Does John Hancock Long-term Care Insurance Cover Assisted Living

Did you know that roughly 70% of people over 65 will require some form of long-term care services during their lives? This statistic alone highlights the critical importance of understanding long-term care insurance, especially when considering options like assisted living.

Navigating the complexities of long-term care insurance policies can be challenging, particularly when determining coverage for specific care settings. This article aims to clarify whether John Hancock long-term care insurance policies typically cover assisted living facilities.

The Importance of Understanding Long-Term Care Insurance

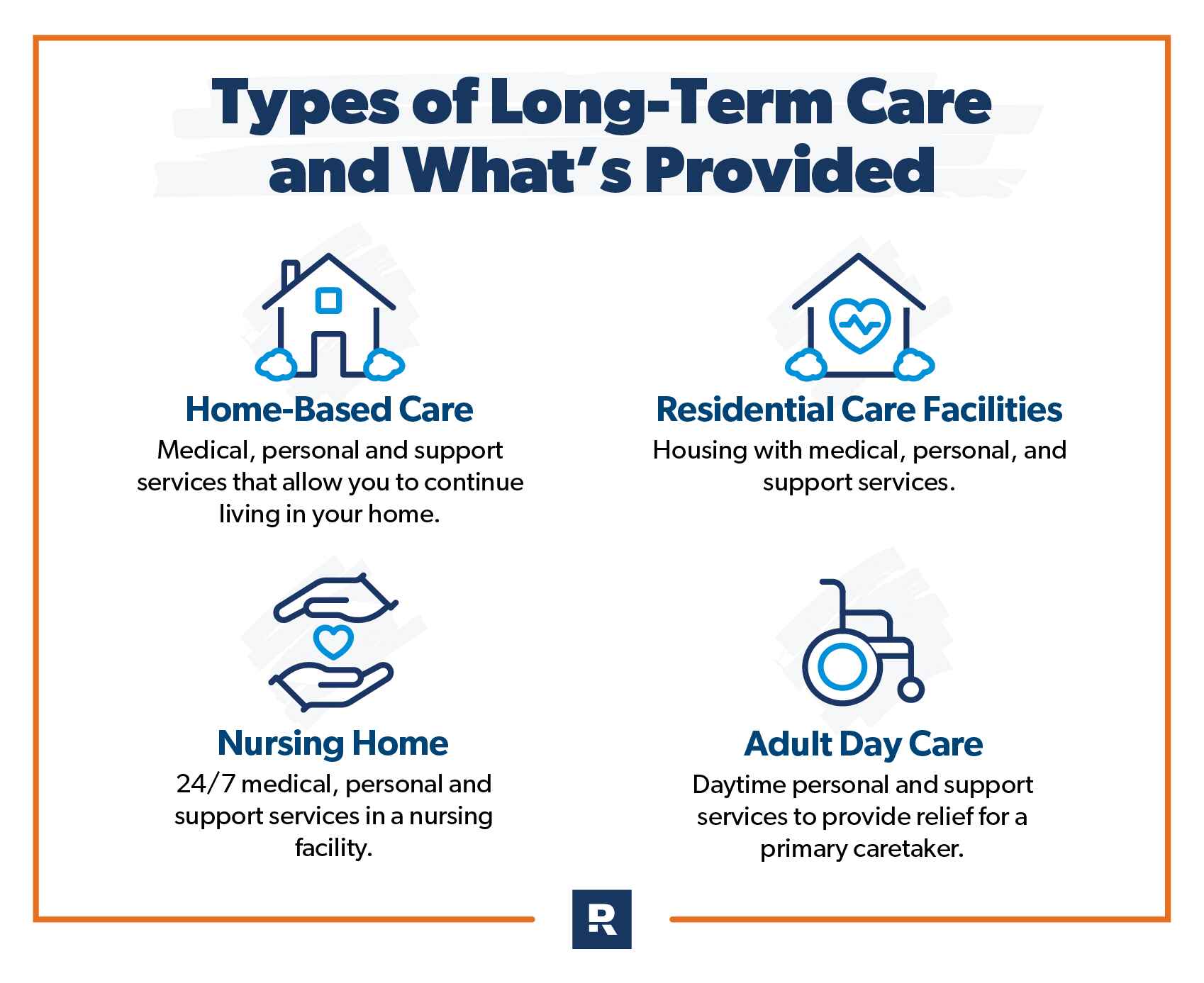

Long-term care insurance is designed to help cover the costs associated with services and support for individuals who can no longer perform everyday tasks independently due to illness, injury, or cognitive impairment. These services can be provided in various settings, including private homes, nursing homes, and, importantly, assisted living facilities.

The rising cost of healthcare and long-term care makes planning essential for individuals and families. Without adequate insurance coverage, the financial burden of long-term care can quickly deplete savings and assets. This impacts not only the individual needing care but also their family members who may need to contribute financially or provide direct care.

John Hancock Long-Term Care Insurance: An Overview

John Hancock is a well-known provider of long-term care insurance policies. However, the specific terms and conditions of these policies can vary significantly depending on the plan purchased. Therefore, it's crucial to understand the details of your individual policy or policies that you are considering.

