Explain Why You Should Always Have A Cash Flow Plan.

In an unpredictable economic landscape, managing finances effectively is paramount for individuals and businesses alike. A crucial tool for achieving financial stability and growth is a well-structured cash flow plan. This article explores why creating and maintaining such a plan is not just good practice, but an essential component of sound financial management.

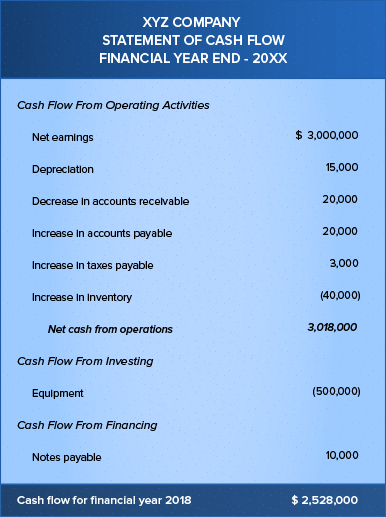

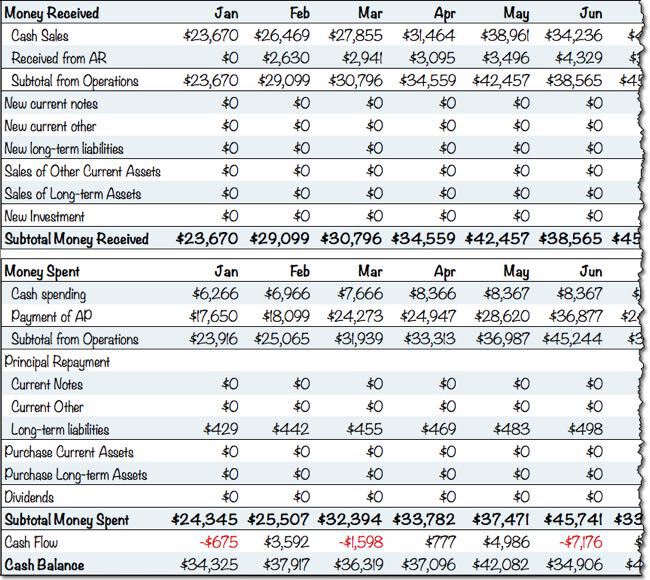

At its core, a cash flow plan, often referred to as a budget, tracks all money coming in (inflows) and all money going out (outflows) over a specific period. This detailed analysis provides a clear picture of your financial health, revealing potential surpluses or deficits. The Institute for Financial Literacy emphasizes the importance of understanding your income and expenses to make informed decisions.

Understanding the Importance

A primary reason for having a cash flow plan is to gain control over your finances. Knowing where your money goes allows you to identify areas where you can cut back or reallocate funds. This is especially important during economic downturns or unexpected financial challenges.

