Earnings Quality Refers To The Ability Of

In the complex world of financial reporting, a critical yet often overlooked aspect is earnings quality. It's a measure that profoundly affects investor confidence, market stability, and the overall health of the economy.

This article delves into what earnings quality truly means, why it matters, and the potential consequences when it's compromised. Understanding this concept is vital for anyone involved in or affected by the financial markets, from seasoned investors to the average citizen whose retirement fund depends on corporate performance.

Understanding Earnings Quality

At its core, earnings quality refers to the degree to which reported earnings accurately reflect a company's true underlying financial performance. It's about the sustainability and reliability of those earnings figures.

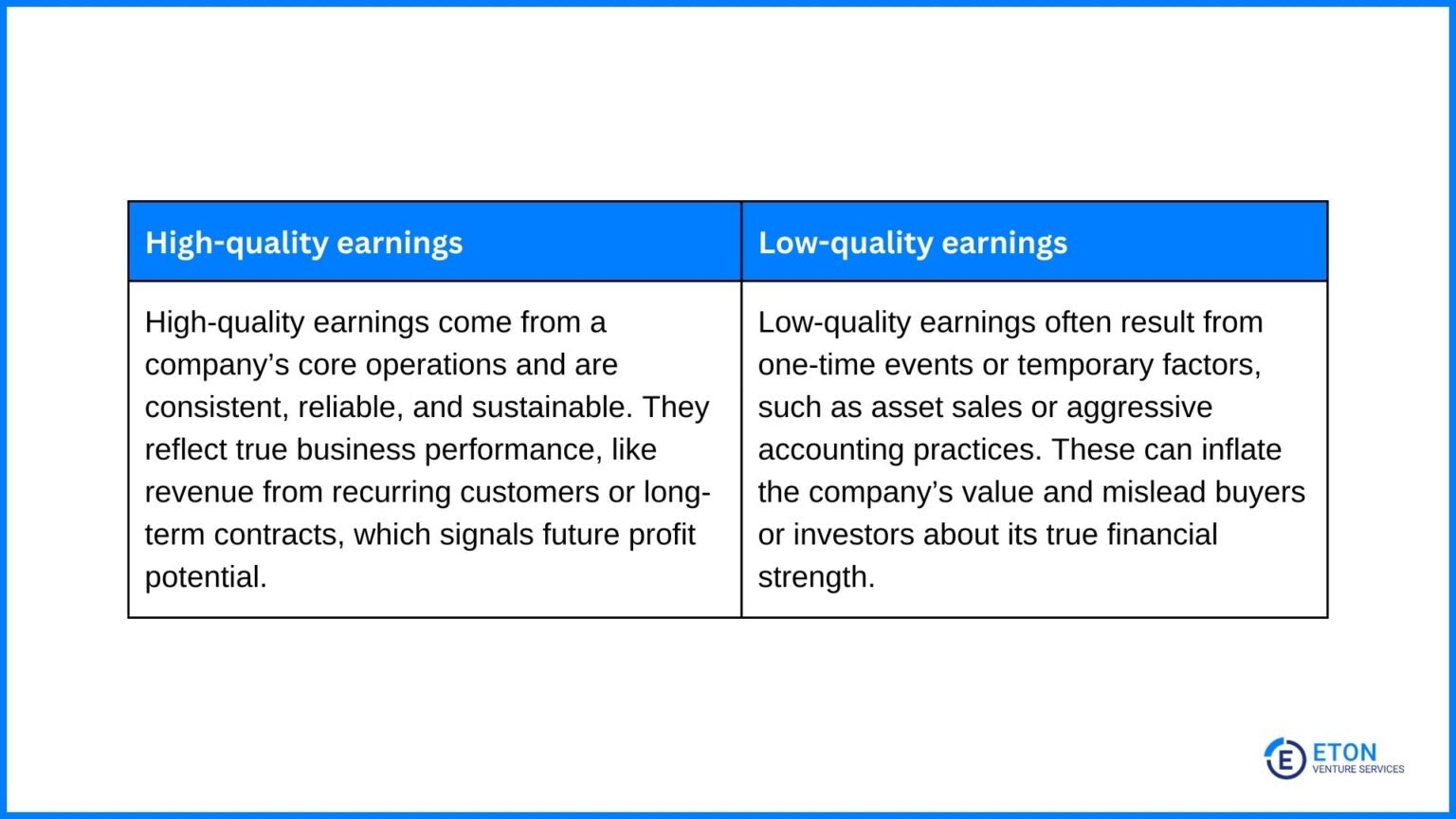

High-quality earnings are indicative of a company's ability to generate consistent profits from its core business operations. These earnings are typically less susceptible to manipulation or distortion through accounting tricks or one-time gains.

