Does Dell Financing Affect Credit Score

In today's world, access to technology is almost essential, and Dell's financing options offer a seemingly straightforward path to acquiring laptops, desktops, and other electronics. However, the convenience of these financing plans often overshadows a critical question: Does Dell financing impact your credit score? The answer is nuanced, and understanding the potential implications is crucial for anyone considering this payment method.

This article delves into the intricacies of Dell financing and its effects on your creditworthiness. We'll explore how Dell's financing plans are structured, how they're reported to credit bureaus, and ultimately, how your actions can positively or negatively influence your credit score. Understanding these factors empowers consumers to make informed decisions when financing their technology purchases.

How Dell Financing Works

Dell offers various financing options, primarily through its partnership with WebBank. These options often include installment loans and revolving credit accounts, similar to store credit cards. The specific terms and conditions, including interest rates and credit limits, depend on your creditworthiness at the time of application.

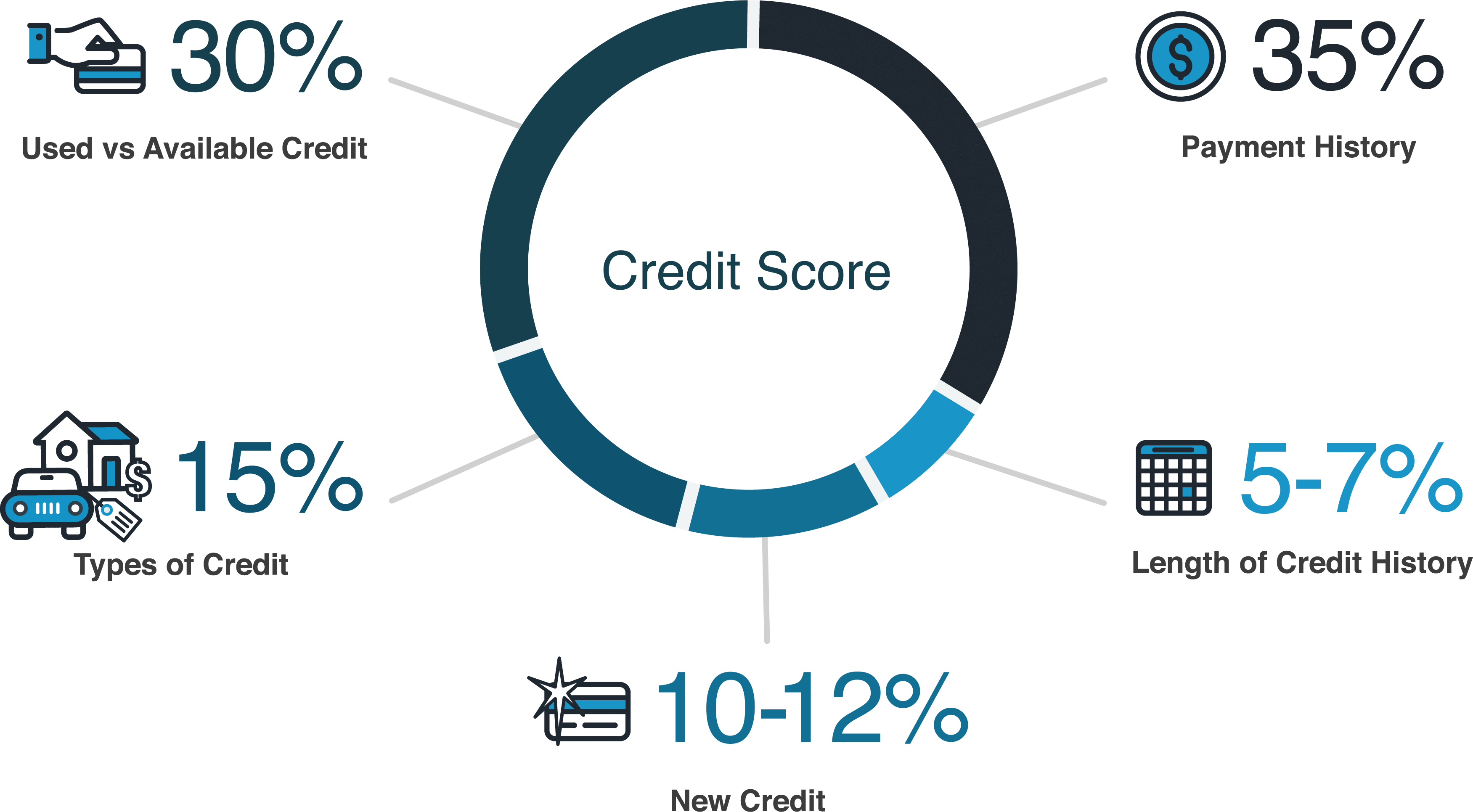

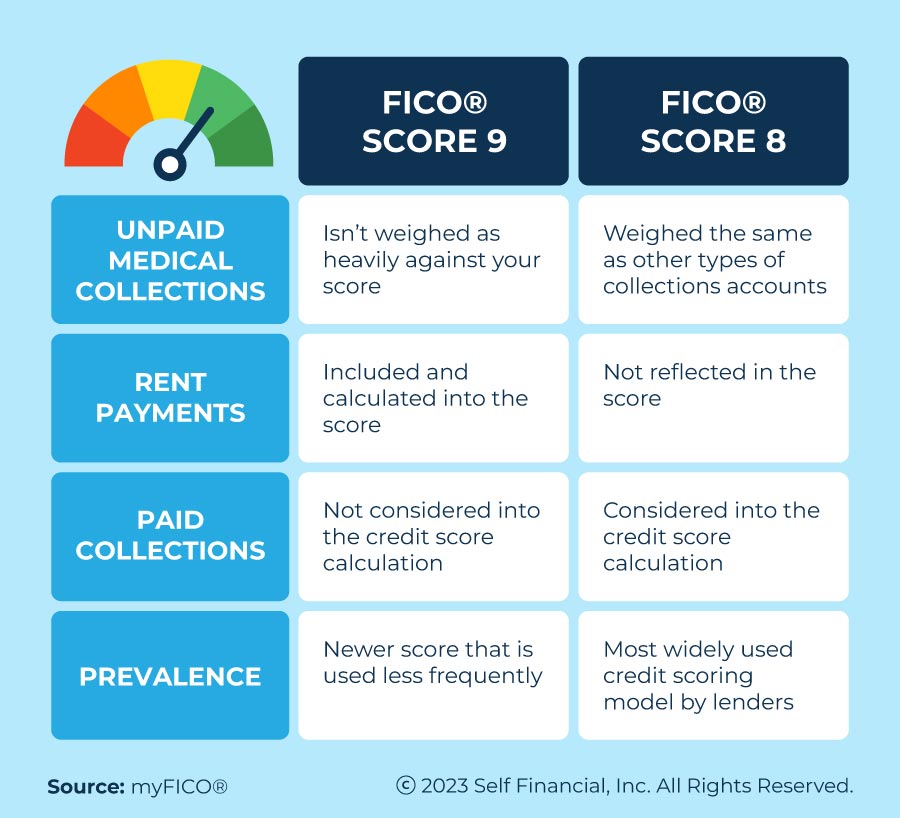

When you apply for Dell financing, WebBank will conduct a credit check. This initial inquiry, known as a hard inquiry, is a standard practice and can slightly lower your credit score. The extent of the impact usually depends on your overall credit history.

