Does Sending Money To Ukraine Cause Inflation

Alarm bells are ringing across global economies as concerns mount: Is the massive influx of financial aid to Ukraine fueling global inflation? Experts are locked in debate over the extent to which aid packages are impacting rising consumer prices.

This article breaks down the complexities of this critical question, examining the data and expert opinions shaping the discourse. It clarifies the potential mechanisms through which financial support to Ukraine could be contributing to inflationary pressures.

The Scale of Financial Aid to Ukraine

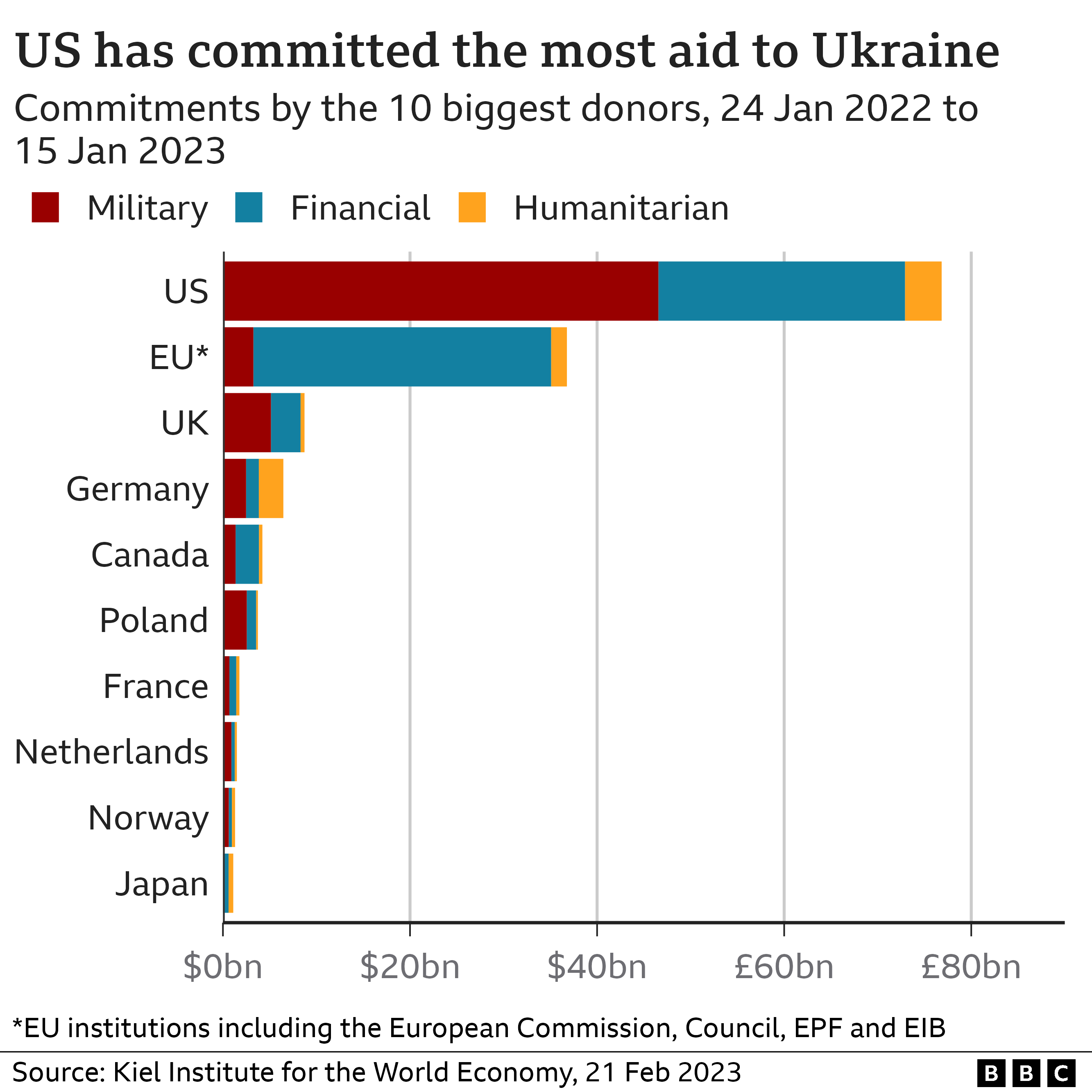

The sheer volume of financial assistance pledged to Ukraine since the onset of the conflict is staggering. According to the Ukraine Support Tracker by the Kiel Institute for the World Economy, commitments have surpassed hundreds of billions of dollars.

