Does Chase Bank Have A High Yield Savings Account

In a financial landscape increasingly defined by fluctuating interest rates, consumers are constantly seeking secure and profitable avenues for their savings. Many are looking to traditional banking giants like Chase Bank to provide competitive high-yield savings options.

This article delves into whether Chase Bank offers a high-yield savings account, outlining the specifics of their current savings products, their rates, and how they compare to other options available in the market. Understanding these details empowers consumers to make informed decisions about where to store their money and maximize their financial growth.

Current Savings Account Options at Chase

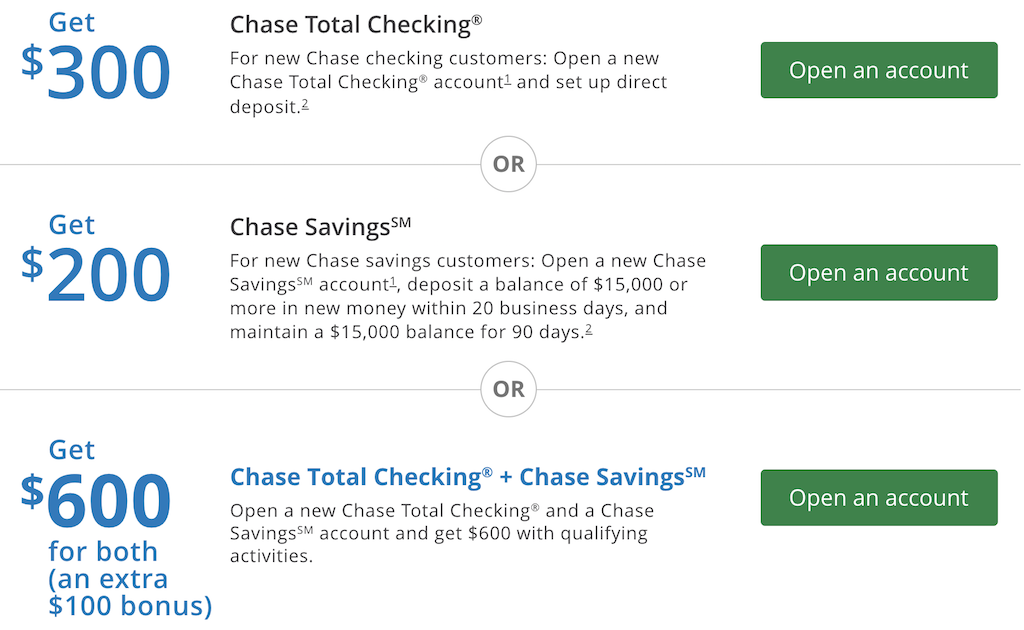

Currently, Chase Bank offers several savings account products. These include the Chase SavingsSM account and the Chase Premier SavingsSM account.

The Chase SavingsSM account is a basic savings option designed for everyday banking needs. Features may include mobile banking, online access, and overdraft protection when linked to a Chase checking account.

The Chase Premier SavingsSM account is geared towards customers who maintain higher balances and want to earn relationship interest rates. However, neither of these accounts, at their base rates, are typically considered "high-yield" when compared to other options on the market.

