Drawbacks Of Money Market Accounts Include:

Money market accounts, often touted as safe havens for cash, offer a blend of security and modest returns. However, beneath the surface of seemingly risk-free growth lie potential drawbacks that savers should carefully consider before entrusting their funds.

This article delves into the often-overlooked downsides of money market accounts, examining their limitations in terms of returns, accessibility, and potential impact on long-term financial goals.

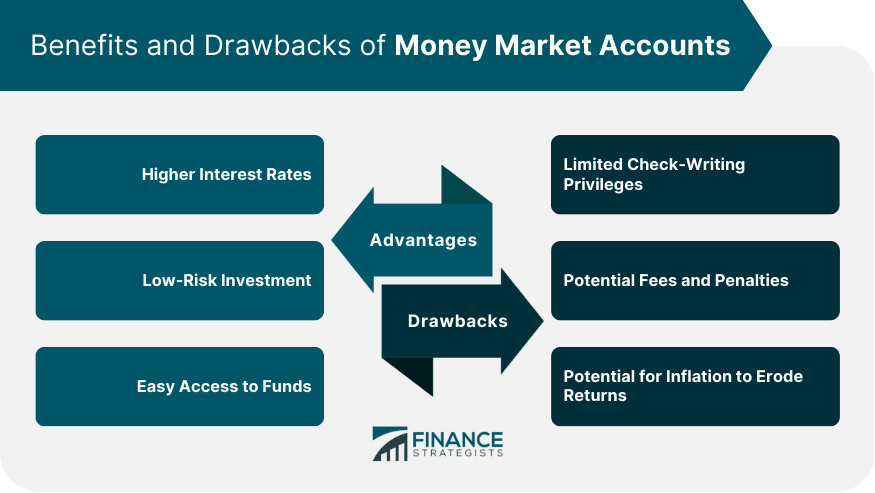

