Do You Have To Pay Taxes On Owners Draw

Small business owners, listen up! Are you taking owner's draws? Understanding the tax implications is crucial to avoid penalties.

This article clarifies whether owner's draws are taxable and how they impact your overall tax liability, ensuring you're compliant and financially secure.

Owner's Draws: The Basics

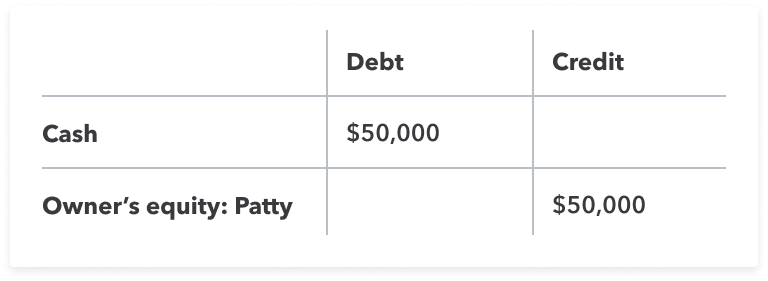

An owner's draw is simply a withdrawal of cash from your business for personal use.

It’s common among sole proprietorships, partnerships, and limited liability companies (LLCs) taxed as pass-through entities.

Remember, owner's draws are not considered salary or wages.

Are Owner's Draws Taxable?

Here's the critical point: Owner's draws themselves are not directly subject to income tax.

However, this doesn't mean you're off the hook.

The business's profits, from which the draws are taken, are what's subject to income tax.