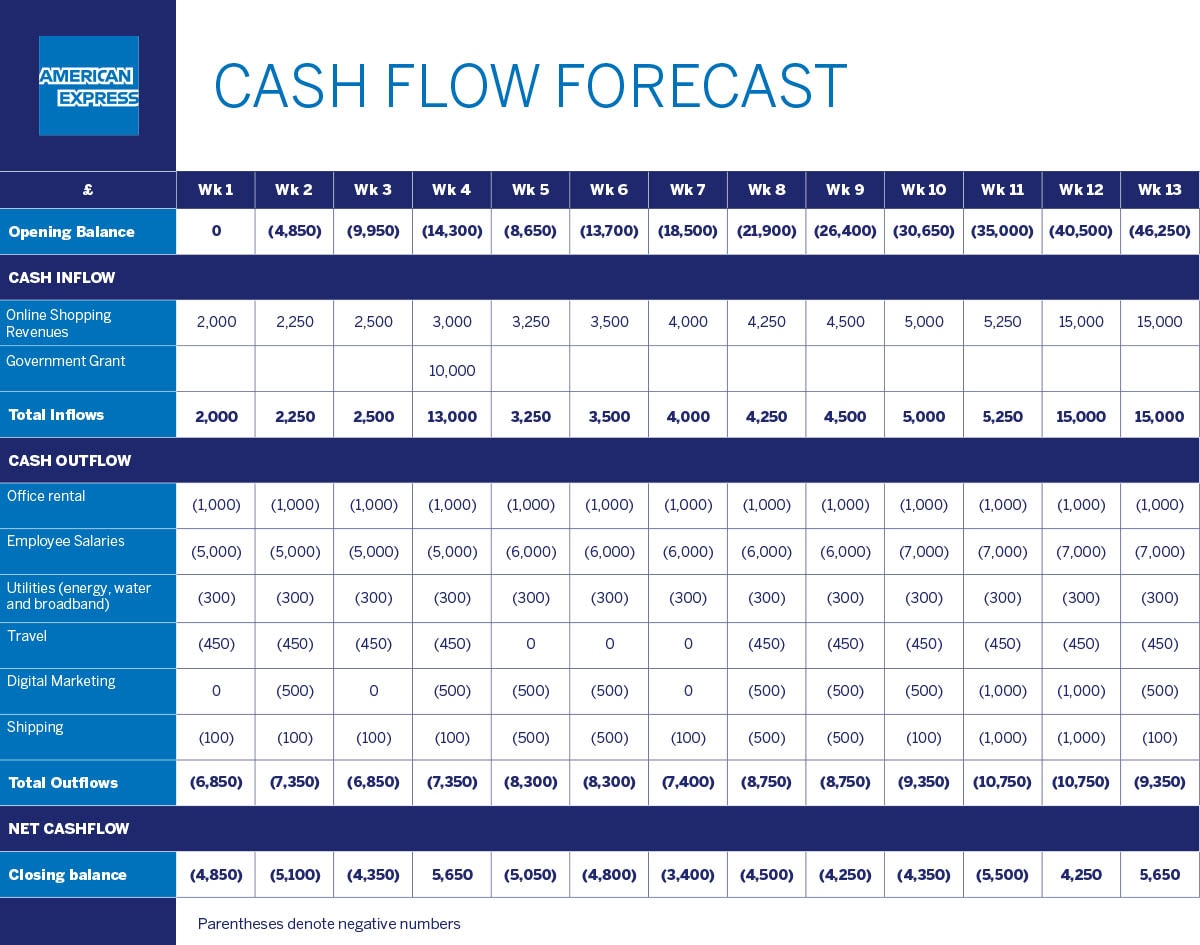

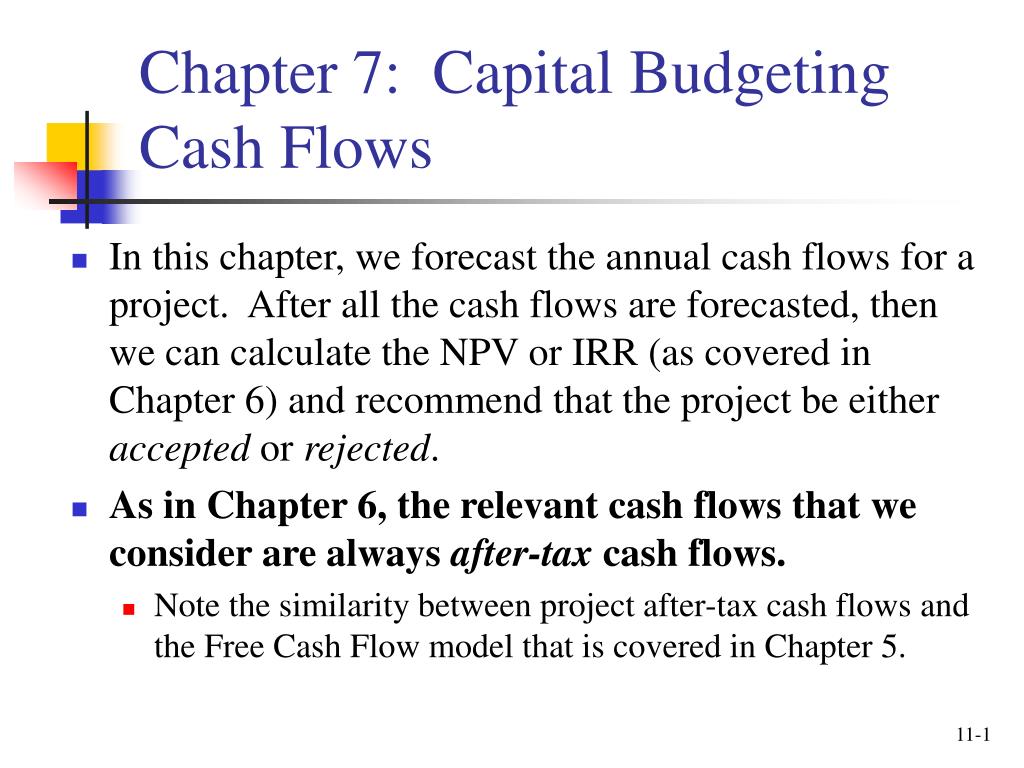

Furthermore, a cash flow plan facilitates better decision-making. By projecting future income and expenses, you can anticipate potential shortfalls and take proactive steps to address them. This could involve reducing spending, increasing income, or securing financing.

Predicting and Preventing Financial Issues

One of the most significant benefits of a cash flow plan is its ability to predict future financial difficulties. By analyzing historical data and making reasonable assumptions, you can forecast potential cash shortages. This allows you to take corrective action before a crisis occurs.

For instance, if your plan shows that you will have a cash deficit in three months, you can start saving money now, reduce expenses, or explore other revenue streams. The U.S. Small Business Administration (SBA) recommends that small businesses regularly monitor their cash flow to avoid liquidity problems.

Achieving Financial Goals

A cash flow plan is instrumental in achieving both short-term and long-term financial goals. Whether you are saving for a down payment on a house, paying off debt, or investing for retirement, a well-defined plan helps you stay on track.

By allocating specific amounts of money to your goals each month, you can systematically work towards achieving them. Setting realistic and measurable objectives is key to success.

"A goal without a plan is just a wish,"a sentiment echoed by many financial advisors.

Attracting Investors and Lenders

For businesses, a cash flow plan is often a prerequisite for securing funding from investors or lenders. A well-prepared plan demonstrates financial responsibility and the ability to manage resources effectively.

