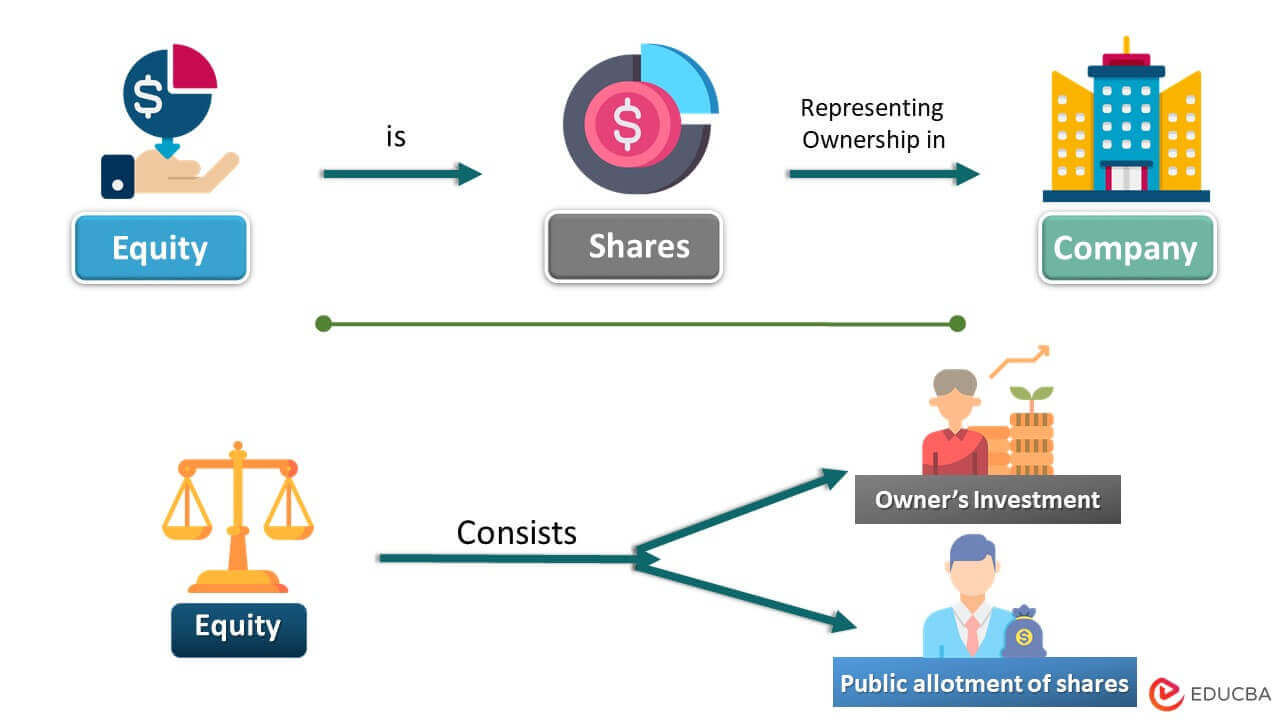

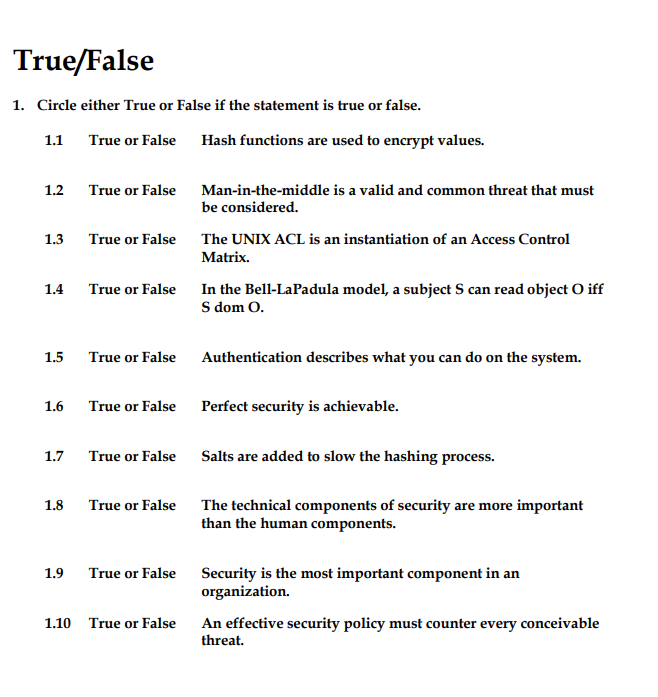

Equity Represents An Ownership Interest. True False Question. True False

Financial markets are reeling after a surge of misinformation surrounding a fundamental concept: the definition of equity. The simple question, "Equity represents an ownership interest. True or False?" has sparked widespread confusion and triggered volatility across various investment platforms.