Interest Rates and APY

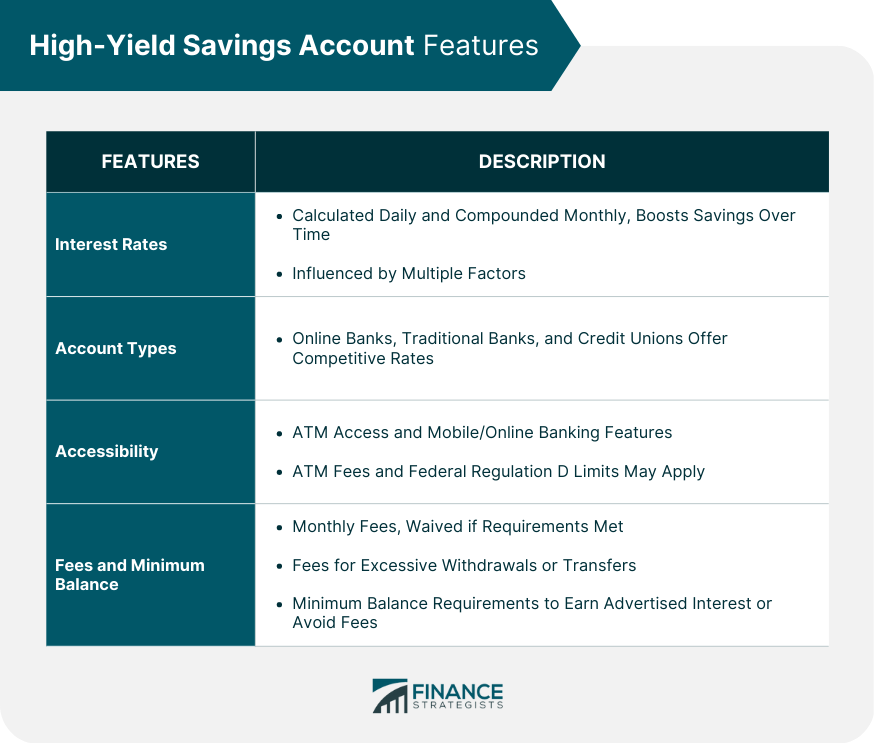

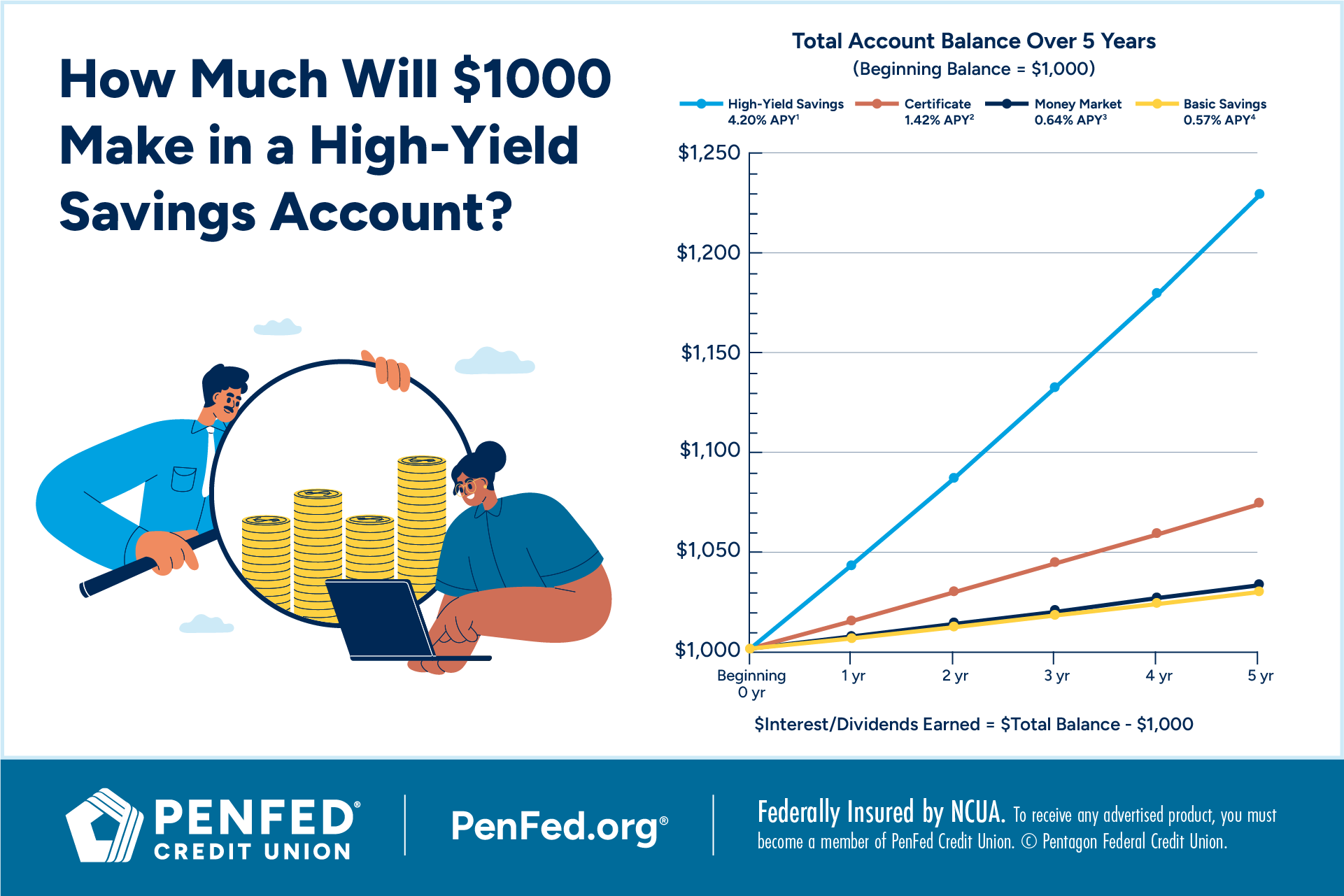

The Annual Percentage Yield (APY) offered on Chase savings accounts is typically lower than that offered by online banks and credit unions. As of late 2024, the standard APY on a Chase SavingsSM account is significantly below the national average for high-yield savings accounts, often requiring a substantial balance to qualify for even slightly increased rates.

The Chase Premier SavingsSM account may offer a slightly higher APY, especially for those who qualify for relationship rates by linking it to a Chase checking account and maintaining a