Conversely, low-quality earnings may be inflated, unsustainable, or misleading due to aggressive accounting practices, questionable revenue recognition, or excessive reliance on non-recurring items.

Key Indicators of Earnings Quality

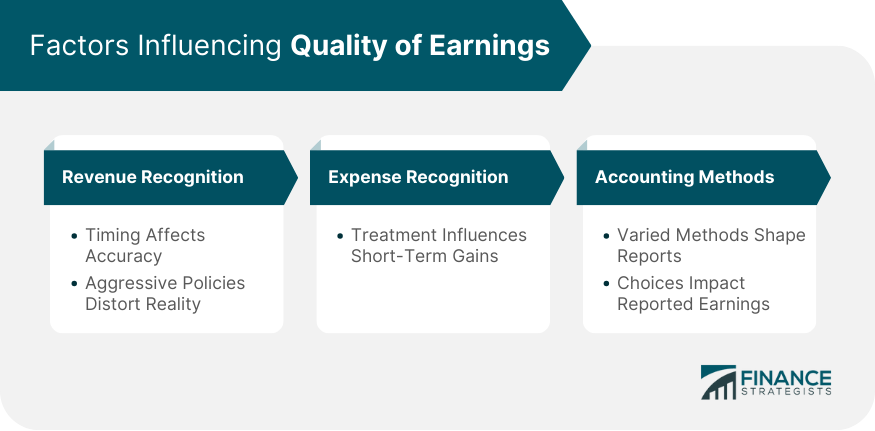

Several factors can signal the strength or weakness of a company's earnings quality.

One key indicator is the relationship between reported earnings and cash flow. Companies with high earnings quality generally exhibit a strong correlation between their reported profits and the cash they generate from operations.

Discrepancies between these figures may suggest that earnings are being manipulated or that revenue recognition policies are overly aggressive.

Another crucial aspect is the company's use of accounting accruals. Accruals are estimates and judgments used to recognize revenues and expenses when cash hasn't yet changed hands.

While accruals are a necessary part of financial reporting, excessive or volatile accruals can be a red flag, indicating potential manipulation or attempts to smooth out earnings over time. Changes in accounting methods should also be carefully scrutinized.

