Expansionary Phase Of The Business Cycle

Imagine a garden in the springtime. Tiny shoots that were once dormant now burst forth with vibrant life, stretching towards the sunlight. Bees buzz diligently, pollinating blossoms, while the air hums with the promise of growth and abundance. This vibrant energy mirrors the expansionary phase of the business cycle, a period of flourishing economic activity that brings hope and prosperity.

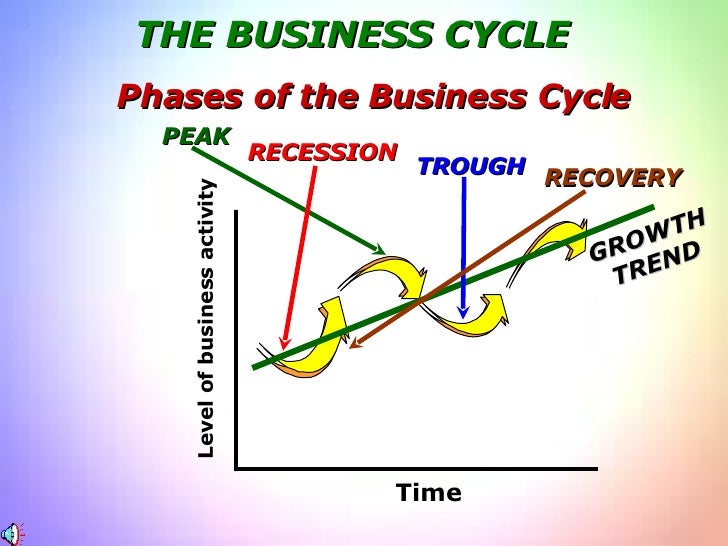