high combined balance. However, this rate is still generally not competitive with the rates offered by many online banks.

Alternatives to Chase Savings Accounts

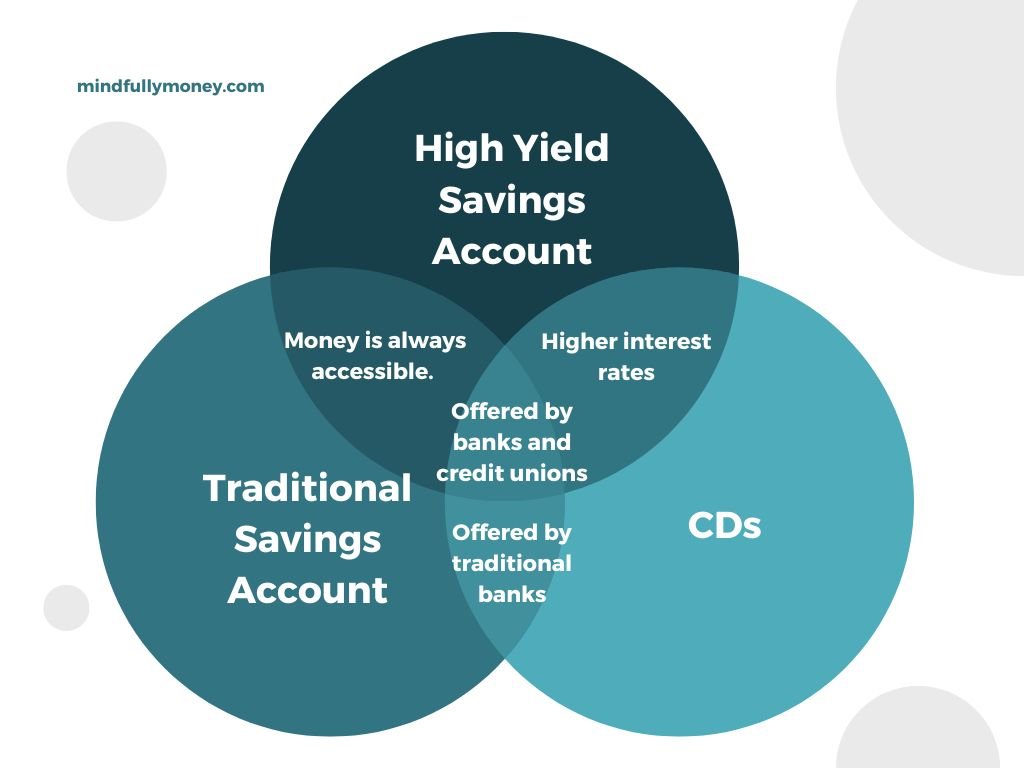

Consumers seeking higher returns on their savings may want to consider alternatives to traditional Chase savings accounts. Online banks frequently offer significantly higher APYs on their savings accounts due to lower overhead costs.

Credit unions can also be a viable option, often providing competitive rates and member benefits. These alternatives can provide a substantial increase in earnings on savings balances compared to standard Chase offerings.

