Evaluate The Digital Remittances Company Remitly

In a world increasingly reliant on digital financial services, Remitly has emerged as a prominent player in the global remittances market. Sending money across borders, once a cumbersome and expensive process, is now streamlined through platforms like Remitly, catering to millions of migrant workers and expatriates who regularly send funds home. But beneath the user-friendly interface and rapid transfer times lies a complex business model facing intense competition, regulatory scrutiny, and evolving customer expectations.

This article delves into a comprehensive evaluation of Remitly, examining its business model, competitive landscape, financial performance, technological innovations, and regulatory challenges. Understanding these key aspects is crucial for assessing the company's current standing and its future prospects in the dynamic world of digital remittances.

Business Model and Services

Remitly operates primarily as a digital remittance service provider, facilitating money transfers from developed countries to recipients in emerging markets. The company distinguishes itself through its mobile-first approach, leveraging technology to offer a more convenient and affordable alternative to traditional methods like banks and money transfer operators (MTOs) such as Western Union and MoneyGram.

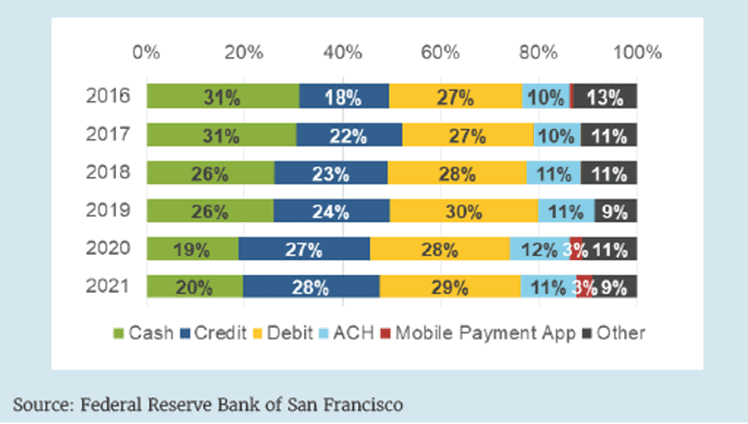

The company’s core service revolves around its user-friendly mobile app and website. Customers can initiate transfers by providing recipient details, selecting a payment method, and specifying the transfer amount.

Remitly offers various delivery options, including bank deposits, cash pickups at designated locations, mobile wallets, and even home delivery in certain regions. This flexibility caters to the diverse needs and preferences of its customer base.