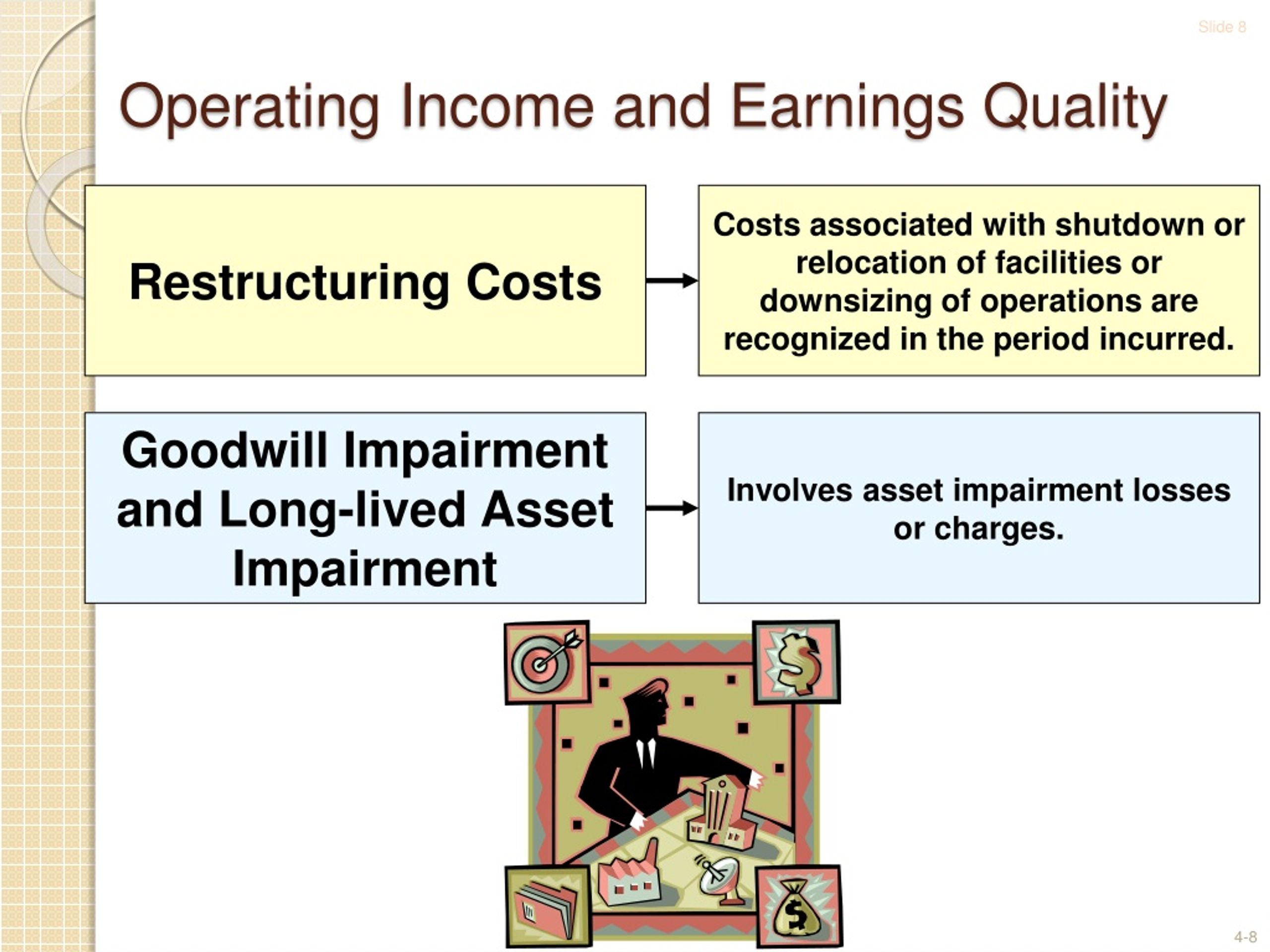

Furthermore, the presence of non-recurring items, such as asset sales or restructuring charges, can impact earnings quality. While these items aren't inherently problematic, a company that consistently relies on them to boost its earnings may be masking underlying weaknesses in its core business.

