Does Sgli Continue After Retirement

URGENT: Many veterans are unaware that their Servicemembers' Group Life Insurance (SGLI) doesn't automatically continue after retirement or separation from service. This oversight can leave families vulnerable and without critical financial protection.

This article clarifies the crucial transition from SGLI to Veterans' Group Life Insurance (VGLI), highlighting eligibility requirements, application deadlines, and alternative coverage options to ensure continuous life insurance for former service members.

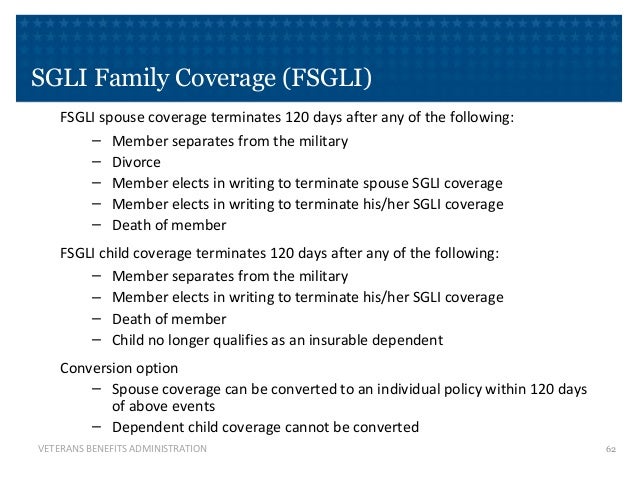

SGLI Termination: The Immediate Impact

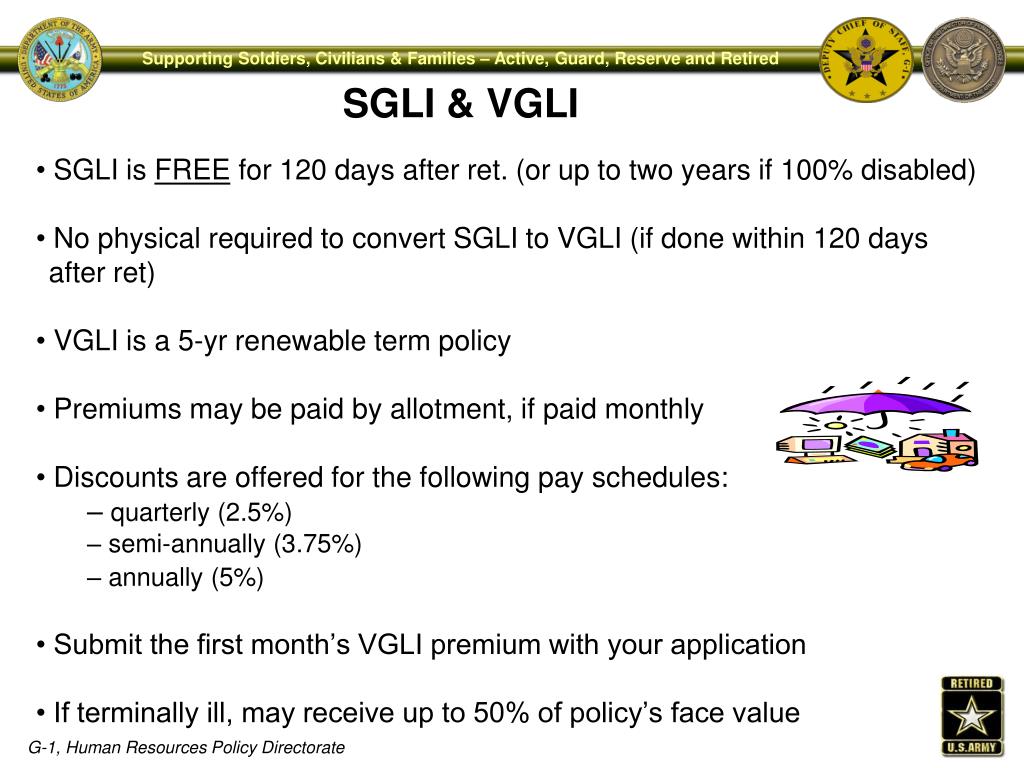

SGLI coverage ends 120 days after separation from active duty. Without action, veterans lose valuable life insurance benefits.

This deadline is critical, and missing it can have significant consequences for veterans and their families. The Department of Veterans Affairs (VA) provides information on this transition, but awareness remains low.

VGLI: The Post-Service Option

VGLI offers a chance to maintain life insurance after service. Eligibility extends to those who had SGLI coverage during their service.

You must apply for VGLI within one year and 120 days from separation to receive full coverage. Applying later results in limited coverage options.

Eligibility and Application Process

To be eligible for VGLI, you must have been covered by SGLI. The application process can be completed online through the VA website.

