Economic Costs Of Production Differ From Accounting Costs In That

The intricacies of business finances often extend beyond simple profit and loss statements. A deeper understanding reveals the crucial distinction between economic and accounting costs, a difference that can significantly impact decision-making and long-term strategic planning for businesses of all sizes.

This distinction, while often overlooked, plays a vital role in accurately assessing a company's true profitability and the viability of its business decisions. Ignoring these nuanced cost evaluations can lead to misinformed resource allocation, flawed investment strategies, and ultimately, a distorted view of the overall financial health of an organization.

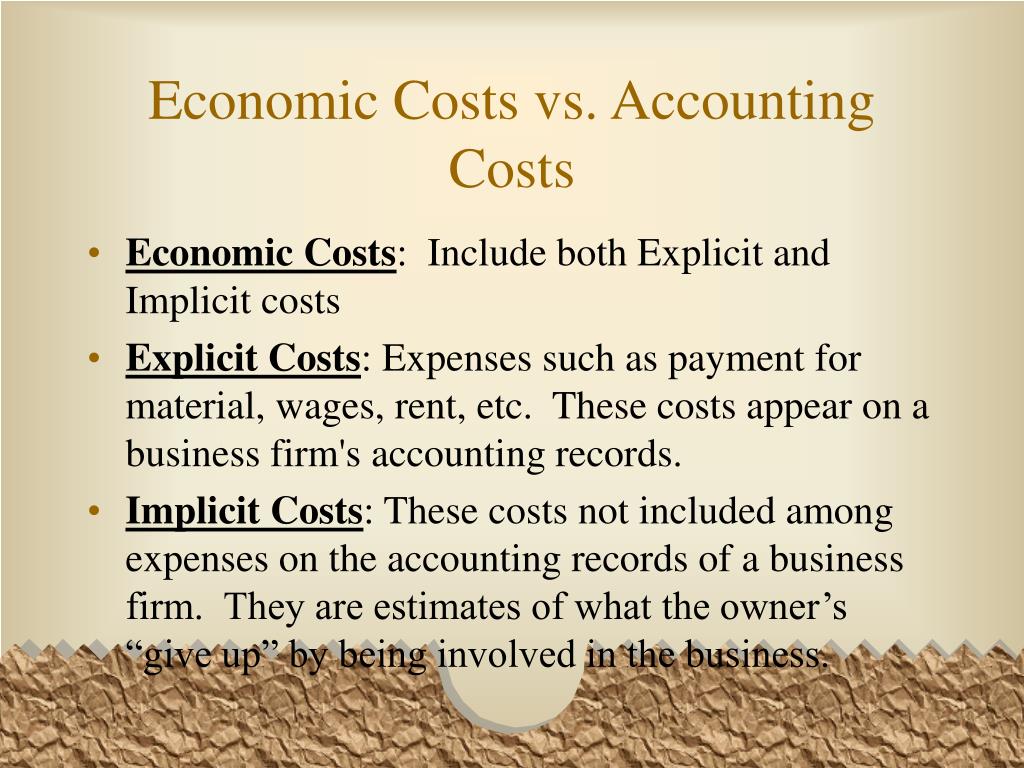

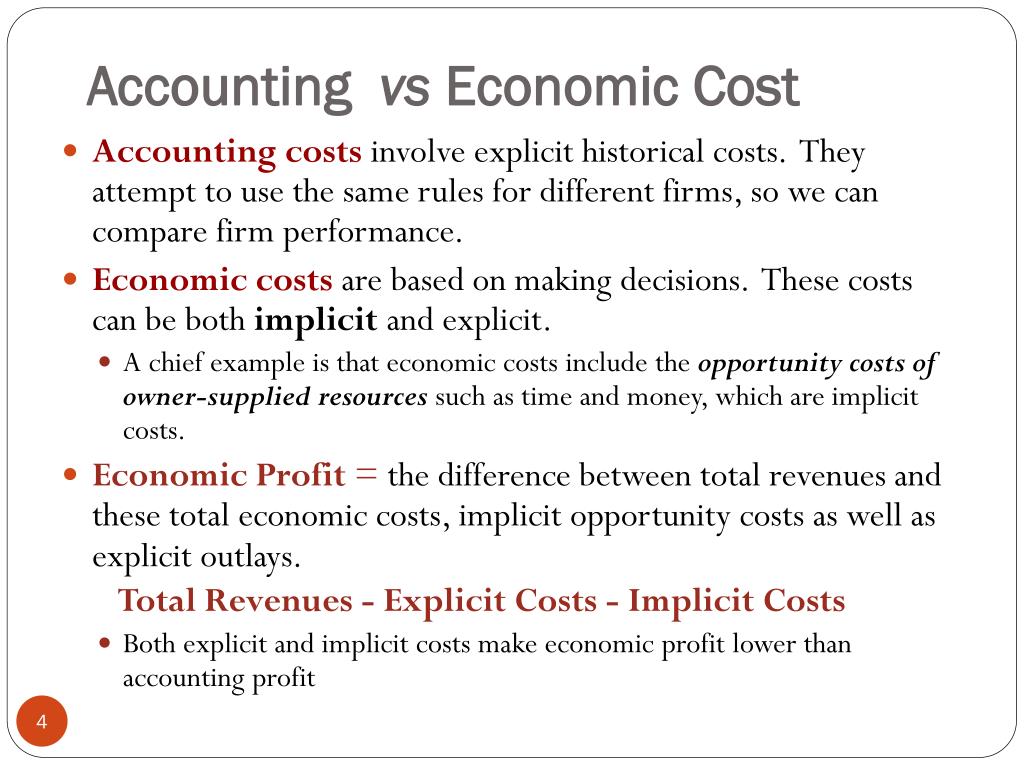

