E-trade Is Reportedly Considering Adding Crypto Trading To Its Platform.

The financial world is abuzz with anticipation as whispers circulate regarding E-Trade's potential foray into the cryptocurrency market. Sources familiar with the matter suggest that the online brokerage giant is seriously considering offering its millions of users the ability to trade digital assets directly on its platform. This move, if realized, could represent a significant shift in the accessibility and mainstream adoption of cryptocurrencies, further blurring the lines between traditional finance and the burgeoning digital asset space.

The decision by E-Trade to potentially integrate crypto trading comes at a pivotal moment for the industry. Increased regulatory clarity, coupled with growing institutional interest, has emboldened traditional financial institutions to explore the possibilities presented by cryptocurrencies. This article delves into the details of E-Trade's potential crypto offering, the implications for its user base, the competitive landscape, and the broader impact on the cryptocurrency market.

A Strategic Move in a Changing Landscape

E-Trade's potential entry into the crypto market is not occurring in a vacuum. Major competitors, including Robinhood and Interactive Brokers, already offer cryptocurrency trading. The move suggests a strategic imperative for E-Trade to remain competitive and cater to the evolving demands of its customer base, particularly younger investors who are increasingly drawn to digital assets.

According to a 2023 report by Coinbase Institutional, institutional interest in digital assets is growing, with 62% of institutions surveyed planning to increase their allocation to crypto in the next 12 months. This data underscores the rising acceptance of cryptocurrencies as a legitimate asset class. E-Trade, by tapping into this trend, could attract new customers and retain existing ones who might otherwise seek crypto exposure elsewhere.

Furthermore, the increased regulatory clarity surrounding cryptocurrencies, particularly in jurisdictions like the European Union with its MiCA regulations, provides a more stable and predictable environment for companies to operate in. This has likely emboldened E-Trade to explore the possibility of adding crypto to its platform.

What Could E-Trade’s Crypto Offering Look Like?

