Doing What You Love Vs Making Money

Tension mounts as graduates face a pivotal decision: pursuing passions or chasing financial security in today's volatile job market.

The age-old dilemma of choosing between "doing what you love" and "making money" intensifies for young professionals, impacting career trajectories and overall life satisfaction, according to recent surveys and economic analyses.

The Data Speaks: A Generation Divided

A new study by Indeed reveals that 68% of recent graduates prioritize job security and salary over personal fulfillment. This marks a significant shift from pre-pandemic attitudes.

The driving force? Soaring inflation and looming recession fears are influencing career choices, pushing many toward more stable and lucrative fields like tech, finance, and healthcare.

Conversely, a Gallup poll indicates that individuals who feel passionate about their work are five times more likely to be productive.

The Appeal of Passion

The allure of pursuing a career aligned with one's passions remains strong. Many argue that intrinsic motivation and job satisfaction lead to higher performance and long-term success, even if initial earnings are lower.

Consider *Emily Carter*, a recent art school graduate who opted to freelance, despite the uncertain income. "I knew I would be miserable in a corporate job," she stated, "and I believe my dedication to my art will eventually pay off."

The Pragmatic Path

However, the reality of student loan debt and rising living expenses pushes others towards a more pragmatic approach. Securing a high-paying job becomes a necessity, even if it means sacrificing personal interests.

According to the National Association of Colleges and Employers (NACE), the average starting salary for computer science graduates is significantly higher than that of humanities or arts graduates. *Mark Johnson*, a finance major, explained, "I have a responsibility to myself and my family to be financially stable, and the finance industry offers that."

Expert Opinions & Practical Strategies

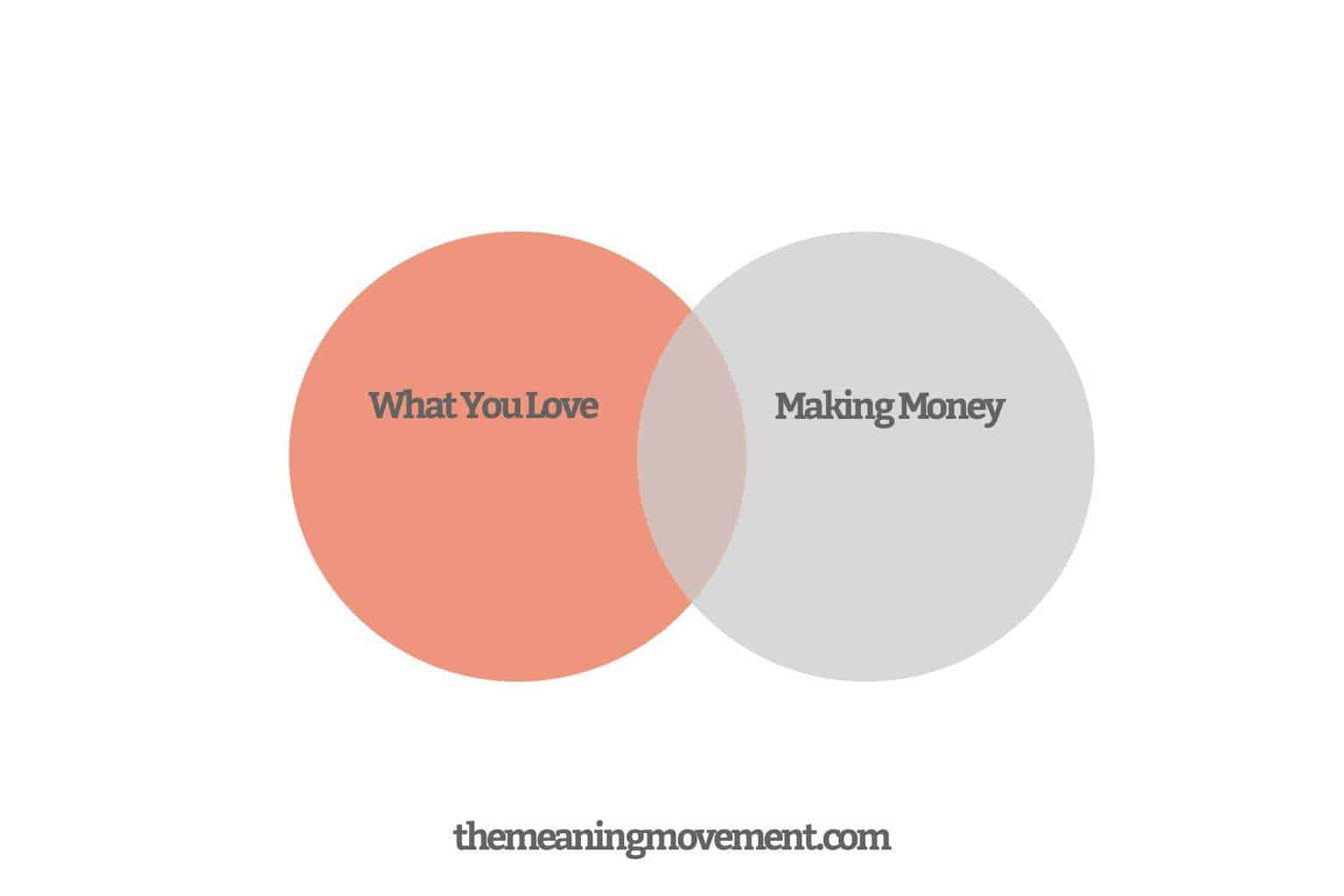

Career counselors emphasize the importance of finding a balance between passion and practicality. "It's not an either/or situation," says Dr. Sarah Lee, a career advisor. "Explore how your passions can intersect with marketable skills."

Many suggest upskilling and networking as strategies to bridge the gap between personal interests and career opportunities. Online courses and industry events can provide valuable skills and connections.

Furthermore, some companies are recognizing the importance of employee engagement and offering opportunities for personal and professional growth. Seeking employers who prioritize both financial compensation and employee wellbeing is essential.

Navigating the Trade-Off

The decision of whether to prioritize passion or income is deeply personal and dependent on individual circumstances.

Understanding one's financial obligations, risk tolerance, and long-term career goals is crucial. Thorough research, self-reflection, and seeking guidance from mentors and professionals can aid in making an informed decision.

"Ultimately," Dr. Lee concludes, "the most important thing is to choose a path that aligns with your values and provides a sense of purpose and fulfillment."

What's Next?

Ongoing studies are tracking the long-term impact of these choices on career satisfaction and financial well-being. Resources and workshops will continue to be offered at universities and career centers nationwide to support students in making informed decisions.

The debate between passion and practicality will likely continue, but by understanding the current job market and prioritizing self-awareness, graduates can navigate this complex landscape and build successful and fulfilling careers.