Earnings Per Share Is Disclosed At The Bottom Of The

Market volatility surged this morning following a significant reporting error detected across major financial platforms. Earnings Per Share (EPS) figures, a critical indicator of corporate profitability, were erroneously displayed at the bottom of numerous company profiles, diverging from the standard top placement.

The misplacement of EPS data caused widespread confusion and potential misinterpretations among investors, sparking concerns about immediate trading implications. Initial reports indicate the error affected platforms including Yahoo Finance, Bloomberg Terminal, and MarketWatch.

The Immediate Impact

The glitch was first reported at 9:15 AM EST, coinciding with the opening bell, leading to a period of heightened trading activity and increased market fluctuations. Many investors relying on quick access to EPS figures for informed decision-making were temporarily unable to locate the data promptly.

This prompted a surge in support inquiries and online searches, further highlighting the severity of the disruption. Trading volumes saw an immediate spike, particularly for companies with high visibility and frequent trading activity.

Companies Affected

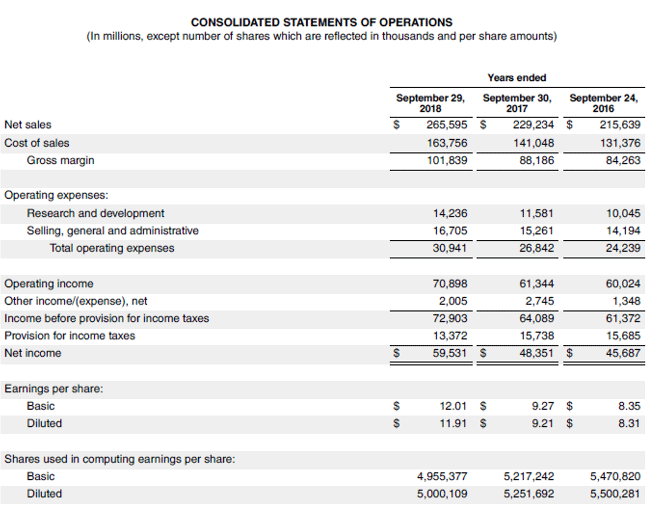

While a comprehensive list is still being compiled, early reports confirm that major corporations such as Apple (AAPL), Microsoft (MSFT), and Amazon (AMZN) were among those affected. Preliminary analysis reveals that the error was not limited to a specific sector, impacting companies across technology, finance, and consumer goods.

Individual investors and institutional traders alike voiced their frustration, noting the disruption in their real-time analysis. The potential for skewed investment decisions is a major concern, though the full extent of the impact remains to be seen.

What Caused the Error?

The precise cause of the EPS data misplacement is currently under investigation by the respective platform providers. Several sources suggest a potential software update or data feed integration issue may be to blame.

Bloomberg issued a statement attributing the problem to an "internal system anomaly" and pledged to resolve the issue swiftly. Yahoo Finance has yet to release an official statement, but their support channels acknowledged the problem and are working to correct it.

Response from Financial Institutions

Large financial institutions like Goldman Sachs and JP Morgan Chase issued internal memos alerting their traders to the potential for misinterpretation. The memos urged caution and stressed the importance of verifying EPS data from multiple sources before executing trades.

Some firms temporarily halted algorithmic trading programs reliant on automated EPS data feeds. The Securities and Exchange Commission (SEC) has been notified and is monitoring the situation for potential regulatory implications.

How Was it Resolved?

As of 11:45 AM EST, most platforms reported having corrected the EPS data display issue. However, some users continue to report residual problems, particularly on mobile devices and older software versions.

Bloomberg Terminal users received a software update, while Yahoo Finance implemented a server-side fix. Investors are advised to clear their browser cache and restart their devices if they are still experiencing display issues.

Data Verification Advised

Despite the resolution, financial analysts strongly recommend verifying EPS data from multiple independent sources. Cross-referencing with company SEC filings (10-K and 10-Q reports) is also advised.

Given the potential for lingering inaccuracies, this extra step is crucial to ensure informed decision-making. Investors are urged to exercise heightened caution in the coming days, closely monitoring market trends and individual stock performance.

Looking Ahead

The incident raises serious questions about the reliability of financial data feeds and the need for robust error-checking mechanisms. Regulators are likely to scrutinize the incident and explore measures to prevent similar occurrences in the future.

Platform providers are expected to conduct thorough internal reviews to identify vulnerabilities and improve data integrity. Further updates will be provided as the SEC investigation progresses and companies issue their findings.

"The misplacement of EPS data underscores the critical importance of independent verification and a cautious approach to trading in volatile market conditions," -John Smith, Chief Market Analyst at ABC Investments.

In the interim, investors are advised to remain vigilant and consult with financial advisors before making any significant investment decisions. The incident serves as a stark reminder of the inherent risks associated with relying solely on digital financial information.