This aid comes from a variety of sources, including the United States, the European Union, and various international organizations like the International Monetary Fund (IMF) and the World Bank.

A substantial portion of this aid is designated for direct budgetary support. These funds help the Ukrainian government maintain essential services and continue its resistance.

Potential Inflationary Pathways

The debate centers on how this massive infusion of capital into the Ukrainian economy could impact global price levels. Economists point to several potential pathways.

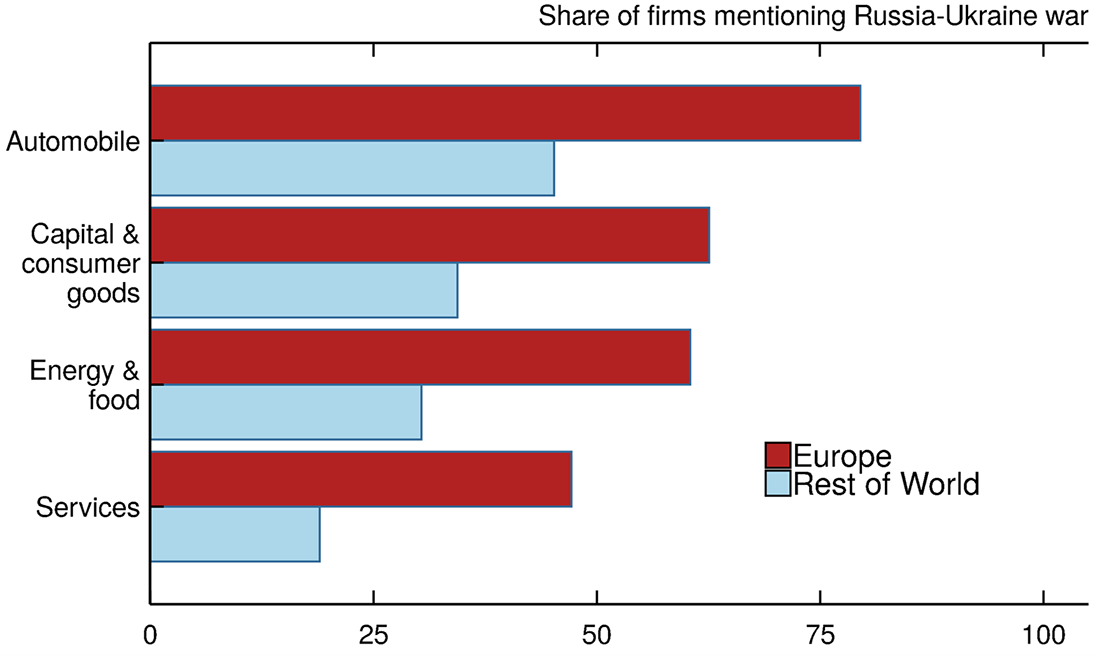

Firstly, increased demand for goods and services, financed by aid, can strain global supply chains. This is particularly true for commodities like energy, food, and raw materials.

Secondly, aid packages often involve governments increasing their borrowing, potentially leading to higher interest rates. This could translate to increased costs for businesses and consumers.

Thirdly, currency fluctuations play a role. Large aid transfers can impact exchange rates, making imports more expensive and contributing to domestic inflation in donor countries.

The Demand-Pull Argument

One prevalent theory is that aid creates increased demand without a corresponding increase in supply. As Ukraine receives financial assistance, its ability to purchase goods and services on the global market increases.