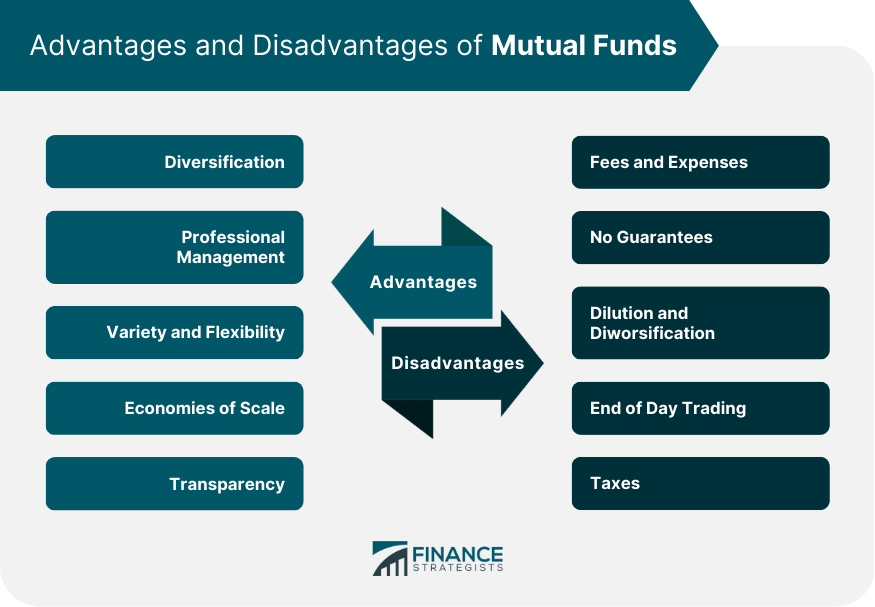

Lower Yields Compared to Riskier Investments

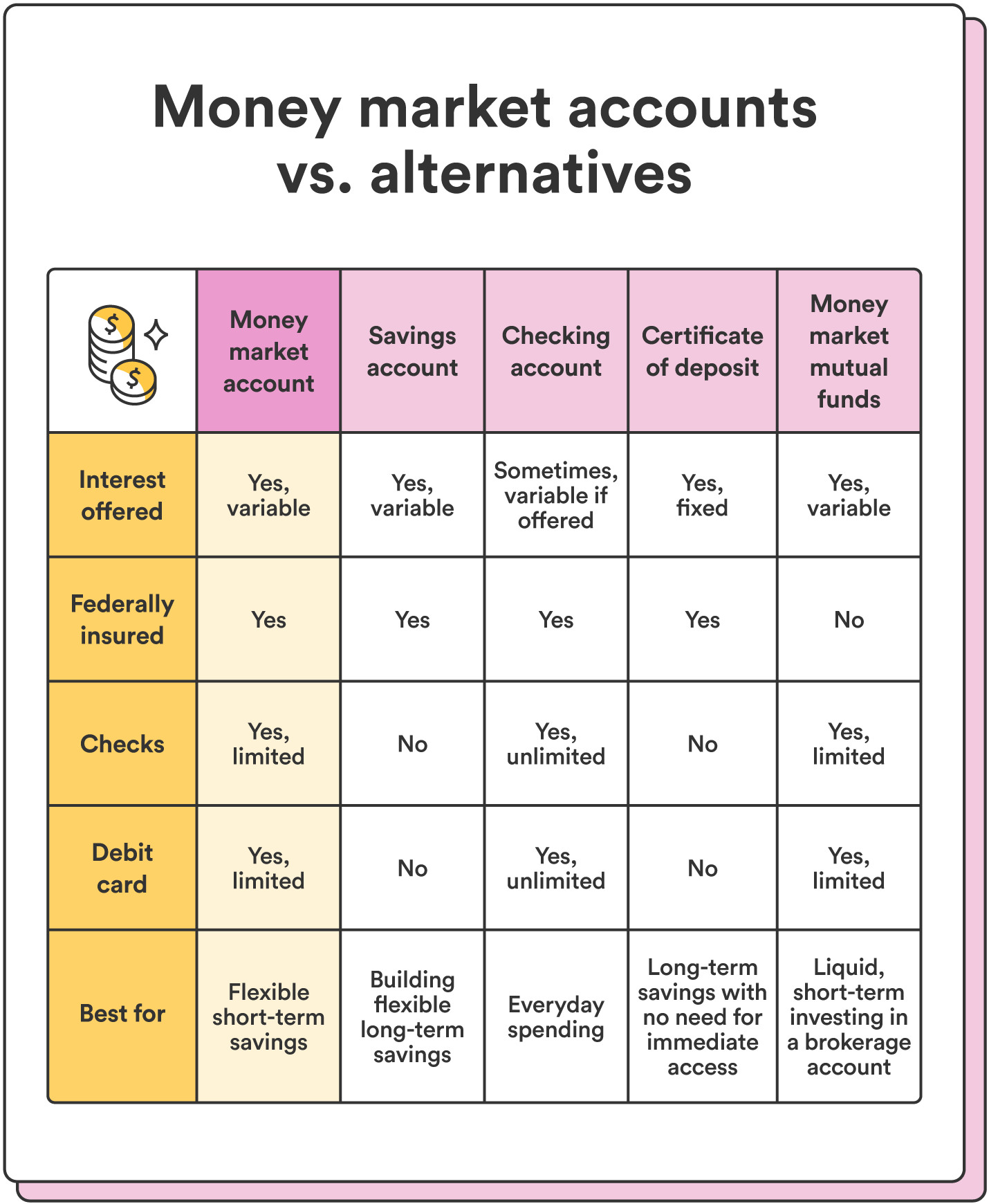

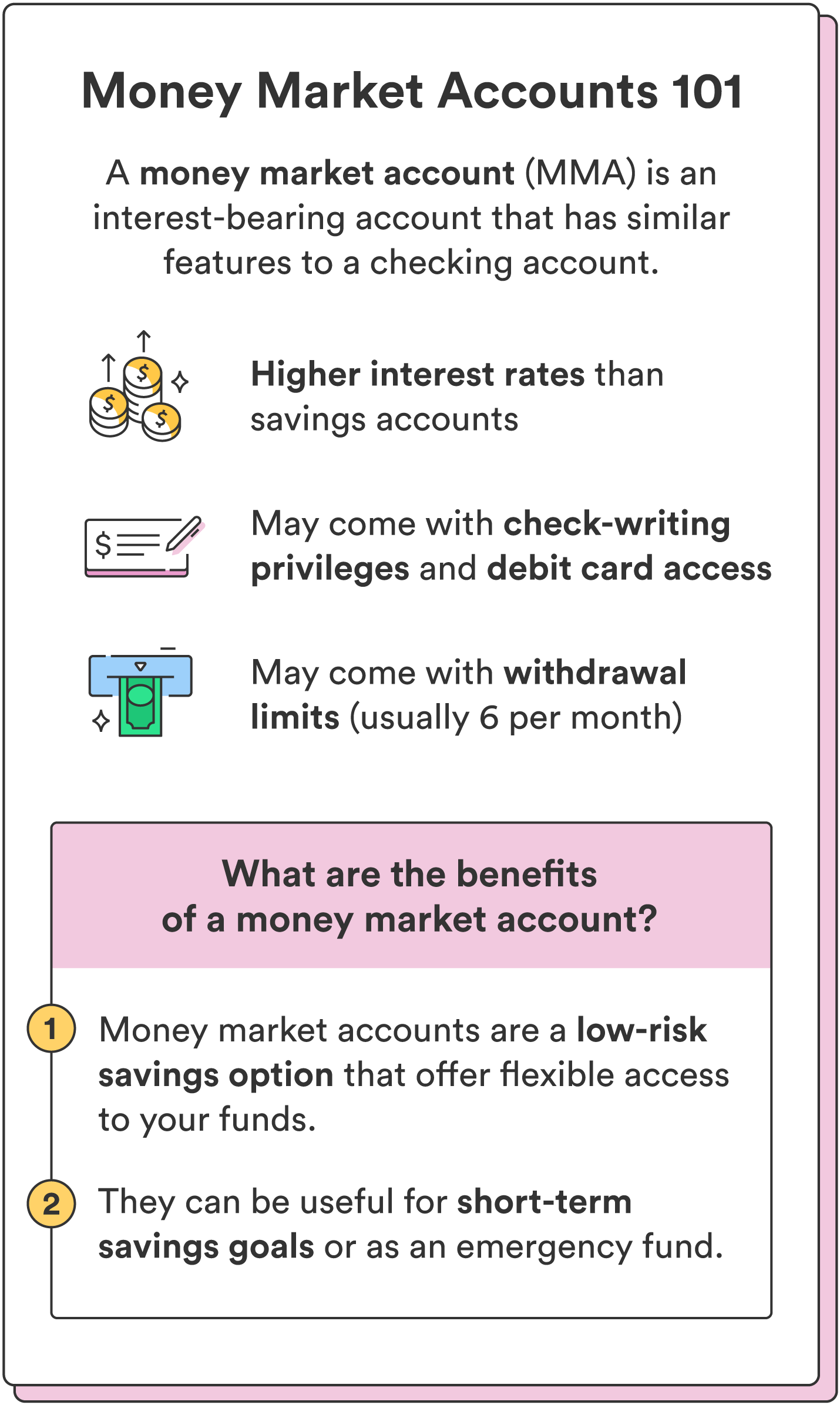

One of the primary drawbacks of money market accounts is their relatively low yield. While they offer a more attractive interest rate than traditional savings accounts, they typically lag behind other investment options, such as stocks or bonds, which inherently carry more risk.

According to recent data from the Federal Reserve, the average yield on money market accounts hovers around a modest percentage, often struggling to outpace inflation. This means that, in real terms, the purchasing power of the money held in these accounts may be eroding over time.

Dr. Anya Sharma, a financial advisor at Bright Future Investments, explains: "Money market accounts are designed for capital preservation, not substantial growth. If your primary goal is to generate significant returns, you'll likely need to explore riskier, but potentially more rewarding, avenues."