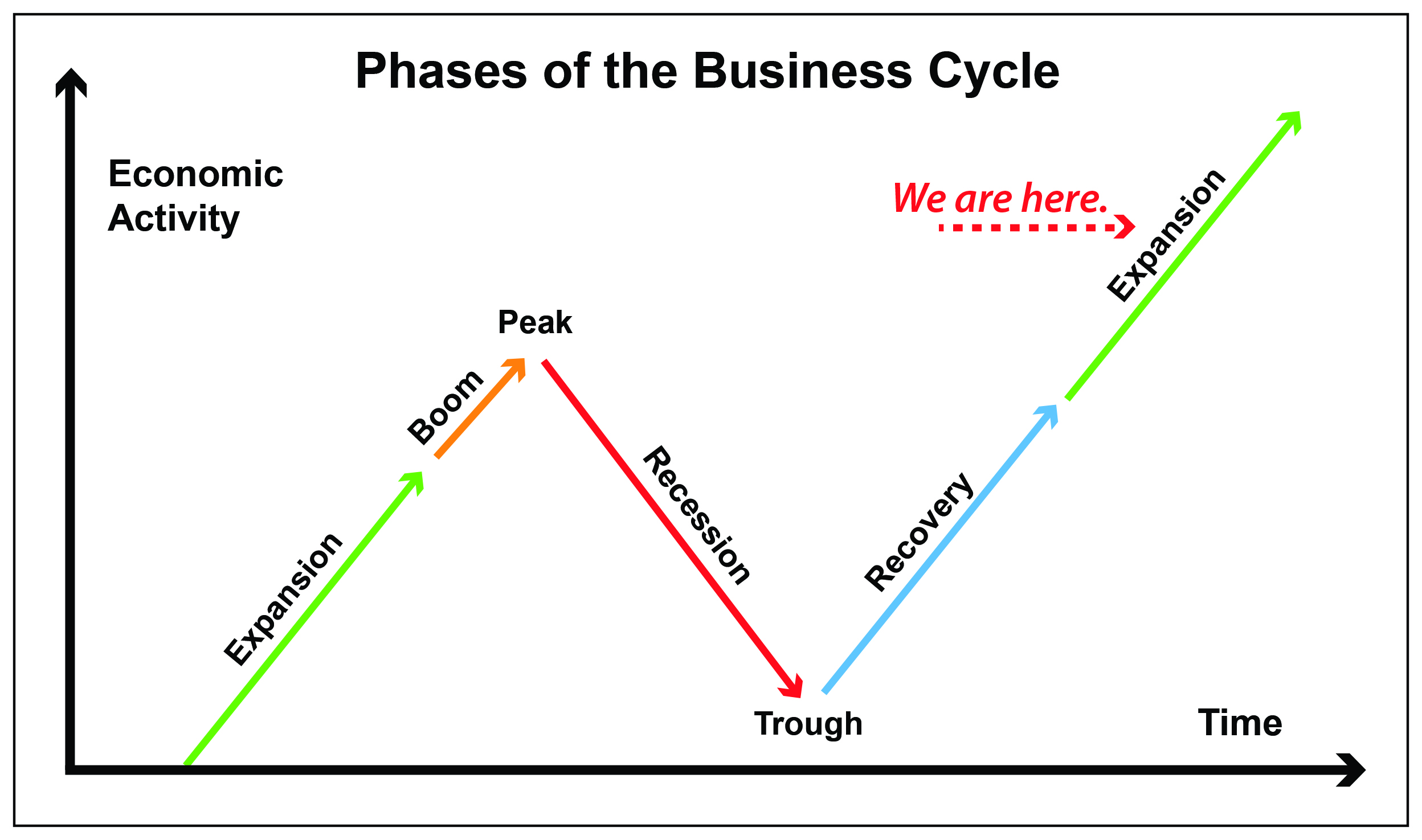

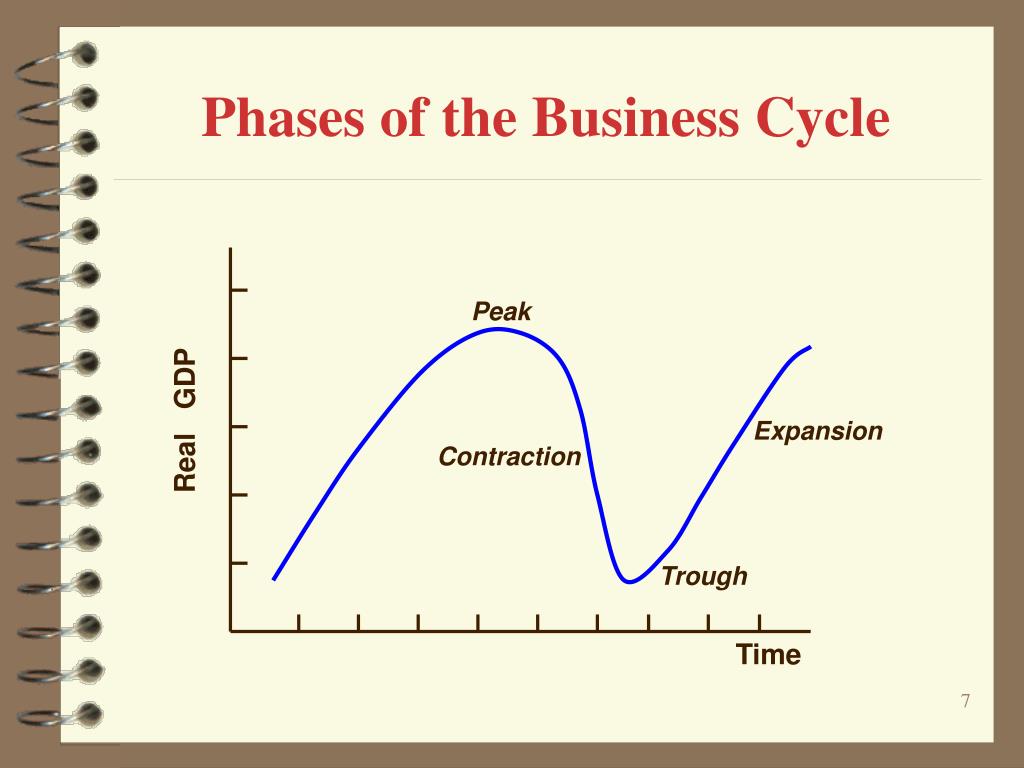

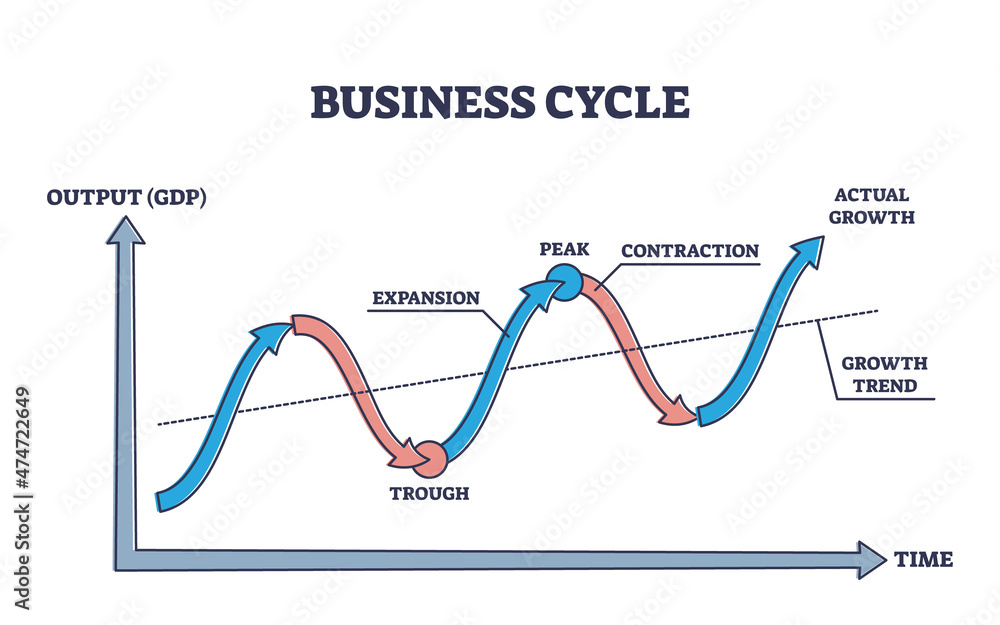

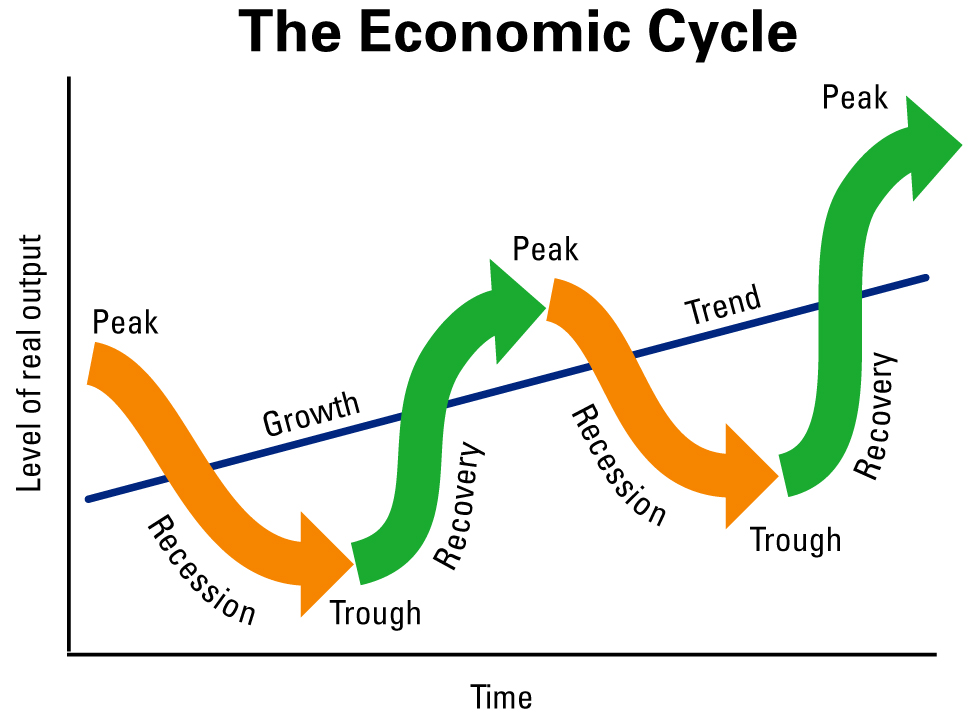

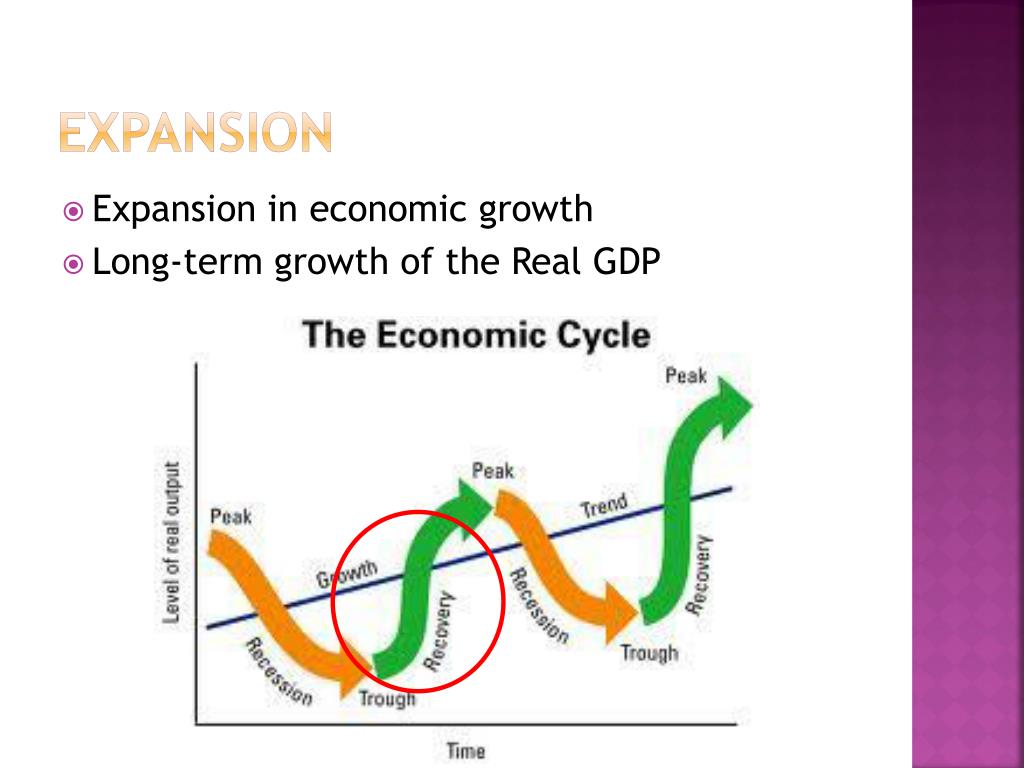

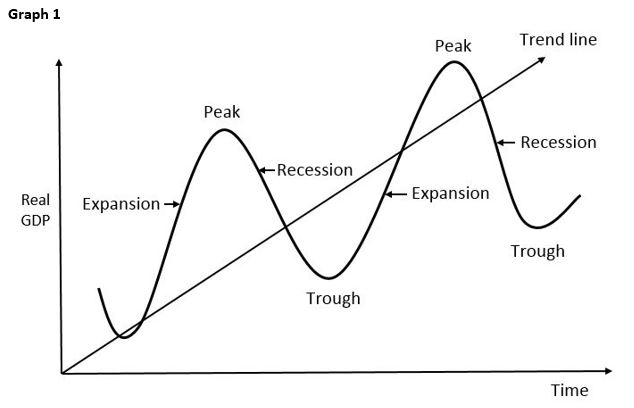

