Do You Have To Have Flood Insurance In Florida

Rising tides, intensifying storms, and increasingly frequent flooding events are becoming hallmarks of life in Florida. For homeowners across the Sunshine State, the question of whether to secure flood insurance is no longer a hypothetical exercise but a pressing concern with significant financial implications.

The complexities surrounding flood insurance in Florida are multifaceted. While not universally mandated, specific circumstances, such as residing in a high-risk flood zone or holding a mortgage from a federally regulated lender, can trigger a mandatory flood insurance requirement. This article delves into the intricacies of Florida's flood insurance landscape, clarifying who needs it, how to obtain it, and the potential consequences of going without it.

Understanding Flood Zones and Risk

Florida's vulnerability to flooding stems from its extensive coastline, low elevation, and susceptibility to hurricanes and tropical storms. The Federal Emergency Management Agency (FEMA) categorizes areas based on their flood risk, designating zones that dictate insurance requirements and premiums.

High-risk zones, often labeled with letters like A or V, have a 1% chance of flooding in any given year, also known as a 100-year floodplain. Residents in these zones with mortgages from federally regulated lenders are typically required to carry flood insurance.

However, even those outside high-risk zones should consider flood insurance. Statistics show that over 20% of flood insurance claims come from areas deemed to have moderate to low risk. The devastation from recent storms like Hurricane Ian underscores the fact that flood risk is not confined to designated zones.

The Mandatory vs. Voluntary Debate

Federal law mandates flood insurance for properties in high-risk flood zones with mortgages from federally regulated lenders. This requirement is enforced to protect both the homeowner and the lender from potential financial losses due to flood damage.

Homeowners in these zones must maintain flood insurance for the life of the loan. Failure to do so can result in the lender force-placing a policy, which is typically more expensive and provides less coverage than a policy the homeowner secures themselves.

Outside of these mandatory situations, the decision to purchase flood insurance is voluntary. However, many experts strongly advise all Florida homeowners to consider obtaining coverage, regardless of their flood zone designation.

Navigating the National Flood Insurance Program (NFIP)

The National Flood Insurance Program (NFIP), managed by FEMA, is the primary provider of flood insurance in the United States. It offers coverage for physical damage to buildings and personal property directly caused by flooding.

NFIP policies have maximum coverage limits. For example, coverage for the building itself is capped at $250,000, while personal property coverage is limited to $100,000. These limits may not be sufficient to cover the full cost of repairs or replacement for some homes.

Furthermore, the NFIP has faced criticism for its complex claims process and its financial solvency. Rising claims due to increasingly frequent and severe flooding events have placed a significant strain on the program.

The Rise of Private Flood Insurance

Due to the limitations and challenges associated with the NFIP, the private flood insurance market has been expanding in Florida. Private insurers offer alternative coverage options, often with higher coverage limits and more flexible terms.

Private flood insurance policies can be tailored to meet the specific needs of individual homeowners, providing coverage for items that may not be covered by the NFIP. They also may offer broader coverage for things like additional living expenses while a home is being repaired.

However, private flood insurance policies can be more expensive than NFIP policies, especially for homes in high-risk flood zones. Homeowners should carefully compare the costs and coverage options of both NFIP and private policies before making a decision.

