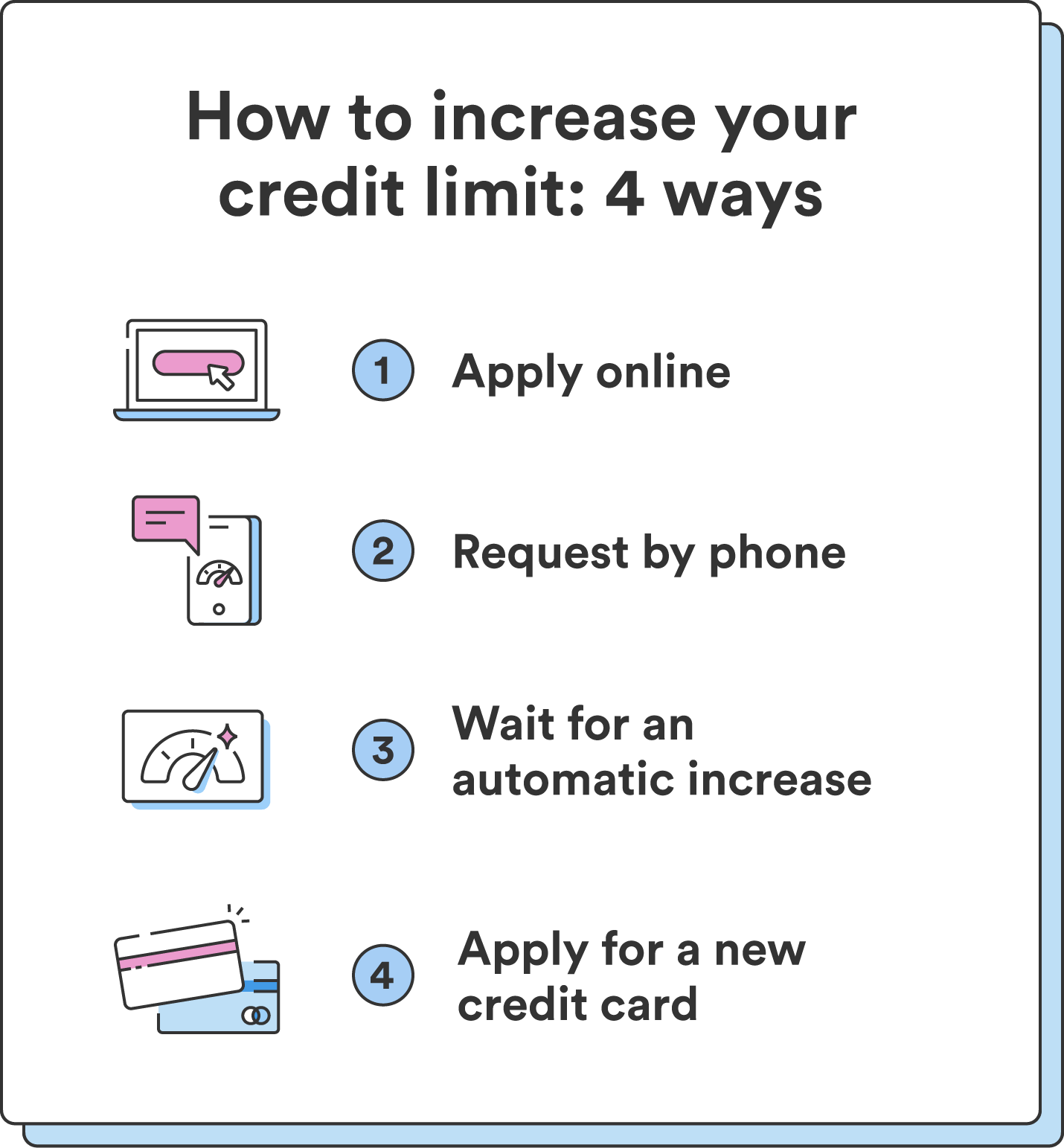

Some issuers may periodically review accounts for potential credit limit increases, while others require cardholders to request an increase directly. Contacting your issuer and inquiring about their policies can provide valuable insights.

Experian, one of the major credit bureaus, emphasizes the importance of regularly monitoring your credit report for any errors or inaccuracies that could be hindering your credit score.

The Graduation Path: From Secured to Unsecured

The ultimate goal for many secured credit cardholders is to graduate to an unsecured card. This transition typically involves the return of the initial security deposit and access to a higher credit limit without collateral.

Graduation often triggers a credit limit increase, as the issuer is now extending credit based on your creditworthiness rather than the security deposit. This represents a significant step forward in building credit.

According to data from TransUnion, another major credit bureau, demonstrating consistent responsible credit behavior over time significantly increases the chances of graduation.

Looking Ahead: Strategies for Success

To maximize your chances of obtaining a credit limit increase on your secured card or graduating to an unsecured card, focus on responsible credit management.

Pay your bills on time, keep your credit utilization low, and regularly monitor your credit report. These steps will not only improve your credit score but also demonstrate your creditworthiness to the issuer.

The Consumer Financial Protection Bureau (CFPB) offers valuable resources and guidance on responsible credit management, empowering consumers to take control of their financial health.

Ultimately, while credit limit increases on secured credit cards are not guaranteed, they are attainable with diligent effort and responsible financial habits. By understanding the factors that influence these decisions and proactively managing your credit, you can pave the way for greater financial flexibility and access to more favorable credit products.