Economic Costs And Accounting Costs Differ Because

Imagine Sarah, a passionate baker, dreaming of opening her own cupcake shop. She meticulously calculates the cost of flour, sugar, rent for a small storefront, and the wages she'd pay a part-time assistant. These tangible expenses, the out-of-pocket costs, paint a promising picture of profitability. But, lurking beneath the surface are the less obvious, yet equally important, considerations – the salary she's foregoing from her stable office job, the interest she could have earned on the money used for the initial investment, and the sheer value of her time spent building this dream from scratch.

The difference between the expenses Sarah considers in her initial calculations and the true cost of her venture highlights a fundamental concept in economics: the distinction between economic costs and accounting costs. While both aim to measure expenses, they operate under different frameworks, leading to vastly different conclusions about profitability and the overall feasibility of a business decision.

This article delves into the nuances of economic costs and accounting costs, exploring their definitions, key differences, and the implications for individuals and businesses alike.

The Foundation: Accounting Costs

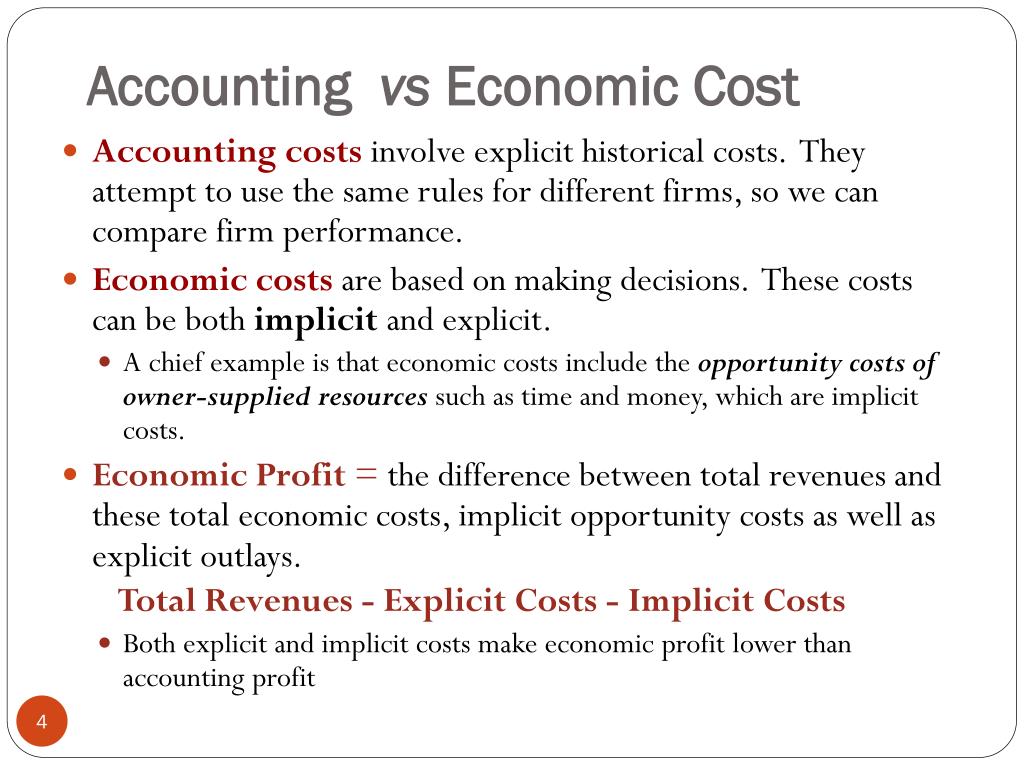

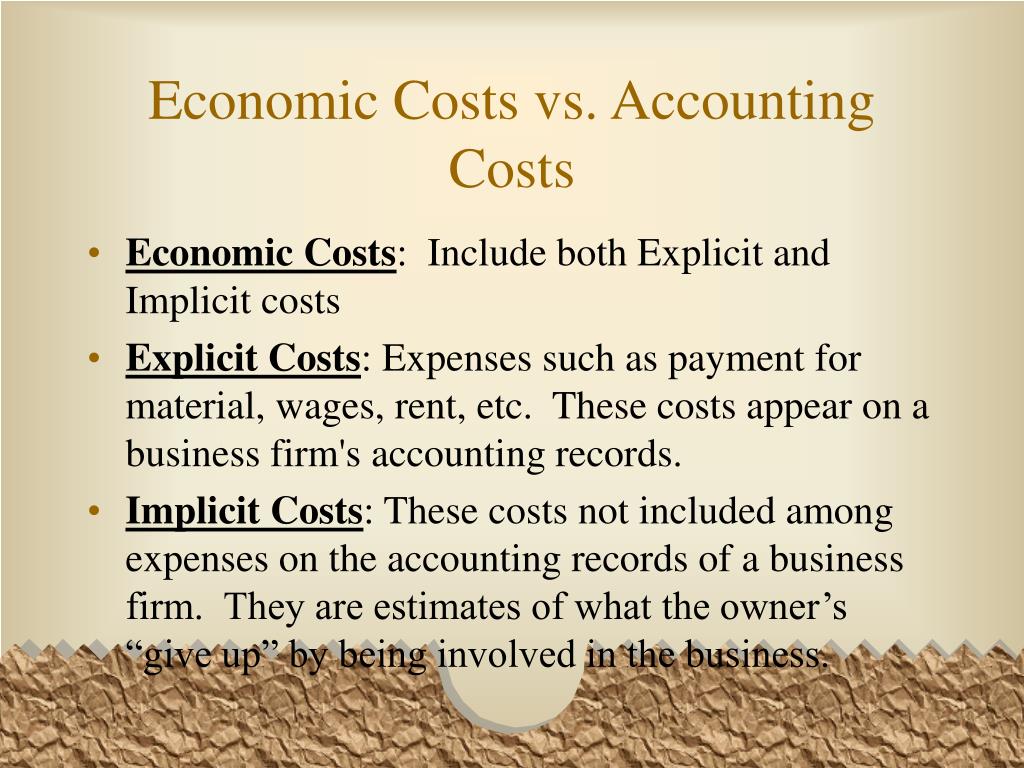

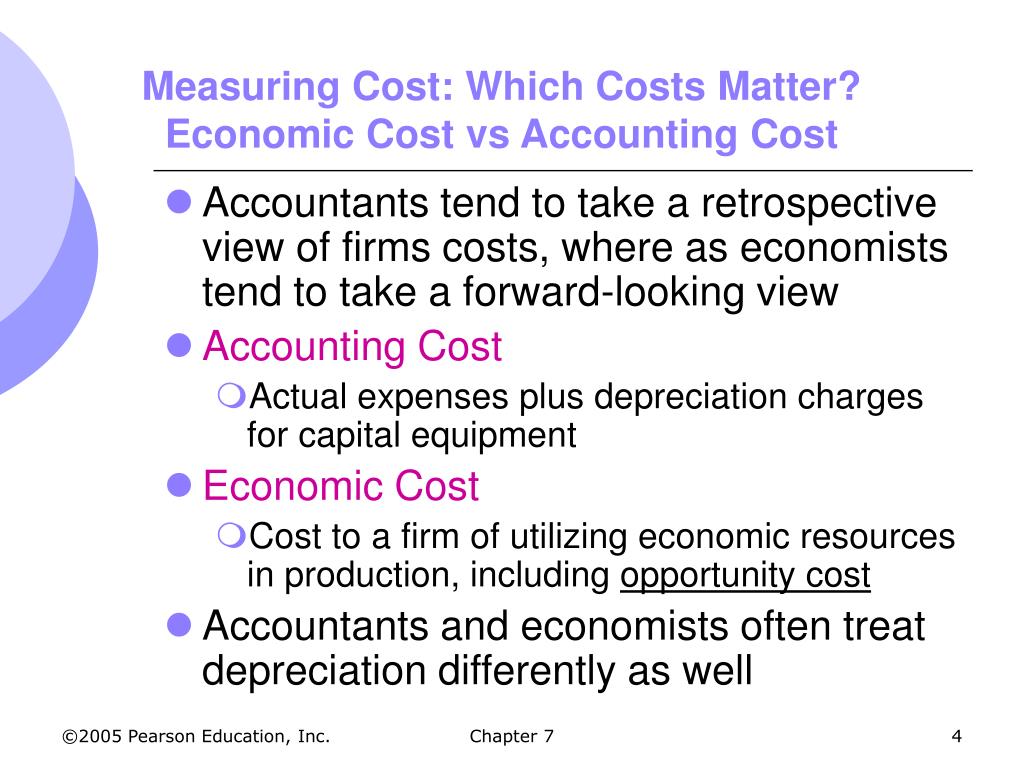