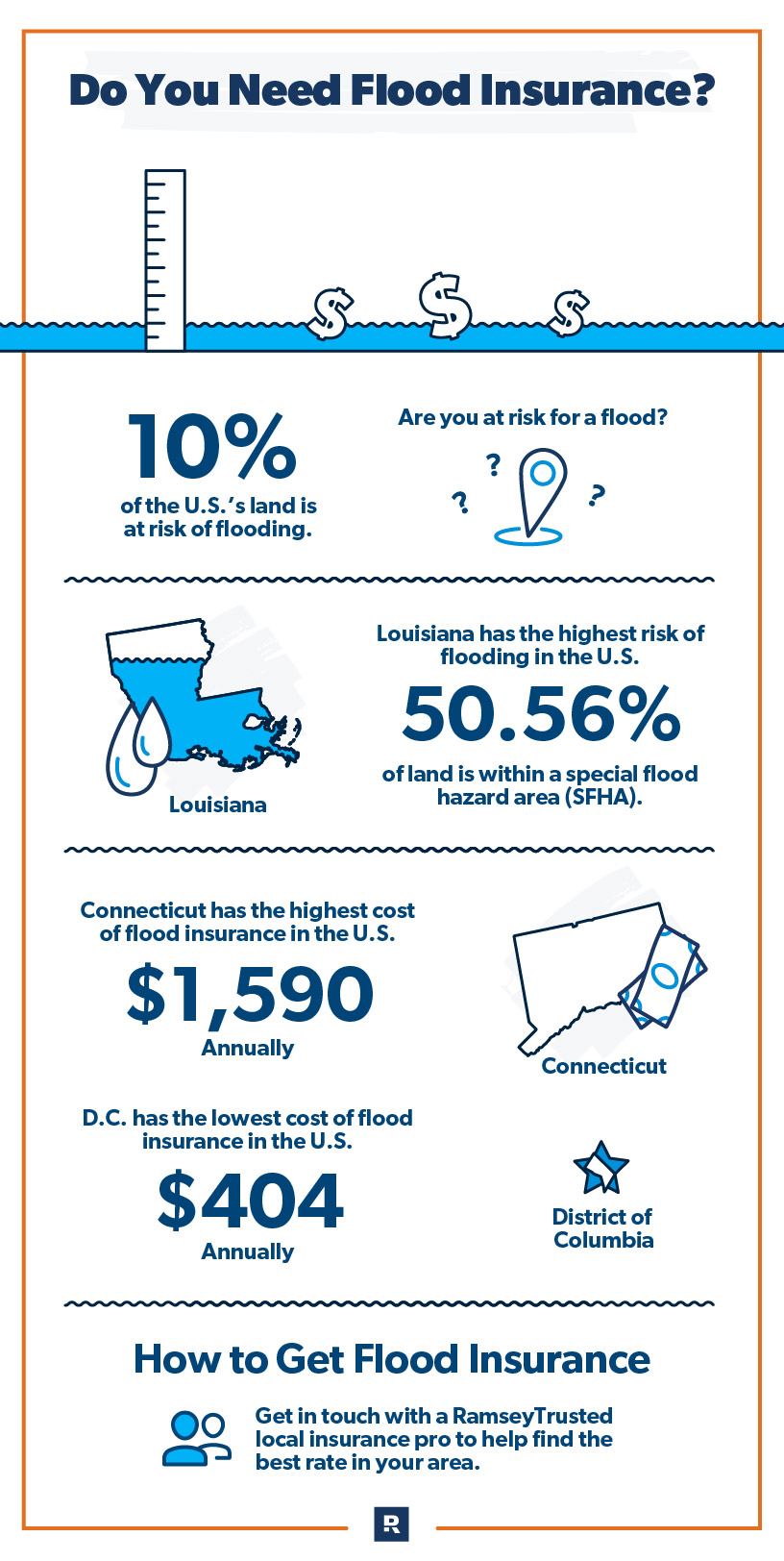

Cost Considerations and Factors Influencing Premiums

The cost of flood insurance in Florida varies widely, depending on several factors. These include the property's location, flood zone designation, elevation, construction type, and coverage amount.

Properties in high-risk flood zones typically have higher premiums than those in low-risk zones. Older homes may also have higher premiums due to outdated construction standards.

Homeowners can take steps to reduce their flood insurance premiums. Elevating a home, installing flood vents, and implementing other flood mitigation measures can help lower the risk of damage and reduce insurance costs.

The Consequences of Going Without Flood Insurance

The financial consequences of experiencing a flood without insurance can be devastating. Flood damage is often not covered by standard homeowners insurance policies, leaving uninsured homeowners to bear the full burden of repair or replacement costs.

Even a few inches of floodwater can cause significant damage to a home's structure, flooring, and belongings. The cost of repairing or replacing these items can quickly run into the thousands of dollars.

Furthermore, flooding can lead to health hazards, such as mold growth, which can further exacerbate the financial and emotional stress of dealing with flood damage. The peace of mind that comes with having flood insurance is often worth the investment, even for those not required to have it.

Looking Ahead: Adapting to a Changing Climate

As climate change continues to drive sea-level rise and increase the frequency and intensity of extreme weather events, the importance of flood insurance in Florida will only continue to grow. Proactive measures are needed to adapt to these changing conditions and protect homeowners from the financial risks associated with flooding.

Policymakers, insurers, and homeowners must work together to develop strategies for managing flood risk and ensuring the affordability and accessibility of flood insurance. Investing in flood mitigation infrastructure, updating building codes, and providing financial assistance to homeowners can help reduce the impact of flooding on Florida communities.

Ultimately, the decision of whether to purchase flood insurance is a personal one. However, given the increasing vulnerability of Florida to flooding, it is a decision that should be carefully considered by all homeowners. Ignoring the risk is no longer a viable option.