Exploring Peo Co Employment And Its Scope In The U S Workforce

PEO Employment Surges: Is Your Company Prepared?

Professional Employer Organizations (PEOs) are rapidly reshaping the employment landscape, offering outsourced HR solutions and affecting millions of workers. This article dissects the burgeoning PEO industry, its impact on US businesses, and key considerations for companies contemplating this model.

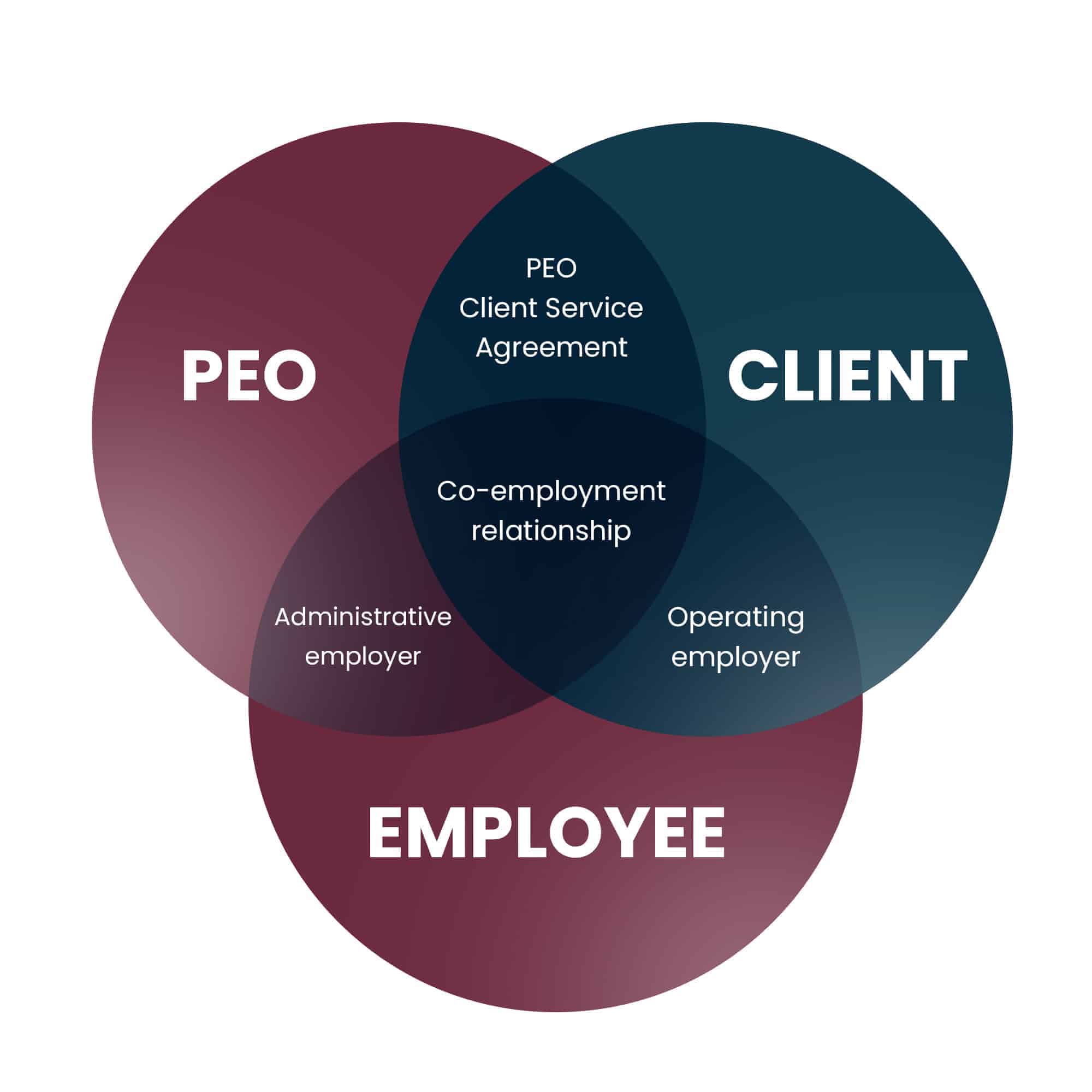

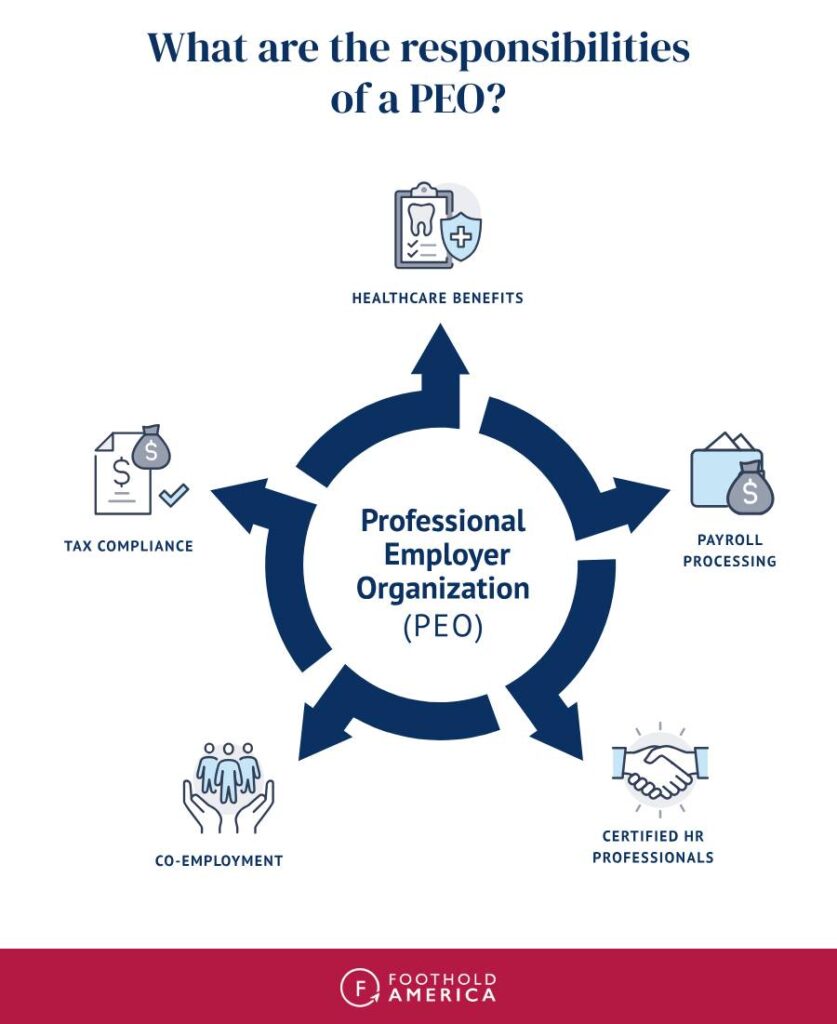

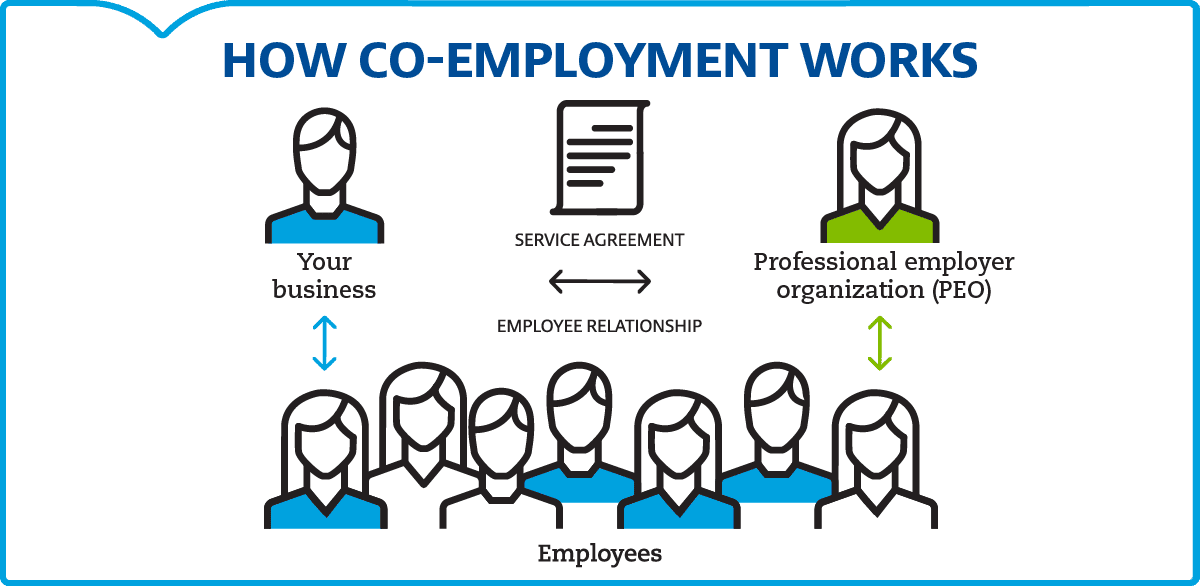

What is a PEO and How Does it Work?