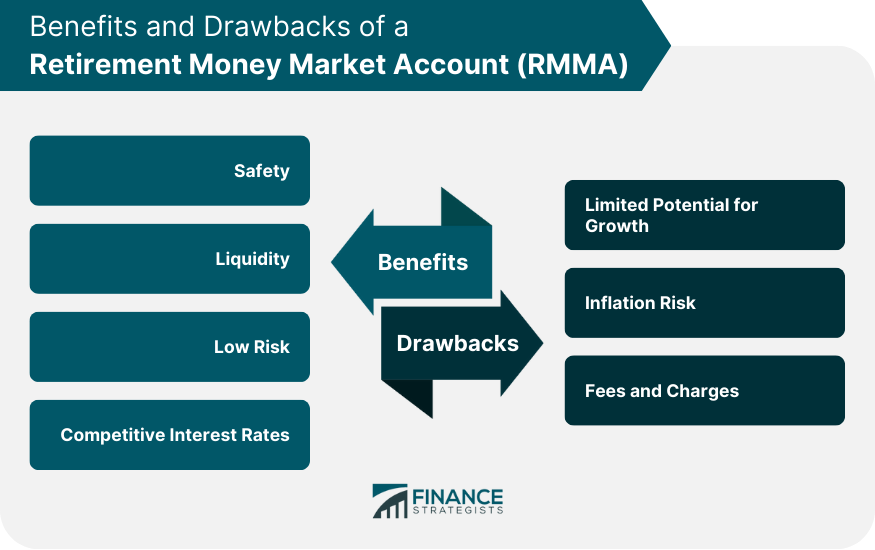

Limited Growth Potential

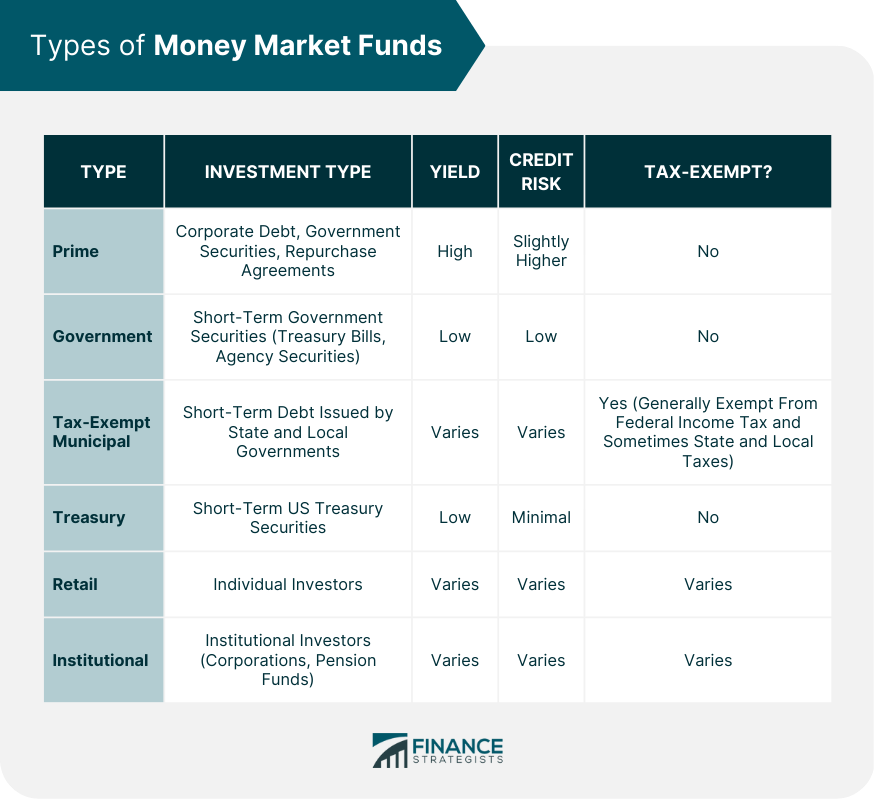

The conservative nature of money market accounts restricts their growth potential. The investments held within these accounts are typically limited to highly liquid, short-term debt instruments, such as Treasury bills and commercial paper.

