Does Accrued Market Discount Increase Gain

The intricacies of tax law often leave investors navigating a complex landscape, particularly when it comes to the treatment of accrued market discount on bonds. A recurring question among financial professionals and individual investors alike is whether this accrued market discount ultimately increases capital gains when a bond is sold or matures.

Understanding the mechanics of market discount and its tax implications is crucial for making informed investment decisions. Failure to properly account for these nuances can lead to unexpected tax liabilities and potentially erode investment returns.

Understanding Market Discount

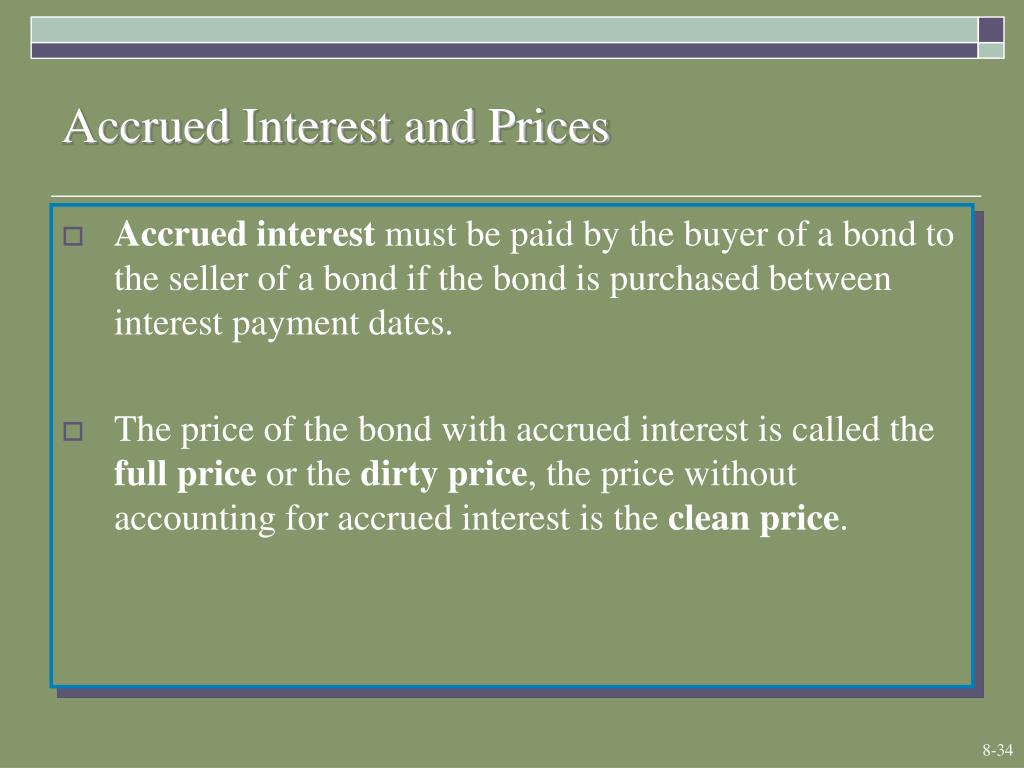

Market discount occurs when a bond is purchased on the secondary market for less than its face value. This price difference can arise due to several factors, including rising interest rates, the issuer's perceived creditworthiness, or other market conditions.

The difference between the bond's face value and the purchase price represents the market discount. The tax treatment of this discount depends on various factors, including the amount of the discount and whether the investor makes an election to accrue the discount currently.

Accrued Market Discount: The Core Question

The central question remains: does the accrued market discount increase the capital gain upon the sale or maturity of the bond? The answer, while nuanced, generally points to an increase in taxable gain, but often in a specific way.