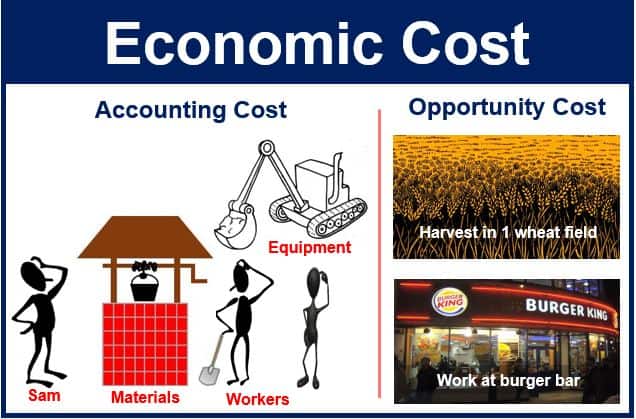

Accounting costs, often referred to as explicit costs, are the easiest to grasp. They represent the direct, out-of-pocket expenses incurred by a business.

These are the costs that accountants meticulously track, record, and report on financial statements. Think of it as the visible tip of the iceberg.

Examples abound: raw materials, wages and salaries, rent, utilities, marketing expenses, and depreciation of assets. These are all tangible, quantifiable expenditures.

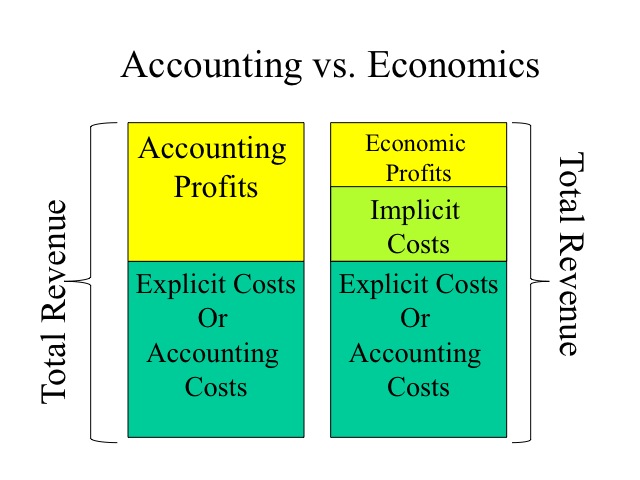

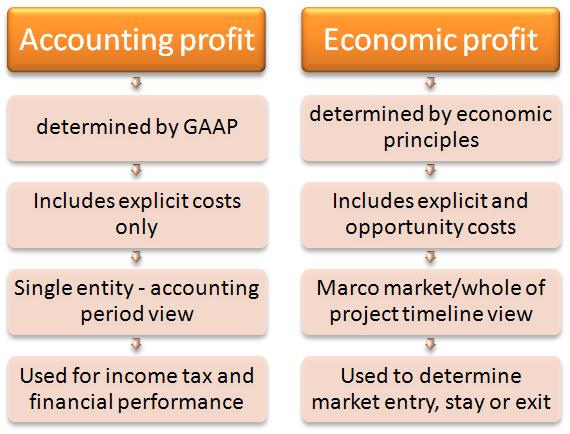

Accounting profit is calculated by subtracting these accounting costs from total revenue.