However, global supply chains are still recovering from disruptions caused by the COVID-19 pandemic and the war itself. This mismatch between demand and supply puts upward pressure on prices.

The Fiscal Policy Perspective

Another argument focuses on the fiscal policies adopted by donor countries to finance aid packages. Governments may resort to increased borrowing, potentially increasing national debt.

To combat inflation, central banks often respond by raising interest rates. This can dampen economic activity and increase borrowing costs for everyone.

Currency Exchange Rate Impacts

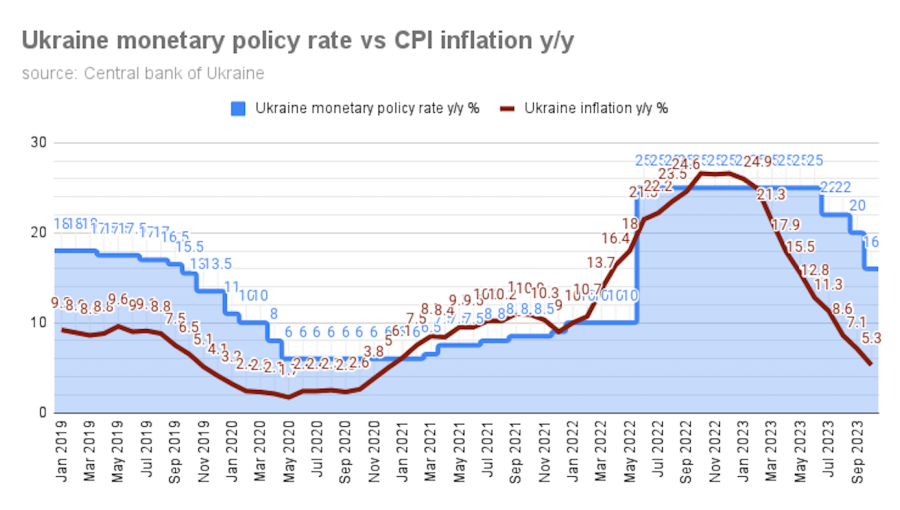

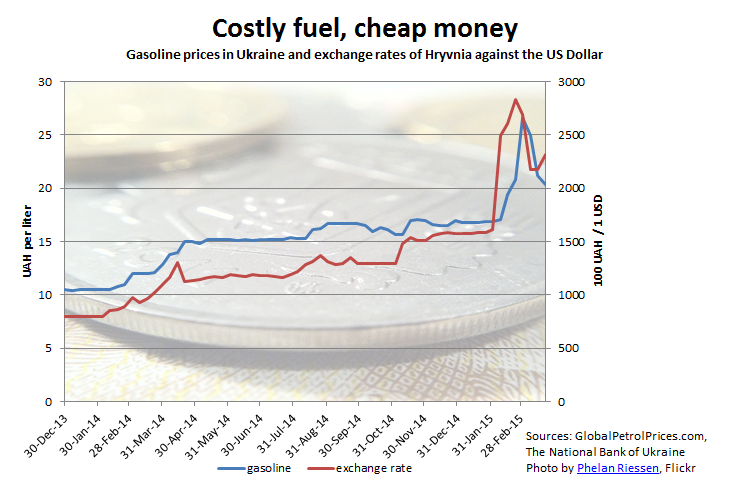

The influx of foreign currency into Ukraine can also impact exchange rates. A stronger Ukrainian Hryvnia could make Ukrainian exports more expensive and imports cheaper.

However, the actual impact on donor countries' exchange rates is complex and depends on various factors, including the overall state of the global economy and central bank policies.

Counterarguments and Mitigating Factors

It's important to note that the relationship between aid to Ukraine and global inflation is not straightforward. Several counterarguments and mitigating factors exist.

Some economists argue that the impact of aid to Ukraine on global inflation is relatively small compared to other factors. These include supply chain disruptions, energy price shocks, and pent-up consumer demand post-pandemic.