This limits the potential for capital appreciation, meaning that the value of the underlying assets is unlikely to increase significantly. Unlike stocks, which can experience substantial price swings, money market accounts offer little opportunity for outsized gains.

Impact on Long-Term Financial Goals

For individuals saving for long-term goals, such as retirement or a down payment on a house, relying solely on money market accounts may be insufficient. The slow growth offered by these accounts may not keep pace with the rising costs of living or the increasing value of assets.

Maria Rodriguez, a certified financial planner, cautions: "While money market accounts have their place, they should not be the cornerstone of a long-term investment strategy. A diversified portfolio that includes a mix of asset classes is generally more effective in achieving ambitious financial goals."

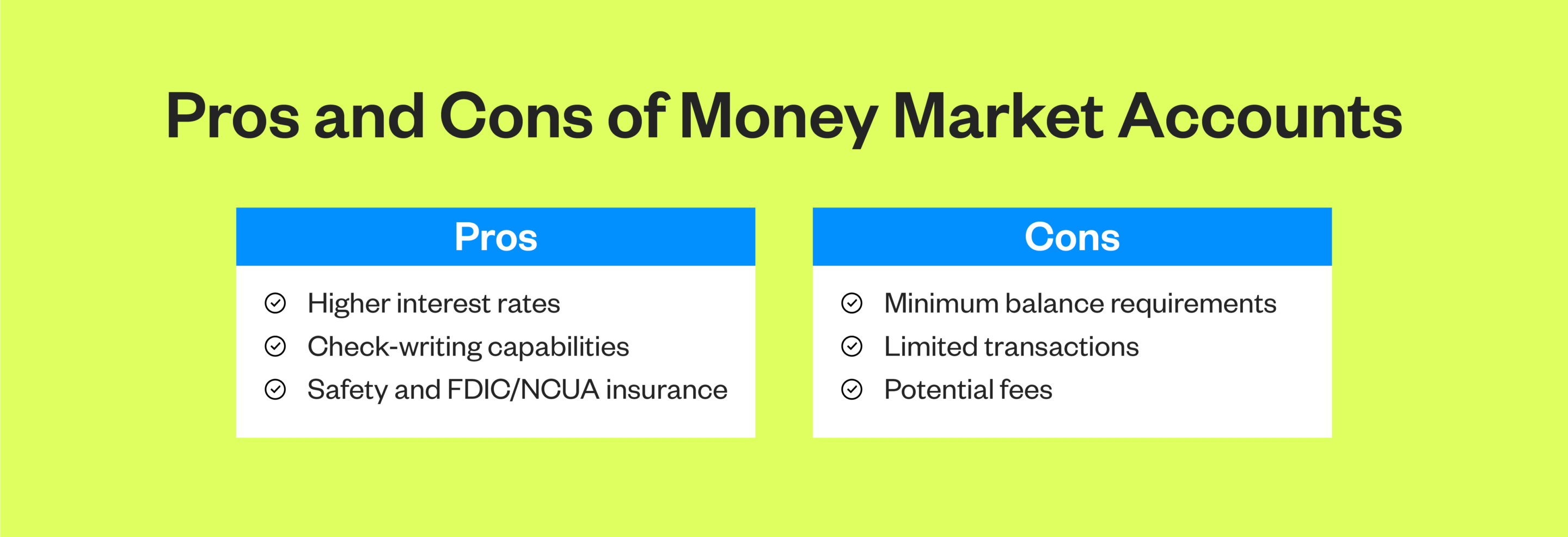

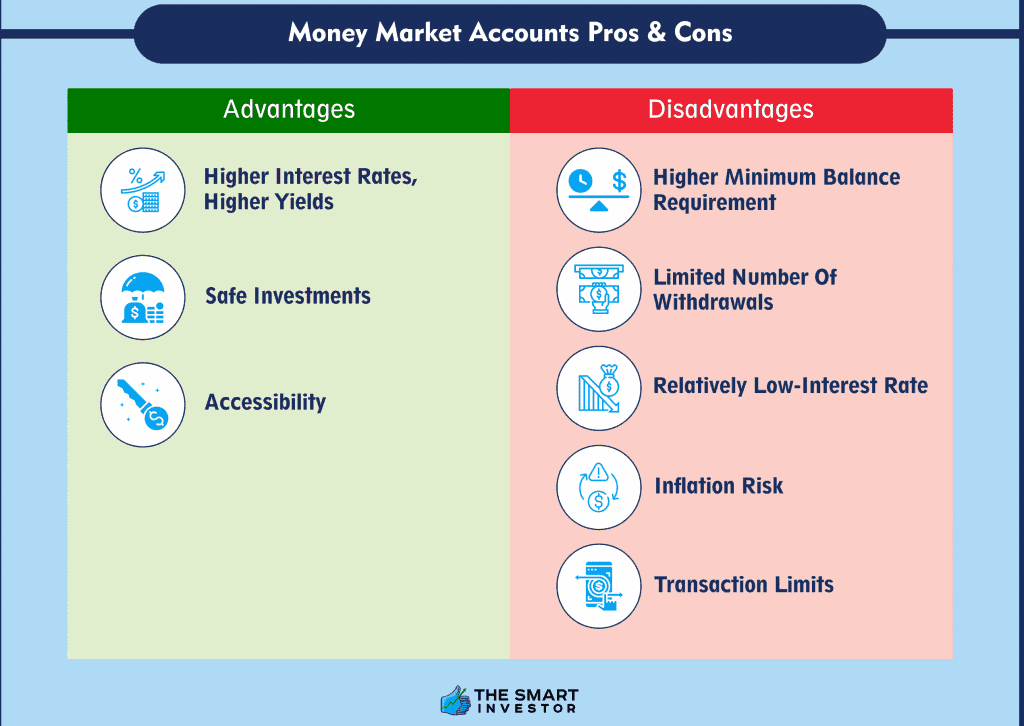

Fees and Minimum Balance Requirements

Some money market accounts may be subject to fees, such as monthly maintenance fees or transaction fees. These fees can eat into the returns earned on the account, reducing its overall effectiveness as a savings vehicle.

Additionally, some institutions require account holders to maintain a minimum balance in order to avoid fees or earn the advertised interest rate. This can be a barrier to entry for individuals with limited funds.

It's crucial to carefully review the terms and conditions of a money market account before opening it to understand any associated fees or minimum balance requirements.