How Profits Are Taxed

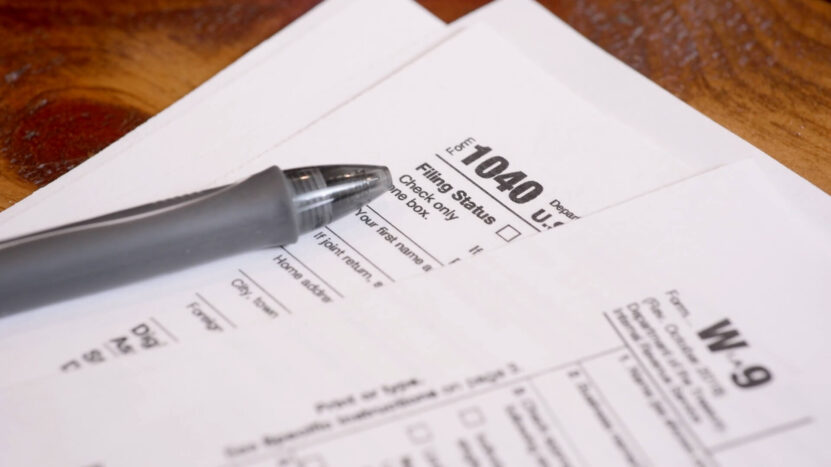

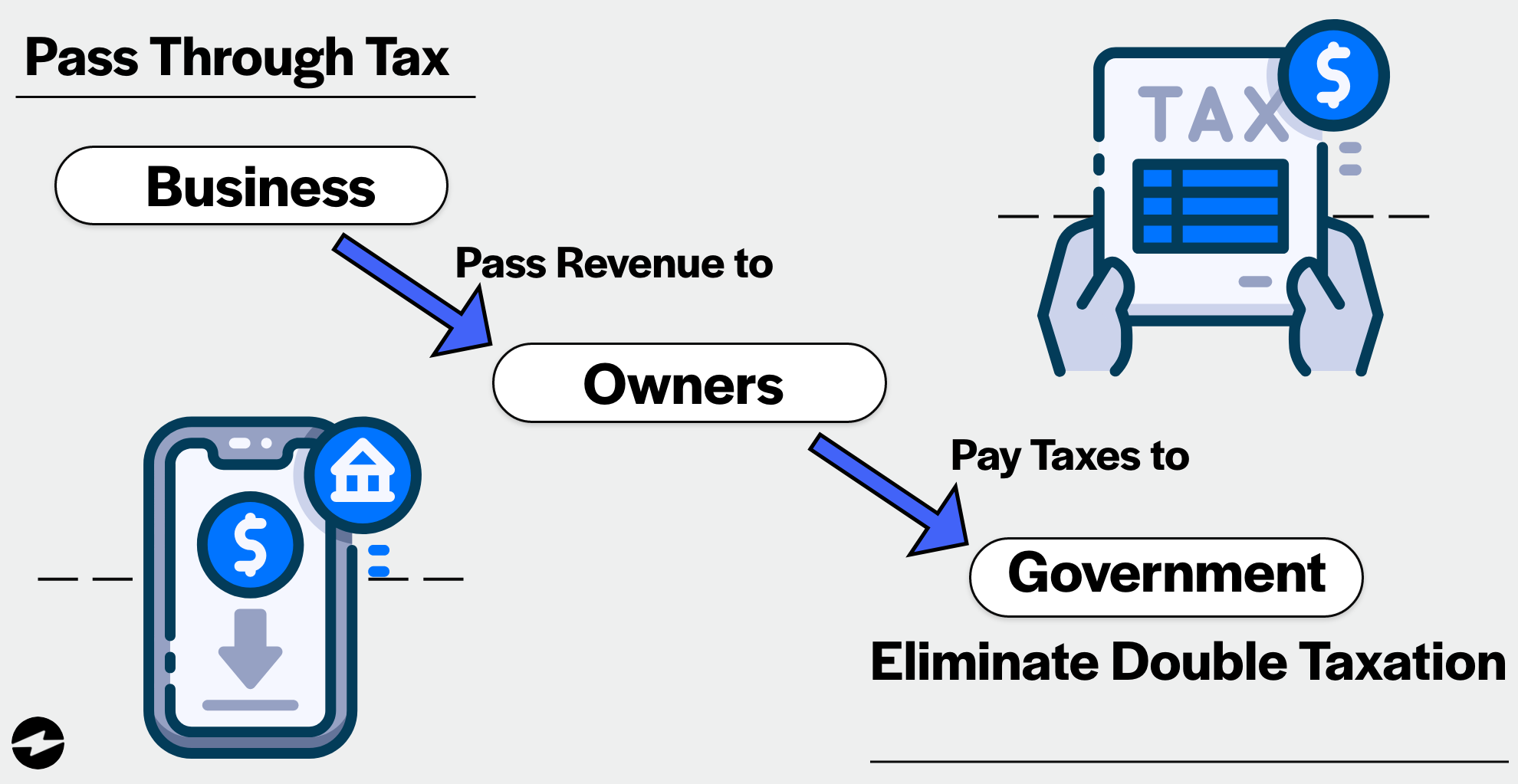

For pass-through entities, the business's profit "passes through" to the owner's personal income tax return.

You'll report your share of the business's profits on Schedule C (for sole proprietorships), Schedule K-1 (for partnerships and S corporations), or similar forms.