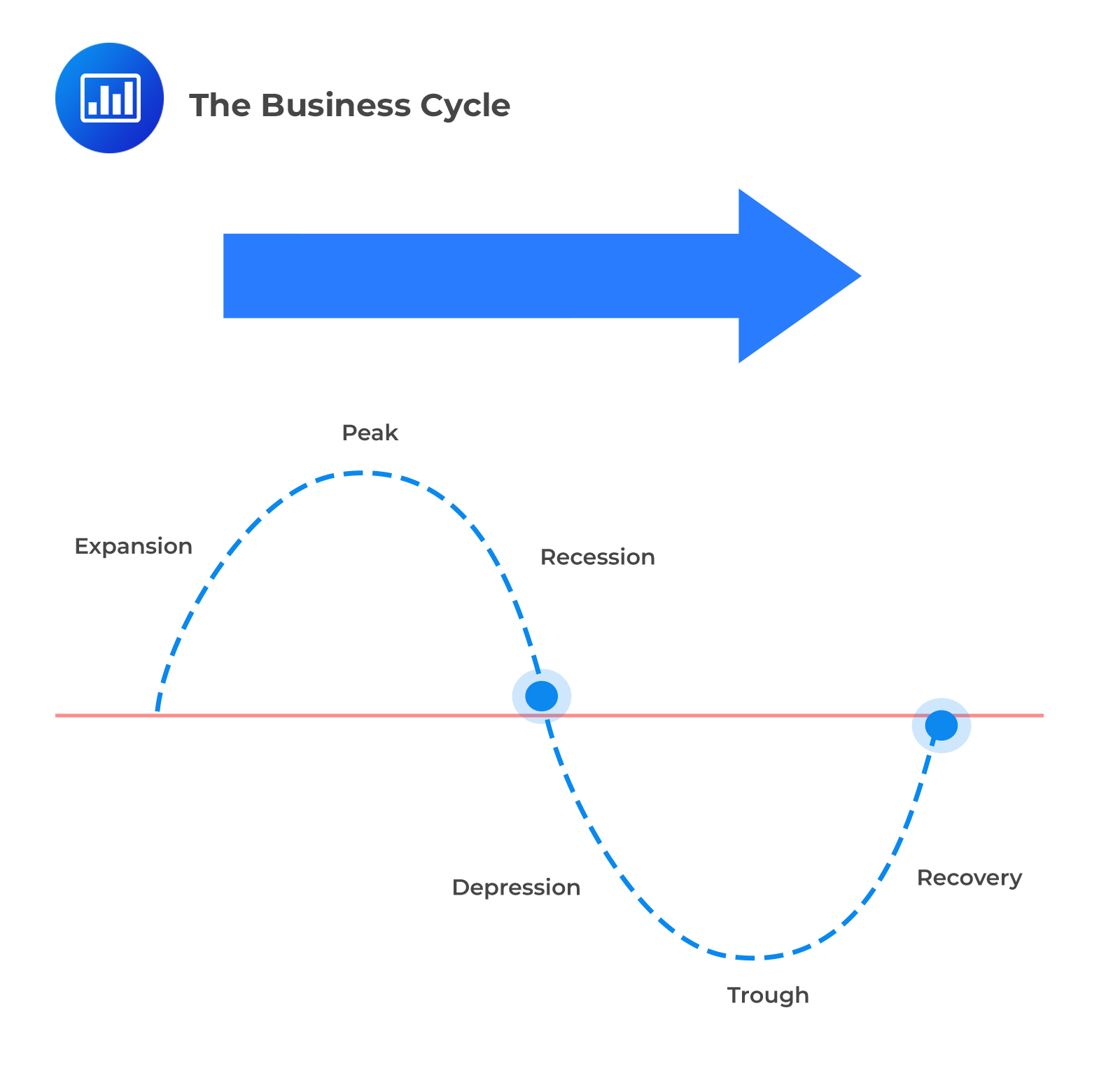

The expansionary phase, a critical component of the business cycle, signifies a period of sustained economic growth. This phase follows a trough, the lowest point of an economic contraction, and is characterized by increasing employment, consumer spending, and business investment. Understanding this phase is crucial for businesses, policymakers, and individuals alike, as it provides insights into potential opportunities and challenges on the horizon.

