Farmers State Bank Of Alto Pass

Alto Pass, Illinois – Farmers State Bank of Alto Pass, a cornerstone of the rural community for over a century, has announced its acquisition by another financial institution, marking a significant shift in the local banking landscape.

The acquisition, finalized on [Insert Date, if known, otherwise use "recently"], raises questions about the future of community banking in the region and the potential impact on local residents and businesses. This development signifies a broader trend of consolidation within the banking industry, particularly impacting smaller, independent banks.

Acquisition Details and Key Players

The acquiring institution is [Insert Name of Acquiring Bank], a [Insert Size/Description, e.g., regional bank with a growing presence in Southern Illinois]. The terms of the agreement, which remain largely confidential, involve [Insert Name of Acquiring Bank] assuming all assets and liabilities of Farmers State Bank of Alto Pass.

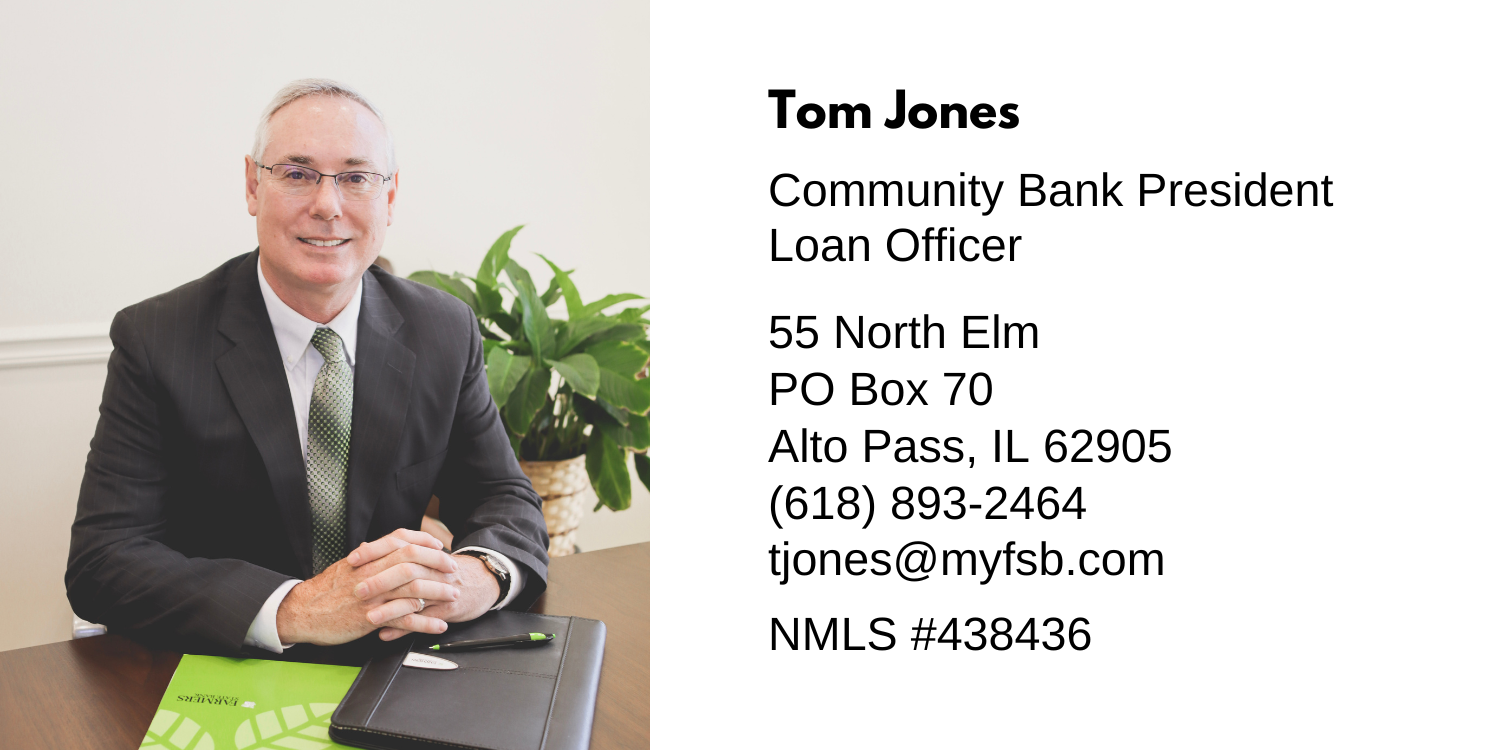

The acquisition was officially announced in a joint statement released by [Name of CEO of Farmers State Bank] and [Name of CEO of Acquiring Bank]. The statement emphasized a commitment to ensuring a smooth transition for customers and employees.

“[Quote a short, relevant statement from either CEO about the acquisition, e.g., commitment to customers or future plans],” stated [Name of CEO, with title] in the press release.

