Does Cardtronics Atm Charge A Fee

Imagine this: you're strolling through a bustling city, the aroma of street food filling the air, and you spot that perfect souvenir. But alas, your wallet is light on cash. There it is, a familiar sight – a Cardtronics ATM, beckoning with the promise of readily available funds. But a nagging question lingers: will it charge a fee?

The question of whether Cardtronics ATMs charge fees is a complex one, dependent on a variety of factors including your bank, the ATM location, and any agreements Cardtronics has with retailers or financial institutions at that specific site. This article explores the intricacies of Cardtronics ATM fees, shedding light on when you might encounter them, how to avoid them, and what the larger implications are for consumers.

Cardtronics, now part of NCR Atleos, is one of the world's largest non-bank ATM operators. They own and operate a vast network of ATMs found in convenience stores, gas stations, retail outlets, and various other locations. Their ATMs provide convenient access to cash for millions of people worldwide.

But this convenience often comes at a price. That price is a surcharge, a fee charged by the ATM operator for using their machine.

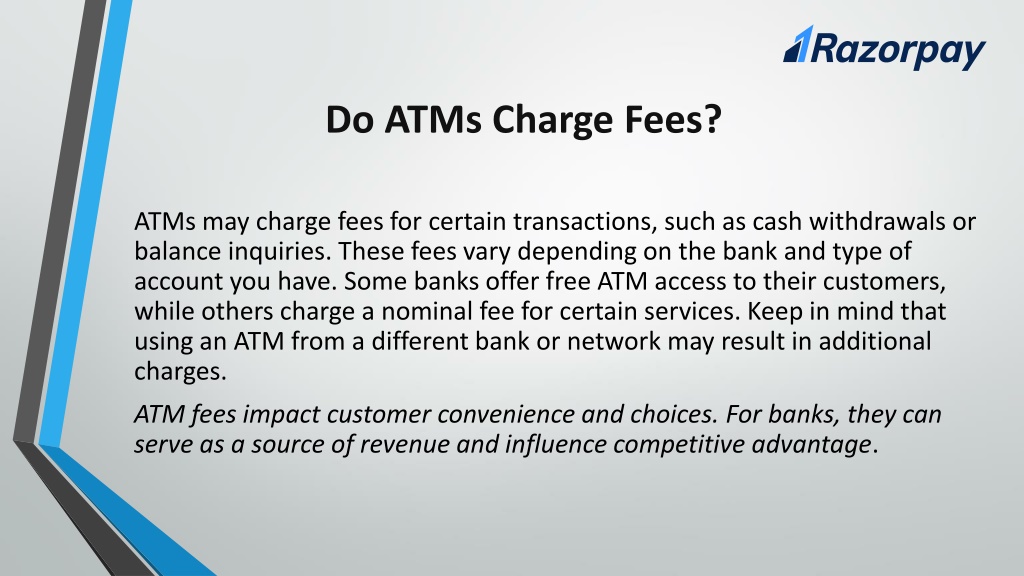

Understanding ATM Fees

ATM fees are generally categorized into two types: surcharges and foreign transaction fees. Surcharges are imposed by the ATM operator, like Cardtronics, for using their ATM. Foreign transaction fees are charged by your own bank when you use an ATM outside of its network.

Cardtronics, as the ATM operator, controls the surcharge. This fee is usually displayed on the ATM screen before you complete your transaction, giving you the opportunity to cancel if you're not willing to pay it. The surcharge can vary widely, ranging from a few dollars to upwards of $5 or more, depending on the location and the ATM owner's policies.

It's important to note that surcharges are not unique to Cardtronics. Most non-bank ATM operators charge them as a way to recoup their costs for maintaining the ATM network.

Navigating the Fee Landscape

Several factors influence whether you'll encounter a fee at a Cardtronics ATM. Your own bank is a primary determinant. If your bank participates in a surcharge-free network, such as Allpoint or MoneyPass, and Cardtronics ATMs are part of that network, you can withdraw cash without incurring a surcharge.

Cardtronics often partners with retailers to offer surcharge-free ATM access to customers of specific banks or financial institutions. These partnerships are location-specific, so it's worth checking the ATM screen for any surcharge-free network logos.

The location of the ATM also plays a significant role. ATMs in high-traffic areas, such as airports, tourist hotspots, or entertainment venues, often have higher surcharges than those in less busy locations.

Avoiding ATM Fees

Fortunately, there are several strategies to avoid ATM fees altogether. Planning ahead is key.

The most straightforward approach is to use ATMs within your bank's network. Most banks have online ATM locators or mobile apps that can help you find nearby ATMs that won't charge you a fee.

Consider joining a bank or credit union that participates in a surcharge-free ATM network like Allpoint, MoneyPass, or SUM. These networks provide access to thousands of ATMs nationwide without surcharges.

Many retailers offer cashback options when you make a purchase with your debit card. This can be a convenient way to get cash without paying ATM fees.

If you frequently use ATMs, consider opening an account with an online bank that reimburses ATM fees. Several online banks offer this perk, making it easier to access cash without incurring costs.

The Broader Context: ATM Fees and Financial Inclusion

ATM fees can disproportionately affect low-income individuals and those who rely on cash. When every dollar counts, a $3 or $5 ATM fee can be a significant burden.

This raises concerns about financial inclusion and access to basic banking services. High ATM fees can drive people away from traditional banking and towards more expensive alternatives, such as payday loans or check-cashing services.

Consumer advocacy groups have long argued for greater transparency and regulation of ATM fees. Some have even called for a cap on the maximum surcharge that can be charged.

While efforts to regulate ATM fees have faced resistance from the banking industry, the issue remains a topic of ongoing debate and discussion.

Cardtronics' Perspective

Cardtronics (now NCR Atleos) maintains that surcharges are necessary to cover the costs of operating and maintaining their ATM network. These costs include the expense of purchasing and installing ATMs, providing cash replenishment services, and ensuring the security and reliability of the machines.

The company emphasizes that it provides clear disclosures of fees on the ATM screen before a transaction is completed. This allows consumers to make an informed decision about whether or not to proceed.

Cardtronics also points to its partnerships with retailers and financial institutions that allow some customers to access surcharge-free ATMs. These partnerships demonstrate the company's commitment to providing affordable access to cash for certain segments of the population.

Conclusion

Whether or not a Cardtronics ATM charges a fee is not a simple yes or no question. It depends on a complex interplay of factors, including your bank, the ATM location, and any existing partnerships. However, understanding these factors empowers you to make informed choices about accessing your cash.

While ATM fees can be frustrating, especially for those on a tight budget, there are numerous strategies to avoid them. By planning ahead, utilizing surcharge-free networks, and exploring alternative cash access options, you can minimize the impact of ATM fees on your finances. And that souvenir you spotted? It will feel all the more sweet when purchased without the sting of an unnecessary ATM charge.

In a world increasingly moving towards cashless transactions, the ATM remains a vital lifeline for many. By understanding the nuances of ATM fees, we can navigate the financial landscape with greater confidence and control.

![Does Cardtronics Atm Charge A Fee 14 Best Checking Accounts To Avoid International ATM Fees [2023]](https://upgradedpoints.com/wp-content/uploads/2019/05/ATM.jpg)