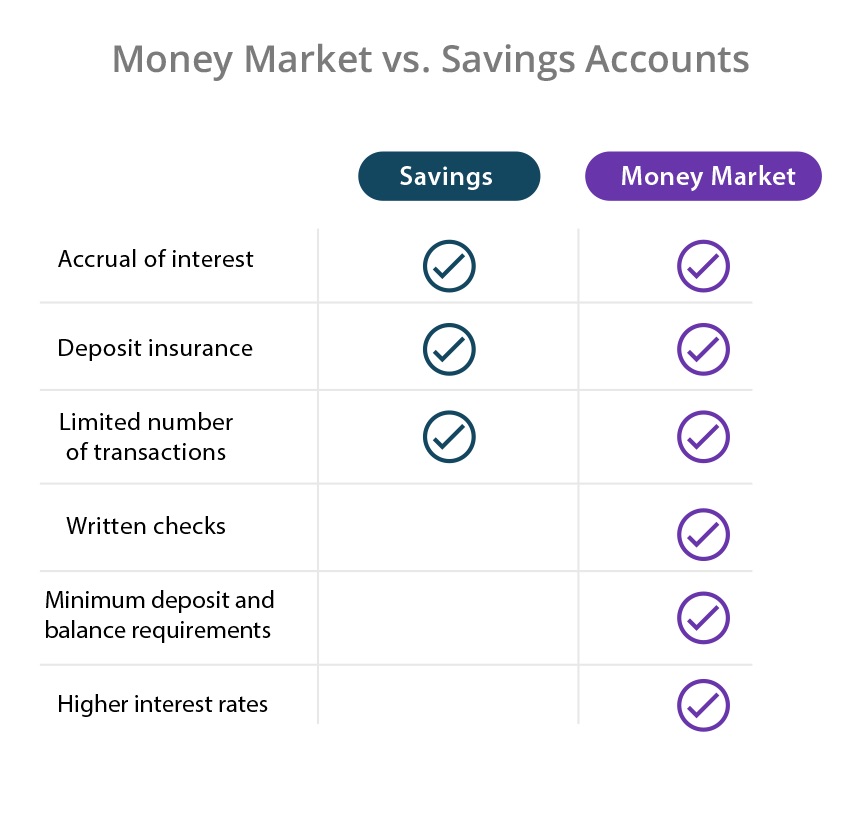

Accessibility and Withdrawal Restrictions

While money market accounts generally offer good liquidity, there may be some restrictions on withdrawals. Some accounts may limit the number of withdrawals that can be made per month or impose penalties for exceeding those limits.

These restrictions are designed to prevent excessive trading activity, which could disrupt the stability of the account. However, they can be inconvenient for individuals who need frequent access to their funds.

David Lee, a banking analyst, notes: "It's important to understand the withdrawal policies of a money market account before depositing your funds. Make sure the account offers the level of accessibility you require."

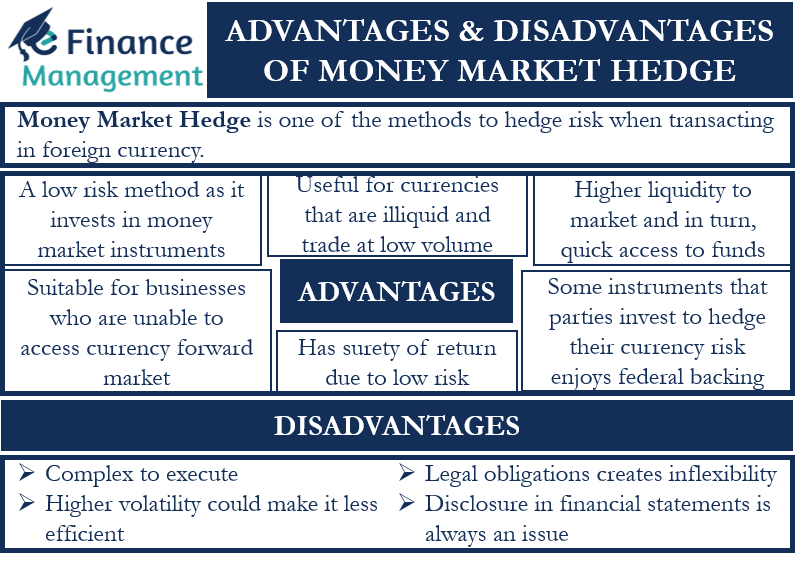

Not Entirely Risk-Free

Although money market accounts are often perceived as risk-free, they are not entirely without risk. While the risk of losing principal is generally low, it's not zero.

In rare cases, a money market fund could "break the buck," meaning that its net asset value falls below $1 per share. This can happen if the fund's investments experience significant losses.

While such occurrences are uncommon, they serve as a reminder that even seemingly safe investments carry some degree of risk. FDIC insurance covers many, but not all, money market accounts. Understanding the type of money market account is important to understanding its potential risks.

Conclusion

Money market accounts offer a convenient and relatively safe way to earn a modest return on cash. However, their limitations in terms of growth potential, fees, withdrawal restrictions, and underlying risks should be carefully considered.

For individuals seeking higher returns or saving for long-term goals, a diversified investment portfolio that includes a mix of asset classes may be a more suitable option. Understanding the pros and cons of money market accounts is crucial for making informed financial decisions.

Ultimately, the decision of whether or not to use a money market account depends on an individual's specific financial goals, risk tolerance, and time horizon. Consulting with a financial advisor can help individuals determine the best savings and investment strategies for their unique circumstances.

:max_bytes(150000):strip_icc()/money-market-account-vs-highinterest-checking-account-which-better-v1-af34686e14ce4eb5a140c72e4b6abfbb.jpg)