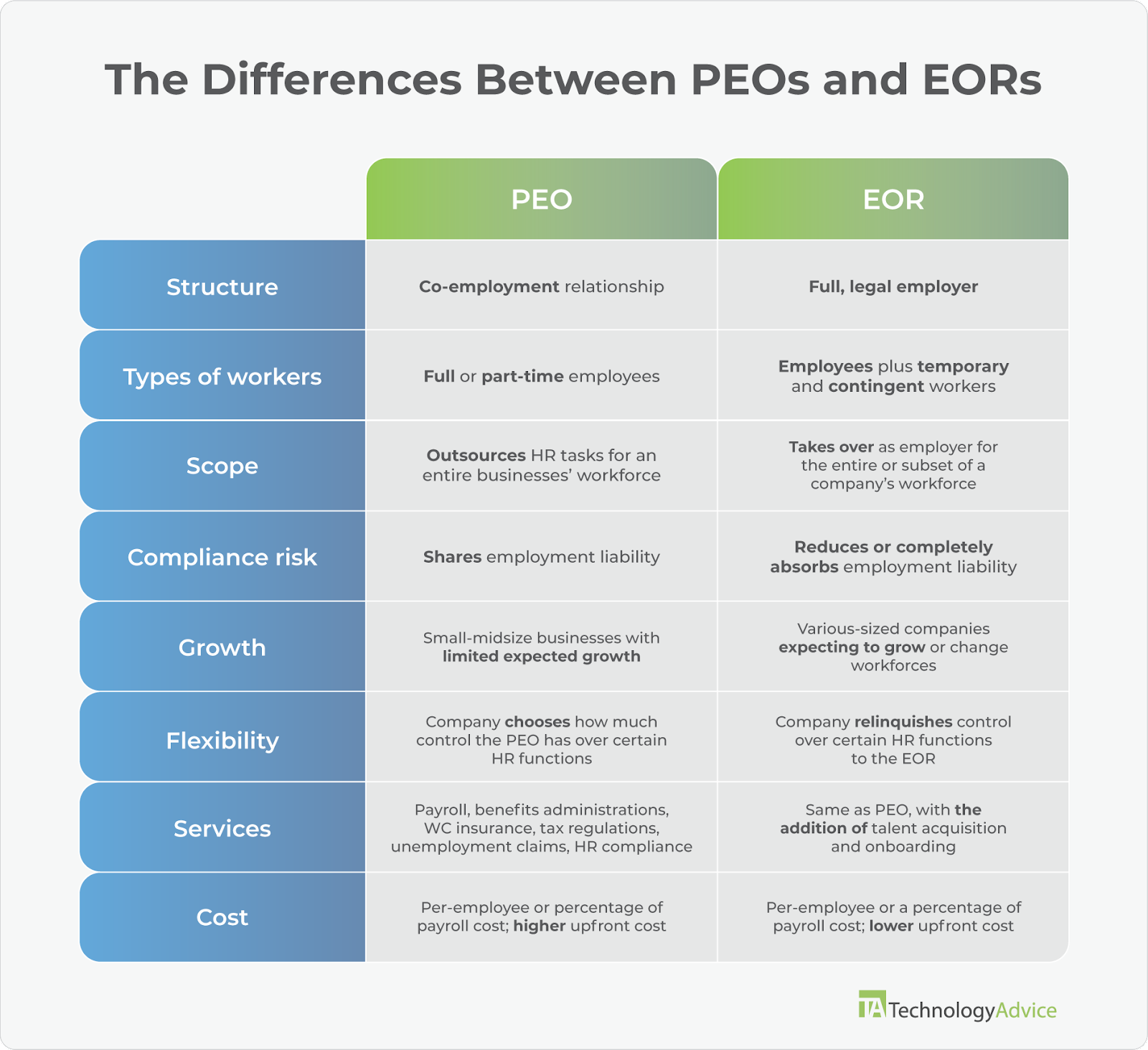

A Professional Employer Organization (PEO) provides comprehensive HR solutions to small and medium-sized businesses. These solutions include payroll, benefits administration, HR compliance, and risk management.