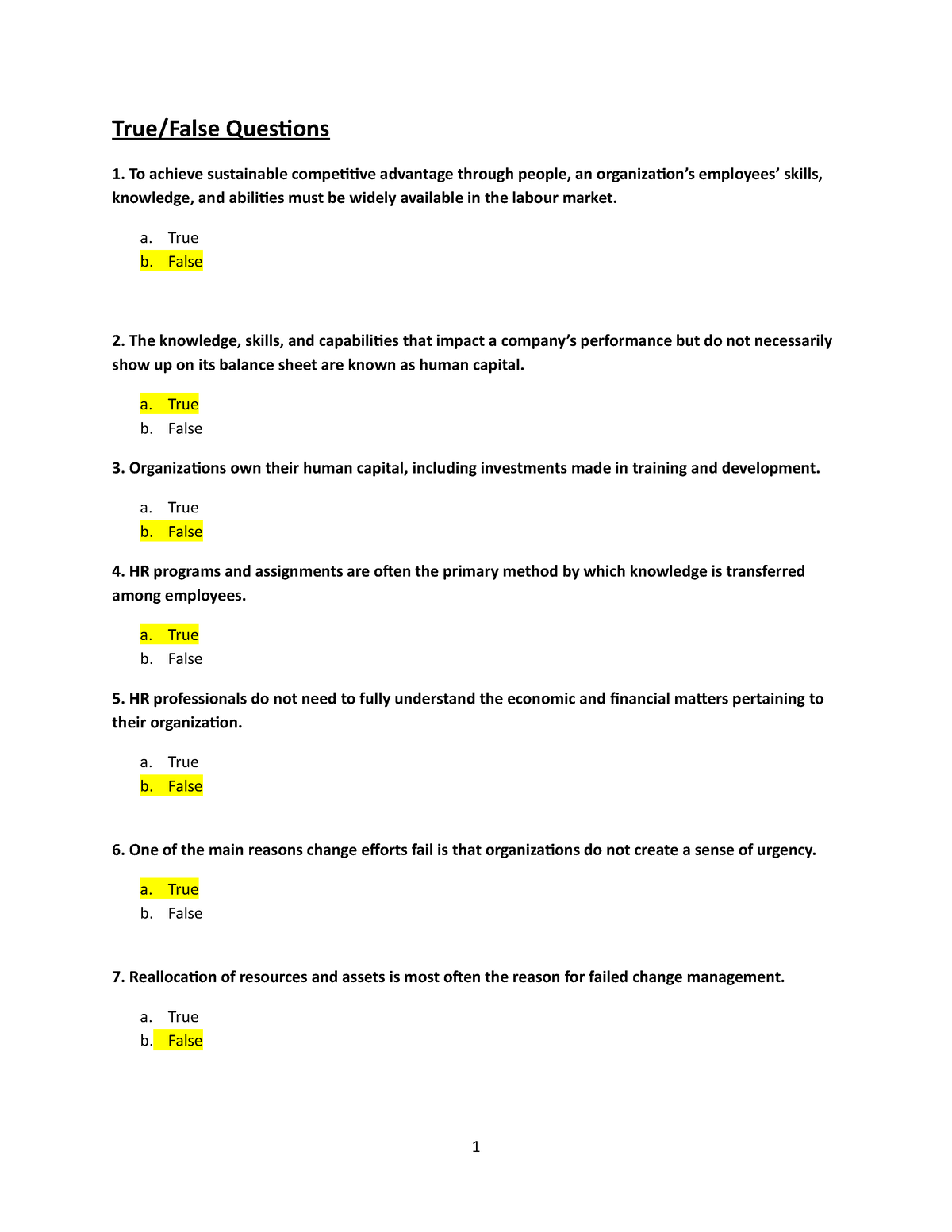

This seemingly straightforward question, designed to assess basic financial literacy, has exposed vulnerabilities in investor understanding. This is fueled by online disinformation campaigns, raising concerns about market manipulation and the need for immediate educational intervention.

The Origin of the Confusion

The disruption began late yesterday afternoon when a viral post on social media platform X (formerly Twitter) presented the "True or False" question with a deliberately misleading graphic. The graphic, subtly altered to suggest a false answer, quickly spread through online forums frequented by novice investors.

Initial reports indicate that accounts, some later identified as bots, amplified the misinformation, targeting specific demographics known to be new to investing. The Securities and Exchange Commission (SEC) is now investigating the source and intent behind these accounts.

Market Reaction and Volatility

The immediate consequence was a marked increase in trading volume, particularly in fractional shares and exchange-traded funds (ETFs). Several brokerage platforms reported unusually high traffic as users frantically bought and sold assets, seemingly based on the erroneous understanding of equity.

According to data from Nasdaq, trading volume surged by 30% in the last hour of trading yesterday. The most affected sectors include tech and renewable energy, areas popular among younger, less experienced investors.

The Dow Jones Industrial Average experienced a temporary dip of approximately 150 points before recovering slightly. Analysts at Goldman Sachs attributed the dip directly to the confusion surrounding the fundamental definition of equity.

Expert Responses and Clarifications

Financial experts are scrambling to counteract the misinformation. Numerous educational videos and articles are being released, reinforcing the correct answer: True. Equity *does* represent an ownership interest in a company.

"It's incredibly alarming to see such a basic concept so easily distorted," said Dr. Anya Sharma, a professor of finance at the Wharton School of the University of Pennsylvania. "This highlights the critical need for ongoing financial education and media literacy, especially in the age of social media."

The Financial Industry Regulatory Authority (FINRA) issued an alert this morning, urging investors to verify information from trusted sources before making any investment decisions. They also provided a link to their investor education website, offering free resources on basic financial concepts.

