Equitas Small Finance Bank Interest Rates

Imagine a bustling marketplace, filled with vendors hawking their wares, each offering something unique. In this vibrant economic landscape, financial institutions are the vendors, and interest rates are their most compelling offers. For many, especially those with limited resources, navigating this market and finding the best "deal" can be daunting. Equitas Small Finance Bank, known for its commitment to financial inclusion, is striving to make this process easier for its customers.

At the heart of this story is the bank's recent announcement regarding its interest rates. Equitas Small Finance Bank is strategically adjusting its interest rate offerings on savings accounts and fixed deposits (FDs). This move signifies its ongoing effort to balance customer benefits with the bank's operational needs, amidst a dynamic economic environment.

The Equitas Promise: Financial Inclusion

Equitas Small Finance Bank has carved a niche for itself by focusing on serving the underbanked and unbanked segments of society. Its ethos centers around providing accessible and affordable financial services to those who often face barriers to traditional banking. This commitment has earned them considerable trust and loyalty from a diverse customer base.

Understanding the Interest Rate Adjustments

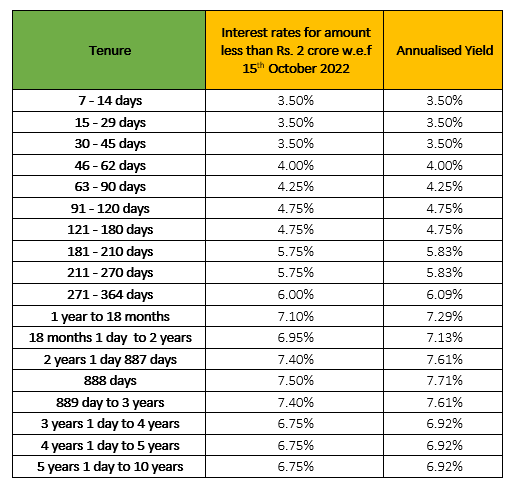

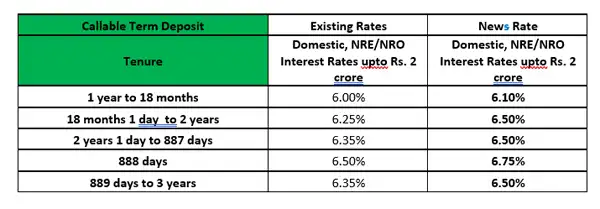

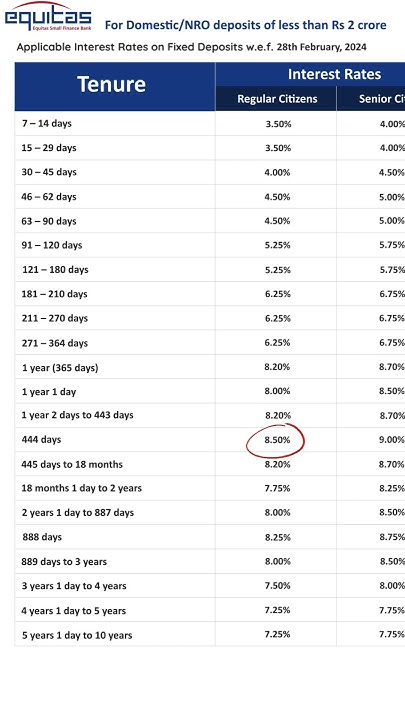

The recent changes to the interest rates reflect a response to prevailing market conditions and the Reserve Bank of India's (RBI) monetary policy decisions. According to an official statement, Equitas Small Finance Bank aims to offer competitive rates while ensuring sustainable growth. The specific adjustments vary depending on the type of account and the deposit tenure.

For savings accounts, rates are tiered based on the balance maintained. Customers with higher balances generally stand to gain slightly more. This is a common practice among banks to incentivize larger deposits.

Fixed deposit rates have also been recalibrated, with some tenures seeing an increase while others remain stable. Longer-term deposits typically attract higher interest rates, providing customers with an opportunity to maximize their returns over time.

"Our focus remains on providing value to our customers while maintaining a healthy balance sheet," stated a spokesperson from Equitas Small Finance Bank.

Impact on Customers

What does this mean for Equitas Small Finance Bank customers? The revised interest rates could positively influence savings habits, particularly for those who are diligent savers. Higher FD rates may encourage more people to lock in their funds for longer periods.

However, it's crucial for customers to carefully evaluate their individual financial goals and risk appetite before making any decisions. Consulting with a financial advisor is always recommended to ensure that the chosen products align with their long-term needs.

The Bigger Picture: Economic Significance

Interest rates play a crucial role in shaping economic activity. They influence borrowing and spending decisions, affecting inflation and overall economic growth. Small finance banks like Equitas are particularly important in driving financial inclusion and empowering marginalized communities.

By providing access to credit and savings products, they help uplift livelihoods and foster entrepreneurship. Their impact extends beyond individual customers, contributing to broader societal well-being.

Looking Ahead

Equitas Small Finance Bank continues to navigate the ever-changing financial landscape, striving to provide sustainable and inclusive financial solutions. Their commitment to transparency and customer-centricity remains unwavering.

As the market evolves, Equitas will likely adapt its strategies to meet the evolving needs of its customers and maintain its position as a trusted financial partner. The journey of financial inclusion is an ongoing one, and Equitas Small Finance Bank is dedicated to playing a vital role in this endeavor.

)