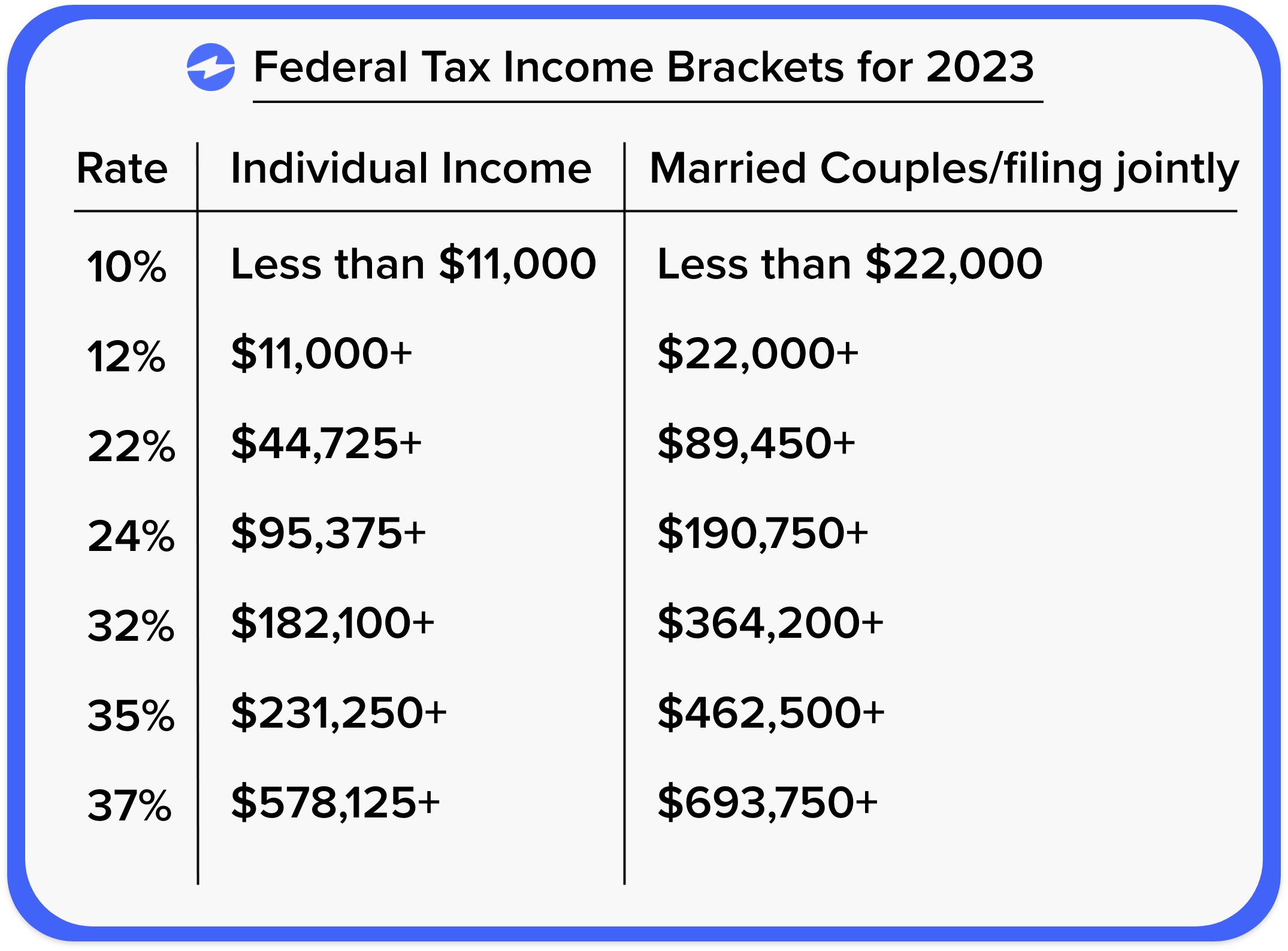

This profit is then subject to your individual income tax rate.

Self-Employment Tax Considerations

Beyond income tax, self-employment tax is a significant factor.

Self-employment tax consists of Social Security and Medicare taxes.

You'll generally pay this on 92.35% of your net earnings from self-employment exceeding $400, even if you only took a small draw.

Estimated Taxes: Staying Ahead

Because income tax and self-employment tax aren't automatically withheld from owner's draws, you're responsible for paying estimated taxes quarterly to the IRS.

Failing to do so can result in penalties.

Calculate your estimated tax liability based on your projected annual income.

Record Keeping Is Key

Maintain meticulous records of all owner's draws and business expenses.

Proper documentation is essential for accurate tax reporting and can help you justify your deductions in case of an audit.

Use accounting software or consult with a bookkeeper to stay organized.

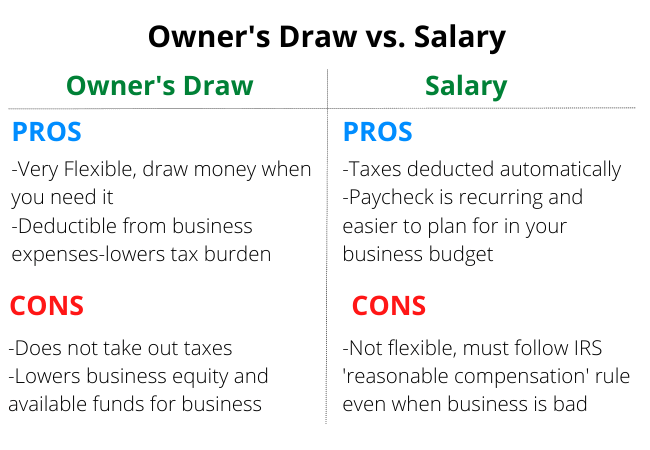

Distinguishing Draws from Salaries

If your business is structured as an S corporation, you might be both an owner and an employee.

In this case, you must pay yourself a reasonable salary, which is subject to payroll taxes (income tax, Social Security, and Medicare).

Owner's draws in an S corp are distributions of profit, separate from your salary.

LLC Flexibility

LLCs have flexibility in how they're taxed.

They can be taxed as a sole proprietorship, partnership, S corporation, or C corporation.

The tax treatment of owner's draws depends on the LLC's chosen tax classification.

Professional Advice is Crucial

Tax laws are complex and constantly changing.

It is highly recommended consult a qualified tax professional.

A CPA or tax advisor can provide personalized guidance and ensure you're compliant with all applicable regulations.

Next Steps: Review and Plan

Review your business structure and profit projections immediately.

Calculate your estimated tax liability and set up a payment schedule.

Don't wait until tax season – proactive planning is your best defense against surprises and penalties.