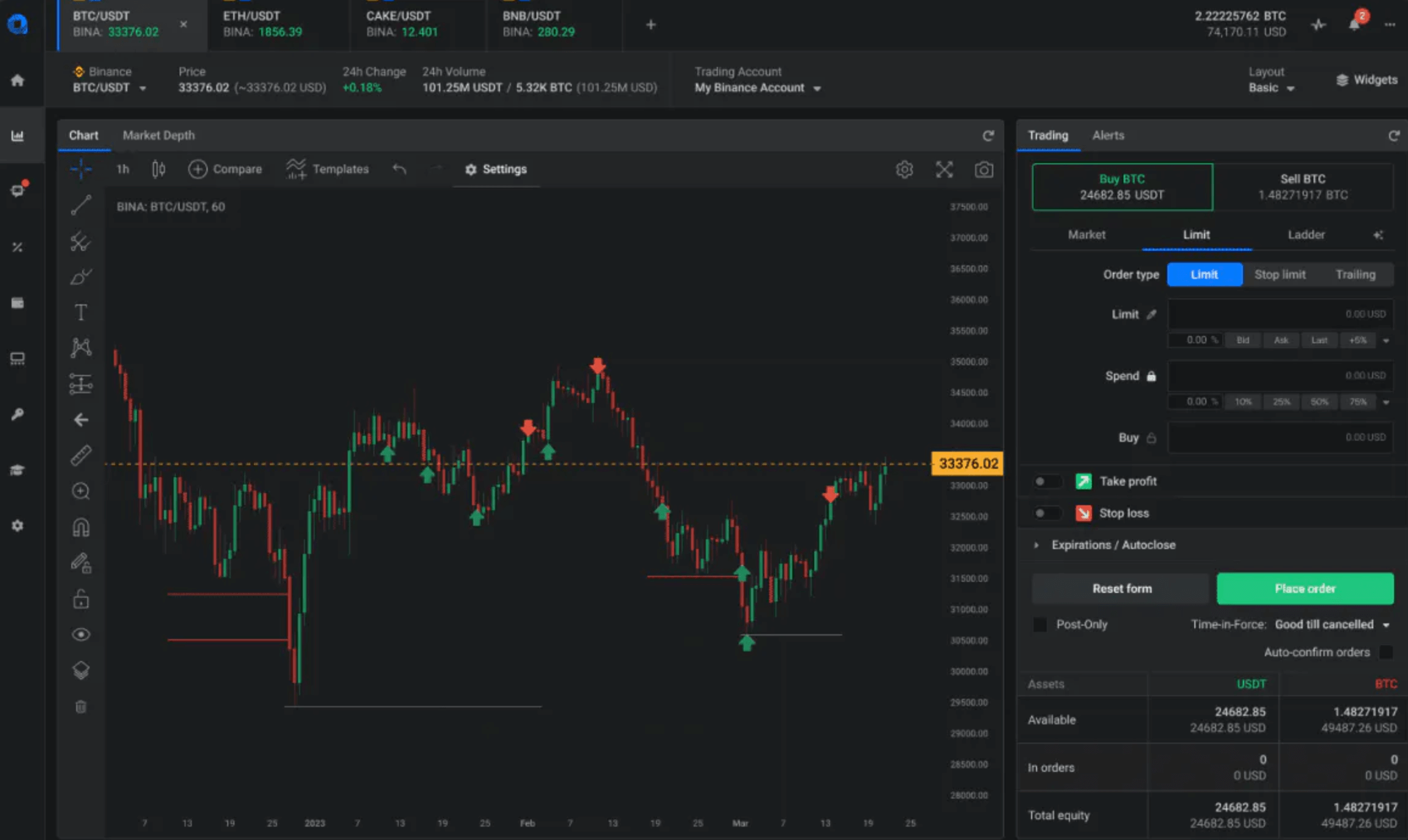

While details remain scarce and unconfirmed, speculation abounds regarding the potential features of E-Trade's crypto offering. It is likely that E-Trade would initially offer trading in major cryptocurrencies such as Bitcoin (BTC) and Ethereum (ETH).

Bloomberg Intelligence analysts suggest that E-Trade might follow a similar model to Robinhood, offering a simplified and user-friendly interface for buying and selling crypto. This approach would appeal to a broad audience, including novice investors who may be intimidated by the complexity of dedicated crypto exchanges.

Moreover, E-Trade could leverage its existing infrastructure to provide features such as integrated tax reporting and secure custody solutions. These features would provide additional value to users and differentiate E-Trade's offering from that of dedicated crypto exchanges.

Impact on E-Trade’s User Base and the Crypto Market

The introduction of crypto trading on E-Trade could have a significant impact on both its user base and the broader cryptocurrency market. For E-Trade users, it would provide convenient access to a new asset class within a familiar and trusted platform. This could lead to increased engagement and activity on the platform.

From the perspective of the cryptocurrency market, E-Trade's entry could bring in a new wave of investors, further boosting trading volumes and liquidity. This would be particularly beneficial for smaller cryptocurrencies that may not be widely available on other platforms. Increased adoption could also contribute to the long-term stability and maturity of the crypto market.

However, it is important to acknowledge the potential risks associated with cryptocurrency trading. Cryptocurrencies are known for their volatility, and investors could experience significant losses. E-Trade would need to implement robust risk management tools and provide educational resources to help users understand the risks involved.

The Competitive Landscape and Future Prospects

E-Trade's potential entry into the crypto market would intensify competition among online brokers. Robinhood, which has already established a strong foothold in the crypto space, would face increased pressure to innovate and offer more competitive pricing. Interactive Brokers, another major player, would also need to respond to E-Trade's move.

Looking ahead, the integration of crypto and traditional finance is likely to continue. We may see more online brokers offering a wider range of crypto-related services, such as staking, lending, and decentralized finance (DeFi) products. This evolution could ultimately lead to a more integrated and accessible financial system.

Ultimately, the decision of whether or not to add crypto trading to its platform rests with E-Trade's leadership. However, given the current market trends and competitive pressures, it appears that E-Trade is seriously considering taking the plunge. The financial world will be watching closely to see if this potential move becomes a reality.