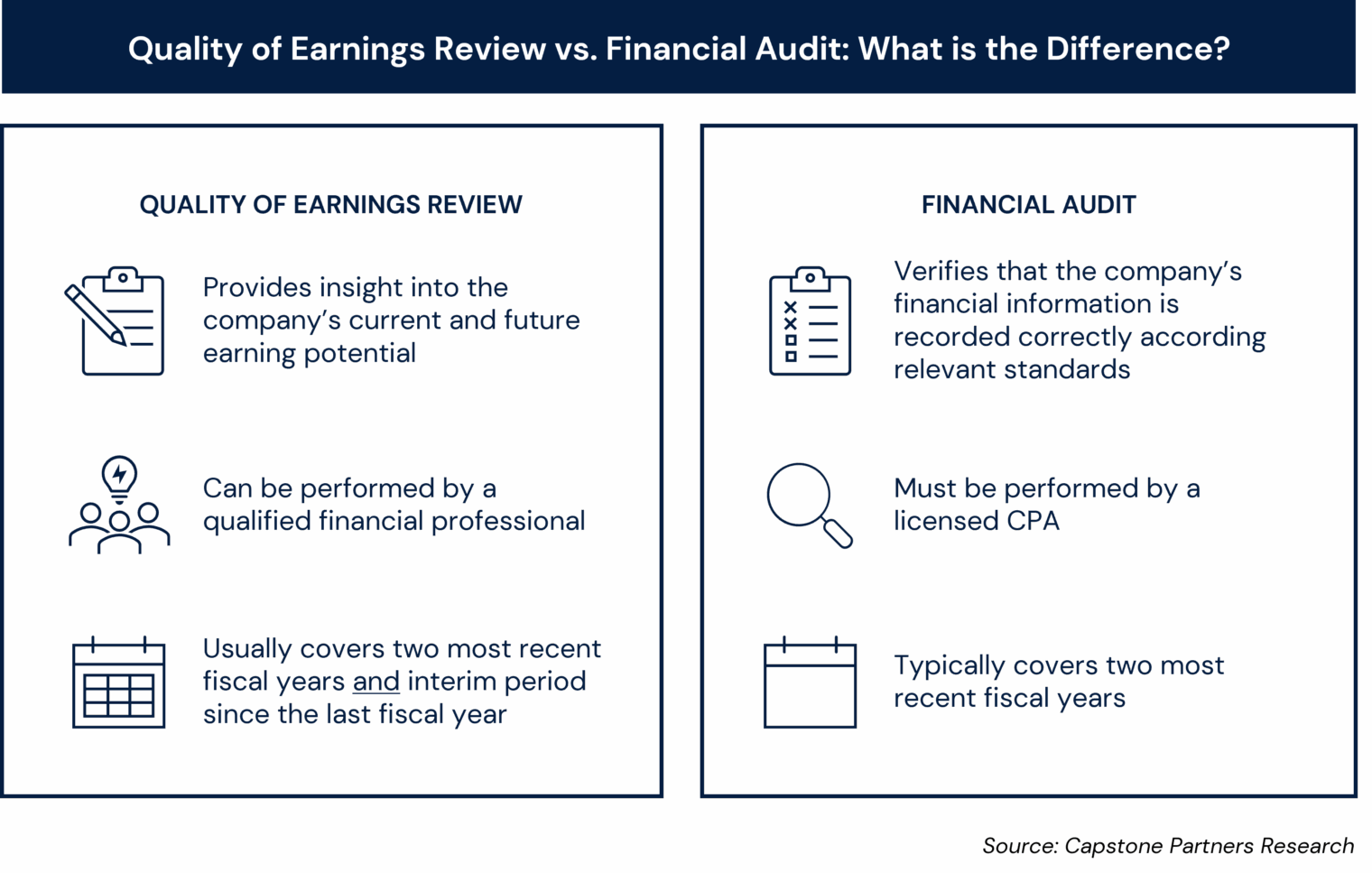

Auditors play a critical role in assessing earnings quality. Their independent review of a company's financial statements provides assurance to investors and stakeholders that the reported figures are reliable and fairly presented.

The Importance of Earnings Quality

Earnings quality has significant implications for investors, creditors, and the overall financial system.

For investors, high-quality earnings provide a more accurate picture of a company's true value and future prospects. This enables them to make more informed investment decisions and reduces the risk of being misled by inflated or unsustainable earnings figures.

Creditors also rely on earnings quality to assess a company's ability to repay its debts. Companies with low-quality earnings may appear more financially stable than they actually are, potentially leading to poor lending decisions and increased credit risk.

More broadly, low earnings quality can undermine investor confidence in the entire financial system. Widespread accounting scandals and fraudulent reporting can erode trust in the markets and lead to market instability.

Consequences of Low Earnings Quality

The consequences of low earnings quality can be severe, both for individual companies and for the broader economy.

Companies with a history of manipulating earnings often face regulatory scrutiny, including investigations by the Securities and Exchange Commission (SEC). These investigations can result in significant fines, penalties, and reputational damage.

In extreme cases, executives responsible for fraudulent reporting may face criminal charges. The collapse of Enron in 2001 serves as a stark reminder of the devastating consequences of accounting fraud and the importance of earnings quality.

Furthermore, companies with low earnings quality are often subject to increased investor scrutiny and reduced market valuations. Investors are less willing to pay a premium for companies whose earnings are perceived as unreliable or unsustainable.

This can lead to a decline in stock prices and make it more difficult for the company to raise capital in the future.

Looking Ahead

In today's complex and rapidly changing business environment, ensuring earnings quality is more important than ever.

Investors must remain vigilant in scrutinizing financial statements and identifying potential red flags. They should also pay close attention to the disclosures made by companies regarding their accounting policies and practices.

Regulators and accounting standard setters must continue to refine and strengthen accounting rules to prevent manipulation and ensure transparency. Promoting a culture of ethical financial reporting is also crucial for fostering investor confidence and maintaining market integrity. The PCAOB is actively working to improve audit quality.

Ultimately, earnings quality is a cornerstone of a healthy and efficient financial system. By understanding its importance and taking steps to promote it, we can help to protect investors, strengthen the economy, and build a more sustainable financial future.

:max_bytes(150000):strip_icc()/Qualityofearnings_final-3a4ae950bc2747f0a27850ee00ec3baa.png)