Accounting Costs: The Tangible Outlays

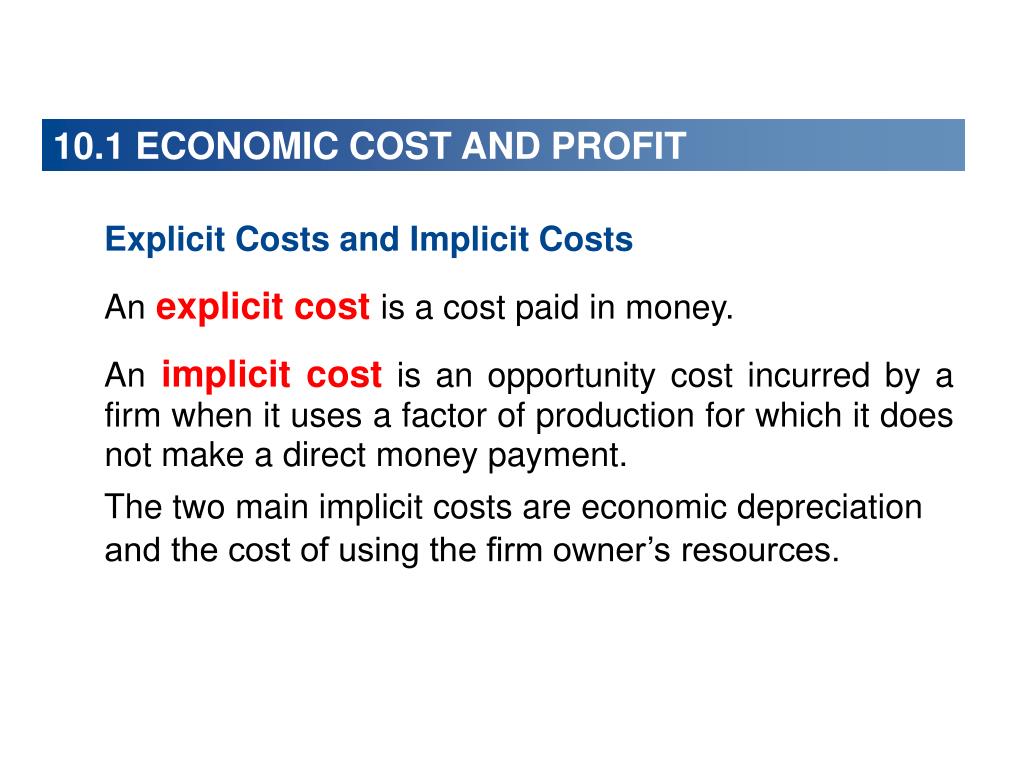

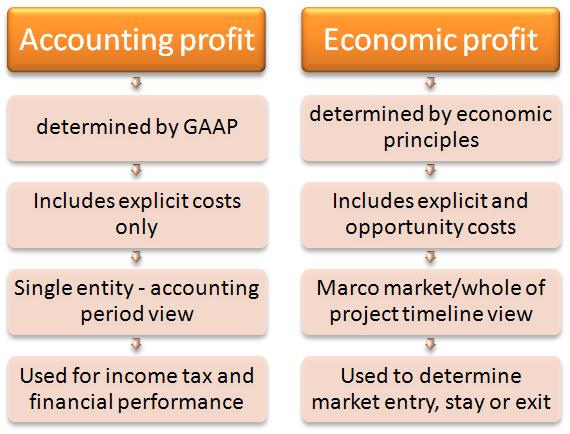

Accounting costs are the explicit, measurable expenses a business incurs. These are the costs that are easily identifiable and recorded in a company's financial statements.

They include items such as wages, rent, raw material costs, utilities, and depreciation of assets. Accountants use these costs to calculate a company's net income, providing a snapshot of its financial performance over a specific period, according to guidelines set by Generally Accepted Accounting Principles (GAAP).

“Accounting profits offer a clear picture of historical financial performance,” says Sarah Chen, a certified public accountant (CPA) at Financial Clarity Group. “However, they only tell part of the story.”