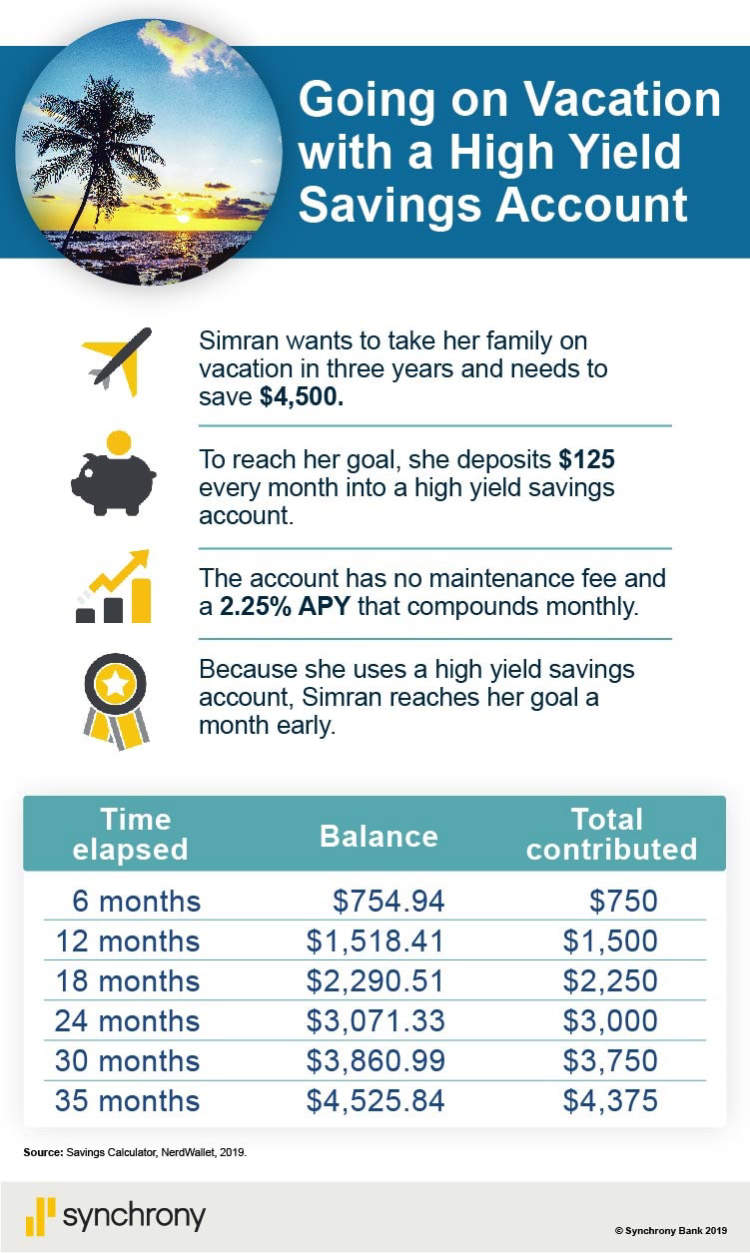

"It's crucial for consumers to shop around and compare interest rates before deciding where to deposit their savings," says Sarah Miller, a Certified Financial Planner. "Even a small difference in APY can add up significantly over time, especially on larger balances."

Impact on Consumers

The availability, or lack thereof, of a truly high-yield savings account at a major institution like Chase has a significant impact on consumers. It forces them to consider whether they are willing to sacrifice the convenience and familiarity of a large, established bank for potentially higher returns elsewhere.

Some customers may prefer the convenience of banking with Chase, even if it means earning less interest. They may value the branch network, established reputation, and integrated banking services. Other customers, however, may prioritize maximizing their savings returns and opt for a high-yield account at an online bank or credit union.

Ultimately, the decision depends on individual financial priorities and needs.

Conclusion

While Chase Bank offers savings account options, they are not generally considered high-yield compared to alternatives available from online banks and credit unions. Consumers should carefully weigh the convenience and features of Chase against the potential for higher returns elsewhere when making their savings decisions.

Prospective savers should always compare APYs, fees, and account features before choosing a savings account that aligns with their financial goals.