Reporting to Credit Bureaus

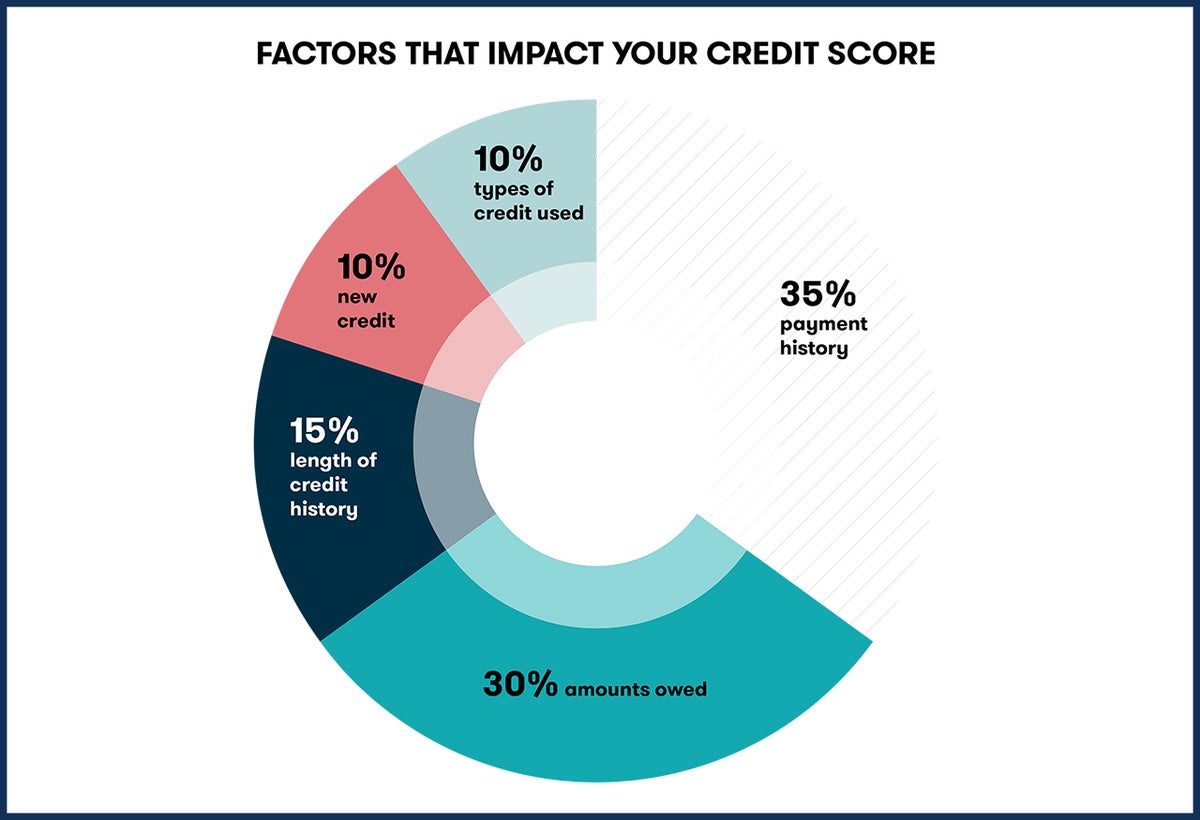

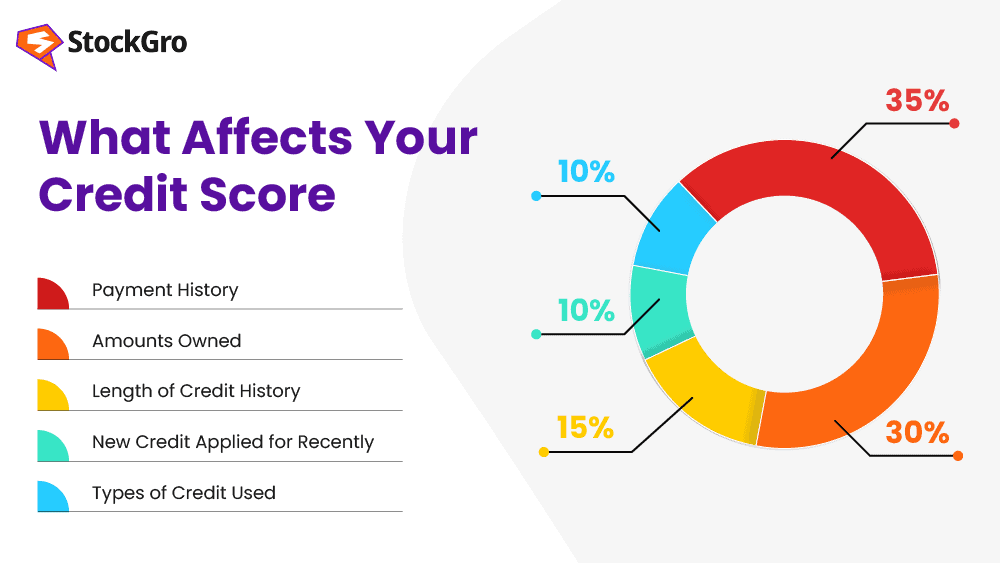

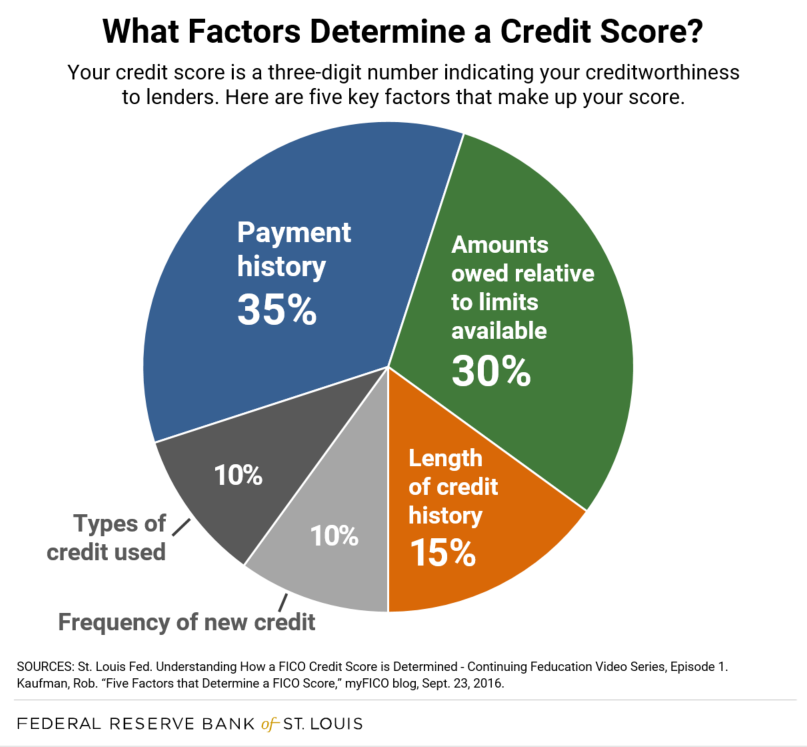

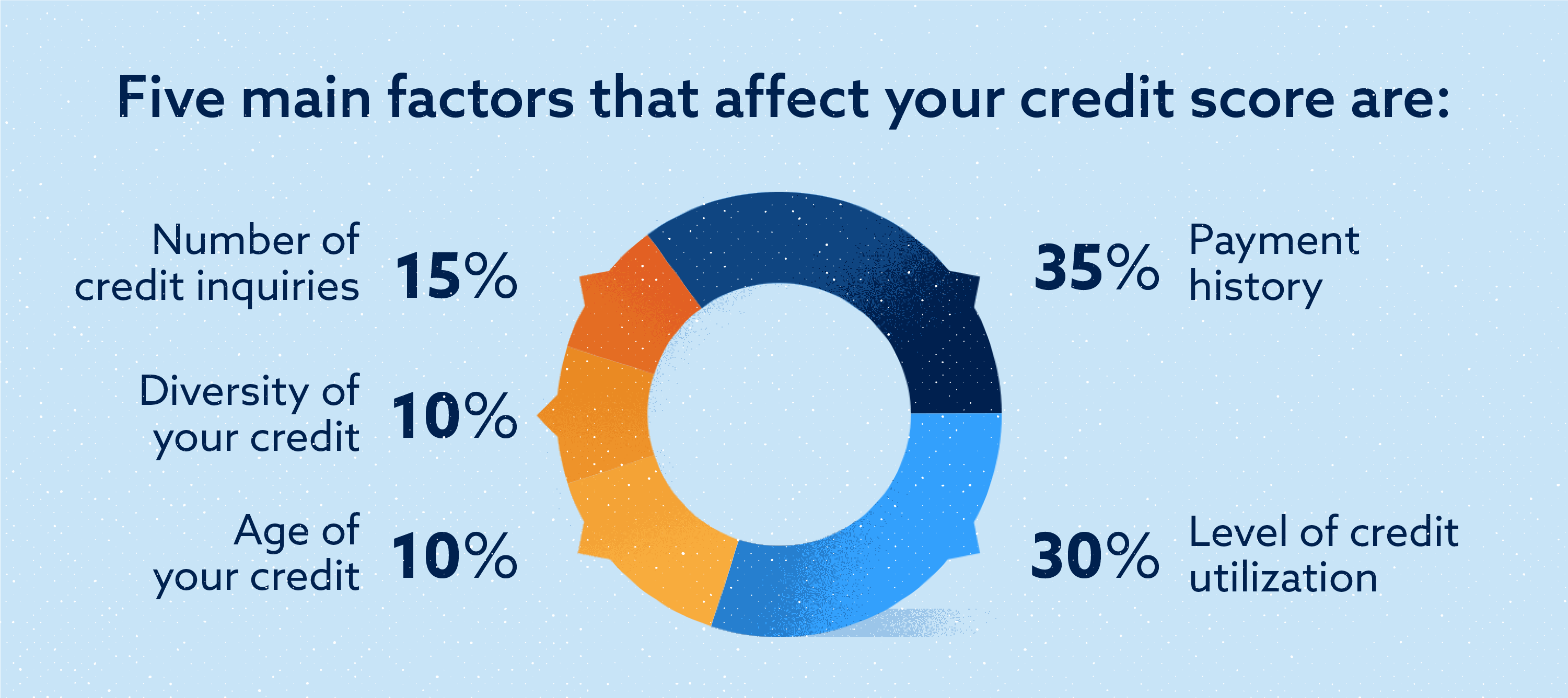

A key factor in understanding the credit impact is how Dell financing is reported to the major credit bureaus: Experian, Equifax, and TransUnion. Dell, through WebBank, typically reports your payment history, credit balance, and other relevant information to these bureaus.

This reporting is crucial because it directly influences your credit score. On-time payments contribute positively, while late or missed payments can significantly damage your creditworthiness.

Positive Impacts on Credit Score

When managed responsibly, Dell financing can actually improve your credit score. Consistent, on-time payments demonstrate your ability to manage credit effectively.

This positive payment history can boost your credit score over time. Responsible use of credit shows lenders you are a low-risk borrower, making you more likely to be approved for loans and credit cards in the future.