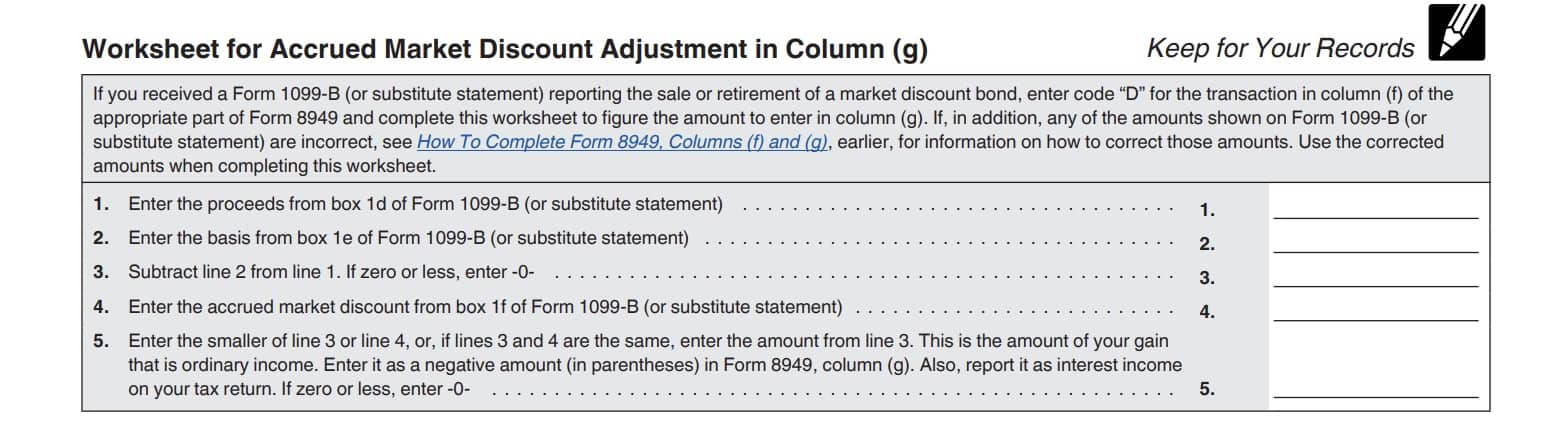

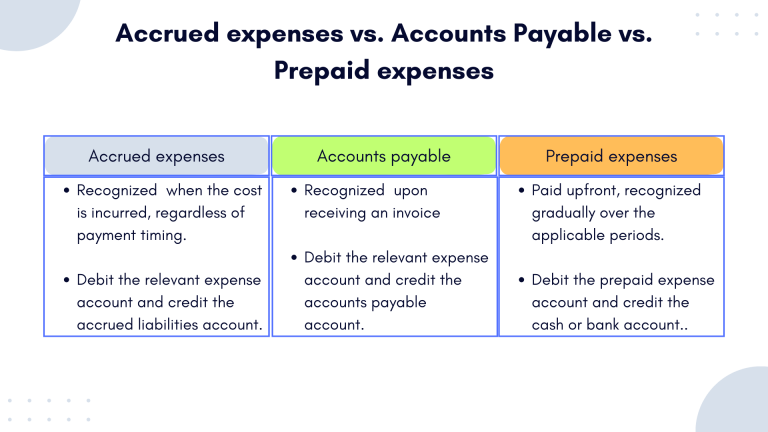

Specifically, the accrued market discount is generally treated as ordinary income when the bond is sold or redeemed. This classification as ordinary income, rather than capital gain, can have a significant impact on the investor's tax liability, as ordinary income tax rates are often higher than capital gains rates.

How It Works: A Closer Look

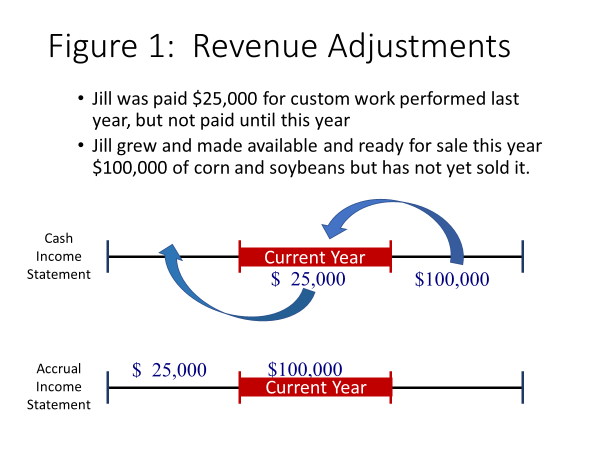

Let's consider a simplified example. An investor purchases a bond with a face value of $1,000 for $900. The market discount is $100.

If the investor elects to accrue the market discount annually, they would include a portion of the $100 discount in their taxable income each year until the bond matures or is sold. This election requires consistent application across all market discount bonds held by the investor.

If the investor does not elect to accrue the market discount annually, the entire $100 discount is treated as ordinary income in the year the bond is sold or redeemed. This can result in a larger tax bill in that particular year.