Understanding the Engine of Growth

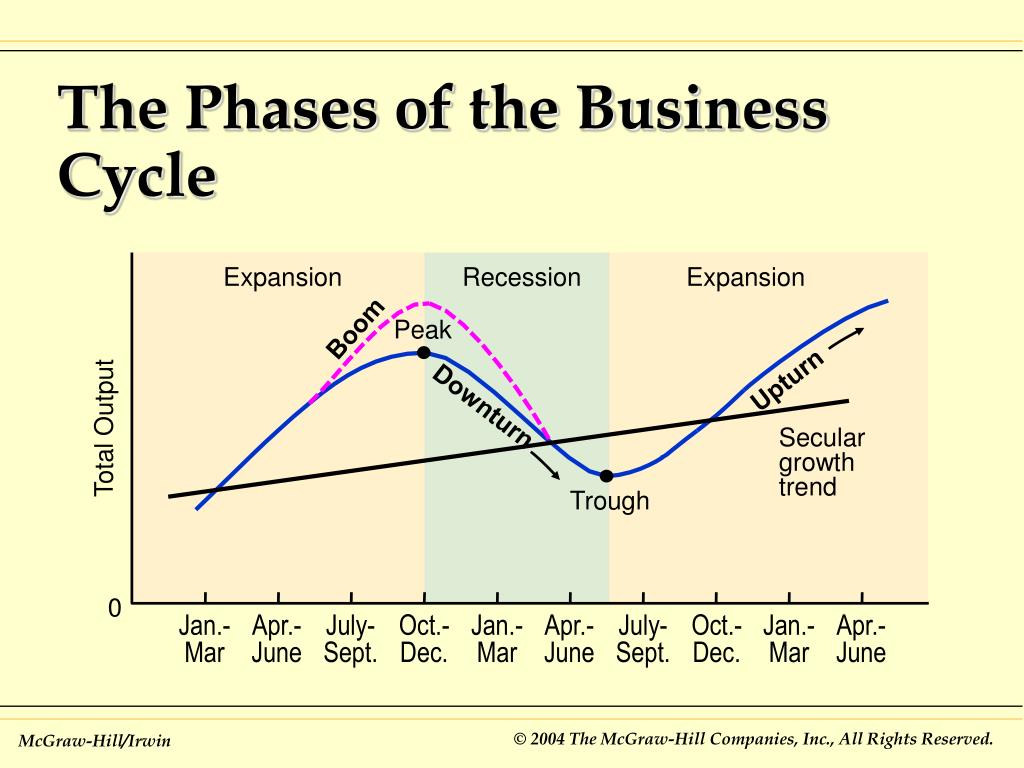

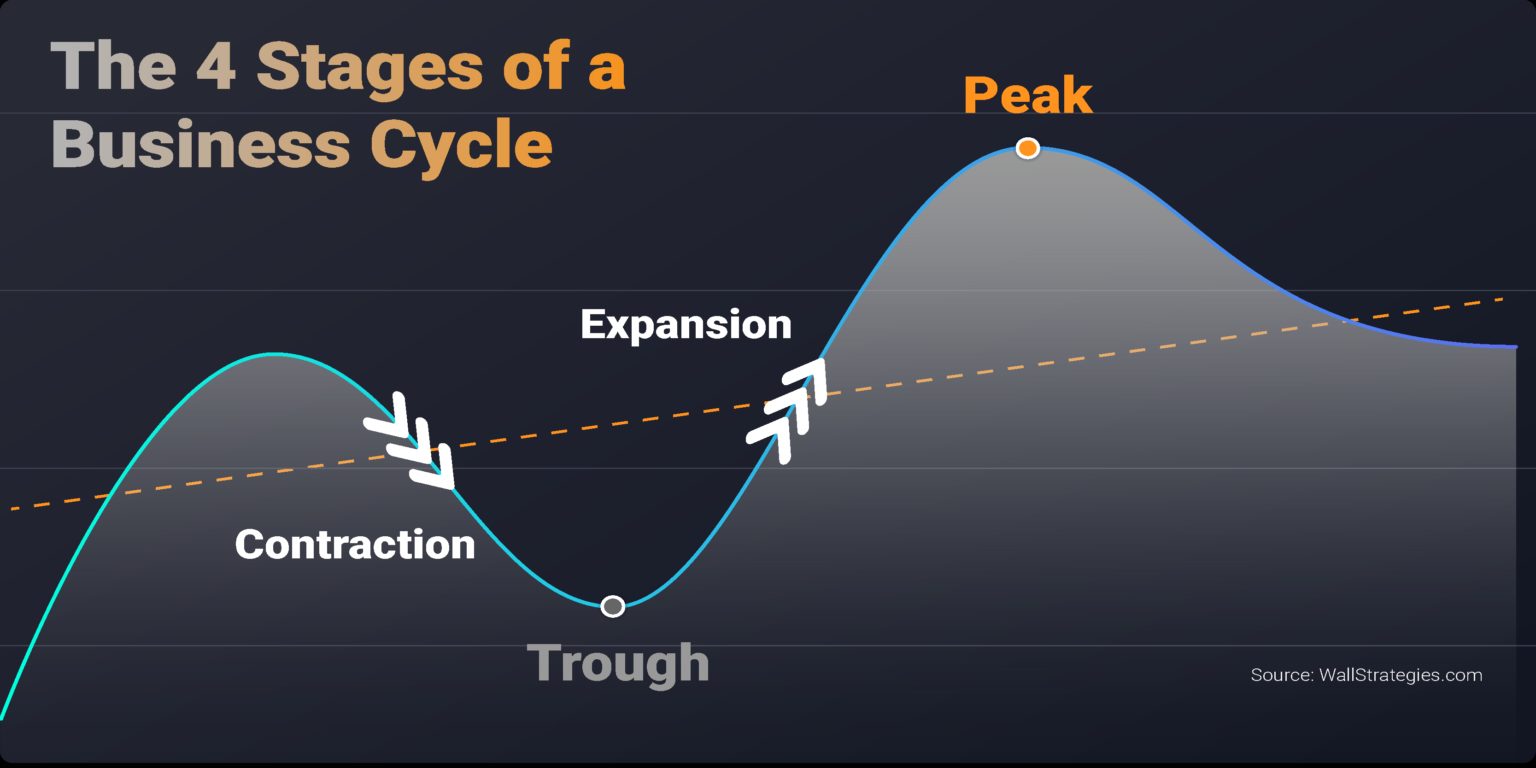

The business cycle, a concept deeply rooted in economics, is essentially the ebb and flow of economic activity in a nation. It consists of four distinct phases: expansion, peak, contraction (or recession), and trough. Each phase presents unique conditions and opportunities for economic actors.