Ensure accurate completion of the form to avoid delays. Provide all necessary documentation related to your military service and existing SGLI coverage.

Coverage Amounts and Premiums

VGLI premiums are based on age and coverage amount. Coverage can be obtained up to a maximum amount, subject to change by the VA.

Veterans should review the premium structure and adjust coverage to fit their financial situation. Evaluate premium cost versus potential benefits.

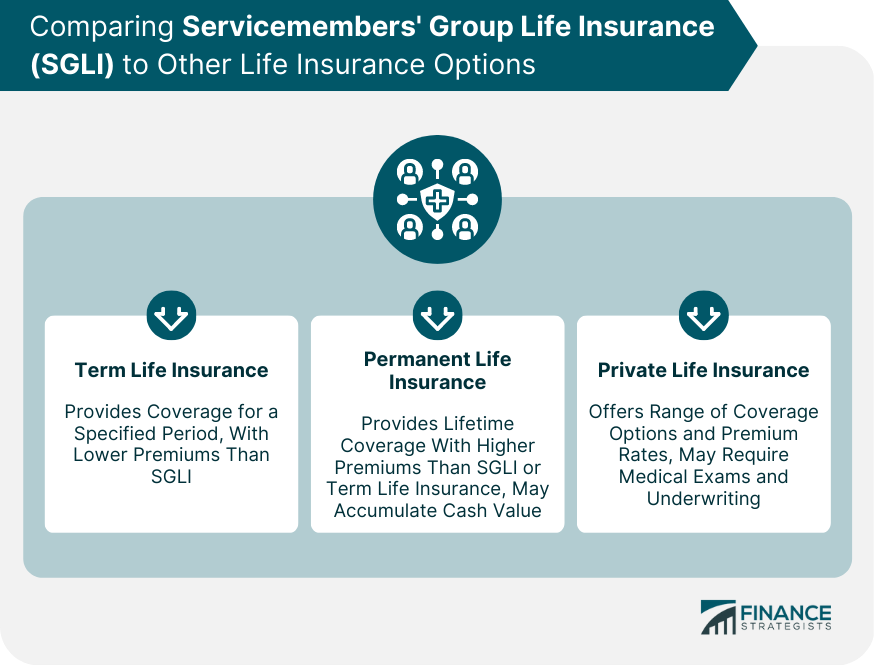

Alternative Life Insurance Options

Veterans have other life insurance options besides VGLI. Commercial life insurance providers offer policies tailored to individual needs.

Consider exploring term life, whole life, and universal life insurance. Consult a financial advisor to determine the best plan.

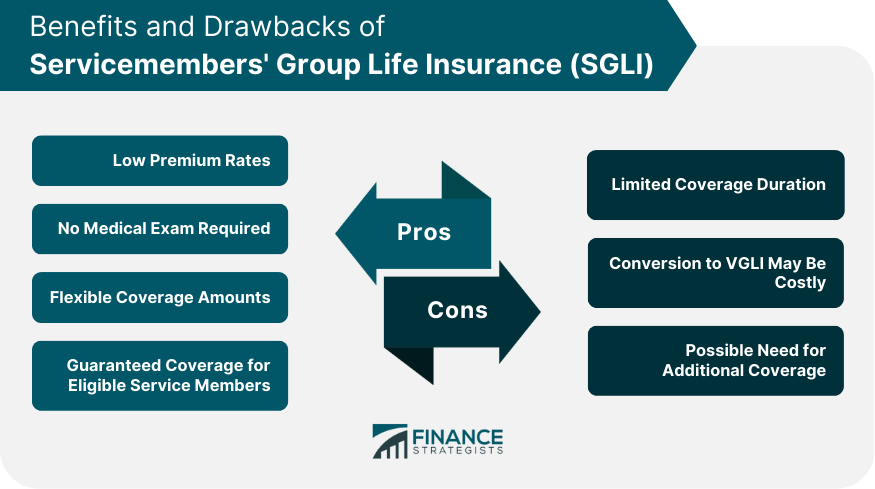

Comparing VGLI to Commercial Insurance

VGLI often provides a baseline of coverage. Commercial options may offer better rates or coverage features.

Compare the costs and benefits of each option carefully. Factor in health status, age, and financial goals.

Urgent Action Required

Time is of the essence for recently separated veterans. Review your SGLI status and explore VGLI enrollment immediately.

Don't delay in securing life insurance coverage. Contact the VA or a financial advisor for guidance.

Next Steps and Resources

Visit the VA website for detailed information on VGLI. Seek assistance from veteran service organizations.

Proactive planning ensures financial security for you and your family. Stay informed about your benefits.

Disclaimer: This information is for general guidance only and does not constitute financial or legal advice. Consult with qualified professionals for personalized recommendations.