Does Uprova Do A Hard Pull

The question of whether Uprova, an online lending platform, conducts a hard credit inquiry when users apply for a loan has become a significant concern for potential borrowers. A hard credit pull can temporarily lower an individual's credit score, making consumers cautious about initiating applications unless they are confident in their approval.

This article aims to clarify Uprova's credit check practices, analyzing available data and reports to provide potential borrowers with accurate information about the impact of applying for a loan through the platform.

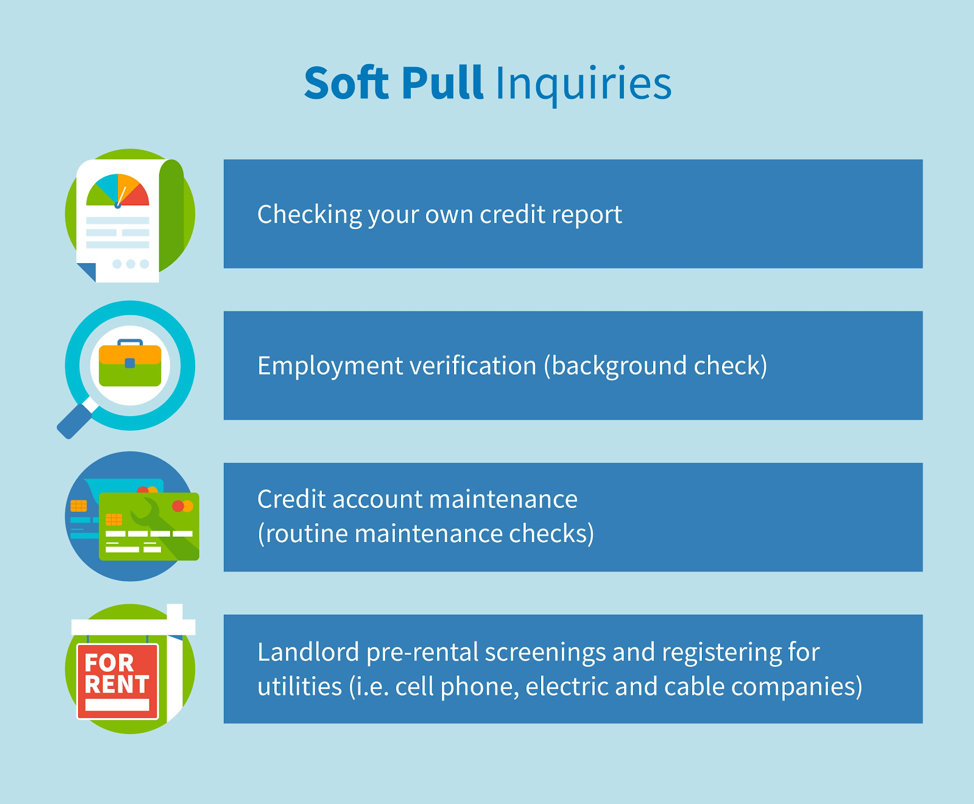

What is a Hard Credit Pull?

A hard credit pull, also known as a hard inquiry, occurs when a lender checks your credit report to make a lending decision. This type of inquiry is typically associated with applications for credit cards, mortgages, or auto loans.

Unlike soft inquiries, which don't affect your credit score, hard inquiries can slightly lower your score, especially if you have several within a short period of time.

Understanding Uprova's Loan Application Process

Uprova specializes in providing installment loans to borrowers, often marketing to individuals with less-than-perfect credit. The application process usually involves providing personal and financial information through their online platform.

It is during this application process that the question of a hard credit pull arises.

Official Statements and Disclosures

Navigating the official website of Uprova reveals important clues about their credit check practices. Their privacy policy and terms of service are primary sources of understanding their protocols.

Many online lending platforms explicitly state whether they perform a hard credit pull during the application process; however, Uprova's communication can be vague.

Customer Experiences and Reports

Beyond official statements, analyzing customer experiences is crucial. Many borrowers turn to online forums and review sites to share their experiences with different lenders.

These reports suggest that Uprova typically performs a hard credit pull during the loan application process. Numerous users have reported a noticeable dip in their credit score shortly after applying.

Alternative Lending Models and Credit Checks

Some online lenders offer pre-qualification processes that involve only a soft credit pull. This allows potential borrowers to see their approval odds and potential loan terms without impacting their credit score.

Uprova, however, doesn't advertise a clear pre-qualification process that guarantees a soft inquiry. This lack of transparency could lead to uncertainty for applicants concerned about credit score impacts.

The Impact on Borrowers

For borrowers with thin credit files or those actively trying to improve their credit scores, a hard inquiry can be a significant deterrent. Multiple inquiries within a short time can compound the negative effects.

Therefore, understanding Uprova's credit check policy is essential for making informed financial decisions.

Borrowers should be aware of the potential impact before applying for a loan.

Best Practices for Applying for Loans

Before applying for any loan, it's advisable to check your credit report for errors. Addressing inaccuracies can improve your credit score and increase your chances of approval.

Consider exploring lenders that offer pre-qualification options with a soft credit pull to compare potential loan terms without impacting your credit score.

Conclusion

Based on user reports and indirect evidence from Uprova's disclosures, it's highly probable that Uprova does conduct a hard credit pull when an individual formally applies for a loan.

Potential borrowers should proceed with caution, being mindful of the possible impact on their credit scores.

It is always recommended to directly contact Uprova's customer service for confirmation regarding their current credit check practices, as policies can change over time.