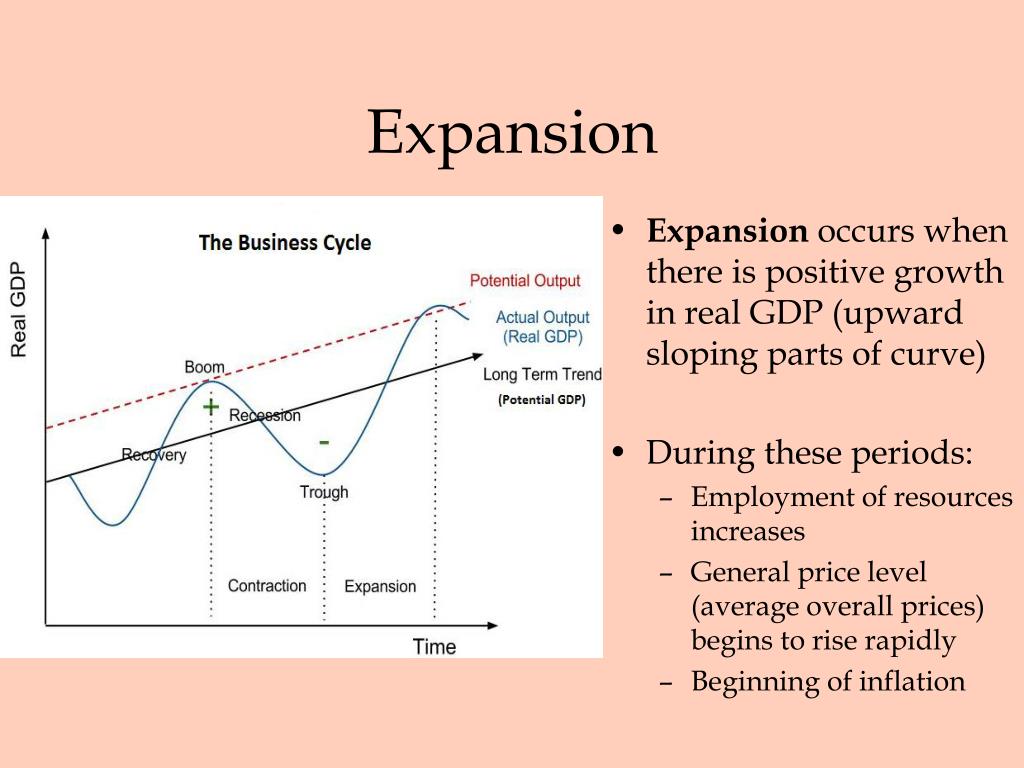

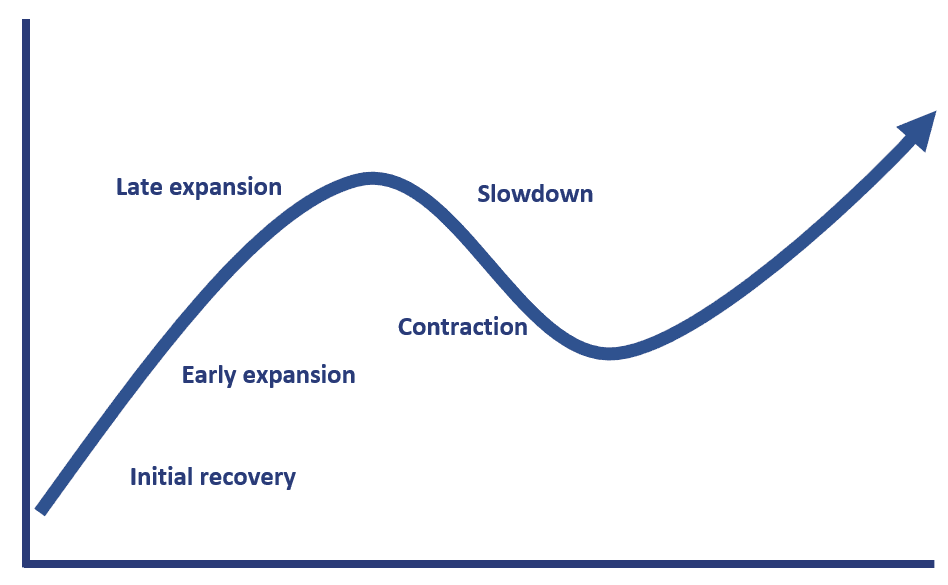

The expansionary phase, sometimes referred to as the recovery phase, is when the economy shifts into high gear. Gross Domestic Product (GDP), the broadest measure of a nation's economic output, begins to climb. As reported by the Bureau of Economic Analysis (BEA), a sustained increase in GDP is a key indicator of a healthy expansion.

During this phase, companies experience increased demand for their goods and services. This leads to higher production, which, in turn, requires more workers. Unemployment rates fall as more people find jobs, bolstering consumer confidence and driving even more spending.

Key Indicators of Expansion

Several key indicators signal the presence of an expansionary phase. Rising consumer confidence, as measured by indices like the Consumer Confidence Index, is a strong sign. Increased manufacturing activity, indicated by the Purchasing Managers' Index (PMI), also suggests that businesses are ramping up production.

Another critical indicator is the increase in business investment. As companies become more optimistic about the future, they invest in new equipment, technologies, and facilities. This further fuels economic growth and creates even more jobs.

Interest rates also play a crucial role. Central banks, like the Federal Reserve in the United States, often keep interest rates relatively low during the early stages of an expansion to encourage borrowing and investment. However, they may gradually raise rates as the expansion matures to prevent inflation from becoming excessive.

The Ripple Effect of Prosperity