Does John Hancock Cover Assisted Living?

Generally, John Hancock long-term care insurance policies do cover assisted living. However, coverage is contingent on several factors, primarily the policy's specific terms and the individual's eligibility.

Most policies require that the individual meet the policy's benefit triggers, which typically involve the inability to perform a certain number of Activities of Daily Living (ADLs). ADLs include bathing, dressing, eating, toileting, and transferring.

Some policies may also require a cognitive impairment diagnosis, such as Alzheimer's disease or dementia, to trigger benefits. The assisted living facility must also meet the policy's definition of an eligible care provider.

Key Policy Features Affecting Assisted Living Coverage

Several key policy features influence the extent of assisted living coverage under a John Hancock long-term care insurance policy.

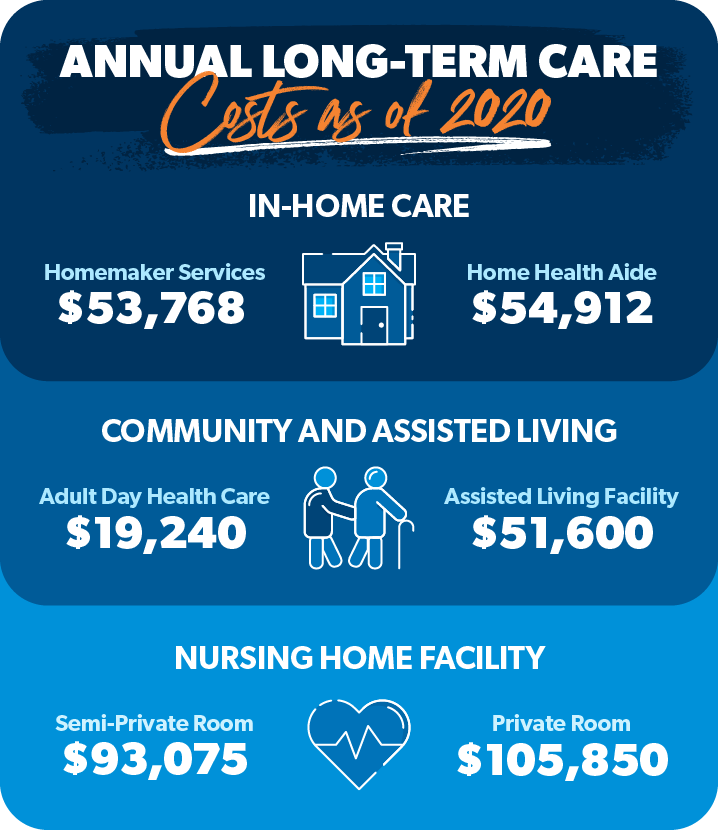

Daily or Monthly Benefit Amount: This is the maximum amount the policy will pay per day or month for covered services. It is crucial to ensure this amount aligns with the average cost of assisted living in your area. According to Genworth's Cost of Care Survey, the median cost of assisted living in 2023 was $4,774 per month. (Genworth, 2023)

Benefit Period: This refers to the length of time the policy will pay benefits. Common benefit periods range from two to five years, or even lifetime coverage. The longer the benefit period, the more comprehensive the coverage.

Elimination Period: Also known as the waiting period, this is the amount of time the policyholder must pay for care out-of-pocket before benefits begin. Elimination periods can range from 30 to 100 days.

Inflation Protection: This feature is critical, especially for policies purchased at a younger age. It helps the benefit amount keep pace with the rising cost of long-term care services over time. Without inflation protection, the policy may not provide adequate coverage in the future.

Steps to Verify Assisted Living Coverage

To determine whether a specific John Hancock long-term care insurance policy covers assisted living, take the following steps:

Review the Policy Documents: Carefully read the policy's terms and conditions to understand the coverage details, benefit triggers, and any exclusions.

Contact John Hancock: Reach out to John Hancock's customer service or claims department to confirm coverage for assisted living and clarify any questions about the policy.

Consult with a Financial Advisor: A financial advisor specializing in long-term care planning can help you understand your policy and assess whether it adequately meets your needs.

Business Implications

For business owners and managers, understanding long-term care insurance is not just a personal matter, it's a business consideration too. Offering long-term care insurance as part of an employee benefits package can attract and retain talent. It can demonstrate a commitment to employee well-being and financial security.

Furthermore, businesses should ensure they have contingency plans in place to address situations where key employees may require long-term care, either for themselves or to care for family members. The absence of a key employee due to caregiving responsibilities can disrupt operations and impact productivity.

Understanding the nuances of policies from providers like John Hancock is vital for informed decision-making about personal care and employee benefits. Proper planning provides peace of mind and protects finances in the face of rising healthcare costs.

In conclusion, while John Hancock long-term care insurance generally covers assisted living, coverage depends on the specific policy's terms and conditions. Diligent review of the policy, communication with the insurer, and consultation with a financial advisor are essential to ensure adequate coverage for long-term care needs.

Source: Genworth Cost of Care Survey 2023.

:max_bytes(150000):strip_icc()/dotdash-031005-Medicaid-vs-Long-Term-Care-Insurance-Final-96bd18c9639a483696cb6e2049e37650.jpg)