Economic Costs: The Broader Perspective

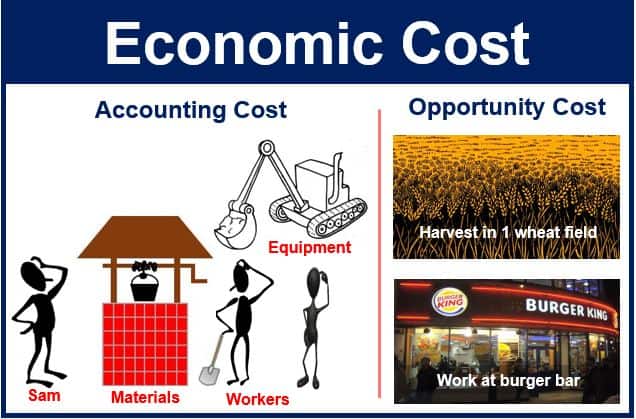

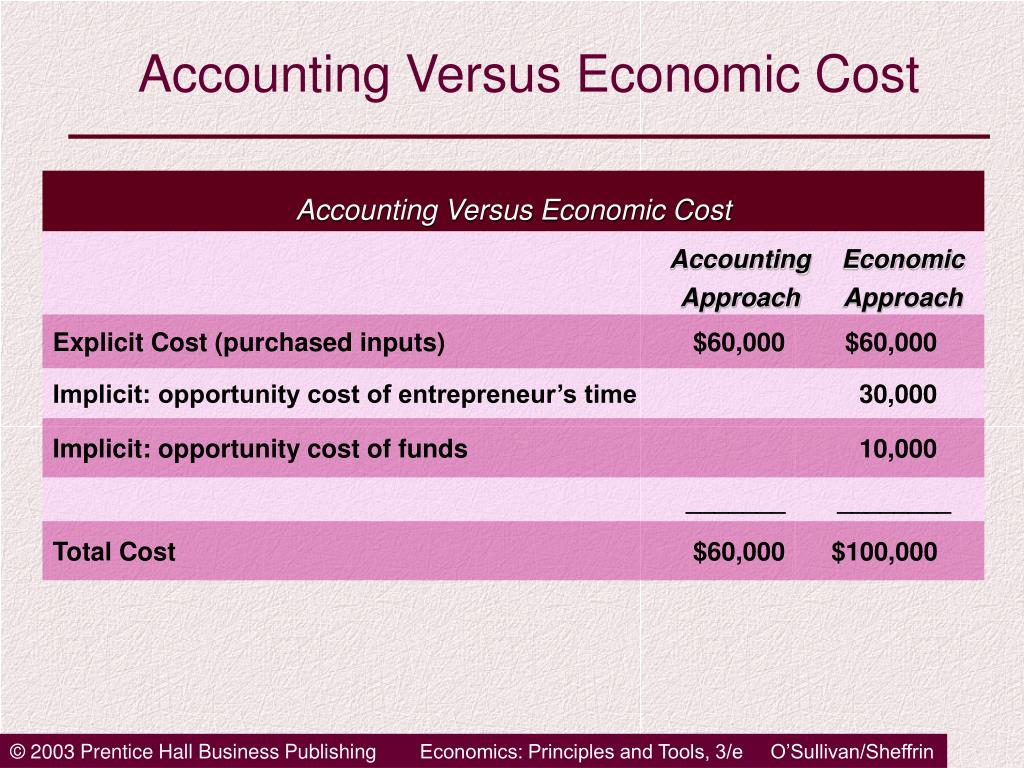

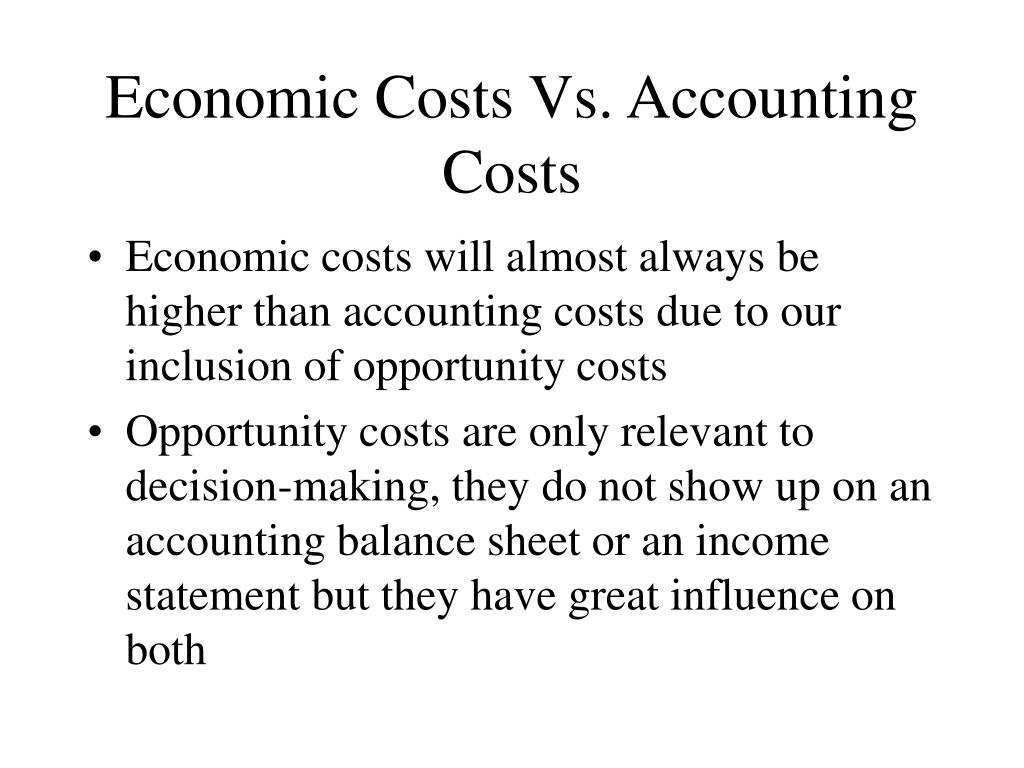

Economic costs, on the other hand, take a broader view, encompassing not only explicit accounting costs but also implicit costs. Implicit costs represent the opportunity cost of using resources in a particular way.