The benefits of an expansionary phase extend far beyond just businesses and workers. Governments also benefit from increased tax revenues. With more people employed and businesses earning higher profits, tax collections rise, enabling governments to fund essential services and invest in infrastructure.

However, even during periods of prosperity, challenges can arise. One of the main concerns is inflation. As demand outpaces supply, prices tend to rise, eroding purchasing power. Prudent fiscal and monetary policies are essential to manage inflation and ensure the expansion remains sustainable.

Furthermore, it's crucial to remember that every expansion eventually reaches its peak. Overconfidence, excessive speculation, and unsustainable debt levels can all contribute to the end of an expansionary phase. Therefore, vigilance and responsible economic practices are vital.

Looking Ahead: Navigating the Path of Growth

The expansionary phase is a time of optimism and opportunity. By understanding its drivers and characteristics, individuals, businesses, and policymakers can make informed decisions and navigate the path of growth successfully. While the cyclical nature of the economy means that expansions don't last forever, they offer a valuable period to build resilience and prepare for future challenges.

As we observe the current economic landscape, it's important to stay informed about key indicators and economic forecasts. This knowledge empowers us to make sound financial decisions, adapt to changing market conditions, and contribute to a more stable and prosperous future for all.

:max_bytes(150000):strip_icc()/phasesofthebusinesscycle-c7cb7a3ce6894e86a3e44d5b0fe4d5e2.jpg)

.png)

/businesscycle-013-ba572c5d577c4bd6a367177a02c26423.png)