Ekso Bionics Ekso Stock News February 2025

Ekso Bionics (EKSO) stock plunges 40% in pre-market trading following disappointing Q4 earnings report and revised 2025 guidance.

The significant drop raises concerns about the company's profitability and future growth prospects, prompting investors to reassess their positions.

Stock Crash Follows Weak Earnings

Ekso Bionics announced Q4 earnings below analyst expectations, reporting a net loss of $12 million, compared to a $9 million loss in the same period last year. Revenue also fell short, reaching only $8 million, significantly lower than the anticipated $11 million.

The company attributed the poor performance to delayed hospital purchases and increased competition in the exoskeleton market. CEO Russ Angold stated that "challenging market conditions" impacted sales growth.

Compounding the negative news, Ekso Bionics revised its 2025 revenue guidance downward, now projecting $35-40 million, a substantial decrease from the previous forecast of $50-55 million.

Key Factors Contributing to the Decline

Several factors contributed to the stock's sharp decline. The disappointing Q4 earnings, coupled with the lowered 2025 revenue guidance, triggered an immediate sell-off.

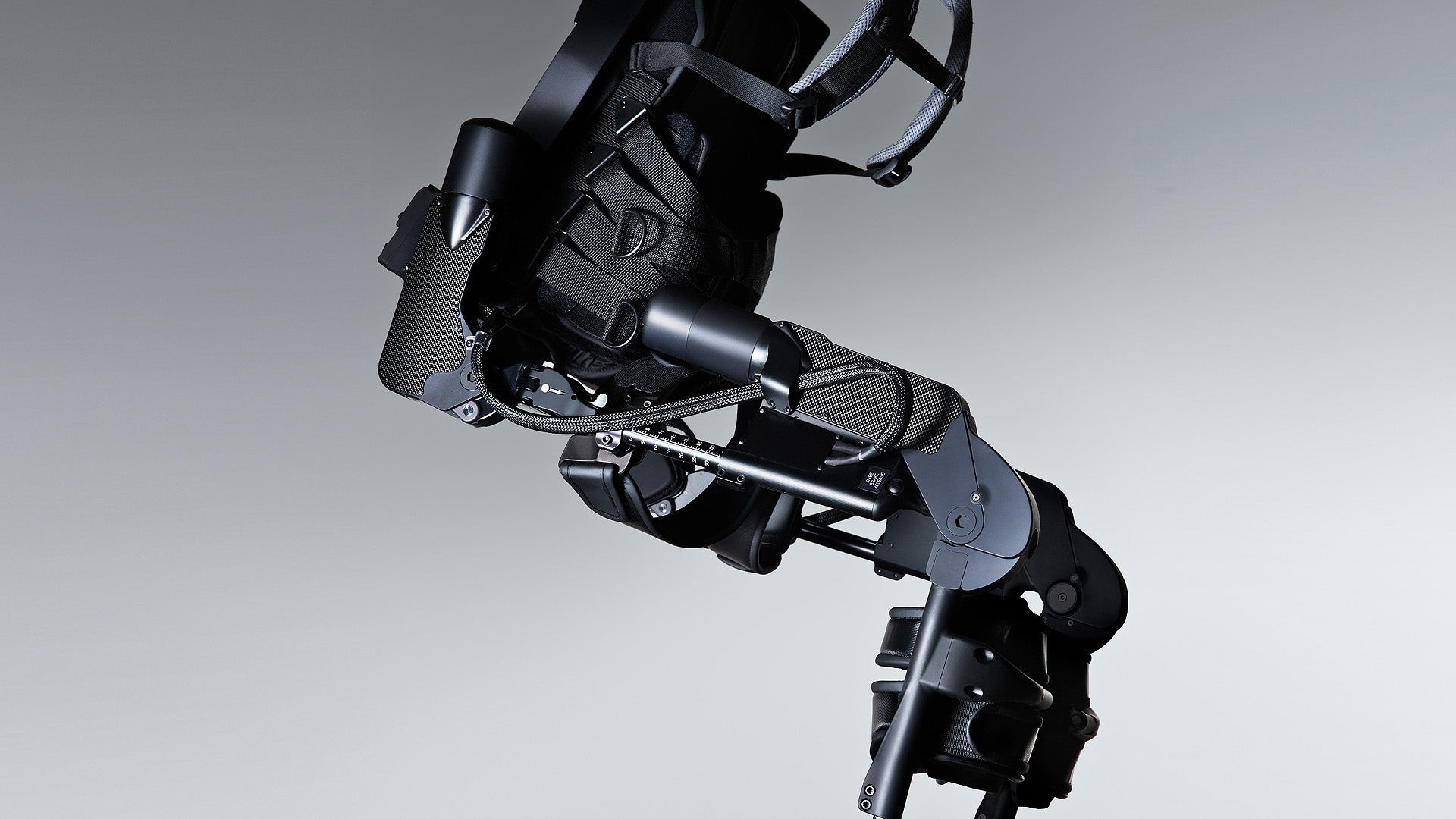

Increased competition from rival companies like ReWalk Robotics and Cyberdyne has put pressure on Ekso Bionics' market share. Delays in hospital purchasing decisions, a key customer segment for Ekso's medical exoskeletons, further impacted sales.

Concerns about the company's cash burn rate are also weighing on investors. With the revised guidance, there are doubts about Ekso's ability to achieve profitability in the near term.

Investor Reaction and Analyst Downgrades

The market reaction was swift and negative. Several analysts downgraded their ratings on Ekso Bionics following the earnings announcement.

Wedbush Securities lowered its rating from "Outperform" to "Neutral," citing concerns about the company's execution and the competitive landscape. Piper Sandler downgraded the stock to "Underweight," citing the lowered guidance and increased uncertainty.

The average price target for Ekso Bionics has been reduced from $12 to $7, reflecting the diminished expectations for the company's future performance.

Trading Halt and SEC Filing

Trading in Ekso Bionics stock was temporarily halted this morning due to the volatility. The halt was triggered by the significant price drop in pre-market trading.

Ekso Bionics has filed an 8-K form with the Securities and Exchange Commission (SEC) detailing the Q4 earnings results and the revised 2025 guidance.

The filing is available for public review on the SEC's website.

Company Response and Future Plans

In response to the market reaction, Ekso Bionics CEO Russ Angold reiterated the company's commitment to innovation and market expansion. He emphasized the long-term potential of the exoskeleton market.

The company plans to focus on streamlining operations, reducing costs, and expanding its product portfolio. Ekso Bionics is also exploring partnerships to enhance its distribution network.

However, analysts remain skeptical, questioning whether these measures will be sufficient to address the underlying challenges facing the company.

The Road Ahead for Ekso Bionics

The future of Ekso Bionics remains uncertain. The company faces significant challenges, including increased competition, slow adoption rates, and a high cash burn rate.

Achieving profitability and restoring investor confidence will require a significant turnaround. The company needs to demonstrate its ability to execute its strategic plan and navigate the evolving exoskeleton market.

Investors will be closely monitoring Ekso Bionics' progress in the coming quarters, focusing on sales growth, cost management, and product innovation.

Further updates will be provided as they become available. The next earnings call is scheduled for May 2025.