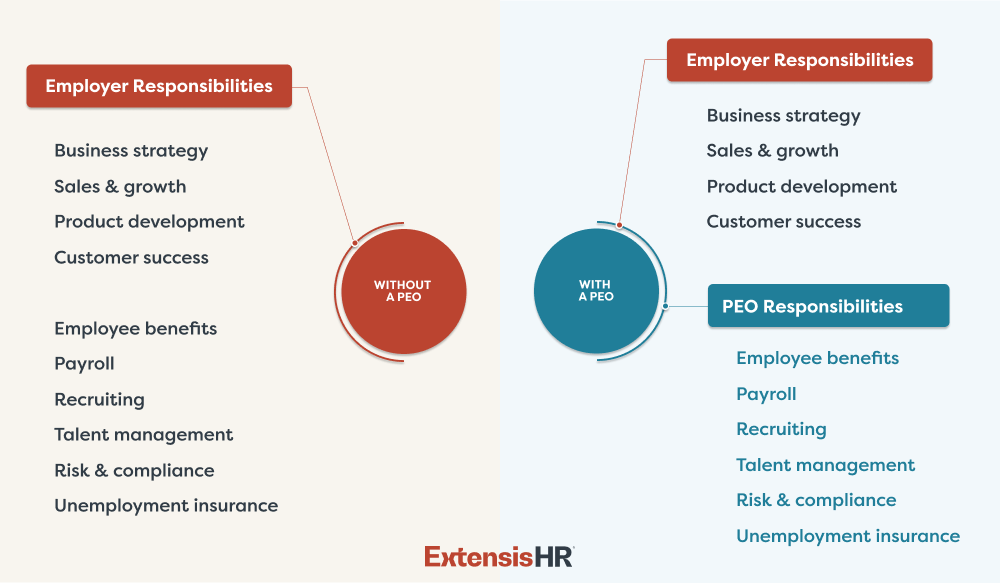

By co-employing a company's workforce, the PEO becomes a legal employer, sharing responsibilities and liabilities with the client company.

This arrangement enables businesses to focus on core operations while the PEO manages complex HR functions.

The Explosive Growth of PEOs: By the Numbers

The PEO industry is experiencing significant growth. According to the National Association of Professional Employer Organizations (NAPEO), there are approximately 900 PEOs operating in the United States.

These PEOs provide services to roughly 175,000 small and medium-sized businesses, co-employing over 4 million workers.

NAPEO data reveals that businesses using PEOs grow 7 to 9% faster, have 10 to 14% lower employee turnover, and are 50% less likely to go out of business.

Where Are PEOs Most Prevalent?

PEO adoption varies geographically. States with a high concentration of small businesses often exhibit greater PEO penetration.

Florida, Texas, California, and New York are among the states with the highest numbers of PEO clients and co-employed workers, according to NAPEO.

Industries with complex regulatory requirements, such as healthcare and manufacturing, also tend to have a higher demand for PEO services.

The Benefits and Risks of PEO Employment

PEOs offer numerous benefits, including access to better employee benefits packages, reduced administrative burden, and improved HR compliance.

However, companies must carefully evaluate the PEO's financial stability, service quality, and compliance record.

It's crucial to understand the co-employment agreement and its implications for employer responsibilities and liabilities.

When Should Companies Consider a PEO?

Companies grappling with HR challenges, rapid growth, or a need to improve employee benefits should consider a PEO.

Startups and small businesses often benefit from the expertise and resources a PEO provides.

However, larger companies with established HR departments may find the PEO model less suitable.

How to Choose the Right PEO

Selecting the right PEO requires careful due diligence. Companies should compare PEOs based on their service offerings, pricing, industry expertise, and references.

It's essential to review the PEO's financial statements and insurance coverage.

Ensure the PEO aligns with the company's culture and values.

Future Outlook: PEOs and the Evolving Workforce

The PEO industry is expected to continue its growth trajectory. This is driven by the increasing complexity of employment laws and the ongoing demand for HR expertise.

NAPEO continues to advocate for policies that support the PEO industry and its clients.

Companies should stay informed about PEO trends and regulations to make informed decisions about their HR strategies.