Impact on Customers

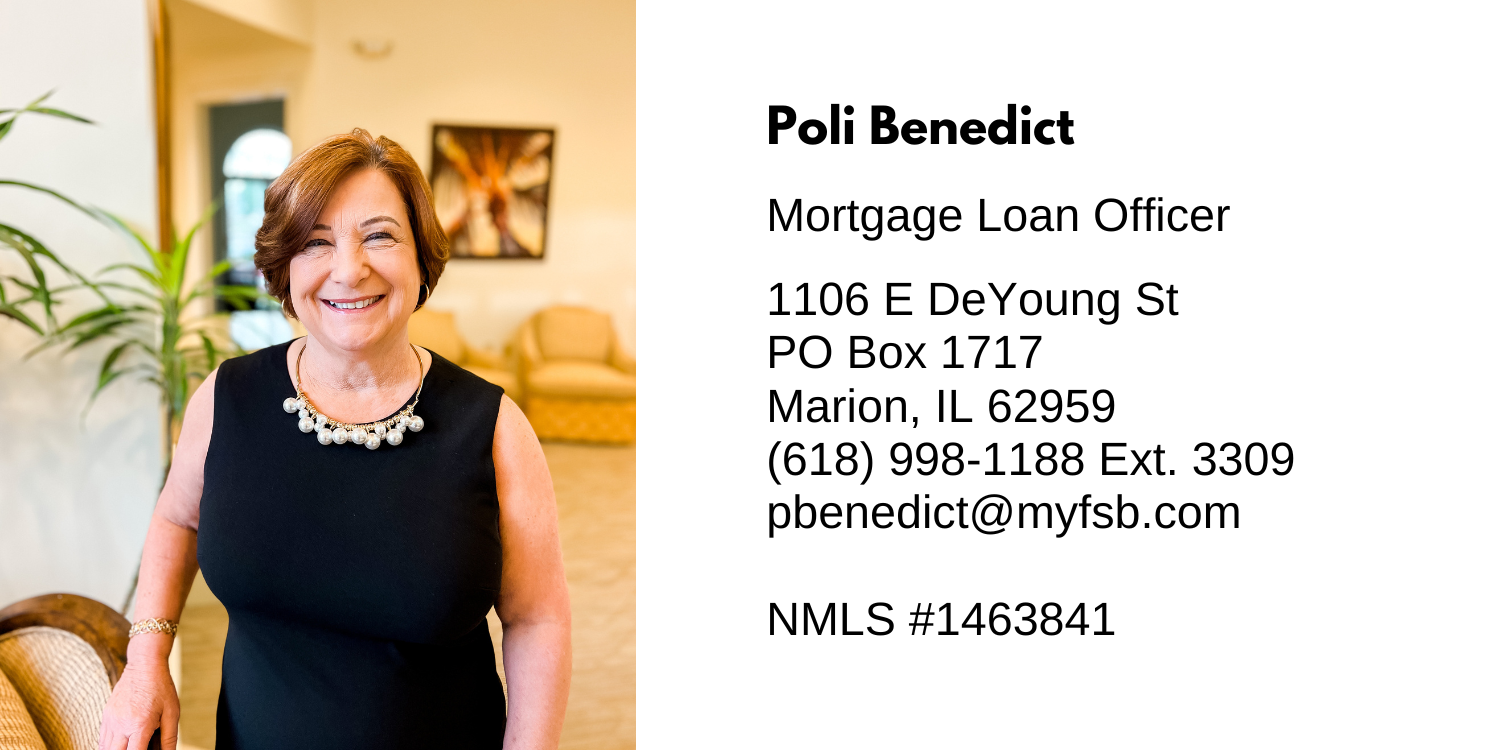

One of the primary concerns for residents is the potential impact on customer service and local decision-making. Farmers State Bank of Alto Pass has long been known for its personalized service and deep understanding of the community's needs.

[Insert Name of Acquiring Bank] has assured customers that they will continue to receive the same level of service. They also noted that customers would now benefit from a wider range of products and services.

However, some residents express worry about the potential loss of local control. This might impact loan approvals and other financial decisions.

“I’m concerned that we'll lose the personal touch that Farmers State Bank always provided,” said [Name of Local Resident, if possible, and their connection to the bank, e.g., a local business owner and long-time customer]. [If possible, add a short quote from the resident].

Economic Significance

The acquisition of Farmers State Bank of Alto Pass highlights the challenges faced by smaller banks in an increasingly competitive environment. Increased regulatory burdens and the rising costs of technology have made it difficult for smaller institutions to remain independent.

Consolidation within the banking industry is a national trend, with smaller banks often being acquired by larger regional or national players. This can lead to greater efficiency and economies of scale.

However, critics argue that it can also reduce competition and limit access to credit for small businesses and individuals in rural areas.

"Community banks play a vital role in supporting local economies,"said [Name and Title of relevant expert, e.g., an economist specializing in rural banking], [Add a very brief, relevant quote or explanation from the expert].

Future of the Alto Pass Branch

[Insert Name of Acquiring Bank] has stated that they intend to maintain a branch in Alto Pass. They recognize the importance of having a physical presence in the community.

The existing staff at Farmers State Bank of Alto Pass have been offered positions with the acquiring bank. This aims to preserve local jobs and maintain continuity for customers.

The transition is expected to be completed within [Insert Timeframe, e.g., the next few months]. During this period, customers will receive information about any changes to their accounts and services.

The acquisition of Farmers State Bank of Alto Pass marks the end of an era for the small town. It underscores the ongoing transformation of the banking industry.