It's a straightforward calculation that provides a snapshot of a company's financial performance according to generally accepted accounting principles (GAAP).

Beyond the Visible: Economic Costs

Economic costs take a broader, more holistic view of expenses. They encompass not only the explicit accounting costs, but also the implicit costs, often called opportunity costs.

Opportunity cost represents the value of the next best alternative that is forgone when a particular decision is made.

In essence, it's the hidden cost of choosing one path over another. It reflects what you could have earned or gained if you had chosen differently.

Consider Sarah again. Her economic costs would include the explicit costs of ingredients, rent, and her assistant's wages. But they would also include the implicit cost of her foregone salary from her office job and the potential interest she could have earned on her initial investment.

Economic profit is calculated by subtracting all economic costs (both explicit and implicit) from total revenue. This provides a more realistic picture of profitability, as it accounts for the true cost of resources used.

The Critical Difference: Opportunity Cost

The inclusion of opportunity cost is the key differentiator between accounting costs and economic costs. It forces individuals and businesses to consider the full spectrum of costs associated with a decision.

Imagine a farmer who owns his land. An accountant might only record the cost of seeds, fertilizer, and labor. An economist, however, would also consider the rent the farmer could have earned by leasing his land to another farmer. This forgone rent is an opportunity cost.

Failing to consider opportunity costs can lead to suboptimal decisions. For instance, a business might continue operating even if its accounting profit is positive, overlooking the fact that its economic profit is negative – indicating that resources could be better utilized elsewhere.

Significance and Implications

The distinction between economic costs and accounting costs has profound implications for decision-making across various fields.

For Businesses: Understanding economic costs allows for more informed investment decisions, resource allocation, and pricing strategies. It helps businesses determine whether they are truly maximizing their profits and using resources efficiently.

For Individuals: Recognizing opportunity costs can guide career choices, investment decisions, and even personal spending habits. For example, deciding whether to pursue a higher degree involves considering the tuition costs (accounting costs) as well as the potential income lost during the study period (opportunity cost).

For Policymakers: Economists use economic cost analysis to evaluate the efficiency and effectiveness of government policies. This includes considering the opportunity costs of government spending and regulations.

A study by the Bureau of Economic Analysis (BEA) often incorporates elements of economic cost assessment when evaluating the impact of government initiatives on the national economy. While the BEA primarily focuses on national income and product accounts, understanding opportunity costs allows for a more holistic assessment of resource allocation.

Practical Examples

Starting a Business: As demonstrated with Sarah's cupcake shop, considering the foregone salary and investment returns is crucial for accurately assessing the viability of a new venture.

Education Decisions: The decision to attend college involves weighing the tuition fees (accounting costs) against the potential income that could be earned working instead (opportunity cost).

Resource Allocation: A company might have a factory that is generating a small accounting profit. However, if the land the factory sits on could be sold for a significant sum, the company might be better off selling the land and investing the proceeds elsewhere, as this would represent a higher return on investment. This reveals a negative economic profit for the factory.

A More Nuanced View of Profit

While accounting profit provides a valuable snapshot of a company's financial performance, it is essential to remember that it only tells part of the story. Economic profit, by incorporating opportunity costs, provides a more complete and nuanced understanding of true profitability.

A company may report healthy accounting profits, but if its resources could be generating even higher returns elsewhere, it is not maximizing its potential.

Understanding the difference between these two concepts allows businesses and individuals to make more informed and strategic decisions.

Conclusion: Beyond the Numbers

The difference between economic costs and accounting costs is more than just a technical accounting distinction. It represents a fundamental difference in perspective. It's a reminder that every decision has a cost, and that the true cost extends beyond the readily apparent expenses.

By considering both explicit and implicit costs, we can gain a deeper understanding of the true value of our choices and make more rational decisions in all aspects of our lives. It encourages a more thoughtful and strategic approach to resource allocation, leading to improved outcomes in business, personal finance, and public policy.

So, the next time you're faced with a decision, remember to look beyond the numbers. Ask yourself: What am I truly giving up by choosing this path? The answer may surprise you and guide you toward a more optimal outcome.