The Impact on Capital Gains

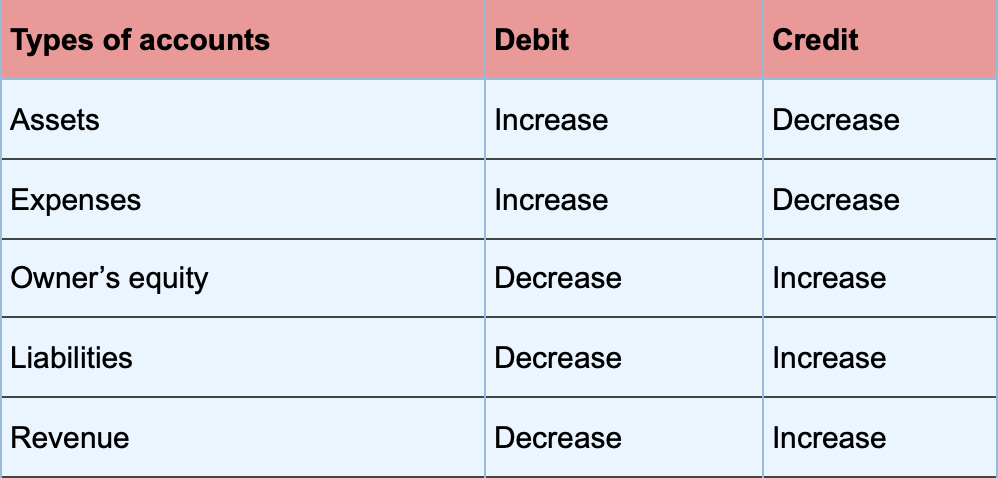

While the accrued market discount itself is treated as ordinary income, it does affect the calculation of the capital gain or loss on the bond. This interplay is critical to grasp.

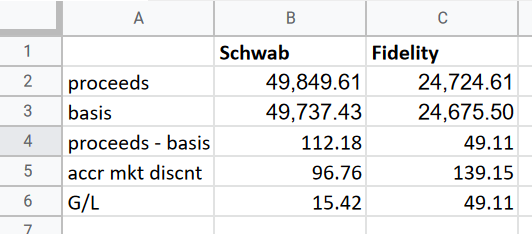

In essence, the investor's basis in the bond is increased by the amount of the accrued market discount. This higher basis then reduces the capital gain (or increases the capital loss) when the bond is ultimately sold. Let’s say, the investor sold the bond for $1,050. Without discount accretion, the capital gain is $150 ($1,050-$900). However, if market discount of $100 was accreted, the basis is $1,000, resulting in $50 capital gain.

The net effect is that a portion of what might have been a capital gain is instead taxed as ordinary income, potentially increasing the overall tax liability. The key is to analyze whether the difference between the ordinary income tax rate and the capital gains tax rate makes the election to accrue advantageous.

Factors to Consider

Several factors influence the decision of whether or not to accrue market discount. These include the investor's current and projected tax bracket, the size of the market discount, and the holding period of the bond.

Investors should also consider the administrative burden of accruing the discount annually, as it requires tracking and reporting this income each year. Seeking advice from a qualified tax professional is always recommended.

According to the IRS, specific rules apply to tax-exempt bonds and certain other types of debt instruments. It is essential to consult IRS Publication 550, Investment Income and Expenses, for comprehensive guidance on market discount and other investment-related tax matters.

Potential Impact on Investors

The tax treatment of accrued market discount can have a significant impact on investors' after-tax returns. Failing to properly plan for this tax liability can lead to unpleasant surprises and reduce the overall profitability of bond investments.

For instance, an investor in a high tax bracket may find that the ordinary income tax rate on the accrued market discount significantly reduces the benefit of investing in discounted bonds. Conversely, an investor in a lower tax bracket may find the impact less pronounced.

Moreover, the decision to accrue the discount annually or not can impact cash flow. Accruing annually means paying taxes on the discount each year, potentially reducing available cash for other investments. Delaying the tax until sale or maturity might be preferable for some investors, even if it results in a higher overall tax liability.

Conclusion

Accrued market discount does indeed generally increase the overall tax liability by converting a portion of the potential capital gain into ordinary income. Understanding the nuances of this treatment is crucial for making informed investment decisions and managing tax obligations effectively.

Investors should carefully weigh the pros and cons of accruing market discount annually, considering their individual circumstances and consulting with a tax advisor. Proper planning can help maximize after-tax returns and avoid unexpected tax burdens.

Ultimately, navigating the complexities of bond taxation requires diligence and a thorough understanding of the applicable tax laws and regulations. Staying informed and seeking professional guidance are key to achieving long-term investment success.