Negative Impacts on Credit Score

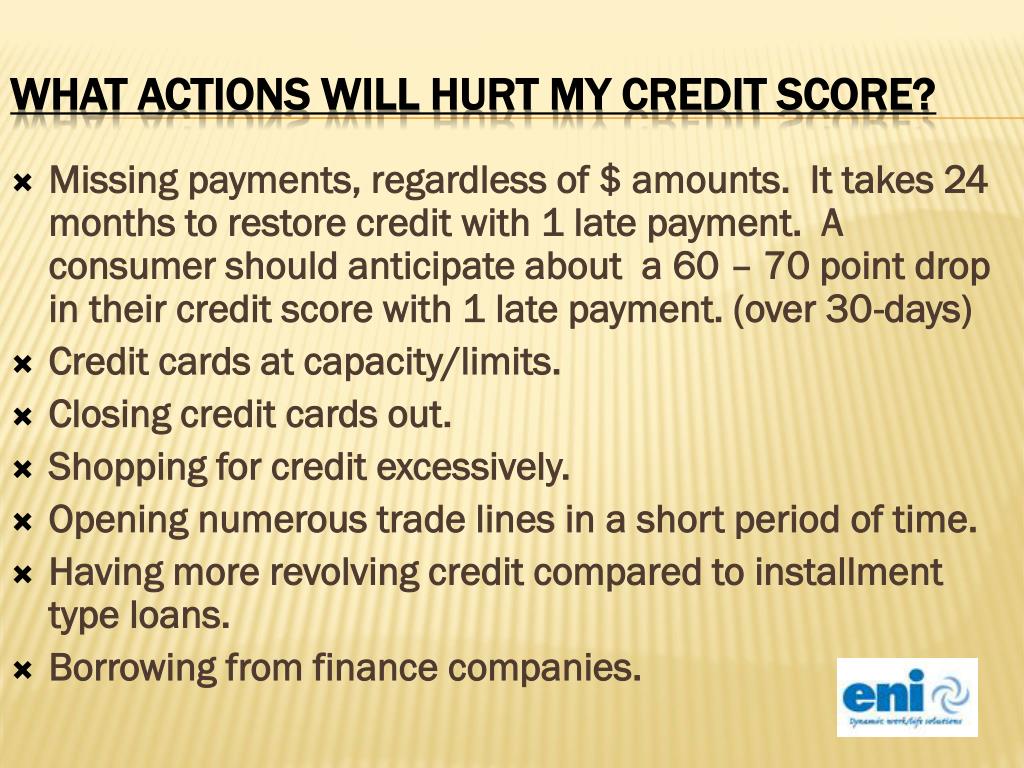

Conversely, irresponsible use of Dell financing can have detrimental effects on your credit score. Late payments, missed payments, and exceeding your credit limit are all red flags for lenders.

Delinquent payments can remain on your credit report for up to seven years, impacting your ability to obtain favorable interest rates or even qualify for credit. Moreover, a default on your Dell financing agreement can lead to collections and further damage your credit.

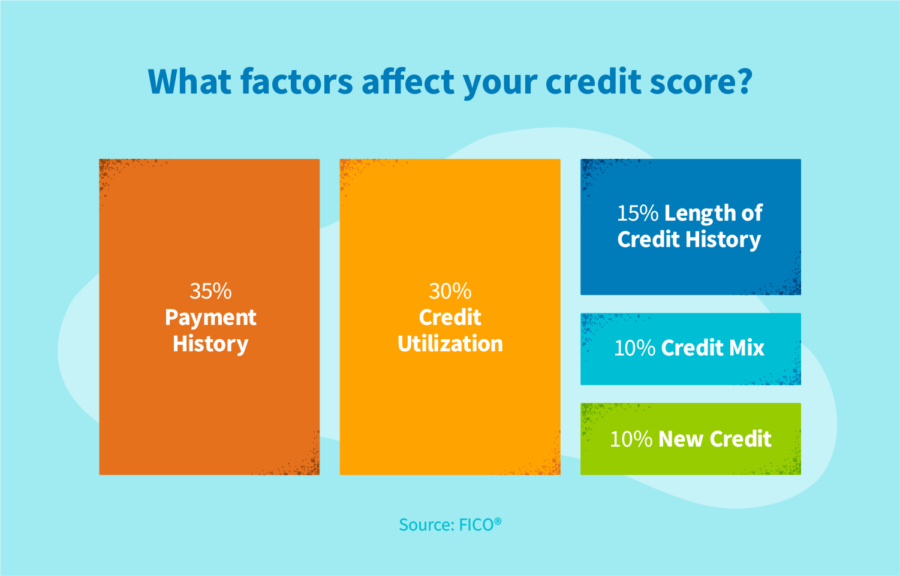

Factors Influencing the Impact

Several factors determine the extent to which Dell financing affects your credit score. Your existing credit history is a primary consideration. If you have a thin credit file or a history of missed payments, the impact of Dell financing, whether positive or negative, will be more pronounced.

The size of your Dell credit limit also matters. A high credit limit can potentially lower your credit utilization ratio, which is the amount of credit you're using compared to your available credit. However, if you consistently max out your credit limit, this can hurt your credit score.

Expert Opinions and Advice

Credit experts generally advise caution when using store-specific financing options. "While the allure of instant gratification is strong, it's essential to consider the long-term implications on your credit health," says John Ulzheimer, a credit expert. "Treat Dell financing like any other credit account and prioritize on-time payments."

Financial advisors often recommend exploring alternative financing options, such as personal loans or credit cards with lower interest rates. Before opting for Dell financing, compare the terms and conditions with other available options.

Conclusion: Making an Informed Decision

Dell financing can be a convenient way to acquire technology, but it's crucial to be aware of its potential impact on your credit score. Responsible management, including on-time payments and keeping your credit balance low, can help you build credit.

However, late payments or overspending can significantly damage your creditworthiness. By understanding the risks and rewards, you can make an informed decision about whether Dell financing is the right choice for your financial situation and avoid any unnecessary negative consequences to your credit score.

/creditscorepie-56a1de5c3df78cf7726f5801.png)