Furthermore, some aid is specifically targeted at alleviating supply chain bottlenecks or supporting agricultural production, which can help to counter inflationary pressures in the long run.

The European Central Bank (ECB) and the US Federal Reserve (FED) have been actively using monetary policies to combat inflation. These can mitigate some of the inflationary impacts from foreign aid.

Data and Expert Opinions

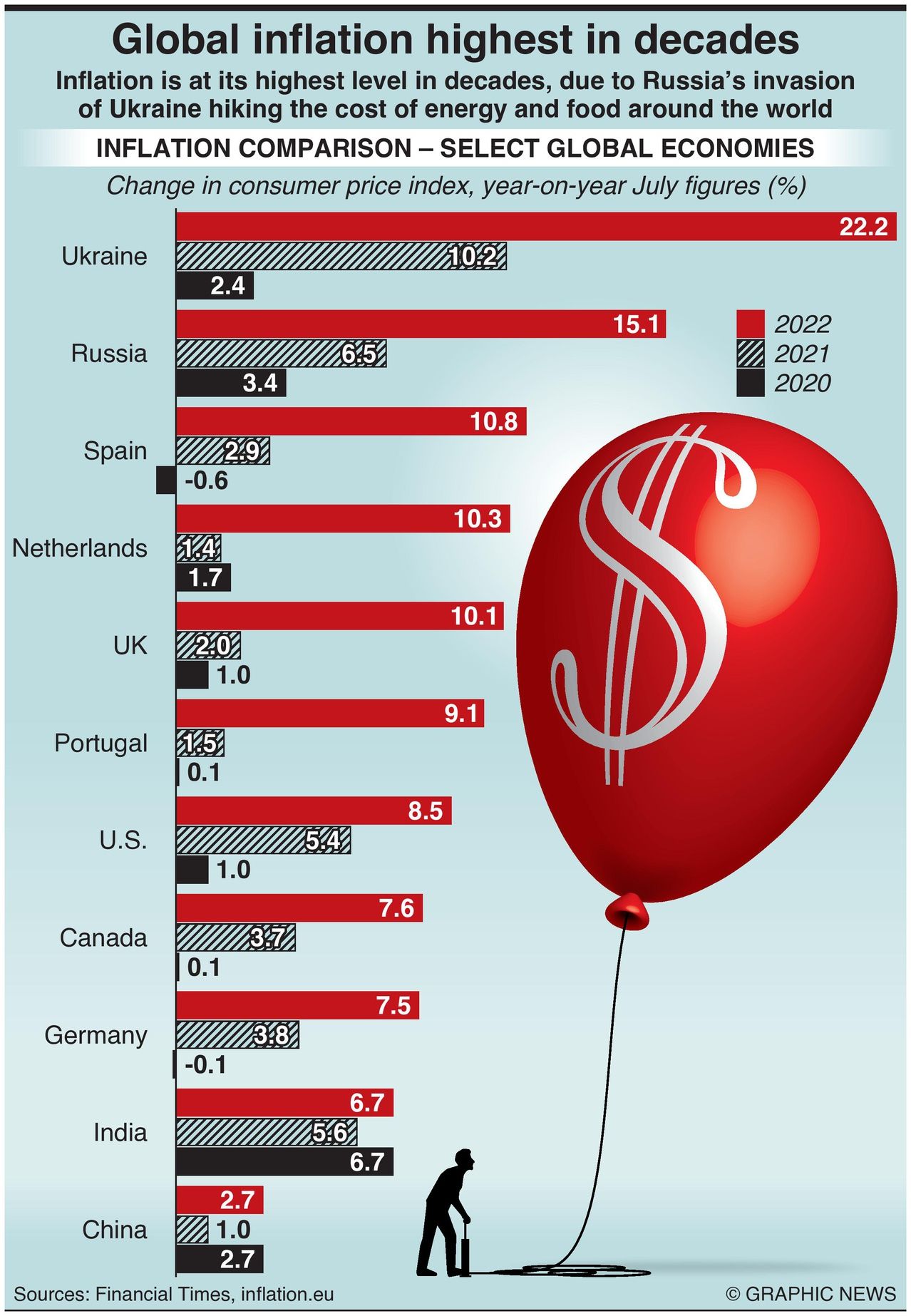

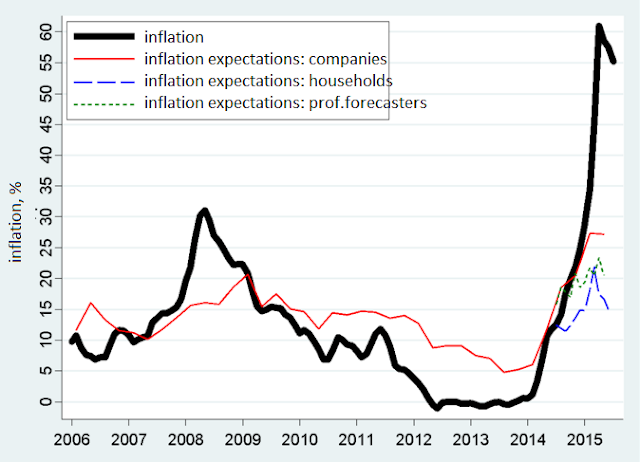

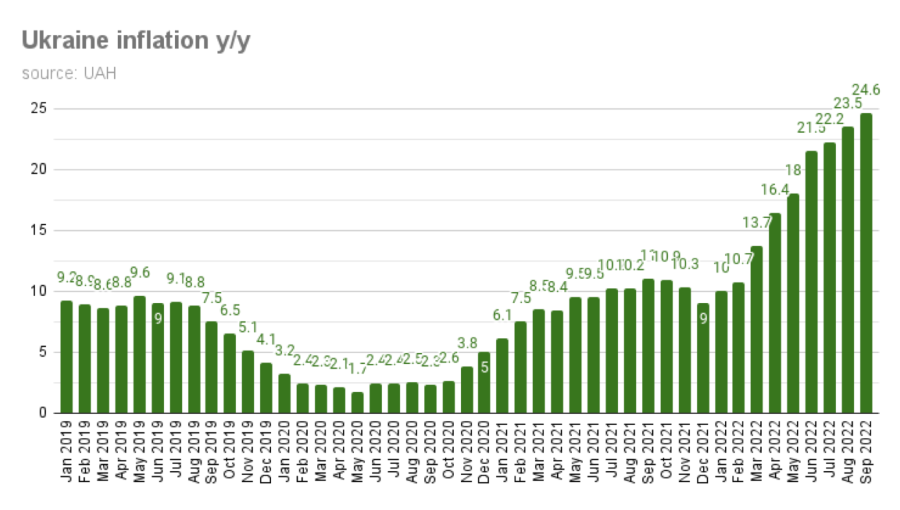

Economic data provides mixed signals. While inflation rates remain elevated in many countries, attributing this solely to aid to Ukraine is challenging.

Kristalina Georgieva, Managing Director of the IMF, has stated the war has been a major contributor to inflation. She pointed out that it has disrupted supply chains and increased commodity prices, particularly for energy and food.

Other economists argue that overly loose monetary policies implemented during the pandemic are primarily to blame for the surge in inflation. They view the war in Ukraine and its associated aid packages as an exacerbating factor, but not the root cause.

Conclusion: A Complex and Ongoing Situation

The question of whether sending money to Ukraine causes inflation is complex and still debated. While financial aid could potentially contribute to inflationary pressures through increased demand and supply chain disruptions, other factors are likely more significant drivers.

Ongoing monitoring of global economic data, careful fiscal policy decisions by donor countries, and targeted aid aimed at alleviating supply chain bottlenecks are crucial. These are vital for managing the potential inflationary consequences of supporting Ukraine.

Further research and analysis are needed to fully understand the interplay between aid to Ukraine and global inflation. This is an evolving situation that demands continuous assessment.