This includes the value of the next best alternative forgone. For example, if a business owner uses their own building for their company instead of renting it out, the potential rental income they forgo is an implicit cost.

Likewise, the salary a business owner could have earned working elsewhere is also considered an implicit cost when calculating economic profit. Economic costs = Accounting Costs + Implicit Costs.

The Significance of Opportunity Cost

The concept of opportunity cost is central to understanding economic costs. It forces businesses to consider the full range of alternatives before making decisions.

Consider a small bakery owner who uses their personal savings to fund their business. The accounting cost would be the interest they *didn't* pay on a loan they *didn't* take. The economic cost includes the potential return they could have earned by investing those savings elsewhere, such as in stocks or bonds.

This understanding can lead to better capital allocation and strategic planning. Ignoring opportunity cost could result in the business being underperforming compared to its alternatives.

Impact on Decision-Making

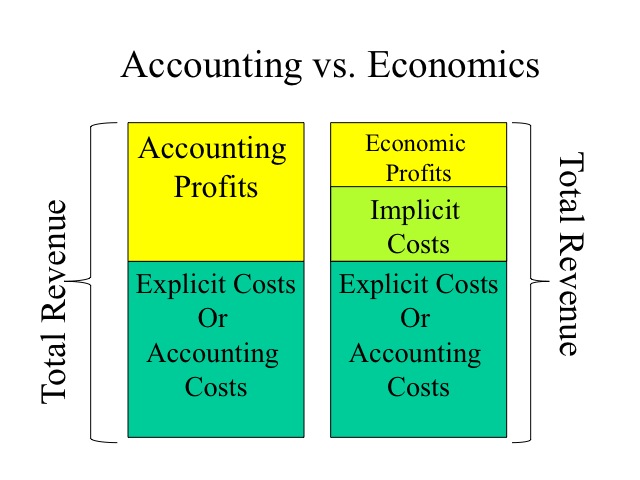

The difference between economic and accounting costs has significant implications for business decision-making. Using only accounting costs can provide a misleading picture of profitability, especially when assessing the long-term viability of projects or investments.

Economic costs, incorporating implicit costs, present a more comprehensive view. This ensures resources are allocated to their most valuable uses, maximizing overall profitability.

For example, a company might be showing an accounting profit but be generating an economic loss if the opportunity cost of its resources is higher than the accounting profit earned.

Real-World Examples

Consider a software developer who decides to start their own company rather than continuing to work for a larger corporation.

Their accounting profit may look substantial on paper, but if the forgone salary from their previous job (an implicit cost) exceeds the accounting profit, the developer is actually experiencing an economic loss. This might lead them to reconsider their business venture.

Another example involves a manufacturing company using outdated equipment. While the depreciation expense reflected on the accounting statements might be minimal, the economic cost includes the lost productivity and potential for higher revenue that could be achieved with more efficient, modern equipment. The company should then decide based on which equipment is more efficient based on calculating the economic costs.

The Role of Economic Profit

Economic profit is calculated by subtracting economic costs from total revenue. A positive economic profit indicates that the business is earning more than it could have earned by using its resources in their next best alternative.

A negative economic profit, on the other hand, indicates that the business is not utilizing its resources efficiently and that there are more profitable uses for them. This provides critical insights for resource allocation and strategic adjustments.

According to a recent report by the Bureau of Economic Analysis, businesses that consistently evaluate economic profit are more likely to experience sustainable growth and improved long-term financial performance.

Navigating the Complexity

Calculating economic costs can be challenging, as implicit costs are not always readily apparent or easily quantifiable.

Businesses often rely on estimations, market research, and expert opinions to determine the value of opportunity costs. However, a diligent and thoughtful approach to economic cost analysis is essential for making informed and strategic decisions.

Understanding the nuances between accounting and economic costs, and particularly the role of opportunity costs, empowers businesses to make sounder decisions, allocate resources efficiently, and ultimately drive long-term success.