Does Allstate Offer Renters Insurance

In today's volatile rental market, safeguarding personal belongings is paramount. Renters insurance has emerged as a critical safety net. The question on many renters' minds is: Does Allstate, a major player in the insurance industry, offer this essential coverage?

The answer is yes. Allstate provides renters insurance policies designed to protect tenants from financial losses due to theft, fire, water damage, and other covered perils. This article will delve into the specifics of Allstate renters insurance, including coverage options, cost considerations, and how it stacks up against competitors, offering a comprehensive overview for prospective policyholders.

Allstate Renters Insurance Coverage: A Detailed Look

Allstate renters insurance offers several core coverages. These are designed to financially protect renters in various unfortunate situations.

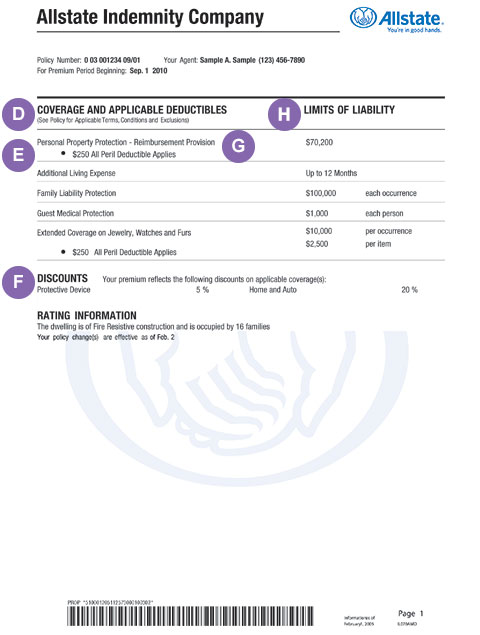

Personal Property Coverage: This protects your belongings, such as furniture, electronics, and clothing, against covered perils. The policy typically covers the actual cash value (ACV) or the replacement cost value (RCV) of your items, depending on the policy option you choose.

Liability Coverage: This helps protect you if someone is injured on your property. It can cover medical expenses and legal fees if you are found liable.

Additional Living Expenses (ALE): If a covered event makes your apartment uninhabitable, ALE coverage can help pay for temporary housing, meals, and other necessary expenses.

In addition to these core coverages, Allstate may offer optional add-ons. These could include identity theft protection, earthquake coverage (in earthquake-prone areas), and coverage for valuable items like jewelry or artwork that may exceed standard policy limits.

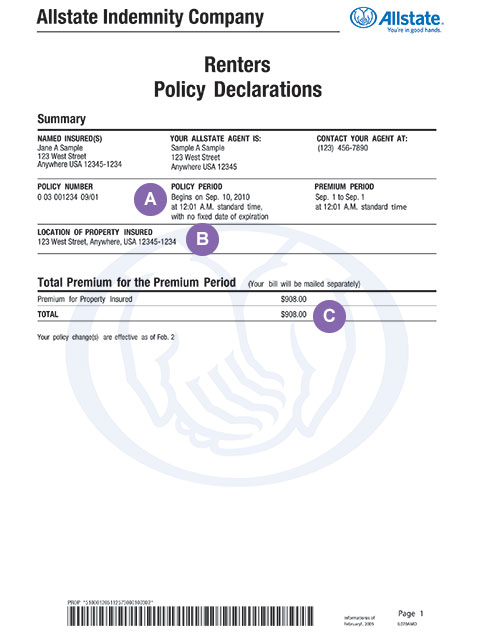

Understanding Policy Costs and Discounts

The cost of Allstate renters insurance varies depending on several factors. These can include the location of the rental property, the amount of coverage desired, and the deductible chosen.

Generally, higher coverage limits and lower deductibles lead to higher premiums. Conversely, lower coverage limits and higher deductibles result in lower premiums.

Allstate offers various discounts that can help reduce the overall cost of renters insurance. Bundling your renters insurance with other Allstate policies, such as auto insurance, is a common way to save money.

Other potential discounts include those for having safety features in your apartment. These include smoke detectors, burglar alarms, or sprinkler systems.

Comparing Allstate Renters Insurance with Competitors

It's crucial to compare Allstate renters insurance with policies from other providers. This ensures that you are getting the best coverage at a competitive price.

Companies like State Farm, GEICO, and Lemonade also offer renters insurance. Each has its own unique features, pricing structures, and customer service ratings.

Lemonade, for example, uses AI to streamline the claims process. While State Farm often receives high marks for customer service, according to various consumer reports.

Consider getting quotes from multiple insurers and carefully reviewing the policy terms. Pay attention to exclusions, limitations, and deductibles before making a decision.

How to Obtain Allstate Renters Insurance

Obtaining Allstate renters insurance is a straightforward process. You can start by visiting the Allstate website.

There, you can get a quote online or connect with a local Allstate agent. You can also call Allstate's customer service line for assistance.

Be prepared to provide information about your rental property. Also provide the value of your belongings, and any specific coverage needs you may have.

The Future of Renters Insurance

The demand for renters insurance is expected to continue to grow. This is driven by increasing rental rates and a greater awareness of the financial risks associated with renting.

Insurance companies like Allstate are likely to adapt their offerings to meet these evolving needs. This may include offering more flexible coverage options, incorporating smart home technology into policies, and providing more personalized customer experiences.

Renters insurance remains a critical component of financial security for tenants. Staying informed about available options is key to making the right choice.