Competitive Landscape

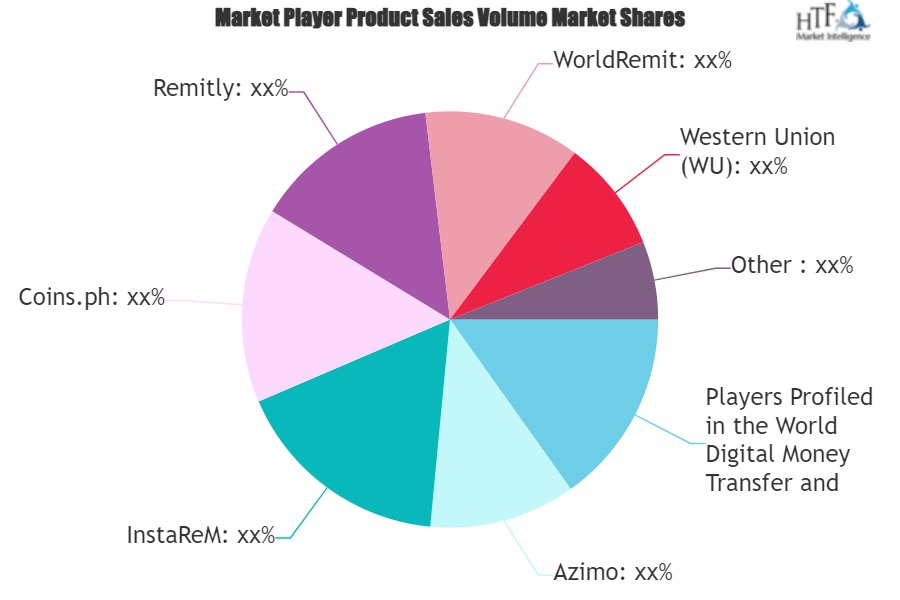

The digital remittance market is fiercely competitive, with numerous players vying for market share. Remitly faces competition from established MTOs like Western Union and MoneyGram, as well as other digital remittance companies such as WorldRemit, Xoom (a PayPal service), and TransferWise (now Wise).

Each competitor brings unique strengths and weaknesses to the table. Traditional MTOs have vast agent networks but often charge higher fees. Digital players focus on lower costs and faster transfers, but may lack the extensive physical presence of their traditional counterparts.

Remitly's success hinges on its ability to differentiate itself through competitive pricing, superior customer service, and technological innovation. The company constantly evaluates its pricing strategies to remain competitive, taking into account exchange rates, transfer fees, and delivery costs.