Platform Responses and Mitigation Efforts

Major brokerage platforms, including Robinhood and Charles Schwab, have implemented pop-up warnings on their apps, reminding users of the correct definition of equity. These warnings appear when users search for information related to stocks or ETFs.

Robinhood also announced a temporary freeze on certain high-risk trading activities for users identified as potentially acting on misinformation. This measure is designed to prevent further impulsive trades based on flawed understanding.

Social media platforms are facing pressure to crack down on the spread of financial misinformation. X has stated that they are working to identify and remove accounts spreading the false information, although critics argue their response has been too slow.

Legal and Regulatory Implications

The SEC's investigation is focused on determining whether the spread of misinformation constitutes market manipulation. If evidence of deliberate manipulation is found, those responsible could face significant fines and legal penalties.

Senator Elizabeth Warren has called for a congressional hearing to examine the role of social media platforms in amplifying financial misinformation. She emphasized the need for stronger regulations to protect individual investors.

The Department of Justice is also reportedly monitoring the situation for potential criminal activity. The focus is on identifying individuals or groups who may have profited from the market volatility caused by the misinformation campaign.

Looking Ahead: Education and Vigilance

The incident serves as a stark reminder of the vulnerability of financial markets to misinformation and the critical importance of financial literacy. Immediate and sustained efforts are needed to educate investors and strengthen safeguards against market manipulation.

The SEC's investigation is ongoing, and further announcements are expected in the coming days. Investors are urged to exercise extreme caution and consult with qualified financial advisors before making any investment decisions.

Moving forward, increased collaboration between regulatory bodies, financial institutions, and social media platforms is crucial to combat the spread of misinformation and protect the integrity of the financial markets. The correct answer remains: True.