Lenders want to see that you have a clear understanding of your income and expenses and that you can repay your debts. A detailed cash flow projection instills confidence and increases your chances of securing the financing you need. The Federal Reserve emphasizes the need for businesses to maintain adequate cash reserves to handle unforeseen circumstances.

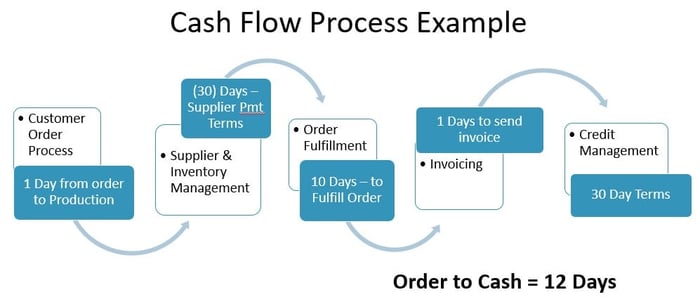

Creating a Cash Flow Plan

Creating a cash flow plan involves several key steps. First, gather all relevant financial information, including income statements, bank statements, and expense records. Accurate data is essential for creating a realistic and reliable plan.

Next, categorize your income and expenses. This will help you identify patterns and trends. Finally, use a spreadsheet, budgeting app, or other tool to track your cash flow over time.

Reviewing and updating your plan regularly is crucial. Your financial situation can change, so your plan should be flexible enough to adapt. Aim to review your cash flow plan at least once a month to ensure it remains accurate and relevant.

Conclusion

In conclusion, a cash flow plan is an indispensable tool for anyone seeking financial stability and success. By providing a clear picture of your income and expenses, it empowers you to make informed decisions, prevent financial problems, and achieve your goals. Whether you are an individual, a small business owner, or a large corporation, investing the time and effort to create and maintain a cash flow plan is a wise and necessary step towards securing your financial future. Embrace the power of planning, and take control of your financial destiny.

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)