Financial Performance

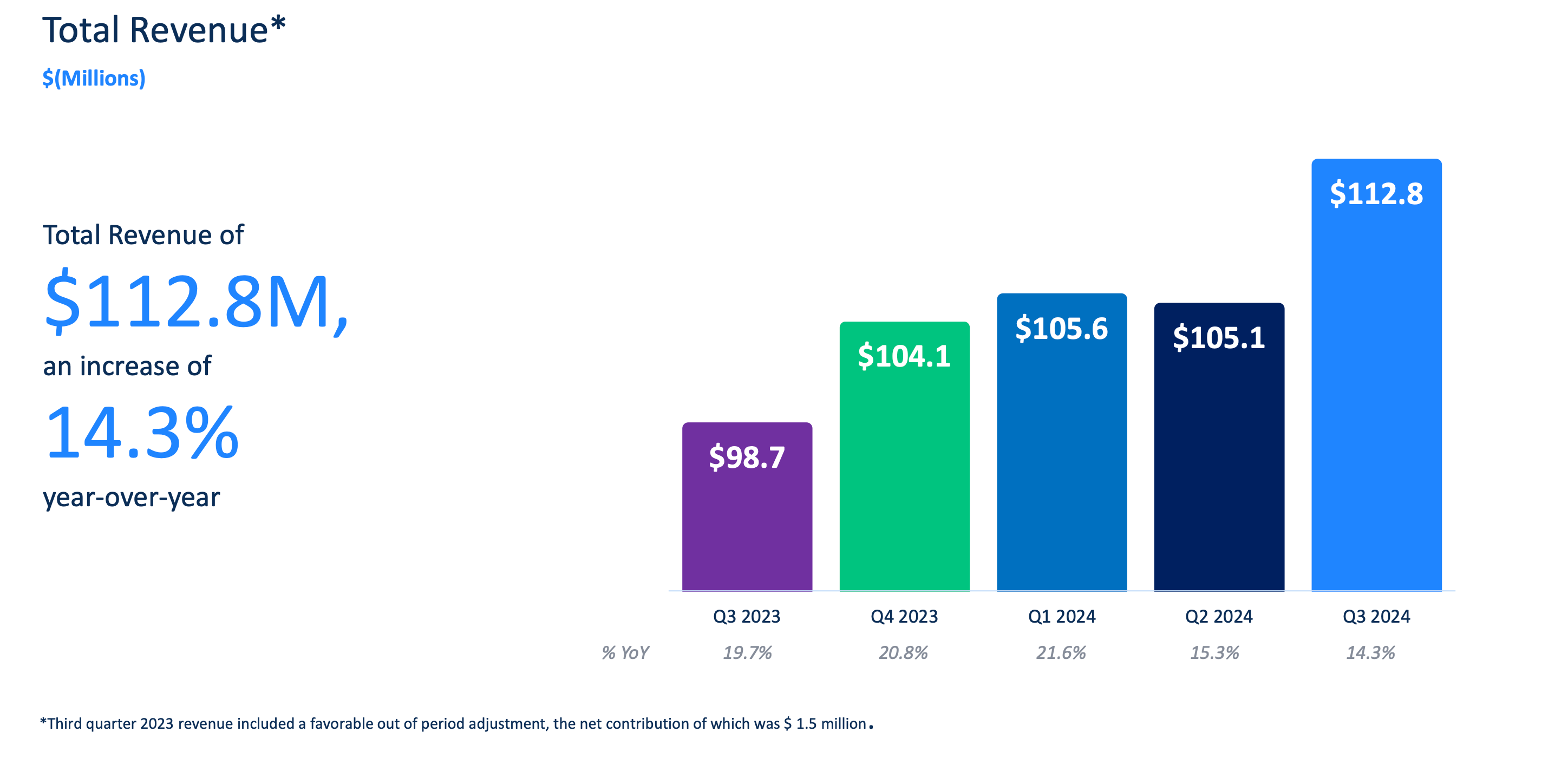

Analyzing Remitly's financial performance provides insights into its growth trajectory and profitability. Key metrics to consider include revenue growth, gross margin, operating expenses, and net income.

Remitly has experienced substantial revenue growth in recent years, driven by increasing transaction volumes and expanding geographic reach. However, the company faces challenges in achieving consistent profitability, as it invests heavily in marketing, technology development, and compliance efforts.

Maintaining a healthy gross margin is critical for Remitly's long-term sustainability. This metric reflects the difference between revenue and the direct costs associated with providing its services.

Technological Innovation

Technology is at the heart of Remitly's business model. The company leverages data analytics, machine learning, and mobile technology to enhance its services and improve the customer experience.

Remitly employs sophisticated algorithms to detect and prevent fraud, ensuring the security of transactions. The company continuously invests in its technology infrastructure to scale its operations and meet the growing demand for digital remittances.

Mobile technology plays a pivotal role in Remitly's strategy, as a significant portion of its transactions are initiated through its mobile app. The company focuses on optimizing the mobile user experience to make it easy and convenient for customers to send money from anywhere in the world.

Regulatory Challenges

The remittance industry is subject to stringent regulatory requirements aimed at preventing money laundering, terrorism financing, and other illicit activities. Remitly must comply with regulations in both the sending and receiving countries, which can be complex and costly.

Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations require Remitly to verify the identities of its customers and monitor transactions for suspicious activity. The company employs sophisticated compliance programs to meet these regulatory requirements.

Changes in regulations, such as those related to data privacy and cross-border payments, can significantly impact Remitly's operations. Staying ahead of regulatory changes and adapting its compliance programs accordingly is essential for the company's long-term success.

Customer Experience and Trust

Customer experience is a critical differentiator in the competitive remittance market. Remitly focuses on providing a seamless and trustworthy experience for its customers, from the initial transfer to the final delivery of funds.

Transparency in pricing and fees is essential for building customer trust. Remitly strives to provide clear and upfront information about all costs associated with a transfer.

Positive customer reviews and word-of-mouth referrals play a significant role in attracting new customers. The company actively solicits customer feedback and uses it to improve its services.

Future Outlook

The digital remittance market is expected to continue growing in the coming years, driven by increasing migration flows, rising smartphone penetration, and the growing adoption of digital financial services. Remitly is well-positioned to capitalize on this growth, provided it can navigate the competitive landscape and regulatory challenges effectively.

Expanding its geographic reach and introducing new services, such as bill payments and microloans, could further enhance Remitly's growth potential. Embracing new technologies, such as blockchain and cryptocurrencies, could also open up new opportunities for innovation.

However, the company must remain vigilant in managing risks, including regulatory compliance, cybersecurity threats, and economic volatility in emerging markets. Only through careful planning and execution can Remitly secure its position as a leading player in the evolving world of digital remittances.